This was my last savings plan execution for$HMWO (-0.84%) and $HMEF (-4.12%) (not in the picture). The two positions together have reached the size of my $VWRL (-1.24%)-position and are therefore full.

In February, the first savings plan execution of $XDWL (-0.75%) and $XEMD (-4.15%). This will then take place once a month instead of twice a month.

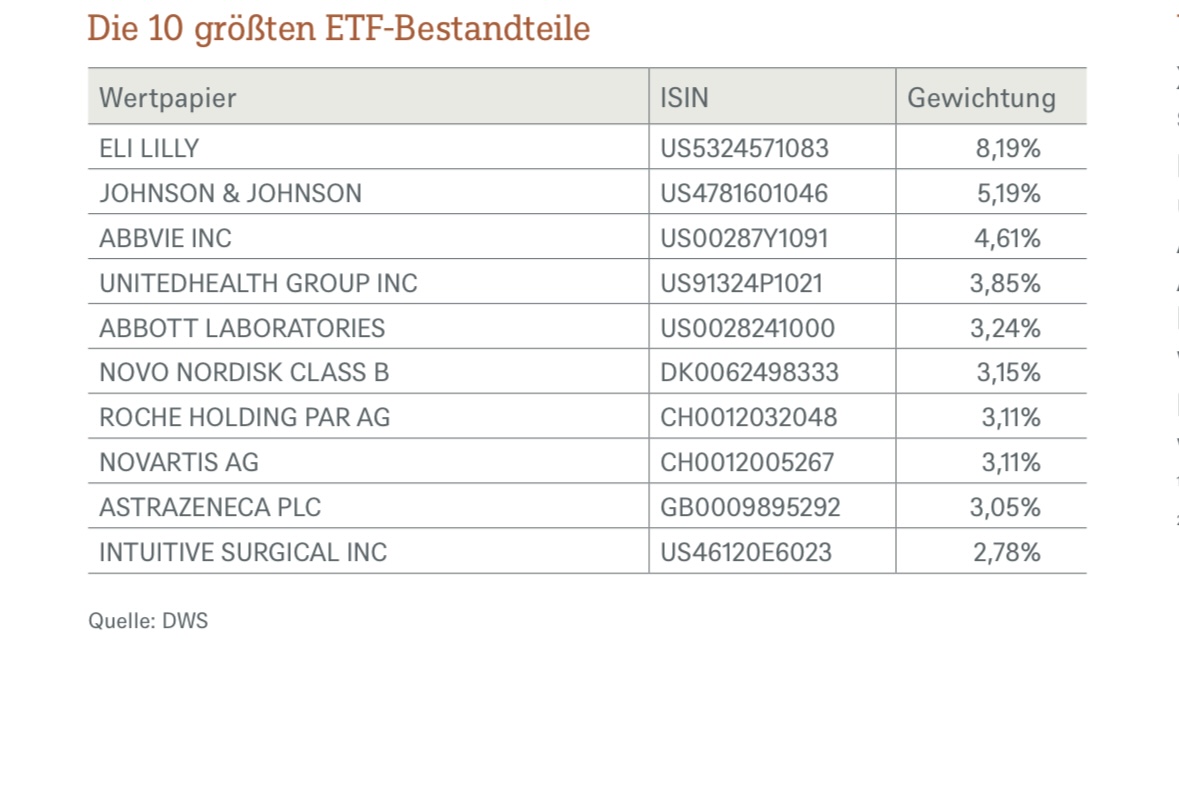

The two smaller savings plans on $WHCS (-0.62%) and $WITS (-0.45%) will continue to run, but will also be changed from 2x per month to 1x per month (amount remains identical).

Why I am using several All World ETF / World + EM. Combinations, you can read here: