See a lot of potential, orders are already more, let's see if it will be a 10bagger ✌️( The company deals with logistics in the warehouse: manufactures constructs where mini robots shift the goods, output input, art constructors are simple and expandable, ATM the largest customers: Richter, Hellofresh, DHL.....) Many opportunities in the long term as long as the orders keep coming.

AutoStore Hldg

Price

Discussione su AUTO

Messaggi

13Podcast episode 73 "Buy High. Sell Low."

Podcast episode 73 "Buy High. Sell Low."

Subscribe to the podcast to beat cancer.

00:00:00 Donald Trump inauguration

00:15:40 Tempus AI A40EDP $TEM (-1,1%)

00:26:00 Groupon $GRPN (-2,16%)

00:30:20 Palantir $PLTR

00:35:00 Insider Trading

00:40:20 Netflix $NFLX (-0,39%)

00:59:00 Adobe AI $ADBE (+0,44%)

01:01:00 Alibaba $BABA (+0,72%)

$9988 (+1,04%)

01:07:40 Baidu $BIDU (-0,49%)

$9888 (-0,63%)

01:15:15 JD com $9618 (+6,18%)

$89618

$JD (+7,9%)

01:16:40 PDD Holdings $PDD (+1,16%)

01:19:00 Xpeng $9868 (+6,04%)

$XPEV (+6,06%)

01:21:00 Nio, BYD, Xiaomi, Huawei $9866 (+1,23%)

$NIO (+1,23%)$1810 (+3,26%)

$XIACY (+2,56%)

$81810

01:28:00 Li Auto $AUTO (-1,09%)

$LI (+1,2%)

01:35:20 Bitcoin $BTC (+0,97%)

Spotify

https://open.spotify.com/episode/4xzXvdMeMtWs5fgYoQaNHU?si=3JuxaaqaQ2KM55PHh5IYWg

YouTube

Apple Podcast

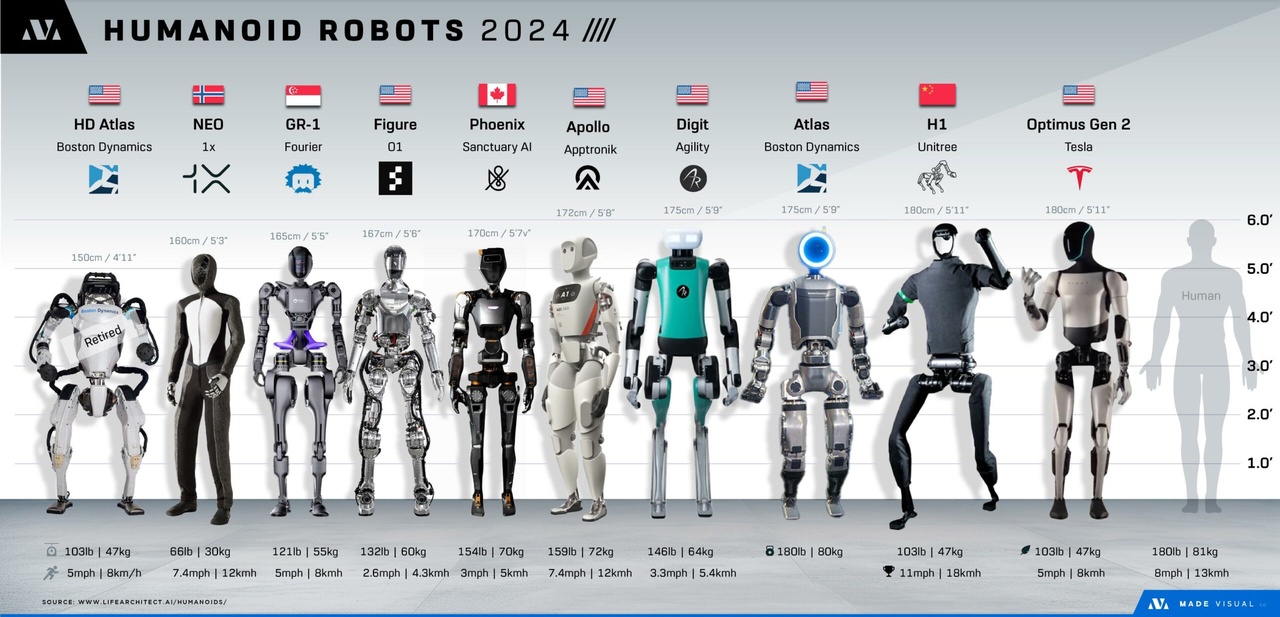

The Age of Robots is Here:

