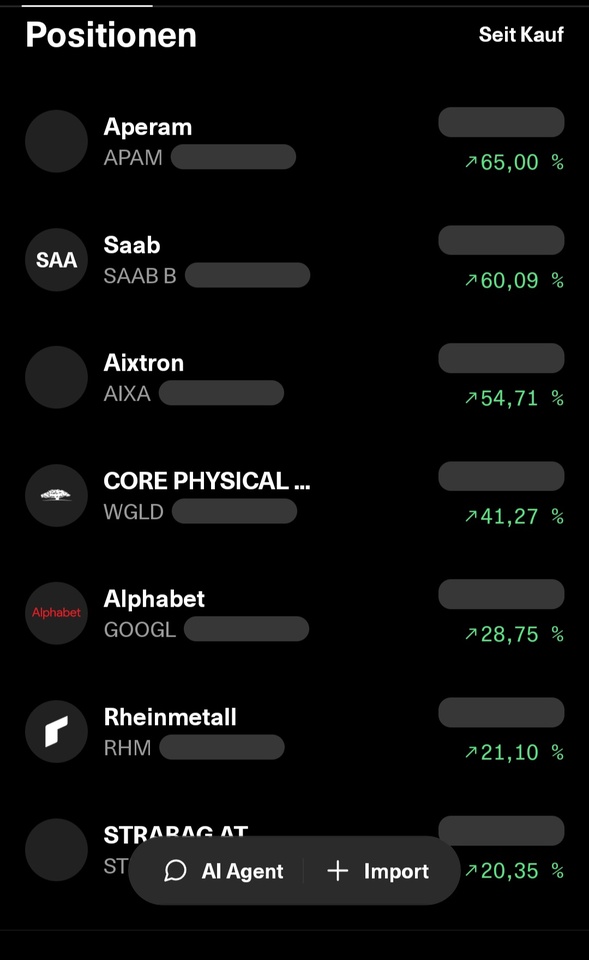

It's interesting how the distribution has shifted...

$FRE (+0,21%) , $INOD (+1,12%) , $BT.A (+0%) and $HIMS (-1,88%) no longer in the portfolio...

Messaggi

5It's interesting how the distribution has shifted...

$FRE (+0,21%) , $INOD (+1,12%) , $BT.A (+0%) and $HIMS (-1,88%) no longer in the portfolio...

+++ UKW buys wind farm from BayWa +++

(News from the only true community investment on Getquin)

The news is now almost a week old again, but I did not want to withhold this from the participants of UKW here.

As $UKW (+0,9%) has announced, they are buying the Scottish wind farm Dalquhandy for about 50 million GBP (about 57 million €).

This wind farm has a total capacity of 42 megawatts and thus increases the total capacity of all turbines held to 1,652MW. Greencoat UK Wind thus holds a stake in 46 wind farms in the United Kingdom.

80% of the electricity generated at Dalquhandy Wind Farm is also sold and supplied under a long-term power purchase agreement to the telecommunications company BT Group. $BT.A (+0%) through a long-term power purchase agreement.

The 10 wind turbines installed there are Vestas wheels model V136 4.2MW.

Another interesting fact is that Dalquhandy is the sixth wind farm acquired from BayWa. More precisely, it is BayWa r.e., the energy subsidiary of the $BYW6 (+2,01%) BayWa, which among other things offers services around energy topics, acts as a PV dealer or is also represented on the market as a project developer for wind farms and other energy solutions.

The transaction is expected to close in May 2023 and our appointed Chairman Shonaid Jemmet-Page (until

@RealMichaelScott

takes the place) stated: "Greencoat UK Wind continues to generate significant cash flow in excess of its dividend and we are delighted to announce the acquisition of Dalquhandy wind farm. This net asset value accretive transaction grows our portfolio to 46 wind farms with a generating capacity of 1,652MW. Our pipeline of potential acquisitions remains healthy and we look forward to making further attractive investments in due course as we continue to play our role in decarbonising the UK economy."

