Can anyone explain to me why the oil price is currently running so contrary to market sentiment? $IOIL00 (+4,58 %) is rising and rising.

I don't understand it somehow.

Postes

34Can anyone explain to me why the oil price is currently running so contrary to market sentiment? $IOIL00 (+4,58 %) is rising and rising.

I don't understand it somehow.

AI-driven flash crash

An AI flash crash occurs when modern trading algorithms trigger massive waves of selling in a matter of seconds.

These systems are usually programmed to react to price changes or data signals, such as stop loss limits or short-term price drops.

If a share reaches a critical price, programmed algorithms automatically trigger sales.

These orders drive the price down further, causing other algorithms with similar mechanisms to also sell ("sell side momentum").

This so-called cascade effect can cause the price to plummet within minutes.

(Example: Cascade effect of critical infrastructure during heavy rainfall)

The trading speed of AI models today is so high that the smallest triggers (e.g. false signals) can result in a storm of trades in a flash.

Experts warn that many AI models are based on similar data, which can lead to "swarm thinking":

If several systems misinterpret the same signals at the same time, a small price slide can very quickly turn into a huge sell-off.

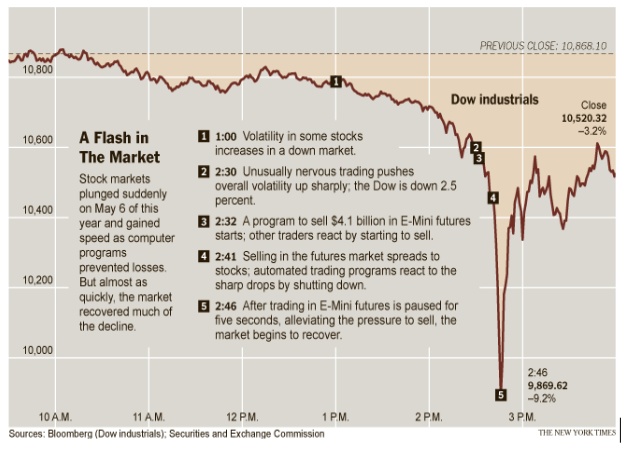

(Example: The flash crash of 6 May 2010 began with a large sell-off program being triggered for S&P 500 futures).

(https://www.advisorperspectives.com)

Although the markets recovered by the close of trading, this example shows how domino effects can be caused by automated orders.

AI can also have its own say:

Modern systems read news and social media in real time and react independently.

Bots can also incorporate completely new information (tweets or news) and generate buy or sell signals from this.

Incorrectly generated or misinterpreted messages can therefore immediately lead to sales.

1.

Possible triggers

Data error or manipulation:

Incorrect market data (prices, volumes) or cyber attacks on data can trigger false signals.

Algorithms that react blindly to data could falsely trigger sales or purchases.

The term:

"Simulation Deception"

(https://www.tencentcloud.com/techpedia/118834)

describes artificial patterns in the market that are created by manipulated data.

For example, an attacker could use fake buy/sell orders (spoofing) to artificially simulate liquidity, whereupon AI systems panic and trade in the opposite direction.

Fake news and deepfakes:

Artificial intelligence now allows deceptively real false reports (deepfake video, fake tweets, etc.).

(Example: on July 16, 2025, Congress member Anna Paulina Luna from Florida wrote on X (Twitter) that she had heard from President Trump that Fed chief Powell would be fired immediately).

(https://www.advisorperspectives.com)

(https://www.advisorperspectives.com)

AI searched all social media posts specifically for tradable news. It found what it was looking for and a violent reaction in the bond and stock markets followed, as shown above.

In previous cases, the impact might have been weaker, as the president could have reacted more quickly and dismissed the statements before many market participants were even aware of the rumor.

Even little-known posts can lead to strong market movements within minutes thanks to AI attention.

World Economic Forum analyses explicitly warn:

Machine-generated fake news can act like a flash crash trigger.

More and more bots are able to spread such false information in order to deceive trading algorithms.

AI misinterpretation:

Even if the data is correct, AI models can misinterpret it.

Trading algorithms that process complex data (news, technical indicators) run the risk of interpreting irrelevant noise as a signal.

Lawfare cites as an example that AI-supported systems already "misread" the market in 2010 and 2016. "misread" the market and launched unfounded waves of selling.

"A few algorithms in use simply misread

the market. The unwarranted sell-off initiated by those mistaken models then caused other programs to respond in kind. The $1 trillion lost in that half hour period was eventually made up thanks to human intervention. "

In the future, such misinterpretations will be even more critical as AI models analyze huge amounts of data from social media and news.

Panic signals/cascades:

In a battered market, automated risk offs (stop sales after a fixed loss limit) can trigger a race.

If, for example, a key figure ($VIXindex level) reaches a critical value, many systems switch to safety at the same time - which can cause a variety of similar assets to fall as an artificial panic impulse.

2.

Affected asset classes

An AI Flash Crash affects various asset classes:

Equities:

This is often the first impetus of a crash.

Globally listed stocks (indices such as S&P 500, DAX, Nikkei) see massive price losses in a matter of seconds.

A shutdown of a large position, for example, can cause other algorithms to panic sell.

Historically, the stock market has experienced such sell-off waves several times.

2010 Dow $DJIA

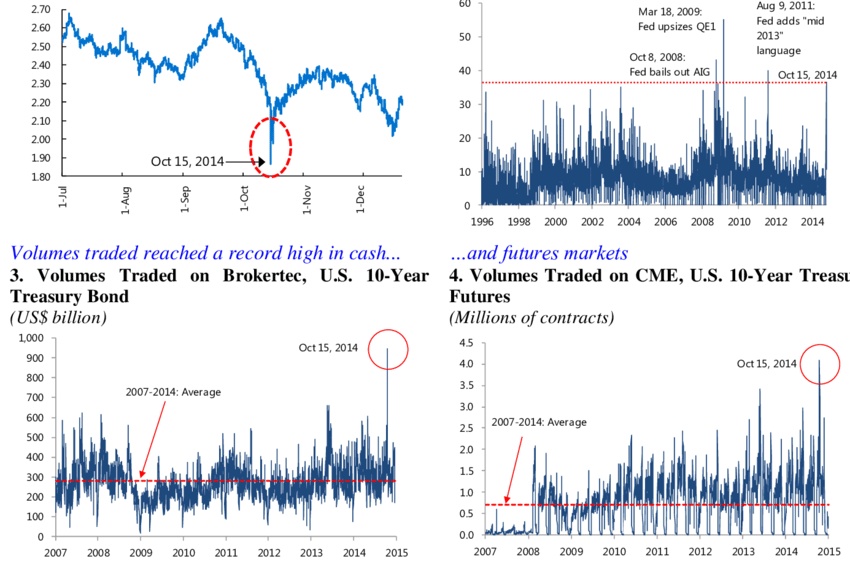

2014 US bonds

An AI-supported flash crash would accelerate this mechanism even further. A sharp slump is usually followed by a partial recovery within a few days or weeks.

Bonds:

Bond markets can also "flash".

