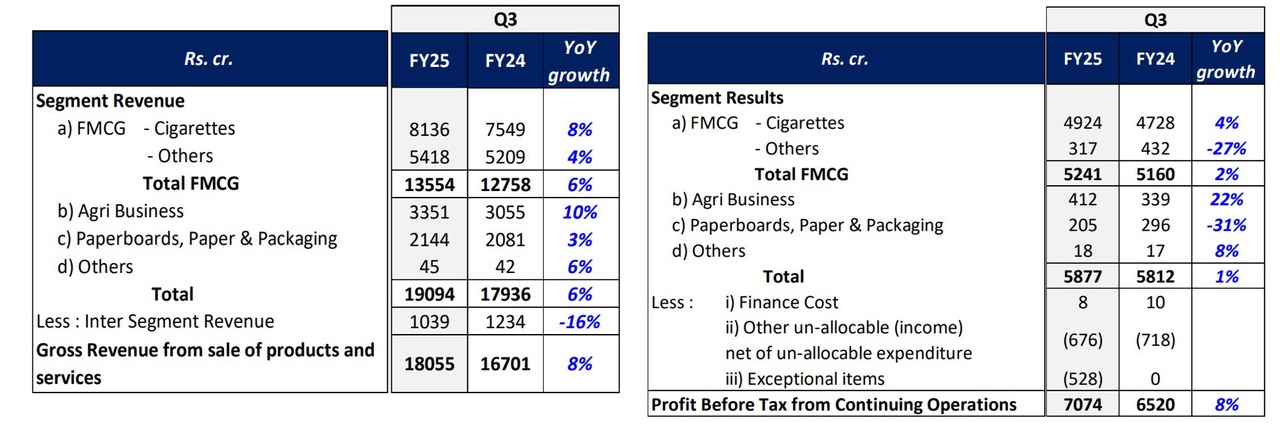

The recovery of market share from the illegal cigarette trade was not sufficient to lift the improvement in earnings from $ITC to the expected level in the third quarter of 2025. Subdued demand in the overall consumer goods sector (FMCG), rising input costs and various external factors continue to put pressure on ITC's profitability (gross margin fell year-on-year from 34.8% to 32.6%).

ITC

Price

Debate sobre ITC

Puestos

6$ITC plans to float ITC Hotels on the stock exchange as a spin-off. $BATS (+1,06 %) will have around 15% of ITC Hotels (1 ITC Hotels share for every 10 ITC shares). The value of the share package is estimated at around $400 million. BAT plans to sell its stake in ITC Hotels without discount. The proceeds from the sale will be used to reduce debt.

$BATS (+1,06 %) and $MO (-1,23 %) have both shares in $ITC / $BUD sold. The proceeds from both are to be used to buy back shares. However, there are major differences here.

- BAT operates in 180 markets, Altria really only in one

- BAT is the global No.2 in heated tobacco, Altria has no product yet

- BAT is the global No.1 in vapes, Altria has only a minimal market share in the USA

- BAT is the global No.1 in oral tobacco, Altria is No.2 in the USA

- BAT sells ITC shares at a profit, Altria sells ABI shares at about 50% loss

The situation of the two companies could not be more different.

Instead of using the money from the sale to finally position itself properly in the global market, Altria is using the money for further share buybacks. The big question now is how many more missteps Altria can afford.

I will be comparing Philip Morris, Altria and BAT in detail in the next quarterly figures.

$BATS (+1,06 %) sells 3.5% of its $ITC shares (~$2 billion) just under $900 million will be used for share buybacks in 2024. In addition, leverage will be further reduced to 2.2-2.5x.

$BATS (+1,06 %) is preparing to reduce its stake in the company to $ITC to 25% this week. They currently hold 29.03% and are therefore the largest shareholder, which they would still be after the reduction. The proceeds will be used to reduce debt and buy back shares. With the 25%, BAT still retains a veto right.

The sale of the ~4% makes sense. It makes no difference whether BAT holds 29% or 25%, I think the debt reduction and especially the share buybacks (if you are valued so favorably) are very good.

