First things first. I hope you all had a peaceful Christmas season and were able to spend a few lovely days with family and friends! 😊

Even though December isn't quite over yet, I'd like to give you a quick update on the past month before the new year and take a brief look at the performance since I started at getquin in September.

👉🏻 December:

Start: 1,253,497 euros + 19,000 cash

End: 1,336,908 euros + 400 cash

Deposit: 3,000 euros

Profit: +61,811 euros (+4.86%)

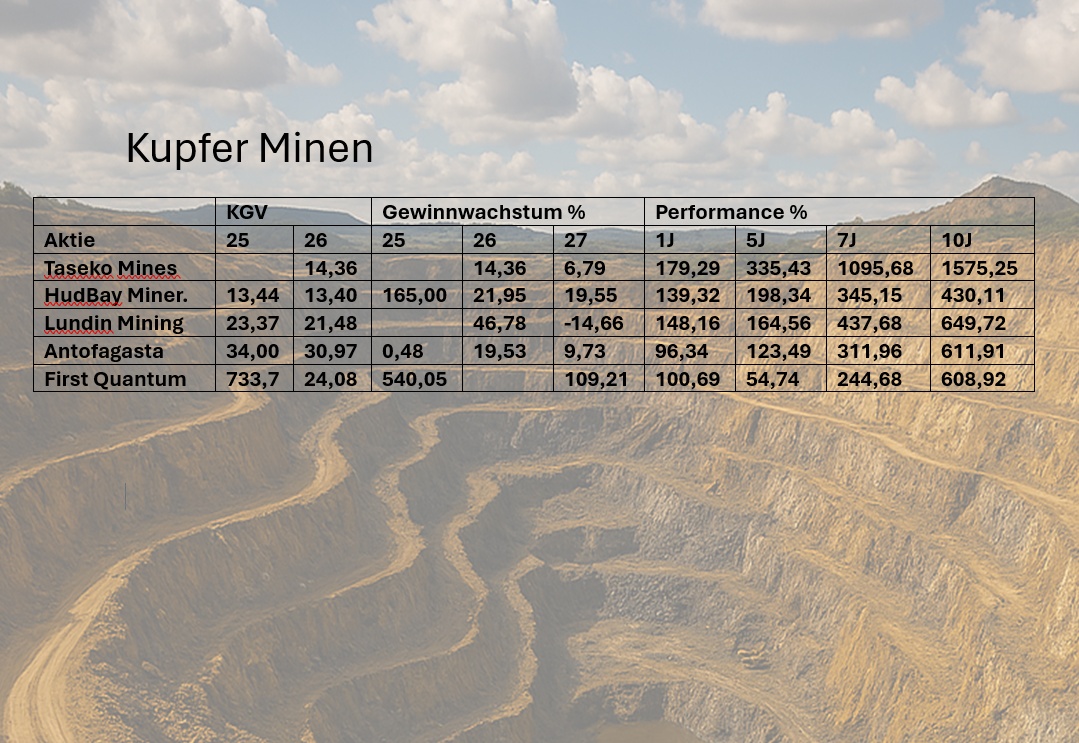

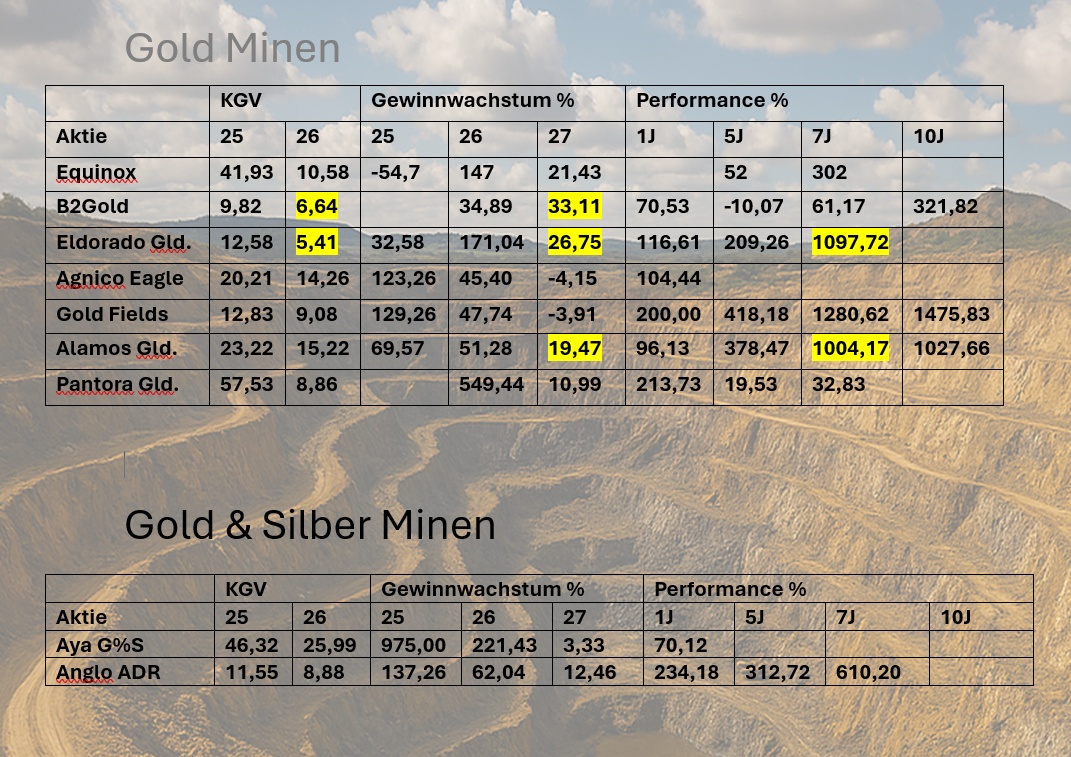

As in previous months, the portfolio benefited from the continued strength of gold in December. The overweight in K92 Mining ($KNT (+1,61 %)), Equinox Gold ($EQX (-1,11 %) ), B2Gold ($BTO (+4,83 %) ) and, more recently, Euro Sun Mining ($ESM (+11,87 %) ) has contributed significantly to the good performance. My sale of SantaCruz Silver ($SCZ) (+3,56 %) in November, on the other hand, unfortunately proved to be an expensive mistake. I lost 50% of my profit, but as you know, you're always smarter afterwards and who could have guessed that silver would go through the roof like this.

Otherwise, not much has changed in my portfolio. I have now fully reinvested the 19,000 euros in cash. Among other things, I have taken an initial position in Vonovia ($VNA (+0,18 %) ) and Zalando ($ZAL (-0,93 %) ). I have also added some Ubisoft ($UBI (-2,49 %) ) and Fuchs Petrolub ($FPE (-0,33 %) ). I only took profits on Puma ($PUM (+0,37 %) ) and significantly reduced my position here when the share price was driven up again by takeover rumors.

As already mentioned, an extremely successful stock market year 2025 comes to an end tomorrow. The performance alone since I started with getquin in September has left me surprised. I wish every year was like this, but ... well. It will probably remain a pipe dream, but I'm all the happier for it! 😊

