After being instructed by @DonkeyInvestor how to present your portfolio on getquin in a sensible way in order to receive sensible feedback, I am hereby starting an attempt to present my model portfolio, which I would like to work towards in the long term.

I already posted my current portfolio the other day, the model portfolio presented here is a kind of wishful thinking of what my portfolio should/could look like in the long term.

My investment horizon and my goals:

I am 22 years old and studying economics, so I still have many years to go before my state pension. However, my goal is to retire a little earlier, i.e. when I can live off my portfolio without reducing its value every year.

My investment strategy:

I have opted for a buy & hold strategy with two ETFs as the fixed core of my portfolio, a few individual stocks that I am convinced of in the long term and a small crypto mix.

The ETFs:

ETF no. 1: $IS3R (+2,3 %)

ETF No. 2: $216361 (+0,26 %)

My single stock/thematic ETFs:

45 individual positions with 1% weighting each, see sample portfolio.

My cryptos:

Approx. 5 to max. 10% crypto weighting.

Of which 50% $BTC (-0,31 %) , 25% $ETH (-0,21 %) , 25% $SOL (-0,67 %)

Why this investment strategy?

I do not yet have sufficient experience with economic indicators and find it difficult to assess how an interesting share is valued at the current time, which is one of the reasons why I have opted for a buy & hold strategy with the two ETFs as the fixed core of my portfolio and a few individual shares that I am convinced of in the long term.

About the ETFs:

I would like to weight both ETFs at 25% each and therefore already invest in both regularly.

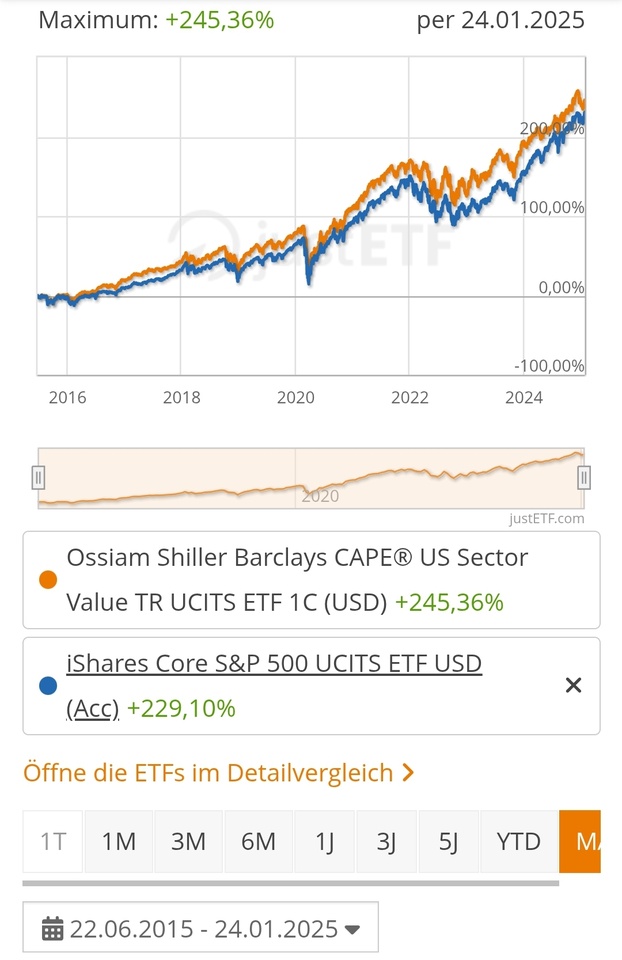

ETF no. 1: MSCI World Momentum ETF

This ETF differs from the normal MSCI World in that it overweights stocks with current price momentum, which has proven to be a superior strategy in recent years. With this ETF, I always have the winners of current developments in this rapidly changing world in my portfolio over the long term.