So, all in all, the path continues to look very good and the acquisition is being made from the company's surplus cash flow. And, that's one of the key points about acquiring new parks... the cash flow will be maintained and the dividend will be secured in the future.

Annual general meeting of #ukw is, by the way, on 28.04.2023.

VESTAS V136-4.2MW wind turbine:

https://www.vestas.com/en/products/4-mw-platform/V136-4-2-MW

About Dalquhandy Wind Farm on the pages of BayWa r.e.:

https://www.baywa-re.co.uk/en/wind/dalquhandy-wind-farm

To the message:

https://www.greencoat-ukwind.com/news/2023/ukw-dalquhandy_acquisition

𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 𝟭𝟮.𝟬𝟱.𝟮𝟬𝟮𝟮

Hello getquin!

You’re looking for a friend to tell you what happened in the world of finance and business? You’ve Got a Friend In Me, as I can show you a Whole New World (of finance and business). Overall, the markets are down, but that’s the Circle of Life.

(In case you didn’t realise, Disney $DIS (-0,96%) released their quarterly earnings last night, and it’s more difficult to think of puns related to British Telecoms)

𝗘𝘂𝗿𝗼𝗽𝗲🌍:

1. Siemens to leave Russia

Siemens $SIE (-0,65%) will quit the Russian market due to the war in Ukraine, having operated there for 170 years. This will cause a 600 million euro hit to their business during the second quarter, and it will not stop there.

🟥 $SIE (-0,65%) Siemens AG (🔽-2.00%)

𝗔𝘀𝗶𝗮🌏:

2. SoftBank may cut startup investments

According to SoftBank $9984 (-0,33%) CEO, Masayoshi Son, they could cut startup investments by more than half this fiscal year. SoftBank $9984 (-0,33%) is vocally cautious about opportunities in the private markets amid a global slowdown, as well as the Japanese conglomerate’s bleak performance.

🟥 $9984 (-0,33%) SoftBank Group Corp. (🔽-5.44%)

𝗔𝗺𝗲𝗿𝗶𝗰𝗮𝘀🌎:

3. GM shares hit new 52-week low

Following a downgraded rating by Wells Fargo $WFC (-2,1%) , General Motors or $GM (-2,78%) shares opened at a 52-week low, and the lowest since November 2020. This downgrade also saw the price target fall from $74 a share to $33 a share.

🟥 $GM (-2,78%) General Motors Corp. (🔽-3.88%)

𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗰𝗮𝗹𝗹𝘀🗣:

1. Walt Disney Co $DIS (-0,96%)

🟥 EPS: $1.08 vs $1.19 expected (-9.09%)

🟥 Revenue: $19.25bn vs $20.04bn expected (-3.94%)

2. BT Group $BT.A (+0%)

🟦 EPS: £0.0454 vs £0.0454 expected (0% - match)

🟥 Revenue: £5.37bn vs £5.44bn expected (-1.31%)

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆🔔:

🟩 TOP, $NVAX (-0,27%) Novavax Inc (🔼+9.55%)

🟥 FLOP, $BMW (-2,04%) BMW Group (🔽-7.88%)

🟥 Most searched, $ALV (-1,3%) Allianz SE (🔽-3.32%)

🟥 Most traded, $TSLA (-1,18%) Tesla Inc (🔽-1.13%)

🟥 S&P500 (🔽-0.90%)

🟥 DAX (🔽-0.64%)

🟩 $BTC (-4,34%) Bitcoin ₿, $29,074.10 (🔼+0.29%)

Time: 17:45 CEST

Did you know that the United States🇺🇸 represents 54.5% of the world stock market capitalization?

𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 𝟭𝟮.𝟬𝟱.𝟮𝟬𝟮𝟮

Hello getquin,

Siemens exits Russia, SoftBank cuts investments and GM hits weekly low 📉. How was your day like? What does your portfolio say?

