Better late than never? Looking back, I'm behind the technology, but nobody is interested in it, especially not now.

I pull the ripcord even if it hurts.

Puestos

42🔶 1st basic idea: Kaspa wants to be the "scalable Bitcoin"

Kaspa was developed by Yonatan Sompolinsky, one of the researchers behind the GHOST protocol (which is even mentioned in the Ethereum whitepaper).

The goal: retain Bitcoin principles but modernize them technically to enable true on-chain scaling.

⚙️ 2. Technological basis

Feature Bitcoin Kaspa

Block structure linear blockchain | Block DAG

Block time ~10min 1sec.

Transaction Approx. 7 100

per second (potentially 1000+)

Finality Approx. 60 min. seconds

➤ What is a BlockDAG?

Instead of just adding one block at a time to the chain (like Bitcoin), Kaspa allows multiple blocks at the same time, arranged in a directed acyclic graph (DAG).

This allows the network to process blocks much faster without sacrificing security.

🔐 3rd philosophy: "Fair Launch & Proof of Work"

Like Bitcoin had Kaspa:

This makes it very different from many modern projects that start via seed rounds and token distributions.

Kaspa therefore remains true to the original Cypherpunk idea.

⚡ 4 Advantages over Bitcoin

✅ Faster transactions: 1 second block time, almost instant finality

✅ High scalability: BlockDAG enables multiple parallel blocks

✅ Fair start: no pre-mine, no insider distribution

✅ Pure PoW philosophy: No proof of stake - same "security logic" as Bitcoin

✅ Active further development: Kaspa Core is being actively improved (e.g. UTXO compression, smart contract layer planned)

🧱 5. points of criticism / counterarguments

❌ Still low acceptance: Bitcoin has a 15-year head start, infrastructure, institutions, ETFs etc.

❌ Mining centralization: faster blocks → potentially higher requirements for nodes

❌ Lack of "store of value" status: BTC is "digital gold", Kaspa must first prove that it is similarly trustworthy

❌ Inflation curve: initially high issuance, which can create short-term selling pressure

💡 6. why many say: "Kaspa is the new Bitcoin"

📊 7. conclusion

Kaspa is not "the new Bitcoin" in the sense of a replacement - but it is arguably the most modern evolution of the Bitcoin concept.

If Bitcoin is the "digital gold", Kaspa could become the "digital cash":

fast, secure, fair, PoW-based.

Hi guys, the snowman is here again ⛄️

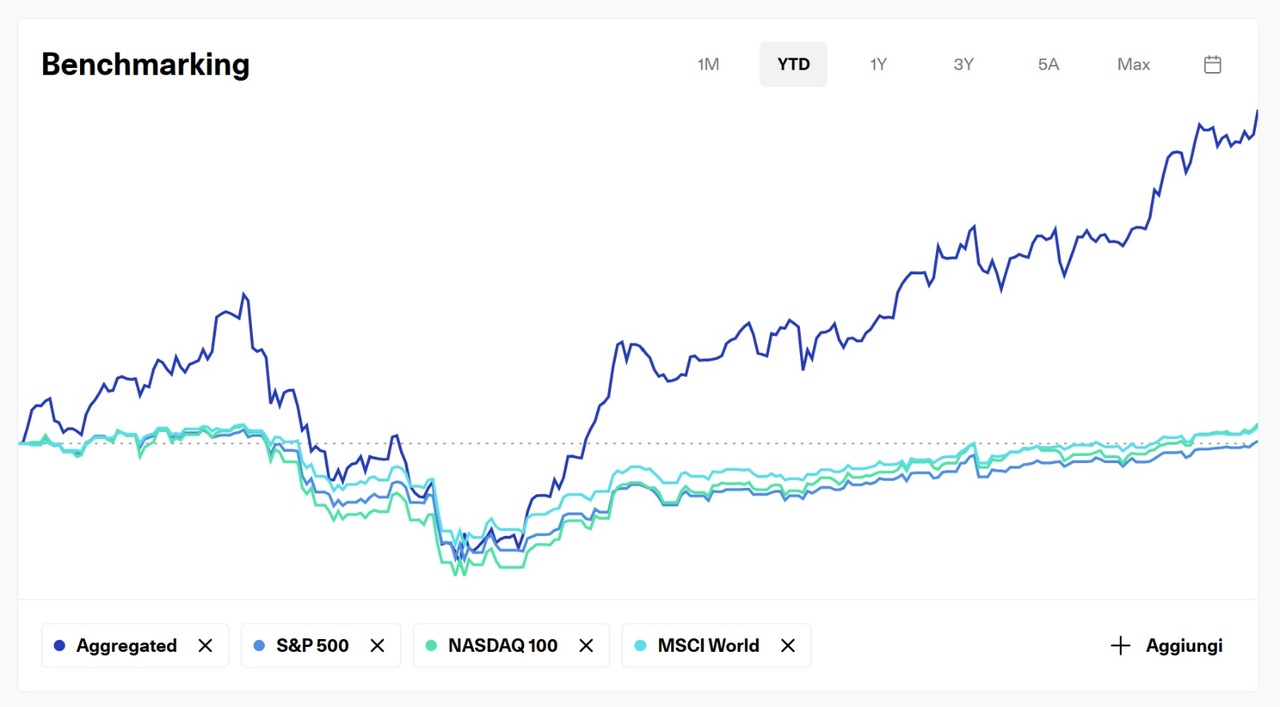

after a really long break with stocks and ETFs, I'm very active in this area again.

