𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗠𝗶𝗰𝗿𝗼𝘀𝗼𝗳𝘁-𝗖𝗘𝗢 𝘃𝗲𝗿𝗸𝗮𝘂𝗳𝘁 𝘀𝗲𝗶𝗻𝗲 𝗔𝗸𝘁𝗶𝗲𝗻 / 𝗦𝗾𝘂𝗮𝗿𝗲 𝗺𝗶𝘁 𝗻𝗲𝘂𝗲𝗺 𝗡𝗮𝗺𝗲𝗻 / 𝗦𝗰𝗵𝘄𝗲𝗶𝘇𝗲𝗿 𝗕𝗿𝗶𝗲𝗳𝗺𝗮𝗿𝗸𝗲𝗻-𝗡𝗙𝗧

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Analog Devices ($ADI (+0.25%)), Anthem ($ANTM (+2.95%)), Arthur J. Gallagher & Co. ($AJG (+0.73%)), Bank of America ($BAC (+0.02%)), Baxter International ($BAX (-0.32%)), BROWN-FORMAN B ($BF.B (-4.71%)), Dominion Energy ($D (-0.14%)), Imperial Oil ($IMO (-0.46%)), Linde plc ($LIN), Nasdaq ($NDAQ (+1.31%)), National Grid ($NG. (-0.32%)), PepsiCo ($PEP (-0.12%)), Suncor Energy ($SU (-0.5%)), Ingersoll Rand ($IR (-0.47%)) and Waste Management ($WM (-0.12%)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Dollar General ($DG (-0.9%)), DocuSign, Inc. ($DOCU (-0.37%)), Canadian Imperial Bank of Commerce ($CM (+1.05%)) , Marvell Technology Group ($MVL) and Toronto-Dominion Bank ($TD (+0.77%)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Microsoft ($MSFT (+1.71%)) - Microsoft CEO Satya Nadella is divesting half of his Microsoft shares, worth $285 million. According to a Microsoft spokesperson, Nadella is selling his shares for diversification and personal financial planning reasons. However, it is believed that he needs the money primarily for tax payments that may soon be due on long-term capital gains. For the same reason, Tesla ($TSLA (+3.21%)) chief Elon Musk sold share packages worth billions.

Square ($SQ (+3.31%)) - The payment service Square is changing its name to Block. The background to this is that Square now wants to focus more on the area of cryptocurrencies, the abbreviation "Block" stands for blockchain. The name change is to be implemented as early as December 10.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

EU countries have agreed on new transparency rules for remittances using bitcoin ($BTC (+7.12%)) and co. On Wednesday, the EU issued a press release saying that all transfers with cryptocurrencies should be traceable in the future. This would mean that anonymous cryptowallets would no longer be allowed. Crypto service providers would thus be obliged to make the information about the recipient and sender of the transfer transparent. The background of the EU lies in the fight against criminal transactions with cryptocurrencies.

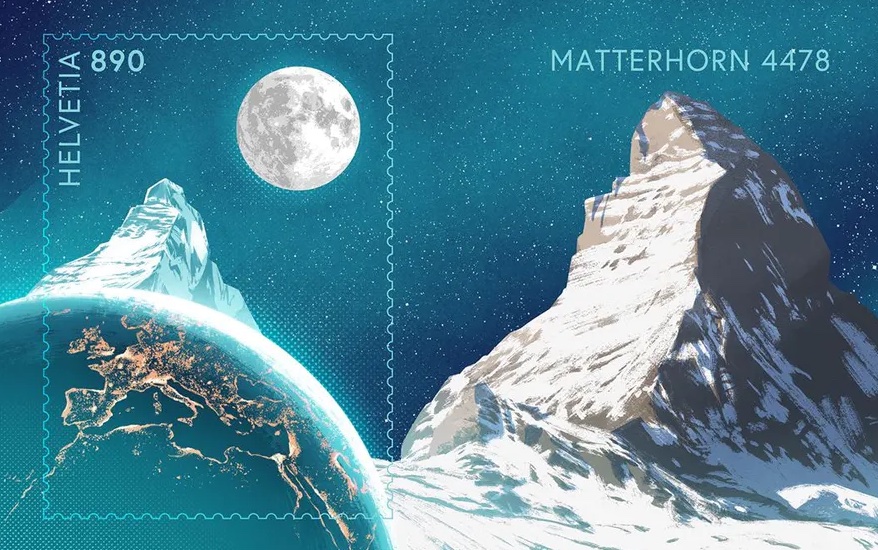

Swiss Post NFTs - On Nov. 25, 2021, Swiss Post launched 175,000 NFT stamps for 8.90 Swiss francs each. The NFT stamps were well received, selling out after only four hours. The stamps are available in 13 different designs. The novel stamp can also be used to frank a letter through a QR code on the physical stamp. However, it is mainly used as a collector's item.

Follow us for french content on @MarketNewsUpdateFR