Discussion about SHIB

Posts

57This weekend it will burn🔥🔥🔥🔥🔥🔥

This weekend should be particularly hot for cryptocurrencies, especially US-based crypto, it's already lunchtime. The stock market will be pulling its money out, as they do every Friday. Focus on crypto now so you can take profits tomorrow and Sunday. On Monday, take your profits and get out with the critters 🚩🚩🚩🚩📤

Solana $SOL (-1.96%)

🔥🔥🔥💵🔥💵💵🔥💵🔥

ISO compatible

XRP $XRP (-1.88%)

XLM $XLM (-2.68%)

XDC $XDC (-2.64%)

VELO $VELO (-1.82%)

ONDO $ONDO (-1.95%)

💵🔥

Meme 🚨

BONK $BONK (-1.66%)

Pepe $PEPE (-1.96%)

Pudgy penguin

Doge $DOGE (-2.22%)

Shiba Inu $SHIB (-2.34%)

As with stocks, there are risks with cryptocurrencies... Do your research and never invest more than you can afford to lose.

Service post for all Shitcoiners among you and anyone still looking for a wallet

Bitbox has arrived in Black Week and is offering up to 21% discount until 02.12.2024:

BitBox02 Multi edition (134,10€)

BitBox02 Bitcoin-only edition (134,10€)

Black Friday Bundle (197,5€) with the following content:

- 1x BitBox02 hardware wallet - to keep your coins safe (edition freely selectable)

- 1x Steelwallet - to make your wallet backup almost indestructible

- 5x tamper-proof security bags - to ensure that no one can view your backup unnoticed

- 3x backup cards - for additional backup security copies

- https://shop.bitbox.swiss/de/products/black-friday-bundle-41/

I will get the Bitbox02 Bitcoin-only edition, as I would like to do without the ledger.

Are you also getting a wallet?

If so, which one is your favorite?

$BTC (-1.61%)

$LTC (-1.49%)

$ADA (-2.53%)

$ETH (-2.18%)

$MATIC (-2.02%)

$FTM (-6.61%)

$SHIB (-2.34%)

At least I was already smart enough to google discount codes to save 5 euros

To all those who are currently trading Shitcoins in the short termI'm slowly getting weak. I should actually be following my strategy, but the gains are too juicy.

My plan is actually to let the Shitcoins run for a bit over the WE at max. lev (3x for me) to take the retailer FOMO with me and conservatively tighten the stops - max. until Monday US opening. And then to run small spot hedges at least for Mon/Thu, depending on the strength, and then to extend longs again.

How do you do it? my trades: $MKR (-0.69%)

$MATIC (-2.02%)

$UNI (-1.42%)

$TAO (-4.2%)

$ADA (-2.53%)

$LINK (-1.92%)

$SHIB (-2.34%)

$DOGE (-2.22%)

$AVAX (-1.25%)

My crypto exit strategy after almost a decade of crypto experience:

Before I go into my crypto strategy in detail, I would like to make it clear that crypto relies heavily on faith (momentum: it rises because it rises). That's why I think you should only invest money here that you can write off/lose immediately. A predefined strategy like the following can help you to act rationally and leave emotions aside.

Reading time: felt like an hour

Total risk of loss:

Choosing to run self-custody (own wallet) has many advantages, but the massive disadvantage that if you lose your private keys, you can't call BTC customer service and suffer a total loss. Also, there will be no new Bitcoin. It takes exactly one minute to create such a "new Bitcoin" and doesn't cost a single euro. What's more, it will be teeming with scams and ICOs - so only trust the marketcap! 99.99% of all projects will die in the long term. The higher the market cap, the more likely it is to survive, but this is never guaranteed - even BTC could go to 0 from one day to the next.

The same goes for yield on your cryptos. In principle, creating a decentralized market is a good idea, and the yields often look very attractive. But often the coins you get as rewards are massively inflated. In addition, the risk of bugs in the code is often underestimated. The latter can also lead to total losses. Impermanent loss must also be considered here, but that would be a topic for a separate post. Returns always have something to do with risk and information arbitrage: stay in the game > outperform the game.

Trading:

For 99%, it's probably smarter to take a HODL (i.e. buy-and-hold) approach with DCA/savings plan if necessary to build a position. However, this should not be done during hype phases, but when nobody is interested in crypto anymore. Trading may seem very attractive and cool, but the majority will underperform compared to the B&H strategy. Apart from the gray hair and fun in life with much more important things than charts that you save yourself.