Humanoids

$TSLA (-2,04%)

Tesla

$XPEV (+6,06%)

Xpeng

$1810 (+3,26%)

Xiaomi

$HYUD

Hyundai

Logistics

$SERV

Serve Robotics

$AMZN (-2,34%)

Amazon

$SYM (-8,08%)

Symbotic

$AUTO (-1,09%)

AutoStore

Robotics Software

$NVDA (-2,56%)

NVIDIA

$PTC (-1,01%)

PTC

Sensors

$OUST

Ouster

Healthcare Robotics

$ISRG (-1,23%)

Intuitive Surgical

$SYK (-1,55%)

Stryker

$MDT (-2,76%)

Medtronic

$ARAY (-4,55%)

Accuray

Industrial Robotics

$HON (-1,78%)

Honeywell

$TER (-10,17%)

Teradyne

$LECO (-5,06%)

Lincoln Electric

Robotics Automation

$ROK (-2,36%)

Rockwell Automation

$ABBN (+0,72%)

ABB

$ZBRA (-4,47%)

Zebra Technologies

$CGNX (-3,58%)

Cognex

$PATH (+2,83%)

UiPath

$PEGA (-2,16%)

Pegasystems

Defense Robotics

$AVAV (+5,64%)

AeroVironment

$KTOS (+2,28%)

Kratos

$LMT (+2,89%)

Lockheed Martin

$NOC (+1,96%)

Northrop Grumman

$BA (+3,99%)

Boeing

$GD (+0,69%)

General Dynamics

Consumer & B2B Robotics

$IRBT

iRobot

$1810 (+3,26%)

Xiaomi

$RR

RichTech Robotics

Specialized Robotics

$OII (-0,67%)

Oceaneering

$FARO

FARO Technologies

Hi folks,

It's been a long time, but I'm going to let you hear from me again for a special occasion. The special occasion is: Today is my second Börsday 🍾

You can read about the first Börsday here:

Thanks to @FrauManuwho woke me up from hibernation and finally gave me the remaining motivation to share an update.

Why hasn't there been anything from me for a while? Because other things were more important.

Until mid-July, the individual share project I started at the end of last year was doing quite well with a solid 20% gain, followed by a crash back into negative territory until October. The initial euphoria evaporated. However, I continued to delve deeper and deeper into the matter, reading and analyzing more and more. What could be done better? What did I perhaps not do well last time?

And then there was the point when you realize that it might be cool to spend almost all your free time with bulls and bears for a while, but you suddenly realize what you've neglected in that time.

For example, a week's vacation in the North Sea with my wife and child was cheaper than my average monthly savings rate. Well, the fact that we want to keep our money together at the moment because changes are imminent also plays a role. But the realization was stark and apparently I wasn't even aware of it.

In addition, the individual shares were accompanied by a completely different form of competition. Suddenly there are other stocks that are performing significantly better, and my own value is plummeting. Fortunately, I didn't succumb to the idea of constantly changing strategy, but it has become much more difficult to stay true to your own strategy. And this despite the fact that 2023 was ultimately a good year on the stock market.

It was a relief to see how first the world, then the entire portfolio and then cryptos turned from negative to positive. In the end, there were plenty of price gains. I have largely spared you the milestone posts.

Well, at least I was able to learn something from it and muted all notifications from investment apps in the middle of the year. I now decide when and how often I want to deal with the topic. That works quite well.

What happened in the portfolio?

Not much, actually. My goal was to reach six figures. I overshot it by a good margin. Milestone achieved 🍾

A brief summary of what's been going on over the last six months: Burned my $AUTO (-1,09%) burnt my fingers and missed the re-entry. With $GOOG (-0,74%) realized profits in the meantime and $SOFI (-1,27%) made up a little ground.

With $FTNT (-1,14%) further expanded, they will come back.

I don't feel like changing anything in the portfolio at the moment. The next six months will be exciting anyway, because if everything works out, I'll be moving house and buying a second car.