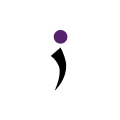

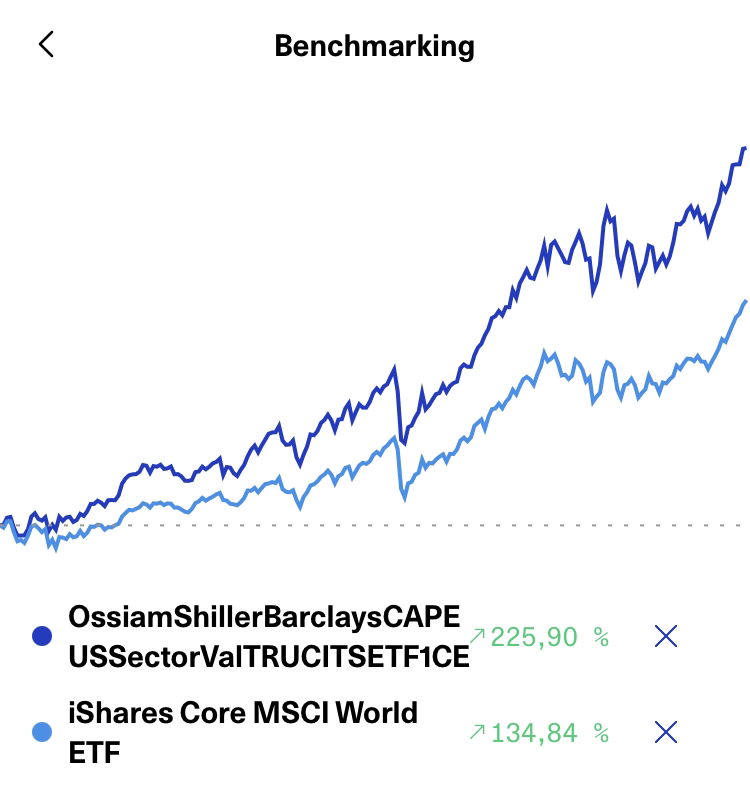

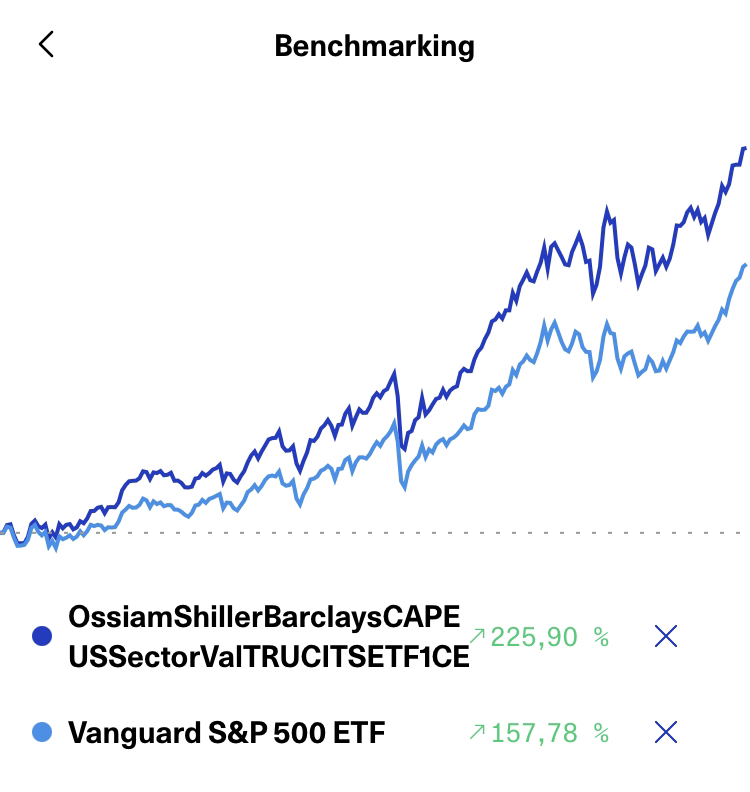

ETF no. 2: Ossiam Shiller ETF

For me, this ETF offers a nice complement to the Momentum Factor ETF, as it invests somewhat more anti-cyclically. The ETF selects the five sectors with the lowest relative CAPE (Cyclically Adjusted Price Earnings) from the S&P 500. The relative CAPE coefficient assesses the relative costliness of a sector based on its current and long-term historical prices and earnings. The method then calculates the sector with the lowest price momentum over a 12-month period, i.e. the sector with the worst performance in the period under review. Each of the remaining four sectors is given the same weighting (25%) and the components of the investment universe are rebalanced on a monthly basis. In short: This is a rather anti-cyclical way of investing, but by leaving out the worst performing sector you are also not falling into the trap.

About my individual stocks/thematic ETFs:

As already mentioned, I am not yet experienced in judging whether a share is currently fairly valued or not. I also don't want to have any companies in my portfolio where I have to research every two weeks whether the business model will still be needed in the near future or not. However, I don't want to do without individual shares altogether either, as a pure ETF portfolio would simply not give me any pleasure. So my solution is as follows:

I take buy&hold-compliant individual shares into the portfolio, where I am simply convinced of the business model in the long term.

I would take these 45 individual positions (including the 3 thematic ETFs) and weight them all at around 1% (excluding the weighting of individual companies in the ETFs). If you buy shares to hold them for more than 20 years, the current valuation plays a somewhat less important role. Even stronger corrections are not the end of the world here, but rather offer good opportunities for additional purchases.

The following shares are in my current portfolio but not in the model portfolio:

Of course I won't sell all of these stocks immediately, I just think that they are rather unsuitable for my long-term strategy, even though I still see good potential for some of them in the near future...

I simply blindly added a few of them to my portfolio at the time without having really looked into the respective company in detail. I will think again (also taking your comments into account) about whether I want to keep these shares or not and when I might sell them.

