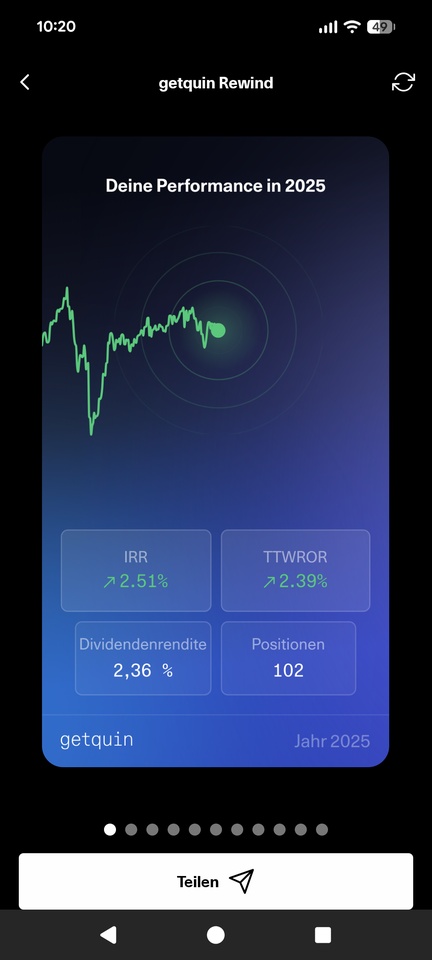

It was a good start to the year :)

Top Movers

$ASML (+4.33%) + 34%

$JEDI (-0.34%) +23%

$SLVY (+3.6%) +22%

$8002 (+0.46%) +17%

$KLAC (+5.34%) +16%

Top Loosers

$HIMS (+42.19%) -17%

$AOF (-1.57%) -15%

$UNH (-1.35%) -14%

$QCOM (+1.66%) -12%

Posts

7It was a good start to the year :)

Top Movers

$ASML (+4.33%) + 34%

$JEDI (-0.34%) +23%

$SLVY (+3.6%) +22%

$8002 (+0.46%) +17%

$KLAC (+5.34%) +16%

Top Loosers

$HIMS (+42.19%) -17%

$AOF (-1.57%) -15%

$UNH (-1.35%) -14%

$QCOM (+1.66%) -12%

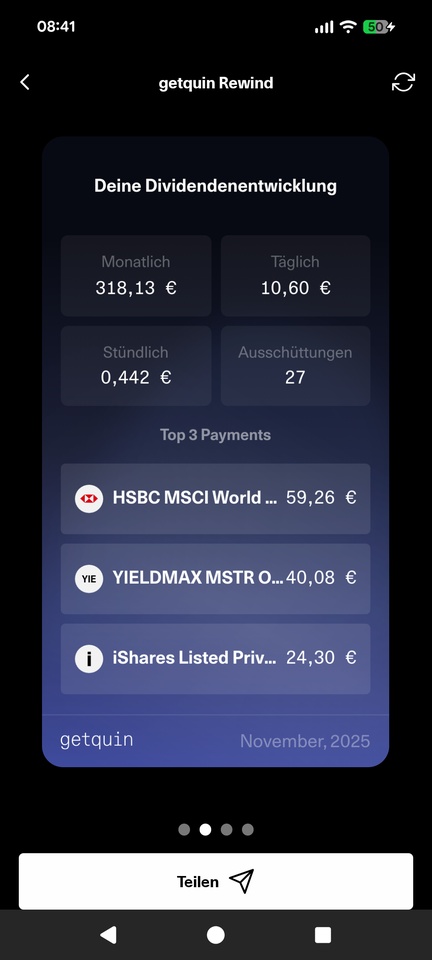

After the annual rewind, here is December

#rewind #december25

Top Movers

$SLVY (+3.6%) +22,2%

$DG (-0.82%) +21%

$ENPH (+2.18%) +13%

$8031 (+3.06%) +11,2%

$D05 (-0.66%) +7,6%

Top Loosers

$HIMS (+42.19%) -18,4%

$AVGO (+3.76%) -14,7%

$MPW (+0.29%) -14,4%

$YMST -12,5%

Bitcoin and dollar weakness hurt this year...