Dividend hunters hate this trick, but I'm going to significantly reduce my savings plans for the first three months so that I still have a buffer after the move and the car.

So my goal for next year is:

Reduce savings rate, increase consumption!

Well, if those aren't great resolutions!

So, now it's time for a coffee, an apartment viewing later and then the Christmas family madness over the next few days.

Performance, stock selection and transactions can be found on the dashboard. Feel free to let me know your opinion, I can listen to it 😉

Take care, love you 😘 ✊

$AUTO (-1,09%) - Breaking News at AutoStore 🇳🇴

+++ Patent dispute with $OCDO (-3,18%) completely settled +++

We have to give the smaller stocks a chance to get attention here, so today something new about AutoStore, the storage specialist from Norway. Here again the link to my presentation:

A raised finger was then on the ongoing patent dispute with the British Ocado, coupled with the uncertainty of whether sales stops or high costs would follow.

Since today it is clear

- All disputes are withdrawn worldwide (Positive)

- Advantageous cross-licensing (Positive)

- Everyone is allowed to use and market their products without restriction (Positive)

- AutoStore has to pay 200 million pounds to Ocado (Not so positive)

I am currently not (anymore) invested in AutoStore, I used the stock more to Buy Low Sell High because of its high volatility. The question is, how is the market taking this news? 200M pounds is just under $260M, which is a third of annual sales. Gulp. All that is known of the payment is that it will be in installments. But it will hit profits and growth significantly, at least in the short term.

Which weighs more? The finite clarity or the high price? I would actually like to see the share go lower again, as I have high hopes for the Q2 figures in mid-August.