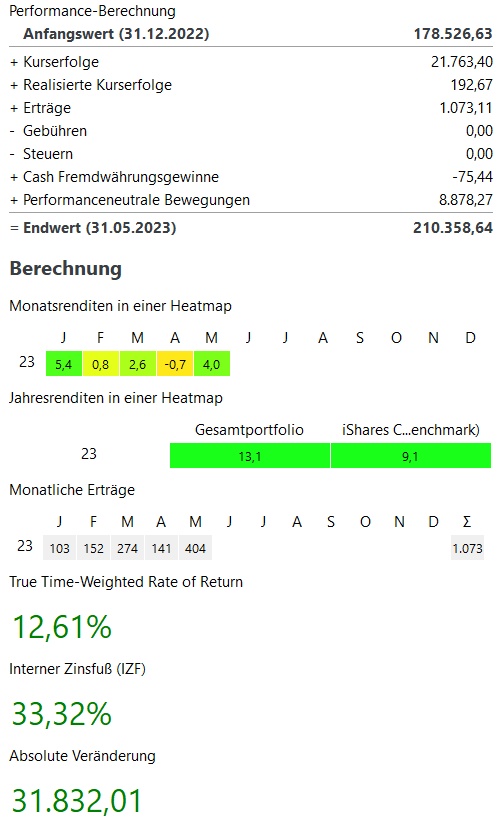

Depot review May 2023 - Sell in May and... oh shit 🚀🚀🚀

"Sell in May and go away" - One of the most famous stock market sayings par excellence and following it would have cost me a lot of money this year.

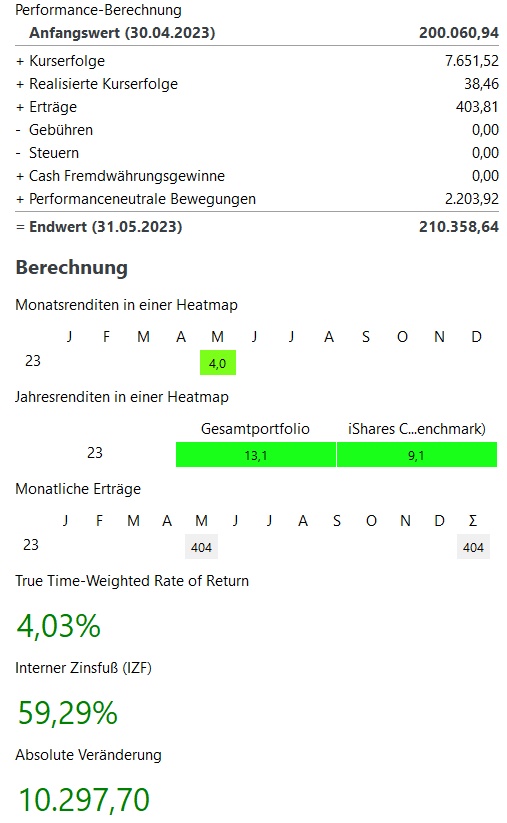

In the depot May was with +4,0% the strongest month after January. Compared to May 2022 with -5.1% an extreme difference.

In the current year, my performance is currently +13,1% and thus significantly above my benchmark (MSCI World +9.6%).

Not surprisingly, of course, extremely strongly driven by NVIDIA $NVDA (+1,53 %) with +41% / + 2.700€. This accounts for almost one third of the price gains in May. Also strong Alphabet $GOOG (+0,12 %) and Palo Alto Networks $PANW (+2,83 %)

On the losing side, in May it was mainly Starbucks $SBUX (+0,13 %) Nike $NKE (-1,45 %) and Sartorius $SRT (+3,5 %)

In total my portfolio stands at over 210.000€ even though I only broke the 200,000€ barrier in April.

Dividend:

- Dividend +16% compared to prior year

- Current year dividends are +32% above first 5 months 2022 after 5 months

Purchases & Sales:

- Bought in May for approx. 3.200€

- Executed mainly my savings plans:

- Blue Chips: Caterpillar $CAT (+1,45 %) NVIDIA $NVDA (+1,53 %) TSMC $TSM (+1,15 %) Amgen $AMGN (-0,02 %) Procter & Gable $PG (-0,98 %) Johnson & Johnson $JNJ (-1,21 %) S&P Global $SPGI (+0,26 %) and as a new investment Hershey $HSY (-1,07 %)

- GrowthBechtle $BC8 (+1,48 %) and Palo Alto Networks $PANW (+2,83 %)

- ETFsMSCI World $XDWD (+0,73 %) Nikkei 225 $XDJP (+2,08 %) and the Invesco MSCI China All-Shares $MCHS (-0,25 %)

- Crypto: Bitcoin $BTC (-0,58 %) and Ethereum $ETH (-0,35 %)

- Sold with the x-trackers MSCI Emerging Markets my complete holdings of the ETF.

- Reasons for this are many, especially the weak performance

- Since I also have a pure China ETF monthly and China makes up about 30% of the MSCI EM I am still invested here. In addition, I have TSMC in my portfolio, which makes up about 7% of the MSCI EM. So in total I have over 35% of the index covered in my portfolio anyway. In addition, the Samsung share $005930 with a share of 5-6% in the Emerging Markets Index on my watchlist.

In the next month I will probably follow the current trend and try with an Itochu $ITC in the savings plan to increase my Japan share a little.

How did your portfolio perform in May? And what do you think of stock market wisdom like "Sell in May and go away"?

#dividende

#dividends

#personalstrategy

#depotupdate

#performance

#update

#rückblick

Valores en tendencia

Principales creadores de la semana