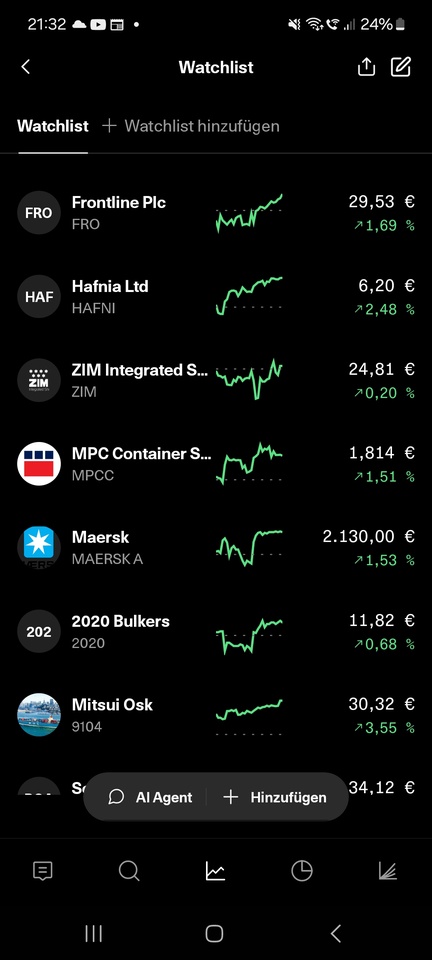

It feels like almost all the prices of shipping companies in my watchlist (see screenshot) and in the portfolio ( $TRMD A (+1,49%) , $WAWI (-0,44%) ).

I was wondering why this is the case and perhaps the explanation could be as follows:

The current surge in shipping stocks in February 2026 can be attributed to a combination of geopolitical tensions, a recovery in global trade and sector-specific special effects.

- Geopolitical risk premiums: Renewed tensions between Iran and the USA and ongoing conflicts in the Middle East are forcing ships to take longer detours (e.g. around the Cape of Good Hope instead of through the Suez Canal). This reduces the effective availability of ships and drives up freight rates.

- Strength in the tanker sector: Tanker stocks in particular are leading the rally. The sanctions against Russia and other players remain in place, permanently lengthening trade routes ("tonne-mile effect"). In addition, increased stockpiling by countries such as China for a high demand for VLCCs (Very Large Crude Carriers).

- Recovery in global trade: Lower interest rates and a more stable global economy are boosting trade volumes. Chinese exports in particular are surprisingly positive, which has driven up forecasts for the coming years.

- Sector rotation & dividends: Following a period of uncertainty, investors are increasingly looking for tangible assets and stocks with strong cash flows. Many shipping companies have strengthened their balance sheets in recent years and are now attracting investors with attractive valuations and dividend promises.