Let's see what happens on Monday 🍿

Depot update April/May

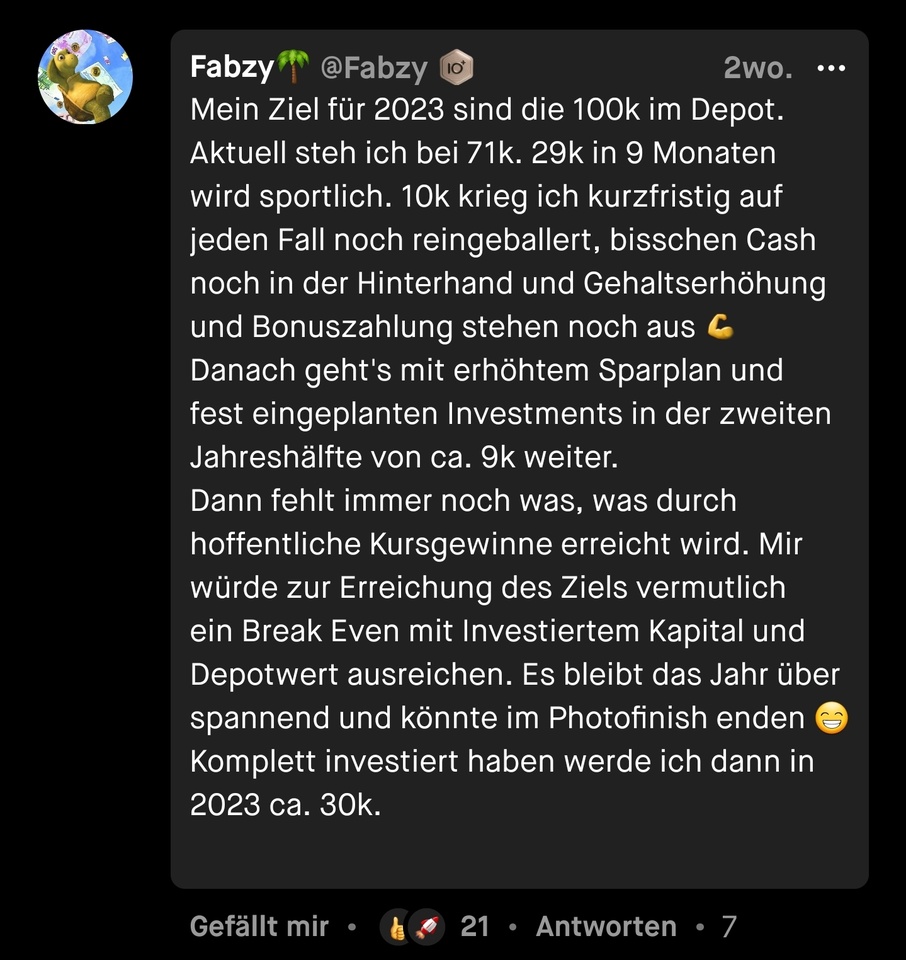

Target 2023 💸 🟩🟩🟩🟩🟩🟩🟩🟩>⬜⬜

🥁🥁🥁🥁🥁🥁 -> 🎆🎇✨🎉🎊

Target 2023 💸 🟩🟩🟩🟩🟩🟩🟩🟩>🟩⬜

Gross. I get to add another green box to my self-made deposit scale. The last time was not so long ago and also the attached screenshot of my comment at the low point in mid-March, in the middle of the banking quake, makes you look at the last two months somehow surreal.

My goal for the year is the 100k in the portfolio. A green box represents a tenth of that. So in the last two months since the commentary on March 13, the portfolio value has moved up +19k. I think of how forever I have oscillated between 55k and 65k .... What a difference a few percentage points suddenly makes at higher deposit values. The good thing is that you grow with your portfolio and get used to it.

At the beginning of the year, I took the euphoria of the exciting world of individual stocks from the end of last year with me and put a few, as I find very nice, satellites in the portfolio, behind which I continue to stand fully and with which I see myself very well prepared for the next half of the year and beyond.

The cash has been used up so far, the individual positions are full. The main focus now is to strengthen the core again, because I expect my satellites to grow stronger than my World+EM combination. In order to keep the balance, the next savings rates will be applied to the core of the portfolio. Back to the roots.

Moreover, I almost fell off my chair when I saw that my MSCI World alltime is only -0.44%. The last time I saw this value in the plus was in April 2022. Overall, the depot is still 2.5% in the minus. I get all bouncy when I think about seeing alltime in green in the foreseeable future.

But we are not there yet and the roller coaster ride is certainly not over yet, but since at the close of the market yesterday the portfolio value was now above the 90k, I think I have earned the green box.

What happened in my portfolio the last weeks?

$NET (+2,21%) - I put in some play money and bet on a rebound after the -25% crash. This also occurred, with a purchase at ~40€ and a sale at ~44€, so just under 10% jumped out. Since it was not intended to hold the value longer, I have not participated in the rest of the increase until today.

$AUTO (-1,09%) - Meanwhile also play money. Two times I could now buy cheap and sell again. Have somehow developed an understanding of the course, drive the little game until I fly on the nose ;)

$TMO (-3,61%) - Last re-buy at ~481€. EK thus lowered to ~505€. The only single share that has not yet delivered as desired. But that will come, I am sure.

Perhaps at this point an anecdote, which I have not yet told 🙈. At $TMO (-3,61%) I had made the mistake of buying with the increase directly after quarterly figures. At that time it went from 515 € to 540 € high or something like that. Spread of course huge, with displayed 525 € course, the purchase price but at 533 €. No matter, it is just going steeply upwards.

...

Yes, I will never do again and also advise everyone else against it. Either buy before or at least sleep over it and watch the development of the price. In the end, I messed up the EC and am more in the red with the value than one should be. What else can I say, except: I learned something again.

$FTNT (-1,14%) - Before the quarterly figures at a favorable 55 € again added. Largest single position in the portfolio. In retrospect, the right decision, given the development since then.

$PYPL (-1,17%) - After the quarterly figures and the further plunge to 58€, I had $NET (+2,21%) - sale, for the money $PYPL (-1,17%) in the depot. Hope was a similar bounce as $NET (+2,21%) to join. But from this attempt, I have then but quite quickly separated again. The starting position of both companies is different. I have noticed myself with my online purchases that GooglePay/ApplePay is actually the more convenient way to pay. Chart-wise, you can't say that $PYPL (-1,17%) big on underpinnings, which makes the short-term chance of a rebound too uncertain for me, undervalued or not. So this is just pure gambling, but you don't have to get involved in every play either.

On the crypto side, nothing new has happened. The two altcoins are downright forgotten and left lying around. The $BTC (+0,97%)-I follow the course, but I do not have the need in the current environment to add here again.