Top performers 2025

$KLAC (+5.34%) +72%

$8002 (+0.46%) +66%

$DG (-0.82%) +57%

$ASML (+4.33%) +37%

$HIMS (+42.19%) +35%

$SLVY (+3.6%) +35%

$AVGO (+3.76%) +31%

$8031 (+3.06%) +21%

$MUX (-1.98%) +20%

$GLDI (-0.42%) +18%

Low performer 2025

$3350 (+1.64%) -69%

$ARE (+1.29%) -54%

$ENPH (+2.18%) -52%

$YMST -48%

$NOVO B (+2.64%) -44%

$UNH (-1.35%) -40%

$RICK (-2.55%) -39%

$ZTS (+1.19%) -30%

$AHH (-4.67%) -29%

+ 1

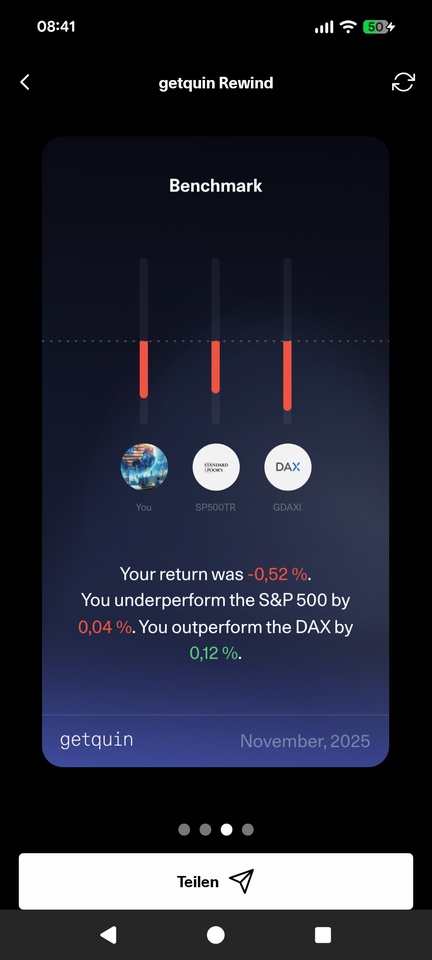

I remembered it worse :D Bitcoin and assets were tough :)

Top Mover

$CI (-0.73%) +12%

$MPW (+0.29%) +11,6%

$6367 (+1.66%) +10,1%

$DG (-0.82%) +8,9%

$AVGO (+3.76%) +8,7%

Loosers

$XS3087774306 (+3.17%) -36,3%

$YMST -34,5%

$3350 (+1.64%) -18,7%

$BTC (+3.41%) -17,9%

$HIMS (+42.19%) -17,5%

$XS3087774306 (+3.17%) # This has been the downfall of my faith in Investing. MSTR is for all intent a scam. Bitcoin goes up but mstr goes down = MSTY/P to drop. But it has a very bad upside as it's capped. So it moves down and down and down.

#rewind #october

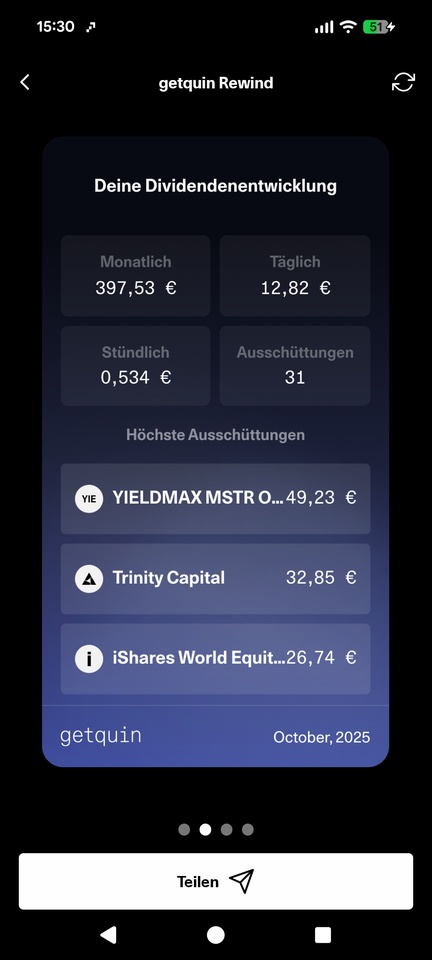

On and on :-)

Top Mover

$KLAC (+5.34%) +15%

$AVGO (+3.76%) +14%

$ASML (+4.33%) +11%

$STAG (+0.7%) +10%

$PLD (+0.45%) +10%

Loosers:

$ARE (+1.29%) -29%

$3350 (+1.64%) -18%

$RICK (-2.55%) -17%

$YMST -17%

$HIMS (+42.19%) -15%

Any Europeans in MSTY yet? Decided to add it to my portfolio and DRIP it when NAV dips below my average purchase price, or use the distributions for longterm safer dividend growth ETF's. Currently it's 10% (150 shares) of my portfolio. Might increase it to 15% when dripping at good price as time goes on.

Top creators this week