Hello Community,

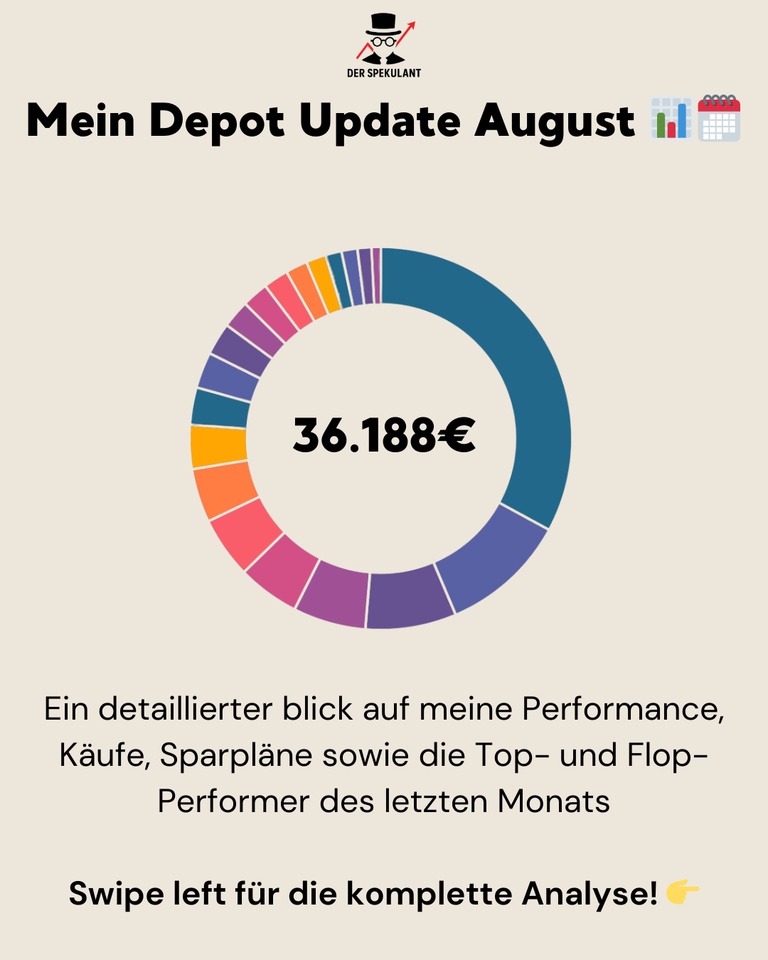

August is over and it's time for the transparent monthly review. The portfolio has reached a new high of € 36,188. It was a month of contrasts, in which the strength of some satellites offset the weakness in the tech sector.

1. the performance: 🚀

Beating the market 📈

With a monthly performance of +0,94% I am very satisfied. As the chart shows, my portfolio clearly outperformed the broad market (FTSE All-World: -0.31%) and the major US indices (S&P 500: -1.11%, NASDAQ100: -2.23%). The result proves the strength of diversification: while my tech stocks corrected, other sectors carried the performance.

2. my buys & sells: 🛒

None ❌

In August, I deliberately kept my feet still and did not make any individual purchases or sales. My focus was on waiting for the important quarterly reports and preparing my tactical purchases for September.

3. my savings plans & purchases in September: Tactical allocation 💸

As you know, I take a flexible approach to my individual shares and adjust my purchases on a monthly basis. Only my ETF savings plans run consistently. My allocation for the start of September looks like this:

➡️ $ACWI

$WSML (+0,08%) (150 €): As always, the foundation is being consistently strengthened.

➡️ $MELI (-1,57%) (€150) & Datadog (€75): Here I continue to build on my core conviction positions.

➡️ $TEM (+3,93%) (125 €): This is my tactical pick for the month. I am opening a position in a highly potent and diversifying bet on the AI medical revolution.

➡️ $DDOG (+0,64%) (75 €): A core position in my cl infrastructure cluster. Digital transformation and the need for cloud monitoring and security are unwavering megatrends for me.

➡️ $NOVO B (+0,39%) (3 €): This is not an active allocation, but the automatic reinvestment of dividends received to maximize the compound interest effect for this quality position.