In the famous Treasury Flash Crash of 2014, the yield on the US 10-year Treasury Yield plummeted by 1.6% in twelve minutes, followed by a recovery - triggered by algorithmic sell orders at record levels.

(https://www.researchgate.net)

(Theoretically, AI can act against this:

In a stock panic, investors often flee into bonds (price rises, yield falls).

But AI-controlled bond funds could simultaneously and automatically reach certain thresholds and trigger the sale of bonds or bond futures.

This could lead to sharp interest rate swings in the short term, even if the fundamentals do not justify this).

Commodities:

When uncertainty is high, commodity prices often tip.

Typically, oil ($IOIL00 (+4,58 %) ), gas ($NGS ) and industrial metal prices ($COPA (-1,22 %) , $ALUM (+2,63 %) , $ZINC (-0,72 %) ) in a crash phase due to expected weaker demand.

AI programs on the commodities market (e.g. in oil or gold futures trading) could intensify this crash or even trigger a "mini flash crash" in individual commodities.

(Example: the slump in silver futures in July 2017:

Price plunge of over 11% during Asia close when thin trading was blamed on algorithm shifts).

AI in commodity markets can therefore both trigger selling spikes and initiate a rapid countermovement through post-buy programs.

Cryptocurrencies:

These are considered particularly volatile.

AI trading bots are everywhere, so cryptocurrencies are in free fall when many bots recognize "fear" signals at the same time.

(Example: In May 2021 $BTC (-0,89 %)

plummeted by around 30% within hours, partly because many algorithms sold en masse after signals about China's Bitcoin ban).

$ETH (-2,92 %) experienced a flash crash on one platform in 2017 because a huge sell order triggered many automated trades.

Crypto markets run 24/7, are unregulated and therefore more susceptible to algorithmic chain reactions.

3.

Risk matrix by region

The probability of occurrence and the extent of damage caused by a crash differ from region to region:

USA:

Europe:

Asia:

Crypto:

The matrix overview could therefore show

A sudden flash crash would last seconds to minutes.

Prices plummet, many stop loss orders are triggered.

Stock exchanges switch on automatic trading pauses to stop algorithm spirals.

Investors lose billions in a very short space of time, many markets are temporarily illiquid.

Confidence collapses, many investors panic and are uninformed.

Markets should stabilize again in the following days to weeks as counter-cyclical AI and manual orders intervene.

In the medium term, economic data could be affected if a crash impacts financing conditions.

Media and public will question confidence in digital markets for months.

Investors report consequences such as increased demand for safe assets (gold, government bonds).

Regulation and market mechanisms would adapt.

We could expect a regulatory boost:

Already in the past, the 2010 flash crash led to new trading interruptions and considerations regarding trading system requirements.

An AI crash would likely have a disciplining effect:

Providers need to develop more robust AI models, and contingency plans (kill switches) could become mandatory.

In the long term, confidence could be slow to recover:

Institutional investors would only have limited confidence in AI systems, and many private investors might temporarily hold back or prefer alternative strategies.

4.

Specific players and technologies

BlackRock Aladdin:

BlackRock's Aladdin AI system currently manages more than 30,000 portfolios and permanently rebalances enormous amounts of capital.

If Aladdin is routinely programmed to sell too much for ETFs or funds, this can trigger billions of orders.

Nvidia & AI chips:

$NVDA (-0,51 %) Supplies the hardware for many AI models and is itself a market star.

High expectations for AI have fueled Nvidia's share price for years.

Algorithms are strongly fixated on such shares.

If, for example, Nvidia's share price falls abruptly, many strategies trigger sell programs.

Such a domino effect

$NVDA (-0,51 %) -> $SEMI (-4,63 %) -> $CSNDX (-0,25 %)

could fuel a crash.

In practice, it has been shown that Nvidia reacts very volatile to macroeconomic and geopolitical news, so the next AI turbulence could drag down the entire tech sector.

AI bots on Binance (Crypto):

On crypto exchanges like Binance, many users trade with automated bots.

A large part of the crypto trading volume comes from AI-supported systems.

These bots can generate simultaneous sell or buy waves.

AI-driven ETF rebalancing:

Large index ETFs and passive funds (BlackRock iShares, Vanguard etc.) use automated systems to implement index changes.

If indices rise or fall quickly, many ETFs start rebalancing at the same time.

If the AI signal is negative, all AI-based funds could sell at the same time.

This creates massive sell orders in a short space of time.

Because the volumes involved are in the billions, rebalancing alone can drive a crash further.

Other players:

News agencies, index operators (eg. $MSCI (-0,72 %) ), hedge funds with AI strategies and social trading platforms also contribute.

Any sudden outage (e.g. power failure at NYSE) or hacker attack on stock exchange systems could further irritate the AI systems on the stock market.

"When algorithms collide and markets tremble in fractions of a second, the new power of AI is revealed: speed without mercy, precision without emotion. One spark is enough - and the domino effect races through indices, derivatives and crypto-spheres. The AI-driven flash crash is no longer a distant shadow, but the echo of a future in which machines set the pace of the financial world."

Feel free to write your feedback on this post in the comments and tell me if you're interested in something like this.

My plan this morning was actually just to write a short post about this topic, but it turned out to be a bit longer. It's so easy to sit and write all day.

@Kundenservice Please increase the maximum number of pictures for a post, unfortunately I didn't get all the pictures in that I had picked out.

Sources:

+ 6

Andurand Capital Management is in one of the worst loss-making phases in its history. Since the beginning of the year, the fund has recorded heavy losses and now has a drawdown of around 60%. The volatility on the commodity markets, particularly in $IOIL00 (+4,58 %) has led to massive mispositioning. Andurand had announced that it would also invest in markets such as cocoa and copper, but the main losses are oil positions. Copper in particular presented additional challenges. Andurand Capital criticized, for example, the poor liquidity and the high discount of the $COP.UN shares against the physical copper price, which further impacted performance. The average discount was around 18%.

𝖤𝗁𝖾𝗆𝖺𝗅𝗌 𝖻𝖾𝗌𝗍𝖻𝖾𝗓𝖺𝗁𝗅𝗍𝖾𝗋 𝖤𝗇𝖾𝗋𝗀𝗒 𝖳𝗋𝖺𝖽𝖾𝗋 𝖻𝖾𝗂 𝖡𝗎𝗅𝗀𝖾 𝖡𝗋𝖺𝖼𝗄𝖾𝗍𝗌 & 𝖮𝗂𝗅 𝖢𝗈𝗆𝗉𝖺𝗇𝗂𝖾𝗌 𝗎𝗇𝖽 𝖦𝗋ü𝗇𝖽𝖾𝗋 𝖽𝖾𝗌 𝖢𝗈𝗆𝗆𝗈𝖽𝗂𝗍𝗒 𝖧𝖾𝖽𝗀𝖾 𝖥𝗎𝗇𝖽𝗌 𝖠𝗇𝖽𝗎𝗋𝖺𝗇𝖽 𝖢𝖺𝗉𝗂𝗍𝖺𝗅