My assessment:

In general, I think the market and performance have changed, especially due to ETFs and the infrastructure that has emerged in recent years. As a result, I think that initially this cycle could be strongly driven by institutional investors - not because the number is so high, but because they are simply very well capitalized and even a small exposure brings in a lot of capital.

I think that the psychological characteristics will remain the same: First rises $BTC (-1.61%) then the "better" Shitcoins, until in the end everything that hasn't gone up yet goes up. If I write Shitcoins, please don't feel offended - I'll explain later why I'm doing this. I hold some myself. Just a brief definition of how I differentiate between less qualitative Shitcoins and qualitative ones:

- Is there a medallion figure who is good at telling stories or talking? (Example: Charles Hoskinson at Cardano $ADA (-2.53%) similar with Ripple $XRP (-1.88%) I would say)

- Is the technology really decentralized?

- How are tokenomics designed? (This is why I always look at the market cap and not the price).

- Does it bring added value beyond the buzzword blockchain?

- How is coin distribution divided up (whale wallets)?

Cycle within a cycle:

I also think that we have already gone through this mini cycle once in the current cycle, but that it will repeat itself throughout the momentum cycle and the price swings will increase in favor of shitcoins. My theory behind this is that when BTC has risen, the excess return is sought, and that when the returns attract the new people, they often have no idea. The "stupid money" then flows increasingly into shitcoins without substance (without wishing to offend anyone, this is how I have come to use the term). That's why I also want to use the Shitcoin performance as an exit indicator.

Exit strategy:

I will sell off a maximum of 50% of my crypto holdings, as for me the performance expectation is around 50% of my investment and 50% BTC is a kind of risk hedge against the centralized financial system. I will carry out the sale in tranches of 25% each. I will use a grid bot for this. I will start as soon as the crypto share exceeds 25% of my total portfolio. I will not invest new capital in crypto for the time being, but will only expand my Shitcoin position by using a slight leverage on my margin account depending on the phase. When I talk about leverage, I don't mean 25x, but rather 1.5x - as the additional return is worth less to me in favor of my security. My motto is always: stay in the game > outperform the game.

In the end, only BTC will remain until the next hype!

My personal shitcoin sector favorites:

I think DeFi will perform strongly as substantially more security could be created in the next 6-12 months due to potential regulatory certainty. In general, however, I suspect that it doesn't really matter which coin you buy, as past experience has shown that towards the end of the cycle people will buy anything that hasn't yet made 10x - regardless of whether there is any fundamental added value.

With regard to L1, I think that $ETH (-2.18%) is currently undervalued. I see reasons for this in the fact that Vitalik Buterin is a miserable salesman (which I actually find positive), and Solana $SOL (-1.96%) can offer much lower fees at the expense of security. The ease of programming allows more dapps to be created. In general, I think that ETH is more in line with the basic idea of crypto than Solana, although it should be mentioned that Solana has gained massive adoption - for me a sign that most people have no idea what they are actually buying.

I think the SUI architecture is promising in principle, but I wouldn't overweight it - but I'm not too deep into the subject either.

L2 makes a lot of sense for ETH, but will only outperform when transaction costs are astronomical again. In general, I see transaction costs as a very good market indicator for timing as well as leverage in the market.

Memecoins:

The probability that Dogecoin $DOGE (-2.22%) continues to rise is high in my opinion. That's why I'm holding a small position. Especially if Elon Musk pushes the coin again, strong price movements could follow in the short term. If that happens, I will also buy less capitalized memecoins in the short term. However, you always have to keep this in mind: It only takes a few minutes and a few hundred dollars on networks like Solana to buy a new $PEPE (-1.96%) , $SHIB (-2.34%) or other meme coin. Such coins are often based purely on hype and momentum

Long-term outlook:

I think we are no longer early in crypto, but early in usability and institutional exposure. Only now is the real value being created as products can be used and regulatory certainty increases. I hope that the volatility of BTC will decrease due to the increasing market capitalization and that in the long run it will reflect modern digital gold rather than a risk-on asset.

