(Delayed) portfolio review October 2024 - A month with 5 share sales and one ETF sale

Even though October was just over two weeks ago, it feels like a different time. Germany still had an (unspeakable) traffic light government, in America the race for the White House was still open and a phone call between Scholz and Putin was unthinkable.

And even though November has been much more exciting on the stock market than October so far, October was a month of major changes from a personal perspective.

Apart from stock market investments, we are slowly starting to think about building a house. As a result, for the first time in a long time I made several sales in my portfolio and therefore also cleared out a little.

Previously this year, there were only 2 sales in my portfolio: at NVIDIA I took my stake out in February and since then have only let the profits run. In addition, in March I had Encavis after the takeover bid.

There were a total of 6 sales in October. For just under €7,000 I sold my China ETF which has recovered well over the last few months.

On the equity side, I have now sold most of the Corona Hype stocks and Match, Atlassian, Shopify and Block have been sold. In addition, I have also Pfizer sold. That was another €8,000, leaving only Sea from the Corona hype times, where I will remain invested for the time being, as it covers a completely different region geographically with Southeast Asia.

My savings quota will therefore be significantly reduced for the time being due to the upcoming house building project. From just under €1,500 to €2,000, it will only be €500-600 per month for the time being

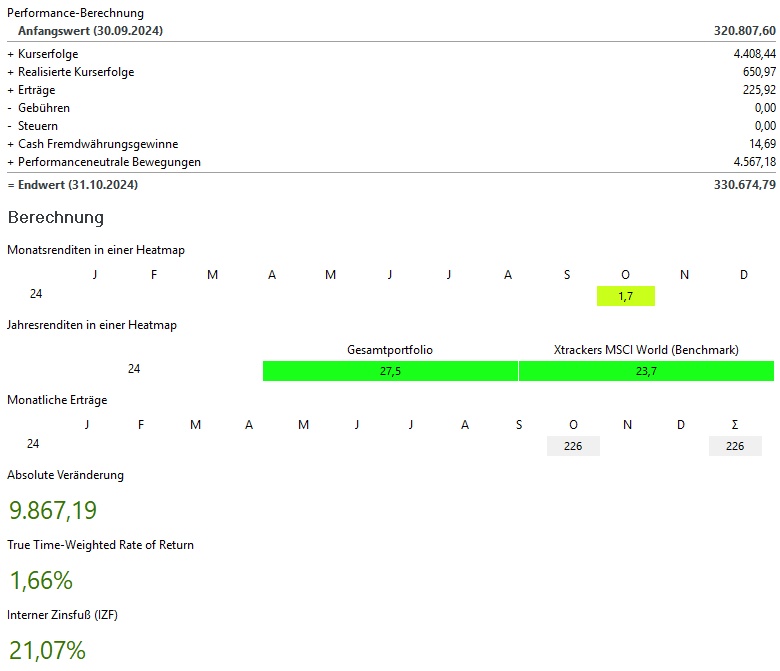

Monthly view:

In total, October was +1,7%. This corresponds to price gains of ~5.000€.

The MSCI World (benchmark) was +0.9% and the S&P500 +1.5%

Winners & losers:

A look at the winners and losers is part of the usual picture:

On the winning side is, as so often NVIDIA is at the top with almost €3,000 in share price gains. It is followed by TSMC, Bitcoin, Alphabet and Palo Alto Networks with gains of €900-1,000 each.

On the loser side above all ASML made its contribution with price losses of almost €1,400. This was followed by Bechtle, Thermo Fisher, LVMH and Nike a broader mix of stocks that have not necessarily performed well recently. Nevertheless, all 5 loser stocks are still part of my savings plans.

The performance-neutral movements in October were just under €4,600. The sales proceeds are all still in cash accounts at the moment, so they have not yet flowed out of the assets. There will be a larger dip here at some point in the future.

Current year:

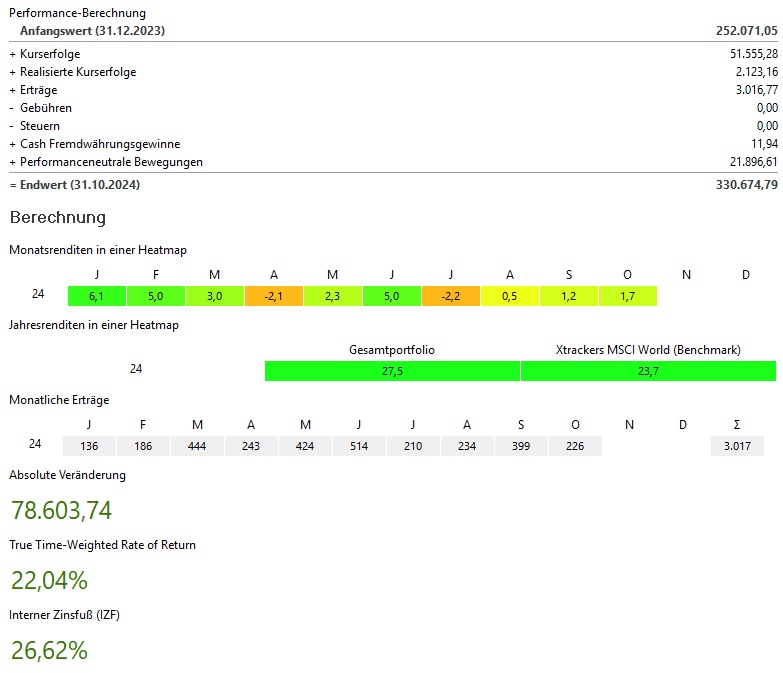

My performance in the current year is +27,5% and thus above my benchmark, the MSCI World with 23.7%.

In total, my portfolio currently stands at ~331.000€. This corresponds to an absolute growth of ~€79,000 in the current year 2023. ~53.000€ of this comes from price gains, ~3.000€ from dividends / interest and ~22.000€ from additional investments.

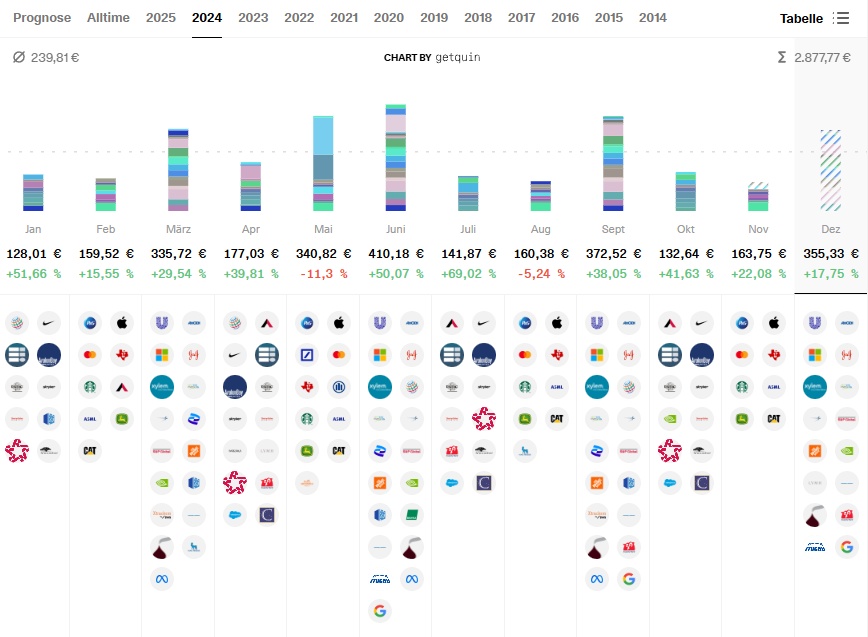

Dividend:

- Dividends in October were 32% above the previous year at ~€150

- TSMC is in the lead with a (gross) dividend of €30 every 3 months. TSMC has already raised the dividend for next year by 30% again

- In the current year, the dividends after 10 months are +25% over the first 9 months of 2023 at ~2.350€

Buys & sells:

- I bought in October for approx. 1.500€

- As always, my savings plans were executed:

- Blue chipsNovo Nordisk $NOVO B (+4,77 %) LVMH $MC (+0,46 %) Apple $AAPL (-0,54 %) Home Depot $HD (+0,5 %) Microsoft $MSFT (+0,44 %) Nike $NKE (-1,45 %) Starbucks $SBUX (+0,13 %) Stryker $SYK (-0,64 %) Texas Instruments $TXN (-0,25 %)

GrowthCrowdstrike $CRWD (+3,36 %) MercadoLibre $MELI (+3,16 %)

ETFsMSCI World $XDWD (+0,73 %) Nikkei 225 $XDJP (+2,08 %) and the WisdomTree Global Quality Dividend Growth $GGRP (+0,37 %)

Crypto: Bitcoin $BTC (-0,58 %) and Ethereum $ETH (-0,45 %)

Sales as mentioned, there were some in October with Match $MTCH (+0,49 %) Pfizer $PFE (-0,35 %) Block $SQ (+3,56 %) Shopify $SHOP (+6,37 %) Atlassian $TEAM Invesco MSCI China All-shares $MCHS (-0,25 %)

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market development in the current year, my portfolio already stands at ~€331,000 at the end of October.

As of mid-November and thanks to the Trump rally, my portfolio is currently approaching €350,000 and was even slightly above this level a few days ago. However, with a larger cash portion that will sooner or later flow into financing as equity.