The fund has actually been very successful in recent years and has grown more than 7x in 3 years. This is also due to the fact that Andurand does not have tight risk limits, which leads to increased volatility. Before founding Andurand Capital, he founded another hedge fund, BlueGold Capital. This was active from 2008 to 2012 and generated a return of 210%. Andurand Capital was founded in 2013 and is estimated to have generated a return of well over 500%. His CV is very impressive. Pierre Andurand

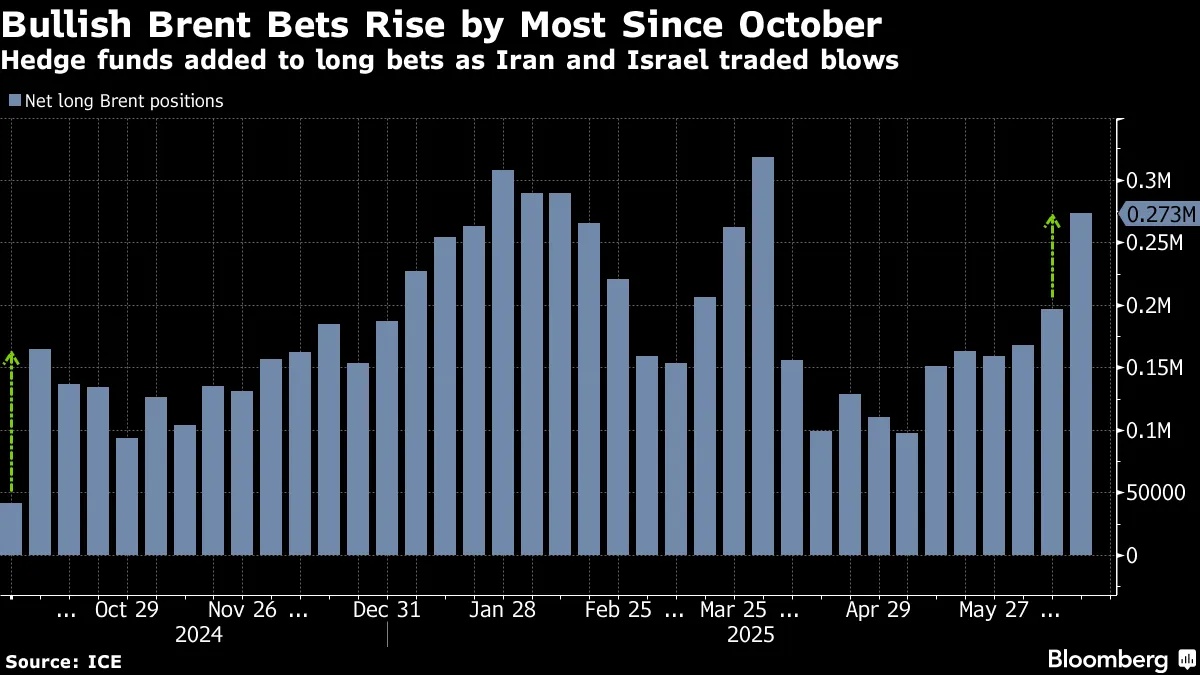

Hedge funds are currently significantly increasing their long positions on $IOIL00 (+4,58 %)as the conflict between Israel and Iran continues. Despite the risks, no serious disruption in oil supplies has yet been reported. However, Israel's latest attacks on Iranian nuclear facilities and Iran's counter-attacks are keeping the market tense. The USA has so far been reluctant to intervene directly, but this may change.

𝖲𝗍ä𝗋𝗄𝗌𝗍𝖾𝗋 𝖠𝗇𝗌𝗍𝗂𝖾𝗀 𝖺𝗇 𝖫𝗈𝗇𝗀 𝖯𝗈𝗌𝗂𝗍𝗂𝗈𝗇𝖾𝗇 𝗂𝗇 𝖡𝗋𝖾𝗇𝗍 𝗌𝖾𝗂𝗍 𝖮𝗄𝗍𝗈𝖻𝖾𝗋 2023, 𝖺𝗎𝖿𝗀𝗋𝗎𝗇𝖽 𝖽𝖾𝖾𝗋 𝖤𝗌𝗄𝖺𝗅𝖺𝗍𝗂𝗈𝗇 𝗓𝗐𝗂𝗌𝖼𝗁𝖾𝗇 𝖨𝗋𝖺𝗇 𝗎𝗇𝖽 𝖨𝗌𝗋𝖺𝖾𝗅.

I would like to briefly explain why it looks like the USA will take part in the war.

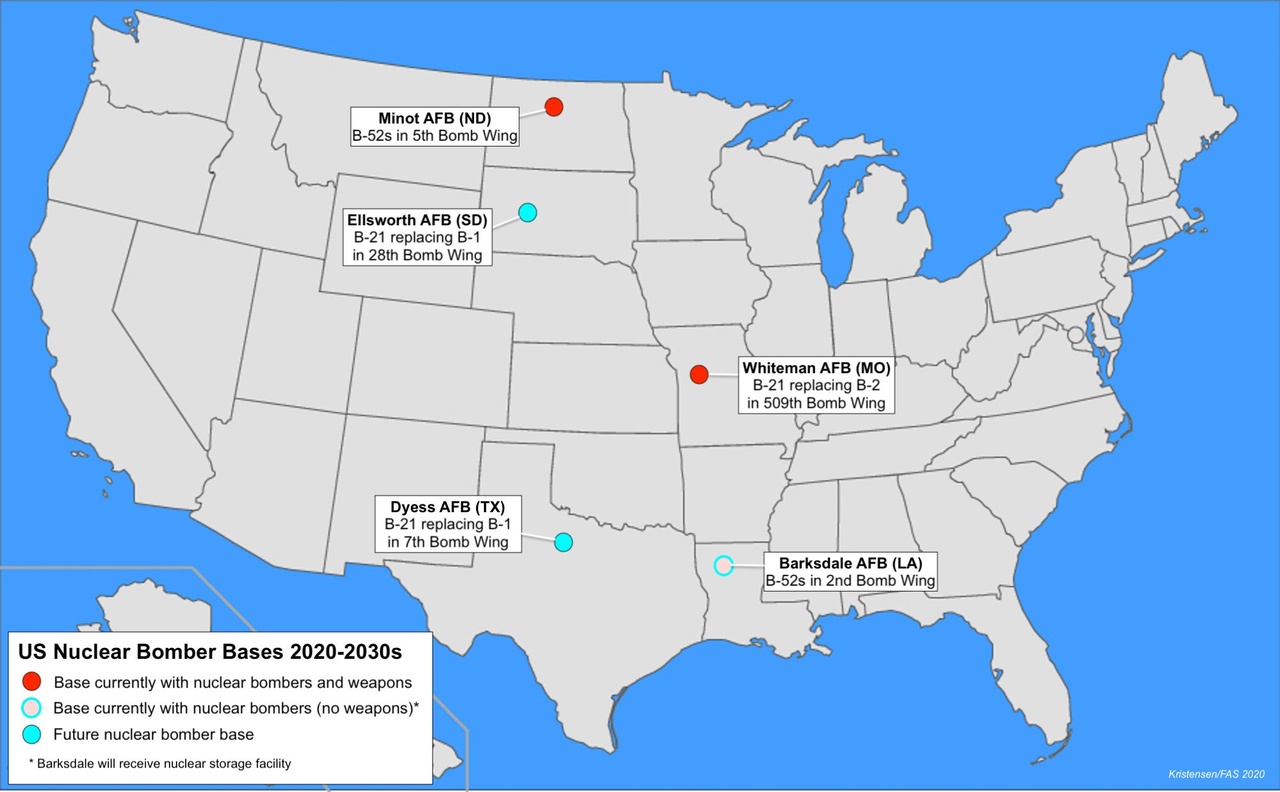

Two B2 bombers took off today (June 21) from Whiteman Air Force Base in Missouri. After takeoff, the bombers were refueled in the air over Kansas by KC-135/KC-46 tanker aircraft. It can be assumed that the B2 bombers took off with maximum weapons load and were therefore refueled in the air. If no immediate attack had been planned, the ammunition could have been logistically transferred to bases such as Guam or Diego Garcia to avoid unnecessary weight.