4. tops & flops: A reflection of the rotation 📉📈

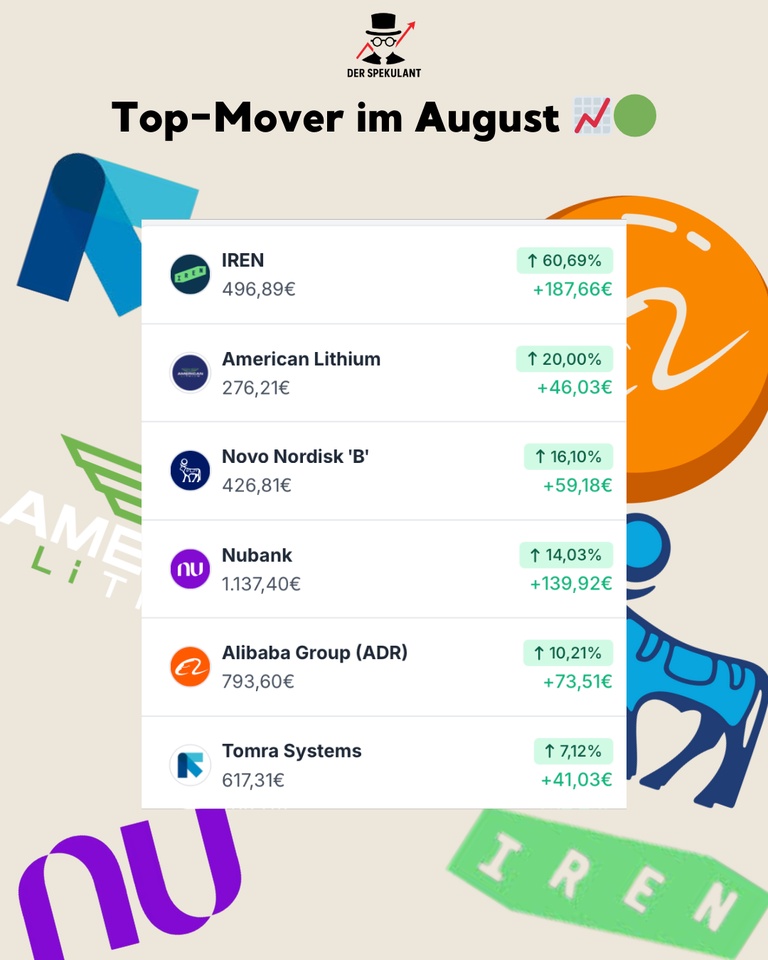

Top mover: 🟢

The list was topped this month by the spectacular performance of $IREN (+7,75%) (+60.69%), which is benefiting from the continuing demand for energy for AI data centers. My speculative bet on American Lithium (+20.00%) also showed strength. The recovery in $BABA (+10,18%) (+10.21%) following good news on the cloud division and AI chip development.

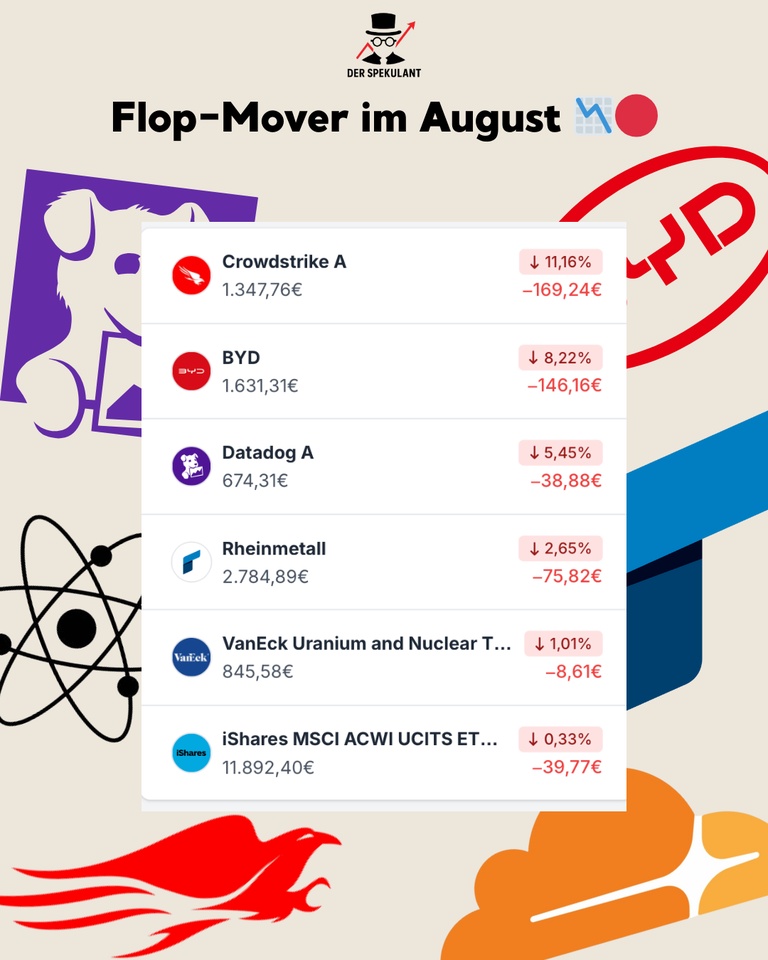

Flop mover: 🔴

As expected, my tech stocks were hit here. $CRWD (-1,07%) (-11.16%) and $DDOG (+0,64%) (-5.45%) suffered and the weak market environment for growth stocks, although the quarterly figures were fundamentally good. Also $1211 (+2,06%) (-8.22%) also suffered after disappointing figures; the situation here remains tense.

Conclusion:

August was perfect proof of why broad diversification across different sectors and themes is so crucial. Weakness in one area (US tech) was more than compensated for by strength in others (energy, China recovery). My flexible approach to monthly purchases allows me to react specifically to such market phases.

How did your August❓ go?

Which shares did you buy tactically ❓

I look forward to the exchange in the comments!