👉🏻 September - December:

Start: 1,022,339 euros

End: 1,336,908 euros + 400 cash

Return (adjusted): +235,305 euros (+21.39%)

A large part of the performance is of course due to (mainly unrealized) price gains, especially in my two largest positions (K92 Mining and Equinox), which now have a very high impact on the overall performance due to their size. However, other trades have also played their part. For 2025 as a whole, I expect to generate around EUR 115,000 in realized capital gains. Of this, around EUR 20,000 is attributable to dividends received, EUR 20,000 to trading profits with K92 Mining and other various gold/silver mines and around EUR 75,000 to the remaining shares (e.g. Alibaba, Xiaomi, Volkswagen, Porsche, 1&1, Ceconomy, etc.), to name just a few.

I am aware that the main ingredient for such a performance is luck (or inside information). Since I don't have the latter, let's agree on luck... 😉

For this reason, I am setting my targets for 2026 correspondingly lower. My main goal is always to receive around 5% of my assets in the form of investment income. Based on today's values, this would mean a range of 70,000 - 90,000 euros. I no longer set myself a target for my total assets. Although my salary can be planned, it is of secondary importance in the overall picture and, as we all know, you can't plan for price gains on the stock market... 👍🏼

➡️🆓: On my way towards 4 million total assets, the target achievement rate is now 44%. 😊

So, enough chatter. I wish you all a happy new year, happiness, satisfaction, health and, of course, success on the stock market in 2026! 🍀

Enjoy the quiet time! I'm off for 3 weeks in the sun and then I'll see you again at the end of January!

See you in a few days! 😊