𝖪𝖢-46 𝖻𝖾𝗍𝖺𝗇𝗄 𝖽𝖾𝗇 𝖡2 𝖡𝗈𝗆𝖻𝖾𝗋

If the B2 bombers stay on course, they would reach their target in Iran a few hours before US futures open. If this were to happen wouldthen you can expect a press conference from the Traump Admin. beforehand to calm the futures.

In recent days, several KC-135s and KC-46s have also been deployed to strategic US bases such as Guam, Diego Garcia, the Middle East, Europe and the Pacific. This deployment is no coincidence, but has been deliberately chosen so that the bombers can be refueled at any level of their possible deployment.

𝖪𝖢-135 𝗎𝗇𝖽 𝖪𝖢-46

What is particularly striking is that the bombers did not take off from Diego Garcia, but from Whiteman AFB. Why? Because, according to the lease agreement, the USA would have to inform Mauritius in the event of an attack from Diego Garcia, which would jeopardize secrecy. Launching from the USA avoids this obligation. What's more, B2 is the only aircraft that can carry the GBU-57, i.e. the bunker buster.

The contract offers the UK and the US exclusive rights of use and full operational control of the military base for at least 99 years, with an option to extend for a further 40 years. The United Kingdom will pay Mauritius an annual lease of 101 million pounds.

In the last 24 hours, the attacks between Iran and Israel have intensified further. Iran has once again fired several missiles at Israel, most of which were intercepted, but there were still hits. Israel, in turn, again attacked targets in Iran, including suspected missile launching pads and facilities in the center of the country. The Israeli Air Force also attacked Iranian nuclear facilities and media centers, while Iran announced further massive attacks and ruled out negotiations during the ongoing Israeli attacks.

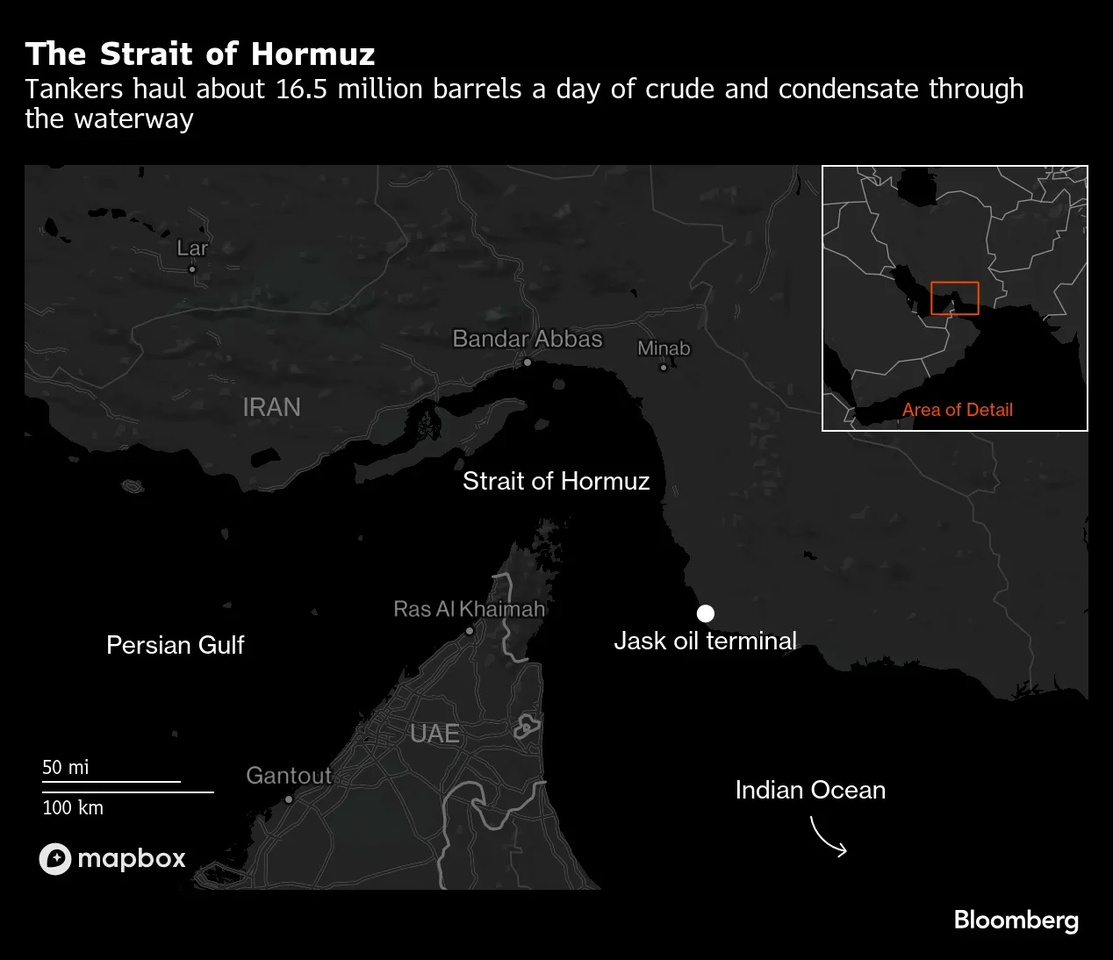

Trump called on the population of Tehran to evacuate and threatened further measures if no agreement was reached on the nuclear program. The situation remains extremely tense, with ongoing air alerts and significant civilian and infrastructural damage on both sides. In the sea area near the Strait of Hormuz, the oil tankers Adalynn and Front Eagle collided.

On the Front Eagle a fire broke out, but it was extinguished. According to the British security company Ambrey, however, the incident was not safety-related and is not directly connected to the military conflict between Iran and Israel.