In conclusion, I think that the AI theme has run its course and crypto could be the new risk-on draw - at least in the short term, as this is also fundamentally justified by potential regulation. Nevertheless, I think that AI currently offers greater fundamental added value in terms of productivity. Crypto is not really needed as long as the centralized services or fiat currencies work. Also, the majority actually has 0 added value and is only riding the crypto wave to attract capital. 99.9% do not correspond to the basic idea.

If a Blackswan event occurs, everything will be sold off in the short term, especially risk-on assets. That's why I always hold cash (currently even 20%) so that I have liquidity to buy. You should never be so naive as to believe that you are 100% right, but always stay humble, think in terms of probabilities and practice risk management!

To conclude once again:

stay in the game > outperform the game. There will be no new Bitcoin, I dare to promise that haha - everything else is speculative. The term "Shitcoin" should help you to always be aware that it is not driven by fundamental value, but by profit expectations!

Everything here is highly speculative and not investment advice, just my humble assessment after a good 8-9 years in the crypto market. Everyone please do what you think is right and don't judge others. "The only thing I can say with 100% certainty is that I can't say anything with 100% certainty": Did Einstein say that?

Congratulations on making it this far and not having a TikTok attention span. Basically, I wrote the whole thing for myself because it @JJJ inspired me to write down more of my thoughts in order to continue making rational decisions - thank you for that! Thanks also to @stefan_21 for the daily BTC education. If I'm honest: BTC is the real deal 😉

Additionally, it's important to make your investment decisions independently of any Youtube Fin or crypto influencers. For the most part, they are only out to push you into trading, as they earn money when you trade with their affiliate links on any exchanges. In general, this financial and especially crypto influencer scene is very, very lucrative due to the commissions - you should always be aware of that!

It has also helped me enormously to deal with very boring topics in order to draw conclusions about the exciting topics:

Bond market, interest rates, especially liquidity, interest rate spreads, fiscal policy, financial psychology, momentum, leverage, to name a few topics.

Of course, not everyone has the privilege of having the time to deal with these topics, but if you do, I can only recommend it. Not because I want to trade volatility or overweight bonds, but because it offers a very good understanding of the overall market and is a basic building block for risk management.

I don't know if anyone still reads here - never mind. Even if not, it has helped me. I've definitely written down enough thoughts for today, I should call my mom again.

$SHIB (-2.34%) I'm looking forward to it in the long term... I do have a few million shibs. I bought it back then with 5 zeros... and made a good profit (with 70 dollars). Now I'll try again with a larger sum and see where the journey takes me in 1-2 years... it's in my monthly savings plan anyway :)

Bitcoin cycles in the year of the halving. If September was green for Bitcoin, the following three months were all green. Bitcoin is up 11.5% this September and there are only four trading days (including today) left this month. Where do you see the Bitcoin price at the end of the year? My guess is $100,000 (currently $65,000).

$BTC (-1.61%)

#bitcoin

$ETH (-2.18%)

$SOL (-0.2%)

$BNB (-0.68%)

$DOGE (-2.22%)

$XRP (-1.88%)

$SUI (-1.3%)

$ADA (-2.53%)

$USDT (-0.09%)

$AAVE (-3.33%)

$BONK (-1.66%)

$SHIB (-2.34%)

$BEST (+0%)

$COIN (+6.4%)

$MSTR (+7.74%)

$GLXY

$IBIT

$BCH (-0.99%)

$21BC (+7.04%)$HIVE (+3.85%)

$MARA (+6.43%)

$RIOT (+1.27%)

$ETHE

$BCHS (+2.29%)

$ARB

Due to the low volatility in recent times, significantly fewer speculators are interested in BTC because it has become too 'boring'.

The US dollar is the last remaining final opponent.

After another rally of +7.4%, the US dollar $BTC (-1.61%) reached a new all-time high yesterday, both in terms of the euro exchange rate and its market capitalization in USD.