𝗘𝘂𝗿𝗼𝗽𝗮🌍:

1. Siemens leaves Russia

Siemens $SIE (-0,65%) will withdraw from the Russian market due to the war in Ukraine after operating there for 170 years. This will cost the company 600 million euros in damages in the second quarter, and it won't stop there.

🟥 $SIE (-0,65%) Siemens AG (🔽-2.00%)

𝗔𝘀𝗶𝗲𝗻🌏:

2. SoftBank could cut investments in startups

According to Masayoshi Son, CEO of SoftBank. $9984 (-0,33%) , it could cut investments in startups by more than half this fiscal year. SoftBank $9984 (-0,33%) is very cautious about opportunities in private markets given the global economic slowdown and the weak performance of the Japanese conglomerate.

🟥 $9984 (-0,33%) SoftBank Group Corp. (🔽-5.44%)

𝗔𝗺𝗲𝗿𝗶𝗸𝗮🌎:

3rd GM stock hits new 52-week low

Following a ratings downgrade by Wells Fargo. $WFC (-2,1%) , shares of General Motors opened $GM (-2,78%) at a 52-week low and the lowest level since November 2020. With this downgrade, the price target also dropped from $74 per share to $33 per share.

🟥 $GM (-2,78%) General Motors Corp. (🔽-3.88%)

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻🗣:

1. Walt Disney Co $DIS (-0,96%)

🟥 EPS: $1.08 vs $1.19 expected (-9.09%)

🟥 Revenue: $19.25bn vs $20.04bn expected (-3.94%)

2. BT Group $BT.A (+0%)

🟦 EPS: £0.0454 vs £0.0454 expected (0% - match)

🟥 Revenue: £5.37bn vs £5.44bn expected (-1.31%)

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆🔔:

🟩 TOP, $NVAX (-0,27%) Novavax Inc (🔼+9.55%).

🟥 FLOP, $BMW (-2,04%) BMW Group (🔽-7.88%)

🟥 Most searched, $ALV (-1,3%) Allianz SE (🔽-3.32%)

🟥 Most traded, $TSLA (-1,18%) Tesla Inc (🔽-1.13%)

🟥 S&P500 (🔽-0.90%)

🟥 DAX (🔽-0.64%)

🟩 $BTC (-4,34%) Bitcoin ₿, $29,074.10 (🔼+0.29%)

Time: 17:45 CEST

Did you know that the United Staaten🇺🇸 accounts for 54.5% of the world's stock market capitalization?

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗧𝗲𝘀𝗹𝗮 𝗮𝘁𝗺𝗲𝘁 𝗮𝘂𝗳 / 𝗕𝗶𝗻𝗮𝗻𝗰𝗲 𝗶𝗻𝘃𝗲𝘀𝘁𝗶𝗲𝗿𝘁 𝗶𝗻 𝗘𝘂𝗿𝗼𝗽𝗮

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Stryker Corp. ($SYK (-1,18%)), Mondolez International Inc. ($MDLZ (+0,11%)) and BT Group Plc ($BT.A (+0%)) are trading ex-dividend.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Tesla ($TSLA (-1,18%)) - An important hurdle to the completion of the Gigafactory in Grünheide has finally been overcome. According to the Brandenburg state government, Tesla has submitted all the documents still missing for calendar week 50 for its application. These documents are now still being reviewed by the State Office for the Environment and the Lower Water Authority of the Oder-Spree district, among others. A date when a decision will be made can therefore not yet be set.

PS: Today is the last trading day of the year, which means that in Germany the stock exchanges are only open until 14:00.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Binance - Crypto exchange giant Binance is investing massive money to strengthen its presence in France after a year of many regulatory hurdles.

They funded a €100 million ($113 million) initiative with industry group France FinTech to support the cryptocurrency and blockchain sector in France. With this, Binance will reach a research and development office and support start ups and training.

Follow us for french content on @MarketNewsUpdateFR

I migliori creatori della settimana