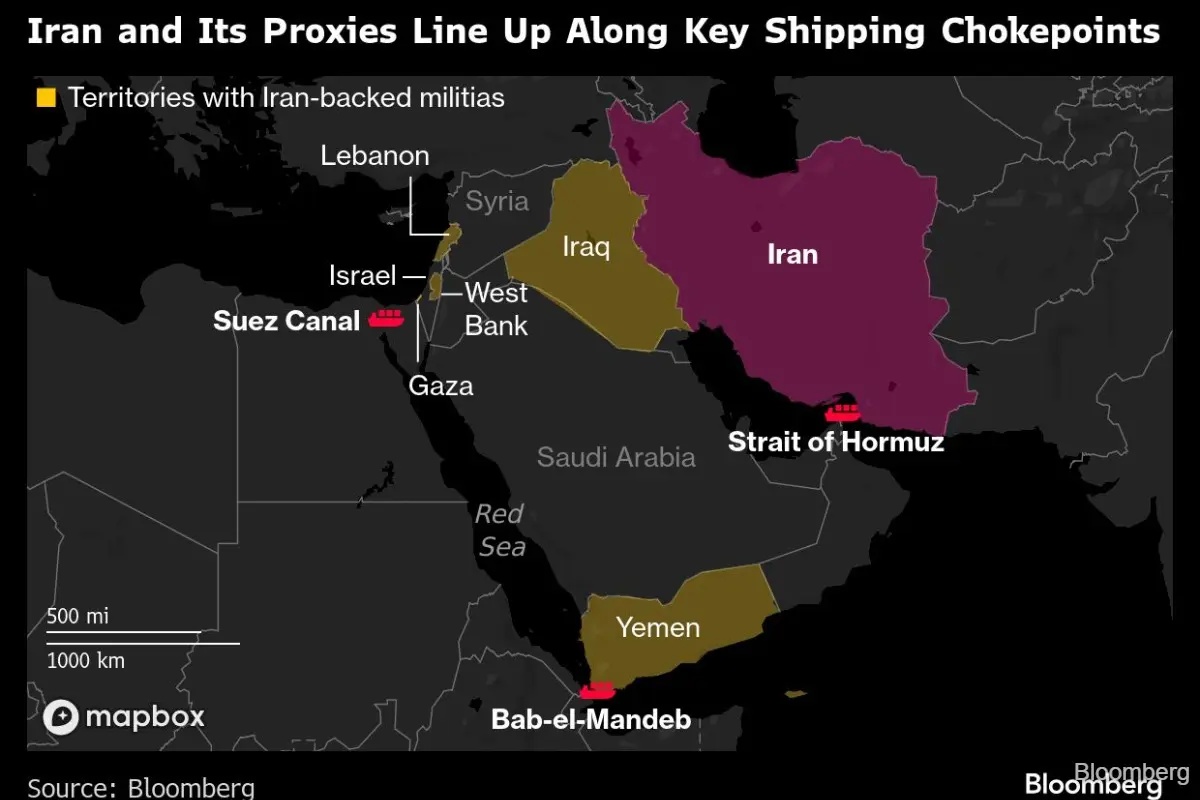

𝖣𝗎𝗋𝖼𝗁 𝖽𝗂𝖾 𝖪𝗈𝗇𝗍𝗋𝗈𝗅𝗅𝖾 𝖽𝖾𝗋 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗓 & 𝖽𝖺𝗌 𝖭𝖾𝗍𝗓𝗐𝖾𝗋𝗄 𝗏𝗈𝗇 𝖬𝗂𝗅𝗂𝗓𝖾𝗇 (𝖧𝗎𝗍𝗁𝗂𝗌 𝗂𝗆 𝖩𝖾𝗆𝖾𝗇, 𝖧𝗂𝗌𝖻𝗈𝗅𝗅𝖺𝗁 𝗂𝗆 𝖫𝗂𝖻𝖺𝗇𝗈𝗇) 𝖾𝗇𝗍𝗅𝖺𝗇𝗀 𝖲𝖼𝗁𝗂𝖿𝖿𝖿𝖺𝗁𝗋𝗍𝗌𝖾𝗇𝗀𝗉ä𝗌𝗌𝖾𝗇 𝖡𝖺𝖻 𝖾𝗅-𝖬𝖺𝗇𝖽𝖾𝖻 & 𝖲𝗎𝖾𝗓-𝖱𝗈𝗎𝗍𝖾 𝗄𝖺𝗇𝗇 𝖨𝗋𝖺𝗇 𝖻𝗂𝗌 𝗓𝗎 40% 𝖽𝖾𝗌 𝗀𝗅𝗈𝖻𝖺𝗅𝖾𝗇 Ö𝗅𝗁𝖺𝗇𝖽𝖾𝗅𝗌 𝖻𝖾𝖽𝗋𝗈𝗁𝖾𝗇

$IOIL00 (+4,58 %) rises significantly in the face of geopolitical tensions. Oil is trading at around USD 74-75 per barrel, with bullish momentum building up. A sustained breakout above the 80 mark could trigger a trend booster, with potential targets above USD 85.

𝖤𝗂𝗇 𝖡𝗋𝖾𝗇𝗍-𝖣𝗎𝗋𝖼𝗁𝖻𝗋𝗎𝖼𝗁 ü𝖻𝖾𝗋 80 𝖴𝖲-𝖣𝗈𝗅𝗅𝖺𝗋 𝗐ü𝗋𝖽𝖾 𝖫𝗈𝗇𝗀 𝖯𝗈𝗌𝗂𝗍𝗂𝗈𝗇𝖾𝗇 𝗂𝗆 𝖢𝖳𝖠 𝗍𝗋𝗂𝗀𝗀𝖾𝗋𝗇.

The Implied Volatility Rate is also exciting. In short, it shows the market expectation for future turbulence. A high IV value indicates increased expected uncertainty and stronger price fluctuations. If the expected volatility increases, options become more expensive. Normally, implied volatility falls when prices rise, but currently it remains at 51% despite the Brent rise.

𝖨𝗆𝗉𝗅𝗂𝗓𝗂𝗍𝖾 𝖵𝗈𝗅𝖺𝗍𝗂𝗅𝗂𝗍ä𝗍 𝖺𝗆 Ö𝗅𝗆𝖺𝗋𝗄𝗍 𝗂𝗆 𝖩𝗎𝗇𝗂 2025 𝗌𝗈 𝗁𝗈𝖼𝗁 , 𝗐𝗂𝖾 𝖻𝖾𝗂𝗆 𝖴𝗄𝗋𝖺𝗂𝗇𝖾-𝖪𝗋𝗂𝖾𝗀

Following the Israeli attack on Iranian nuclear facilities on June 13, 2025, oil prices skyrocketed. $IOIL00 (+4,58 %) rose to USD 77 per barrel, the sharpest increase since the coronavirus crisis in 2020. The market reacted with price losses, and shifts into $965515 (-3,11 %) the US dollar and bonds.

Chapter overview:

I: Key facts

II: Strait of Hormuz

III: Oil Infrastructure

IV: Oil in connection with CPI data

V: Scenarios for this conflict

Let's take a sober look at the situation, is the oil price overreacting?

I: Key Facts

Iran currently produces around 3.3 to 4 million barrels of oil per day and exports around 1.5 to 1.7 million barrels, with the majority of these exports going to China. Should there be a shortfall in Iranian exports, for example due to attacks on production facilities or sanctions, this would be manageable for the commodities market in the short term. The daily volume corresponds to only a small part of the global oil demand of over 100 million barrels per day. This means that although the market will react to a shortfall, other producers such as the USA, Brazil or Saudi Arabia will be able to close part of the gap. The actual market reaction is therefore not primarily driven by a real supply shortfall, but by the fear of further escalation.