-. A few of the 45 positions in the sample portfolio are certainly not classic buy & hold companies, for example Tesla, BYD, Intuitive Surgical, MercadoLibre etc., but they are companies that I am personally convinced of in the long term and that I assume will perform very well in the long term.

-. I am aware that the GAFAM stocks that I have in my portfolio as individual positions are also heavily weighted in the ETFs, which is intentional, as I find these companies so enormously strong that I have no problem with them having a total weighting of around 3-4% through individual positions and ETFs.

-. The high US weighting has bothered me for a long time, but I'm coming to terms with it more and more. Many of the companies in the model portfolio make their sales worldwide anyway.

About my cryptos:

I don't want to give cryptos a high weighting, as there is a very high risk involved. I have set myself a 5% weighting. If the weighting exceeds 10%, I halve it again and put the profits into equities. However, if the weighting falls below 5%, I'm happy to buy more, as cryptos naturally also offer great performance opportunities and the high volatility means there are always opportunities to buy.

My outlook:

I will continue to save in the two ETFs and make sure that I add 45 individual positions to my portfolio in the long term, where I am relaxed and also expect a good performance. As things stand, these are the 45 positions from the model portfolio.

Which I am consciously doing without:

-. I am not a fan of dividends. Even if the psychological advantages should not be underestimated, there are simply many reasons why a focus on dividends does not make much sense as a young investor. I want nice price gains that are not held back by high dividends. That's why you won't find any tobacco or oil stocks in my portfolio.

In the withdrawal phase, I will still receive reasonable dividends, as I have some dividend growth stocks in my portfolio, which I think will be noticeable after a few years. I would also like to finance my pension simply by selling some of the stocks.

-. I also deliberately avoid stabilizing factors such as gold. It's unnecessary with an investment horizon as long as mine and simply costs returns in the long term.

I hope the presentation of my strategy is clearly formulated, I would be extremely pleased to receive factual and detailed feedback from you and I will also take criticism to heart.

Many thanks in advance! 🙏🏼