Now it is first strengthen World + EM by savings plan, the remaining money instead of in the depot for the vacation raushauen and also treat yourself again. There are still a few exciting topics that influence the market in the next few weeks, so look at me as planned rather from the sidelines.

What about those who held a lot of cash at the beginning of the year? Are you completely back in the market or are you still holding on?

AutoStore is really shooting up 25% 📈 after the Q1 figures came out this morning. I had not expected in the strong form, since it also went down quite a bit in recent weeks. The part is really worse than crypto.

Gross margin down last time, but back to record 67% this time. The price increases are starting to have an impact. In the last numbers I talked about the "hole dug by external influences in the past" that the company is in, they already seem to be wriggling their way out of that.

Sales up 21% year-on-year (but not quite as impressive as the previous quarter). Backlog higher than ever before.

Outlook for 2023 remains at the last time lowered forecast of $ 700-750 million in revenue.

Don't look a gift horse in the mouth, I'll take the profits here and have a nice dinner. That way, you can also take advantage of your allowance.

We are still in a difficult market environment, the ECB could continue to raise the key interest rate. How sustainable the +25% is remains to be seen. AutoStore's outlook has not changed yet, the next Q2 numbers could then provide another decent boost if the price increases continue to play into the results and the forecast may be raised again.

I think we will soon give back some of the gained percentages.

At €1.90, I'm back in 😁

+++ Collection of links +++

I've always wanted to have my own page that I can pin to my profile, where my contributions are summarized 🚀🚀🚀 I've put something together. This introductory sentence will be updated in the next few days. ChatGPT has not yet created a successful rhyming poem about turtles and the stock market for me. I'll probably have to do it myself 🙄

Here we go:

📊 - All about investing

🦷 Why you don't need dividends for a monthly cash flow - A closer look at dividends

https://getqu.in/WEG4O1AECMG3/S0ChlFMsx6/

🧑🏻👩🏼 Why do so many young people opt for a dividend strategy? 🤔

An attempt to explain

https://getqu.in/TC4EWu/VxxaDT/ 🥇

🤧 Financial health of a company in theory and practice

https://getqu.in/WEG4O1AECMG3/TUQ9IRwGKi/

🇳🇴 $AUTO (-1,09%) - Company presentation AutoStore

https://getqu.in/WEG4O1AECMG3/ozW7ZCUezy/

🤖 $RBOT (-1,51%) - Automation & Robotics - ETF: Sector bet - Quo Vadis?

https://getqu.in/WEG4O1AECMG3/jpR4JU67ok/

🐢 - Personal

🙋🏻♂️ Introduction - Who I am, why I invest

https://getqu.in/WEG4O1AECMG3/AC6AGHND0F/

https://getqu.in/WEG4O1AECMG3/EuwFKSUGuf/

🎂 Happy Börsday - 1 year on the stock market

https://getqu.in/WEG4O1AECMG3/nTMlsaH4jT/

📈 Last portfolio update - April/May 2023

https://getqu.in/TC4EWu/WcBOGm/

🎂 Happy Börsday - 2 years on the stock market

🤡 - memes

Can be found under the hashtag: #fabzymeme

Hi guys,

after the past month I feel the need to share some things about my portfolio.

There were some changes, additional and new purchases, nerves and a lot of lessons learned. But one after the other.

Disney had to give way from the depot and make room for the following candidate. Disney remains super interesting, but through the exchange no longer for me. The opportunity to take advantage of the setback in the other value outweighed the perspective and perceived security that Disney offers me or does not offer to outperform a world in the medium term.

ASML had a textbook setback here in mid-March in the wake of the bank quake, which I had exploited very well. In the meantime, I also manage to incorporate charts well into my buying decision. The had namely revealed that we have a support at about 560€. So I struck at 561€, with the foresight that it will not go lower without major negative influences for the time being. So it came then also.

With the whole switch between $DIS (-1,07%) and $ASML (-5,28%) I am currently very satisfied.

Super exciting it became with my renewable energy bet. At 76 € we entered a few days ago down to 60 € and partly below. I had already placed the StopLoss order just below 60. The SL to set, and whether at all for me meaningful or not, I find difficult at the moment. It was also based on the chart.