If we look at the status quo from a market psychology perspective, then the main cause of the price jumps is uncertainty about a possible spread of the conflict to the entire Gulf region. After all, this region is responsible for around a fifth of global oil shipments, as it is home to key oil-producing countries such as Saudi Arabia, Iraq, the United Arab Emirates and Kuwait. The mere possibility that the conflict could spread and other countries or production facilities could be affected leads to risk premiums on the futures market. Traders are therefore buying oil futures as a hedge against possible supply chain issues, which is also driving up prices. The fear of a blockade of the Strait of Hormuz, one of the world's most important oil transport routes, is a particularly strong price driver.

II: Strait of Hormuz

𝖣𝗂𝖾𝖾 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗌 𝗏𝖾𝗋𝖻𝗂𝗇𝖽𝖾𝗍 𝖽𝖾𝗇 𝖯𝖾𝗋𝗌𝗂𝗌𝖼𝗁𝖾𝗇 𝖦𝗈𝗅𝖿 𝗆𝗂𝗍 𝖽𝖾𝗆 𝖦𝗈𝗅𝖿 𝗏𝗈𝗇 𝖮𝗆𝖺𝗇 𝗎𝗇𝖽 𝖽𝖾𝗆 𝖠𝗋𝖺𝖻𝗂𝗌𝖼𝗁𝖾𝗇 𝖬𝖾𝖾𝗋. 𝖳ä𝗀𝗅𝗂𝖼𝗁 𝗉𝖺𝗌𝗌𝗂𝖾𝗋𝖾𝗇 𝖽𝗈𝗋𝗍 𝗋𝗎𝗇𝖽 20 𝖬𝗂𝗅𝗅𝗂𝗈𝗇𝖾𝗇 𝖡𝖺𝗋𝗋𝖾𝗅 𝖱𝗈𝗁ö𝗅, 𝖾𝗍𝗐𝖺 𝖾𝗂𝗇 𝖥ü𝗇𝖿𝗍𝖾𝗅 𝖽𝖾𝗌 𝗐𝖾𝗅𝗍𝗐𝖾𝗂𝗍𝖾𝗇 𝖡𝖾𝖽𝖺𝗋𝖿𝗌. 𝖲𝗂𝖾 𝗂𝗌𝗍 𝖽𝖺𝗆𝗂𝗍 𝖽𝗂𝖾 𝗐𝗂𝖼𝗁𝗍𝗂𝗀𝗌𝗍𝖾 Ö𝗅𝗍𝗋𝖺𝗇𝗌𝗉𝗈𝗋𝗍𝗋𝗈𝗎𝗍𝖾 𝖽𝖾𝗋 𝖶𝖾𝗅𝗍.

But a spear of the road is small at the moment. It has to be said that a closure in the future is also very low, because it has never been closed. Bear in mind that there was much more conflict in the region at the time. During the Iraq-Iran war, also known as the tanker war, numerous oil tankers were attacked, but the road remained open despite heavy fighting. Iran has also repeatedly threatened to block the strait in recent decades, particularly in response to sanctions or military pressure. However, the threats were never carried out. From a game theory perspective, this is called an empty threat.

There are several reasons for not closing the straits. First, the US and allies have a strong naval presence in the region to ensure freedom of navigation. Secondly, Iran is also dependent on the revenue from oil exports via the Strait of Hormuz. A blockade would have a massive economic impact on its own country.

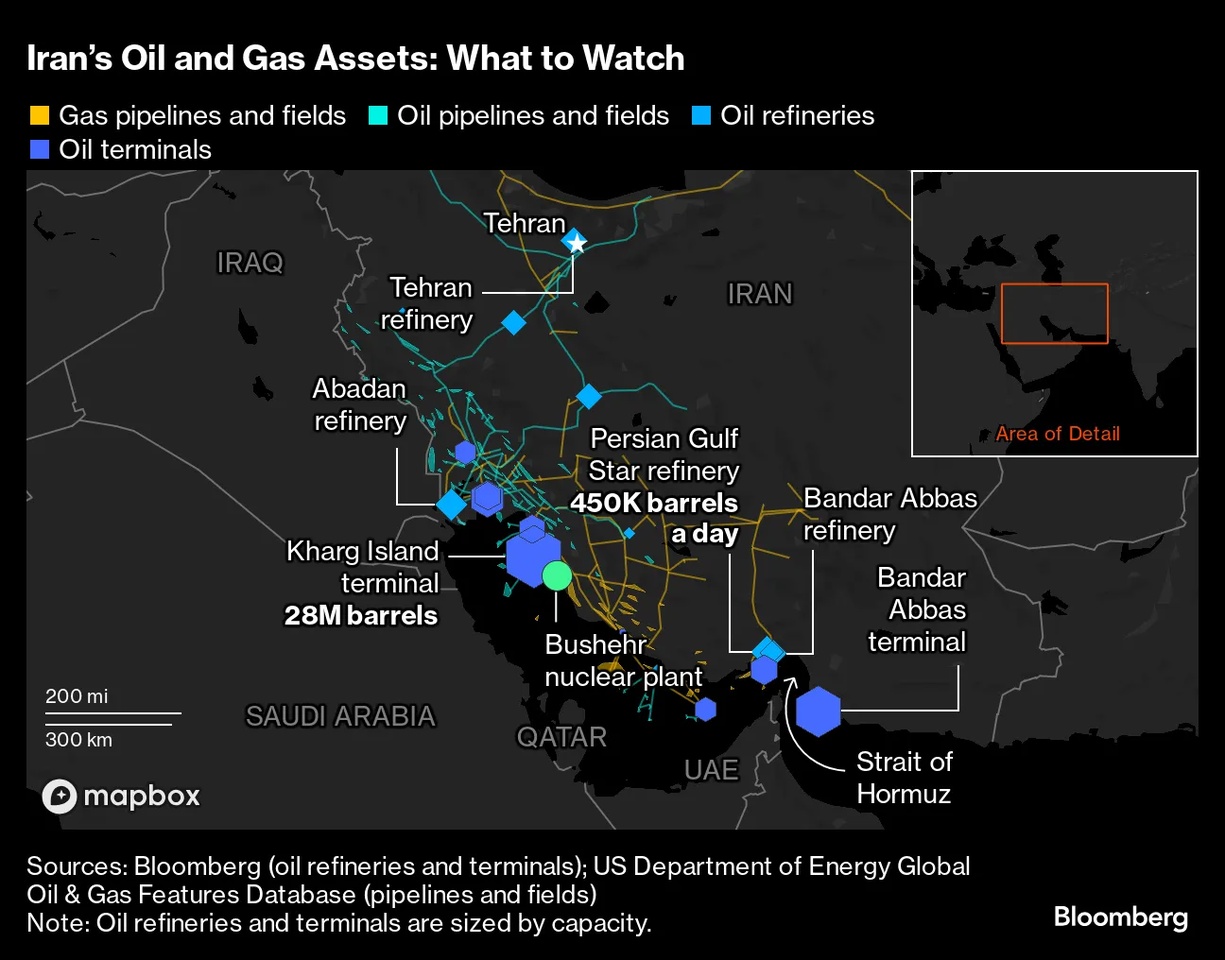

III: Oil infrastructure

Another point responsible for price spikes would be the threat to the oil infrastructure in the Middle East. Should there be attacks on production facilities, pipelines or oil ports, large quantities of oil could disappear from the market in the short term. Targeted attacks on Iranian facilities alone could result in a loss of 1.7 million barrels per day of exports, enough to tip the market from surplus to deficit and drive prices to USD 80 or more. Even more serious, of course, would be attacks or blockades affecting the Strait of Hormuz, but this is unlikely as mentioned above.

