Sooooo it's time for another portfolio update.

Over the last few years, I have noticed that my long therm target of 20% pa is becoming increasingly difficult to achieve as the size of my portfolio increases, because more and more money is flowing into "safe" ETFs. Nevertheless, with my top picks 2025 $RKLB (+0,84%)

$KSB (-3,62%)

$NU (-0,93%) and $GOOGL (-0,59%) very satisfied. However, all 4 are at ATH or just below, which could make things a bit volatile in the short term. Nevertheless, I assume that all 4 will be higher at the end of the year than they are now.

My aim this year is to increase my exposure to small/mid caps. I already made a start last year, $KSB (-3,62%) has already done quite well, stocks like $P4O (-2,83%)

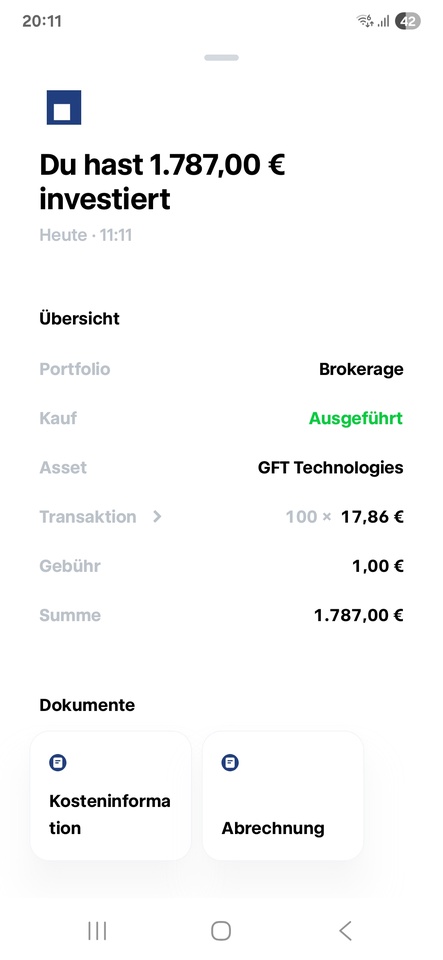

$GFT (+0,44%)

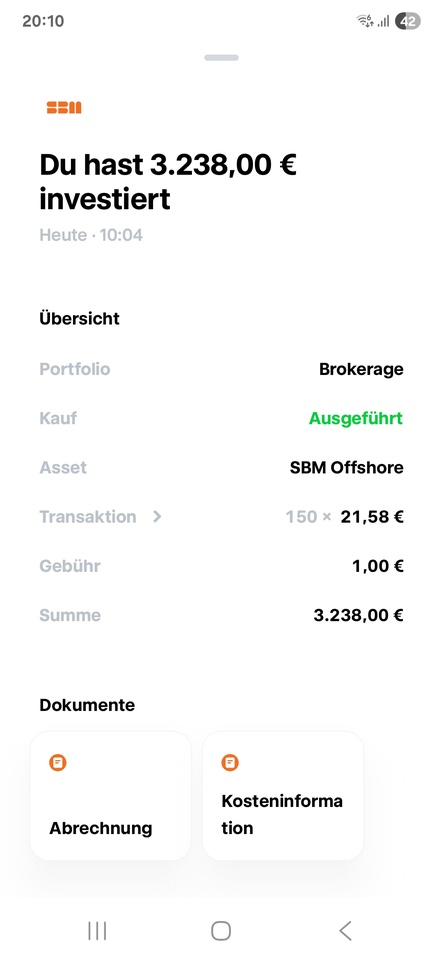

$SBMO (-0,13%) and $OSIS (-7,29%) are to be held, but no major additional purchases are planned there for the time being.

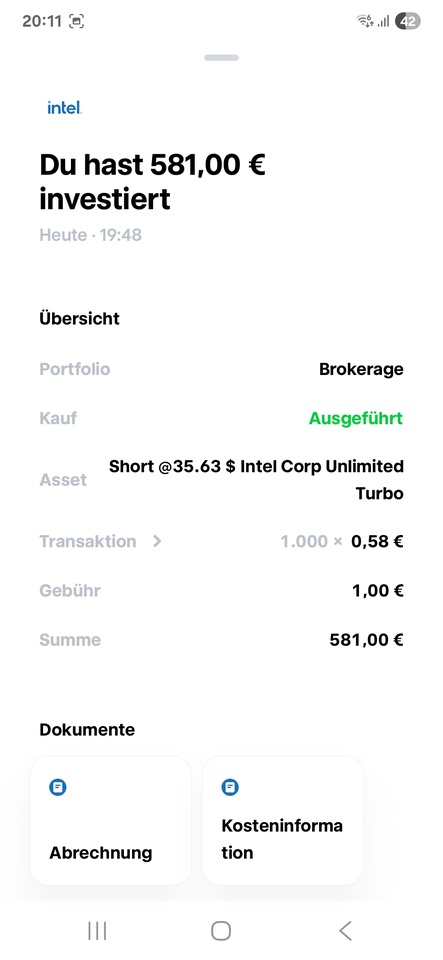

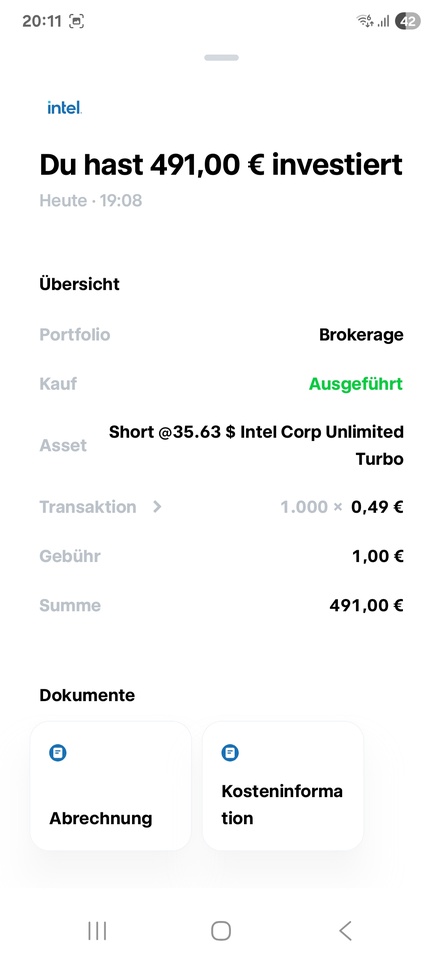

The downward positions in Samsung are all part of my 212 trading pies, divided into 3 different pies. Since mid-August, the pies have gained 21.6%. Meanwhile the total value of my 212 investments is 9600€. These are saved monthly with a total of €500 plus one-off payments from time to time.

Apart from that, there are only 2 three-month savings plans with 1.5k each on the $VWRL (-1,61%) and $TDIV (-0,25%)

In addition, there are still around 60k in various orders, but these are all turnaround bets with short-term targets of between 8% and 12%

In the long term, I will keep my eyes and ears open to find new pearls.