During the time I was inactive, I had tried out a lot of things and focused much more on crypto and achieved very good returns and profits there, of course I also want to avoid losses ⛄️

my focus remains core in crypto even if I will return to the stock market.

my strategy:

As I said, I will not leave crypto out and will continue with my spot trading strategy as before.

Core:

Altcoins:

after the bull run 100% of the $NEAR (-0,15 %) and $SEI (-0,1 %) sold and shifted to the cores

the remainder is monitored again and further HODLn

you can take a closer look at my stock portfolio yourself

my strategy is All in ETFs as I find it difficult to identify with individual shares.

However, it was very important for me to be globally diversified, which is why the big world ETFs are also in the portfolio.

I generate a small cash flow with dividend ETFs, which is why these are also increasingly to be found in my portfolio.

And last but not least, it is important to have good risk management in all situations, which is why the Gold portfolio contains a Bond Coverd ETF and a REITS ETF, which should be given more focus in times of crisis.

because we have all learned from 2020.

Your snowman ⛄️

I am 19 years old and can invest around €1,300 a month.

I have made a conscious decision to invest a little more riskily at this stage of my life in order to build up assets in the long term.

That's why I'm currently taking a 30% / 30% / 40% risk:

Planned split:

My portfolio currently consists of, among other things

I am currently wavering between two strategies:

Build each position to ~€1,000, then just hold and continue to save monthly in one company with a savings plan.

OR

Strengthen the core (30 % S&P 500, 30 % BTC, 40 % individual stocks) and reduce the number of individual stocks to 5-6 in order to invest in a more focused manner.

In the long term, I would like to grow passively, but still retain the opportunity to outperform through selected growth stocks.

Thank you for reading 🚀

I recently started my training as a civil servant and receive €1,400 net. I also receive a half-orphan's pension of €540. As I hardly have any fixed costs (only fuel, food and MMA training), I end up with almost all of my income left over to invest.

🧭 My plan: I have a savings plan for €1,400 on the 2nd of every month. I'm also thinking about putting €200 a month into derivatives - not as my main investment, but as "play money" to take any profits and then shift them into ETFs or BTCs.

Current portfolio & strategy (approx. €11,400):

Core S&P 500 ETF ( 30%)

$CSPX (-1,24 %) (target 30% of the portfolio)

→ This is my core component in the portfolio. I deliberately only want to hold approx. 30% core because I'm prepared to take more risk as I get older.

Bitcoin

$BTC (-0,14 %) (also target 30%)

→ I still need to buy more, but it should have the same weighting as my core.

Nu Holdings

$NU (-0,93 %) 10%

→ I see this as a future stock with a lot of potential.

PayPal $PYPL (-1,17 %) 10%

→ I plan to use it as a turnaround investment. However, no further savings plan, as I want to wait and see how the value develops.

Ondas Holdings

$ONDS (-4,5 %) 5-10%

→ I would describe this as my momentum share - the plan here is to cash in when profits are good.

Kaspa (crypto) $KAS (+0 %) 5%

→ Fun project, but also with a long-term perspective.

Canopy Growth $WEED (+0,38 %)

→ I think I will hold in the medium term.

🚀Target:

In 2.5 years (I'll be 21 then) I'd like to crack the €50,000 mark.

In purely mathematical terms:

So with a little return, the €50k target should be absolutely realistic. 🚀

What do you think about my setup?

👉 Which 2 additional stocks would you recommend for the savings plan (besides S&P500 & BTC)?

👉 How do you see the €200 in derivatives as a "play money" strategy?

Bull Market Stock Portfolio Management.

Screenshot day.

$RKLB (+0,84 %)

$NBIS (-5,5 %)

$HIMS (-1,1 %)

$OSCR (-4,03 %)

$SOFI (-1,27 %)

$AMD (-3,16 %)

$DLO

$TMDX (-8,09 %)

$AMZN (-2,34 %)

$GOOGL (-0,59 %)

$ISP (-2,91 %)

$UNH (-0,68 %)

$OPEN (-3,38 %)

China is pumping $BIDU (-0,49 %)

$BABA (+0,72 %)

$JD (+7,9 %)

Cripto, waiting for altcoin season

$AVAX (-0,33 %)

$BTC (-0,14 %)

$ETH (-0,22 %)

$SOL (-0,55 %)

$RENDER (-1,36 %)

$KAS (+0 %)

Hello everyone,

I have already built up a small portfolio (see below), which is currently quite US and tech-heavy.

My current positions:

I save the remaining positions for my little sister.

I can invest around €1,200 per month (I'm looking for 2-3 shares for this) and I'd also like to put another €2,000-3,000 into Bitcoin in the bear market.

For the savings plan, however, I am specifically looking for stocks outside the USA and without a tech focus.

Questions for you:

I would be delighted if you could share a few ideas so that I can expand my watchlist and diversify my portfolio.

Thanks in advance!

Let's see what happens $KAS (+0 %) convinces me with its speed and possible listing.

Still on the watchlist and also interesting for me $HYPE (-0,61 %)

$QUBIC (+2,88 %)

Principales creadores de la semana