𝖪𝗋𝗂𝗍𝗂𝗌𝖼𝗁𝖾 𝖤𝗇𝖾𝗋𝗀𝗂𝖾𝗂𝗇𝖿𝗋𝖺𝗌𝗍𝗋𝗎𝗄𝗍𝗎𝗋 𝗂𝗆 𝖯𝖾𝗋𝗌𝗂𝗌𝖼𝗁𝖾𝗇 𝖦𝗈𝗅𝖿, 𝖽𝖺𝗋𝗎𝗇𝗍𝖾𝗋 Ö𝗅𝗋𝖺𝖿𝖿𝗂𝗇𝖾𝗋𝗂𝖾𝗇 (𝗐𝗂𝖾 𝖠𝖻𝖺𝖽𝖺𝗇 𝗎𝗇𝖽 𝖡𝖺𝗇𝖽𝖺𝗋 𝖠𝖻𝖻𝖺𝗌), 𝖲𝖼𝗁𝗅ü𝗌𝗌𝖾𝗅𝗍𝖾𝗋𝗆𝗂𝗇𝖺𝗅𝗌 (𝖪𝗁𝖺𝗋𝗀 𝖨𝗌𝗅𝖺𝗇𝖽 𝗆𝗂𝗍 28 𝖬𝗂𝗈. 𝖡𝖺𝗋𝗋𝖾𝗅 𝖫𝖺𝗀𝖾𝗋𝗄𝖺𝗉𝖺𝗓𝗂𝗍ä𝗍) 𝗎𝗇𝖽 𝖯𝗂𝗉𝖾𝗅𝗂𝗇𝖾𝗌. 𝖠𝗅𝗅𝖾 𝖠𝗇𝗅𝖺𝗀𝖾𝗇 𝗅𝗂𝖾𝗀𝖾𝗇 𝗇𝖺𝗁𝖾 𝖽𝖾𝗋 𝗌𝗍𝗋𝖺𝗍𝖾𝗀𝗂𝗌𝖼𝗁𝖾𝗇 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗓 - 𝗂𝗁𝗋𝖾𝗋 𝖵𝖾𝗋𝗐𝗎𝗇𝖽𝖻𝖺𝗋𝗄𝖾𝗂𝗍 𝗆𝖺𝖼𝗁𝗍 𝗌𝗂𝖾 𝗓𝗎 𝗉𝗈𝗍𝖾𝗇𝗓𝗂𝖾𝗅𝗅𝖾𝗇 𝖹𝗂𝖾𝗅𝖾𝗇 𝖻𝖾𝗂 𝗆𝗂𝗅𝗂𝗍ä𝗋𝗂𝗌𝖼𝗁𝖾𝗇 𝖤𝗌𝗄𝖺𝗅𝖺𝗍𝗂𝗈𝗇𝖾𝗇.

IV: Oil in connection with CPI data

In principle, an increase in the price of oil has a direct and indirect effect on inflation. economists estimate that a 10 percent increase in the price of oil increases consumer prices by around 0.4% in the following year. This means that if the oil price rises from USD 80 to USD 88 per barrel, inflation in Europe or the USA could be almost 0.5% higher next year than it would otherwise be. This would not necessarily play into his hands, for example, the last thing he needs is high CPI data.

V: Scenarios for this conflict

A. Regional conflict (probability 70-80%*)

If the conflict remains limited to Israel and Iran, I expect a stabilization at the level of USD 75-80 per barrel. Iran's production and export volumes (around 1.5-1.7 million barrels/day) could be at least partially offset by other producers, as mentioned above.

B. Expansion to the Gulf region (probability 15-25%* )

Should the conflict spread to other countries in the Persian Gulf or targeted attacks on production facilities occur, prices could rise further. One can assume 90-100 US dollars per barrel. Even a partial escalation of the conflict could lead to production losses or transportation delays. Such a price rise would fuel inflation worldwide, increase transportation and production costs and tend to slow down economic growth. The stock markets would come under more pressure and central banks could be forced to keep interest rates high or even raise them again. This would not play into Trump's hands, for example, so he will try to keep the conflict regional if he can.

C. Blockade of the Strait of Hormuz (probability 1-5%*)

The blockade of the Strait of Hormuz is considered a nightmare scenario for the markets. This could lead to a doubling of oil prices within a few hours, with forecasts of USD 100 to 130 per barrel. Every day, 20-21 million barrels of crude oil are shipped via the Strait, i.e. around 20% of global consumption and around a quarter of the global LNG trade. A blockade would therefore suddenly remove a fifth of the global oil supply from the market. Refineries in Asia and Europe would be forced to fall back on emergency reserves. The stock markets would plummet and freight rates for tankers would also explode

*𝖬𝖾𝗂𝗇𝖾𝖾 𝖠𝗇𝗀𝖺𝖻𝖾𝗇

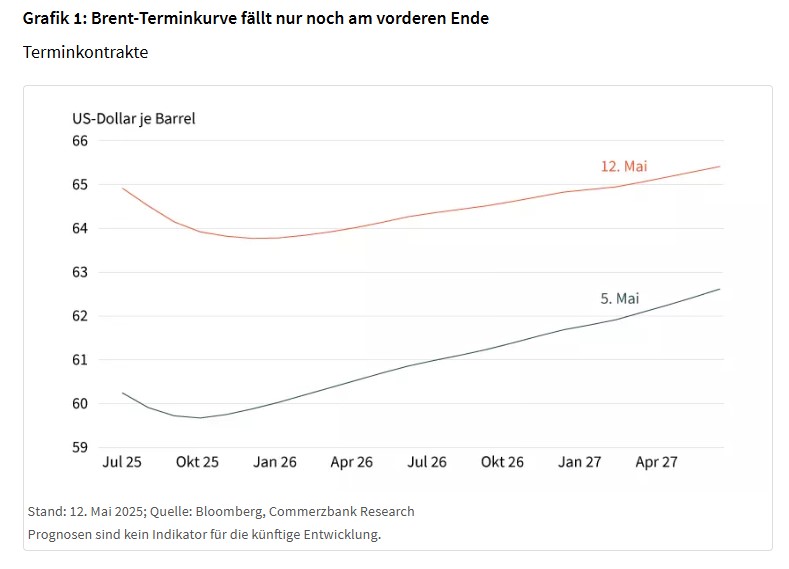

At the beginning of May 2025, a clear change of direction by OPEC+ caused a stir: Eight member states, including Saudi Arabia, announced a significant increase in production of over 400,000 barrels per day in June. The result? A sharp fall in oil prices - $IOIL00 (+4,58 %) Crude oil fell below $59, WTI even to $55.30. The price of gas oil also came under pressure.