I had deleted it fortunately again because I have referred to why I got in in the first place, especially since I absolutely wanted to wait for the consolidated financial statements 2022 on 31.03. and "participate". And it was a good thing I did. By re-buying I was able to lower the EK and now with +10% around the reported figures, I'm here again +-0. From now on, it's hopefully back in the right direction 📈

AutoStore from two of my posts lost a patent lawsuit on Thursday vs. $OCDO (-3,18%) lost. Out of 6 patents, two were invalidated in advance, two were withdrawn by AutoStore, and two were "dismissed" (I can't think of a suitable German word right now) with Thursday's ruling.

I am struggling with the value at the moment, even before the court decision. The stock is in the portfolio because I like the product. The company may be growing nicely, but the surrounding does not correspond to my strategy. In addition $AUTO (-1,09%) is very volatile, going up 20% a week and down again.

Therefore, I play with the idea to put the money back into the $RBOT (-1,51%) which has performed much better YTD. Somehow I feel thereby also confirmed that I just drive with the sector ETF and not the individual stocks in the area.

Fortinet is becoming the favorite stock in the portfolio, which somehow nothing can shake. Falling low, great volatility? Fortinet does not know that. Here, it climbs one step after the other and never looks back. At least that's how it feels. Nice value, which I was also able to buy in mid-March. Want to expand the position even further, the question remains only when and at what price.

$QNT (-0,58%) and $ATOM (-1,25%)

With Quant and Cosmos I have added two crypto bets to the portfolio. But the way there was a single farce, which you should not really tell anyone 🙄

With $AUDIO (-2,56%) I already had a crypto bet last year, but I sold it in the wake of the crisis around Solana.... With -80%.The money went directly into bitcoin, so made up a few percent again. With Audius itself I did not want to go more, the idea behind it convinced, the implementation rather not.

But because I am convinced that blockchains have come to stay, I am not investing in a specific project with a use case, but in the need for different blockchains to be able to communicate with each other in the future. This is about so-called interoperability, where Quant and Cosmos are trying to solve exactly that, but taking different approaches, which for me are not mutually exclusive. Of course, the positions are kept small.

The position at $QNT (-0,58%) was like a small war, because I constantly wanted to get the best return by choosing the best entry point. The back and forth between the fear that it won't go down that much more, so you've already missed something, and the greed for every percentage point of return really got me to the point where I really felt like I was being made fun of and had to seriously ask myself what I was actually doing.

Stop. Reset. Back to the basics.

Now I am quite happy. Buy a position and leave it when you are convinced. The essentials.

What else has kept me busy?

I have to say, this month quite a lot, too much. I have 4 weeks in the wake of the banking crisis and what you have read at the crypto part, so much read, heard, consumed myself that I must say today, it was too much.

As nice as it is to read above that you have caught a supposedly right entry point, but it is so nerve-wracking. Constant back and forth and questioning yourself whether what you are doing is perfect.

But it also took this overshooting the mark to really reach the limits. You don't have to do everything perfectly, small mistakes and inaccuracies are the rule on the stock market, it's just about avoiding the big mistakes.

Lessons learned, again!

And now have a nice evening you dear 😘

P.S.: Actually I just wanted to write a post to attach this GIF by all means 🤣

Dear Diary,

today the Q4 and 2022 figures for AutoStore came out and I'll take the liberty of predicting today's share price.

The forecast is: 📉

While revenue was up 58% quarter-over-quarter and as much as 78% from 2021 to 2022, expectations were still not met. Growth of 80% was expected.

Same picture for profit: EBITDA grew by 50%, expected was rather 60%.

One is currently stuck in a hole, dug by past influences. Supply problems and the increased cost of aluminum caused the company to raise their prices. This will be reflected in higher gross margins this year, but the decreased order intake (-23%) and stagnating order backlog (1.4%) do not give a bullish outlook for 2023.

As a result, the outlook has been revised downwards from USD 750-800 million to USD 700-750 million.

This means that sales growth of only 20-30% is expected for this year.

In the medium term, however, the company will grow three times faster than the market and the first-time profitability in 2022 should not be neglected.

Edit:

08:26: Currently we are 4% up ... Let's see if it stays like this, I wanted to dare myself to the assessment of the figures, maybe I also grasp in the toilet 🤣

09:06: "It's going down" -8% 🫠

Titoli di tendenza

I migliori creatori della settimana