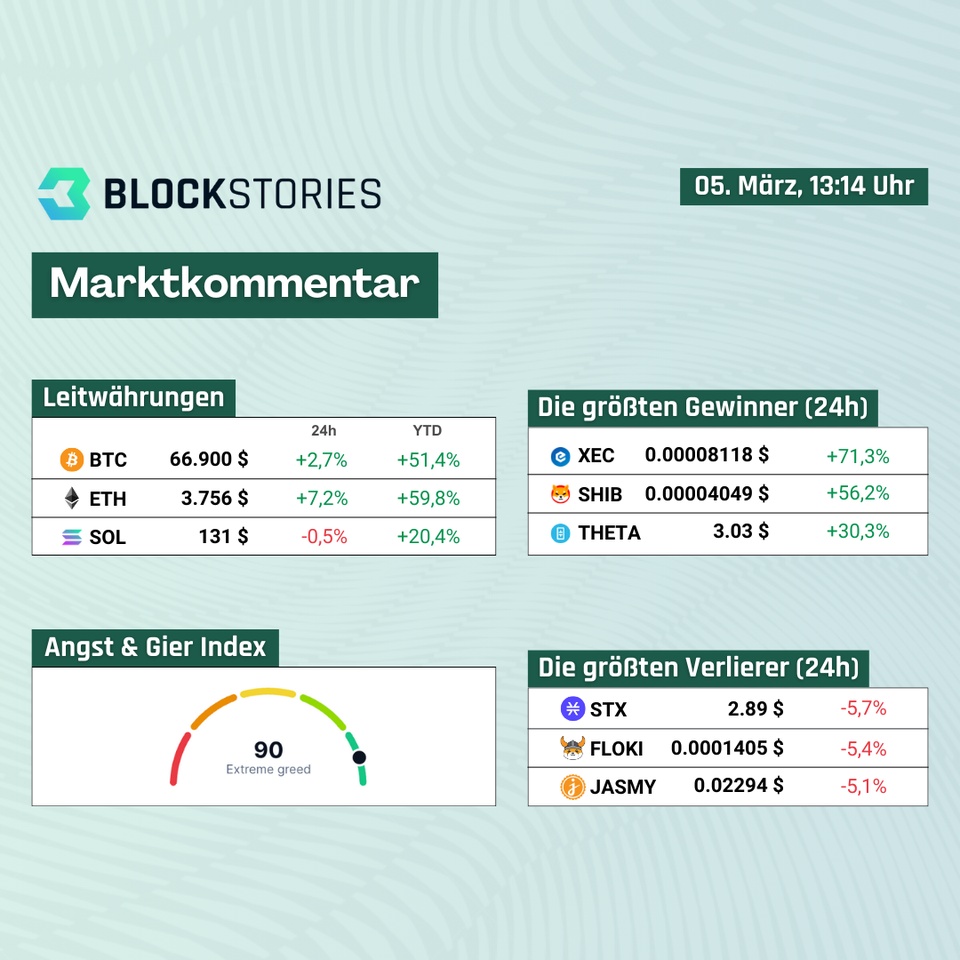

According to the current status (05.03. 13:14) just under +3% and the high from November 2021 would be set.

The market is maximally long and seems not to be overheating precisely because the demand for Bitcoin spot ETFs is virtually absorbing the volatility.

With a trading volume of USD 5.5 billion), the ten spot #etfs marked their second strongest day since launch yesterday.

This brings Bitcoin's dominance of the crypto market back up to 53%.

However, it has become abundantly clear in recent days that some traders are no longer willing to wait until this dominance is broken and some of the capital finds its way to more remote areas of the risk curve.

Memecoin mania reigns.

The menu includes all coins with frogs or dogs on them. Here is a performance overview of selected memecoins in the last seven days:

- $DOGE (-2.22%) +93%

- $BONK +183%

- $WIF+226%

- $SHIB (-2.34%) +291%

- $PEPE +247%

After a short breather tonight, the memecoin rally now seems to be continuing.

This is mainly due to the fact that Robinhood is now letting its users trade $BONK and Binance has announced the listing of $WIF at the same time.

------

What else has happened these days?

- Ordinals record record volumes

- Michael Saylor wants even more Bitcoin

- BlackRock to invest in BTC ETFs with Strategic Income Opportunities Fund

- SEC postpones decision on BlackRock's Ether spot ETF

- Coinbase introduces smart wallets

You can find all the background information in today's newsletter: https://blockstories.beehiiv.com/p/coinbase-stellt-smart-wallets-vor

------

Sources:

Funding Rate Heatmap: https://www.coinglass.com/FundingRateHeatMap

BTC-ETF Volume: https://twitter.com/EricBalchunas/status/1764763178368463267

BTC dominance: https://de.tradingview.com/symbols/BTC.D