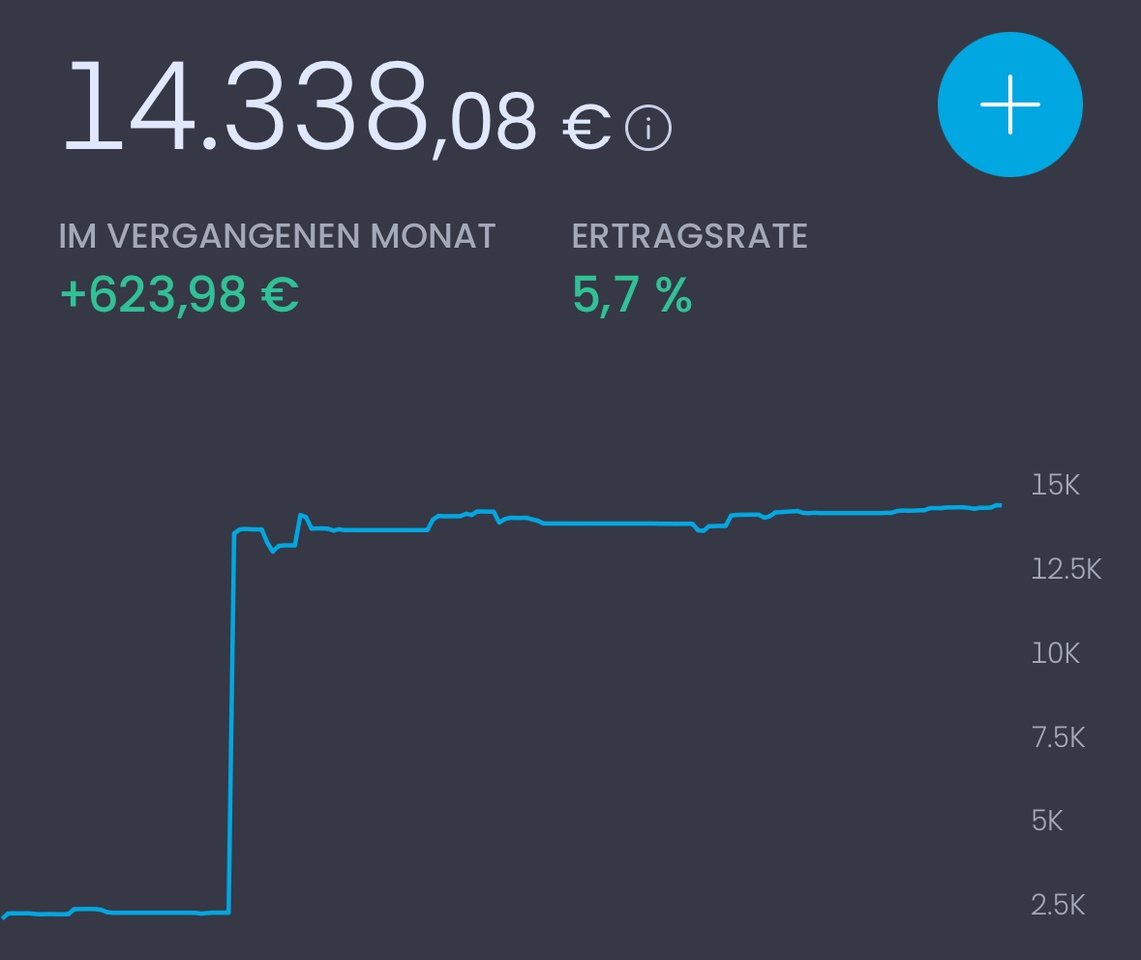

I am currently using the $DGSD (-0,32%) to track small value in EM. As I don't find the proxy that exciting, the exposure is rather small. I just stumbled across Dimensional Fund Advisors being available at Finvesto while looking through my VL contract with FNZ Bank. There, among other things, about the EM Smallcap Value (if I see that correctly) $RQ325Z .

In general, Dimensional is involved in Factoretfs. As far as I know, they are only available in Europe via advisors and want to enter the ETF market this year with 2 ETFs.

@TotallyLost Wouldn't that be interesting for you too? Of course, I don't know what the situation is in Austria. I haven't looked at it that closely so far. (I also don't know the price of custody account management at FNZ-Bank). In terms of costs, the fund seems to be on a par with comparable ETFs. So still expensive, but cheaper than most actively managed funds. I read 0.56% in the prospectus