Saudi Arabia in particular seems to be losing patience with countries such as Kazakhstan and Iraq, which are not adhering to agreed production cuts.

It remains to be seen whether the threat of significantly increased production in the coming months will persuade countries to comply with the agreements. Internal tensions within OPEC+ could lead to further market distortions - i.e. more and cheaper oil.

How the power games within OPEC+ affect supply, prices and investment opportunities can be hier genauer can be read here.

This article is part of an advertising partnership with Société Générale

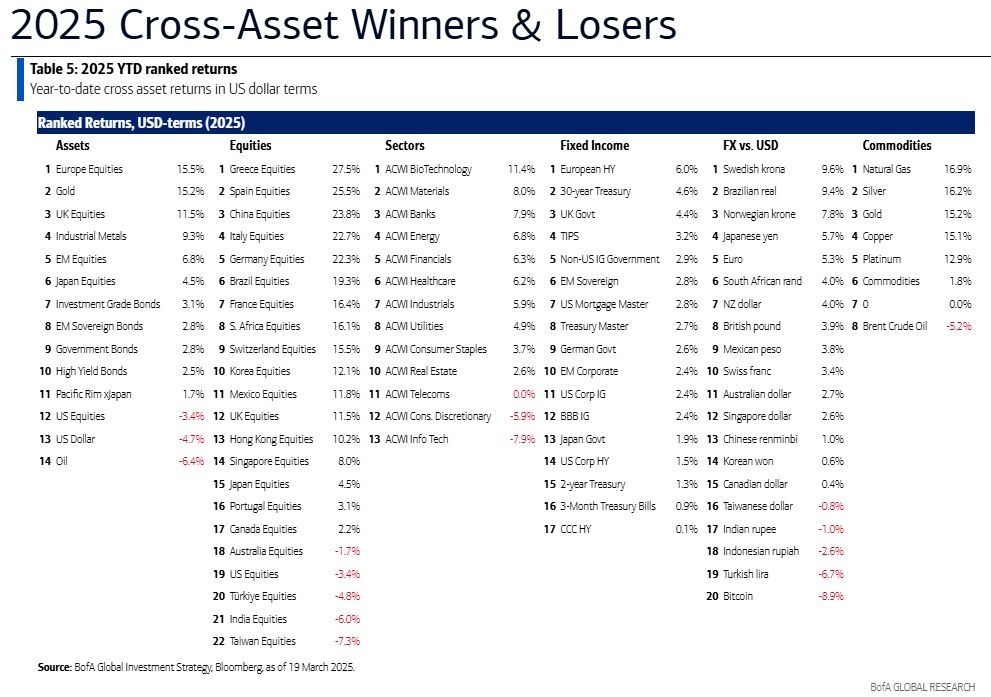

While European stocks and commodities are performing strongly, US equities and volatile assets such as Bitcoin are struggling with significant losses. A brief summary of the chart from Boll's Global Research

Winners

Losers:

Current trends:

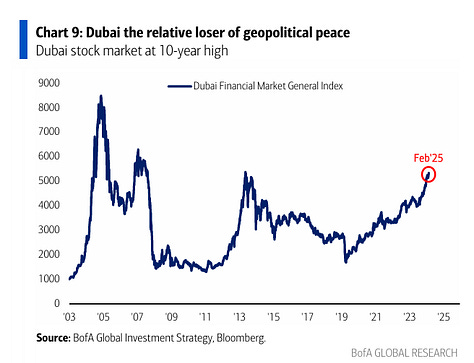

In recent years, Dubai has established itself as a safe haven for money from conflict regions. This development is driven by two factors in particular:

*Western sanctions would include: The exclusion of Russian banks from SWIFT, freezing of 300 billion euros in Central Bank reserves, import ban on Russian coal, investment restrictions in the energy sector, export bans on high tech, import bans on steel and luxury goods, asset freezes and travel bans on "elites", oligarchs and companies close to the government, EU port and airspace closures and EU broadcasting bans on Russian state media.*

The Dubai Financial Market Index reached a ten-year high in December 2024. The main drivers of this development were real estate & banking stocks, such as Emaar Properties. This rise can be directly attributed to capital flows driven by geopolitical crises, for example.

Why peace could weaken Dubai

Dubai's dependence on Crisis Capital means that geopolitical easing brings economic risks. These can be explained by the following points:

Dubai's role in geopolitical competition

In addition to economic implications, Dubai's position as a crisis profiteer also has diplomatic consequences.

The UAE has positioned itself as a mediator between Russia and Ukraine since 2022. Among other things, it has organized 9 prisoner exchanges and strengthened diplomatic relations. The most recent exchange took place on August 24, 2024, in which 115 prisoners were released. President Sheikh Mohamed bin Zayed Al Nahyan held talks with Vladimir Putin on bilateral relations and global developments. At the same time, he also received Ukrainian President Volodymyr Selensky. Peace would reduce this influence.

While Dubai benefits from ongoing crises, Saudi Arabia is increasingly focusing on peace initiatives and long-term investment programs. With the Vision 2030 Saudi Arabia is pursuing an ambitious reform program to reduce its dependence on oil and is planning significant investments in the mining sector and in foreign mining projects with the aim of strengthening its position in mineral supply chains. An easing of tensions would therefore further strengthen Saudi Arabia's position as a leading power in the region.

If the geopolitical situation stabilizes, European banks could expect cash in flows that are currently flowing to Dubai. According to $UBSG (-1,83 %) European banks are heading for record years, with dividend payouts and share buybacks of over €120 billion over the next two years and the EY European Bank Lending Forecast forecasts significant growth in lending volumes in the Eurozone -3.1% for 2025 and 4.2% for 2026.

- Oil

- gas

- EU emissions trading

- Copper

- Aluminum

- Gold

- Silver

Link: https://shorturl.at/5VrEF

#gold

#silber

#öl

#oiel

#kupfer

#aluminium

#metall

#edelmetalle

$SHEL (-1,63 %)

$TTE (-1,78 %)

$ABX

$GLDA (-3,41 %)

$GOLD (-4,38 %)

$LNVA

$GOLD

$DE000EWG0LD1 (-3,01 %)

$B7GN

$PAAS (-7,98 %)

$PHAG (-6,23 %)

$SLV (-7,82 %)

$1BRN

$IOIL00 (+4,58 %)

$WTI

$WTI

$CVX (+0,96 %)

$XOM (-0,79 %)

$OXYP34

$ALEX

$OD7A

$ALUM (+2,63 %)

$COPA (-1,22 %)

$OD7C

$SCCO (-6,19 %)

$GLEN (-1,51 %)

$RIO (-3,75 %)

$RIO (-4,44 %)

$RIO (-3,76 %)

Meilleurs créateurs cette semaine