Hello my dears,

The statement from COPILOT was.

" Stock up on raw materials "

So today I took a deep dive into the world of mines and commodities.

Anyone who knows me knows that as a long-term investor I tend to look at quality and longevity.

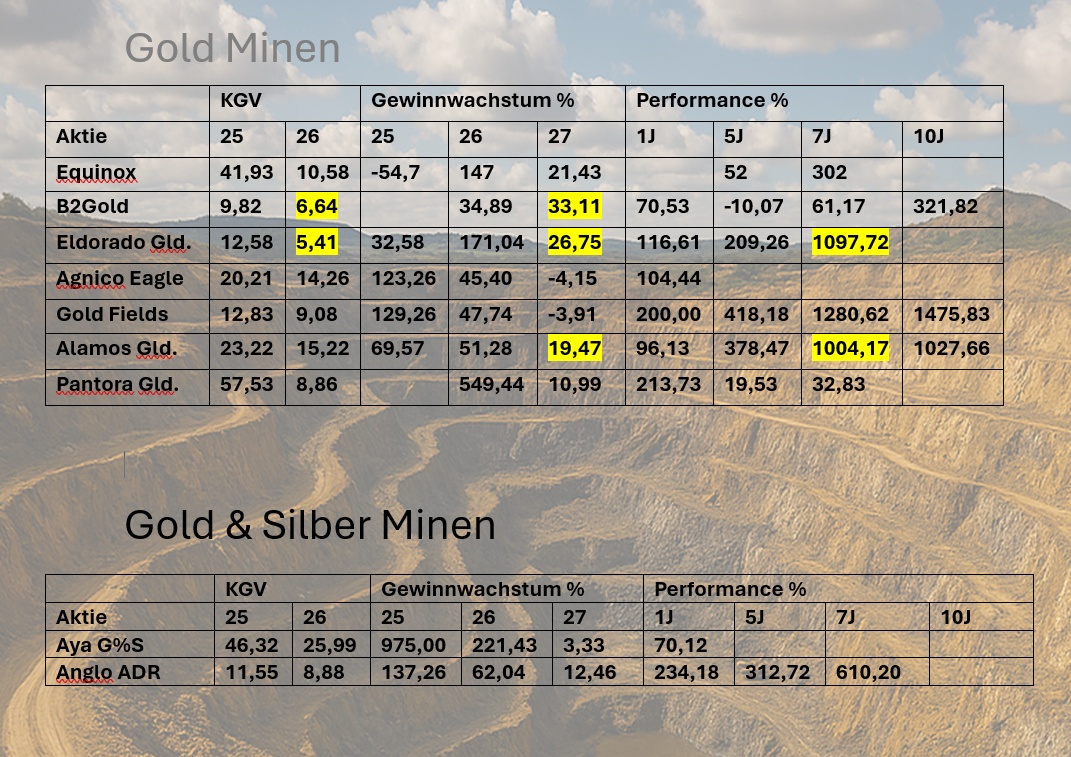

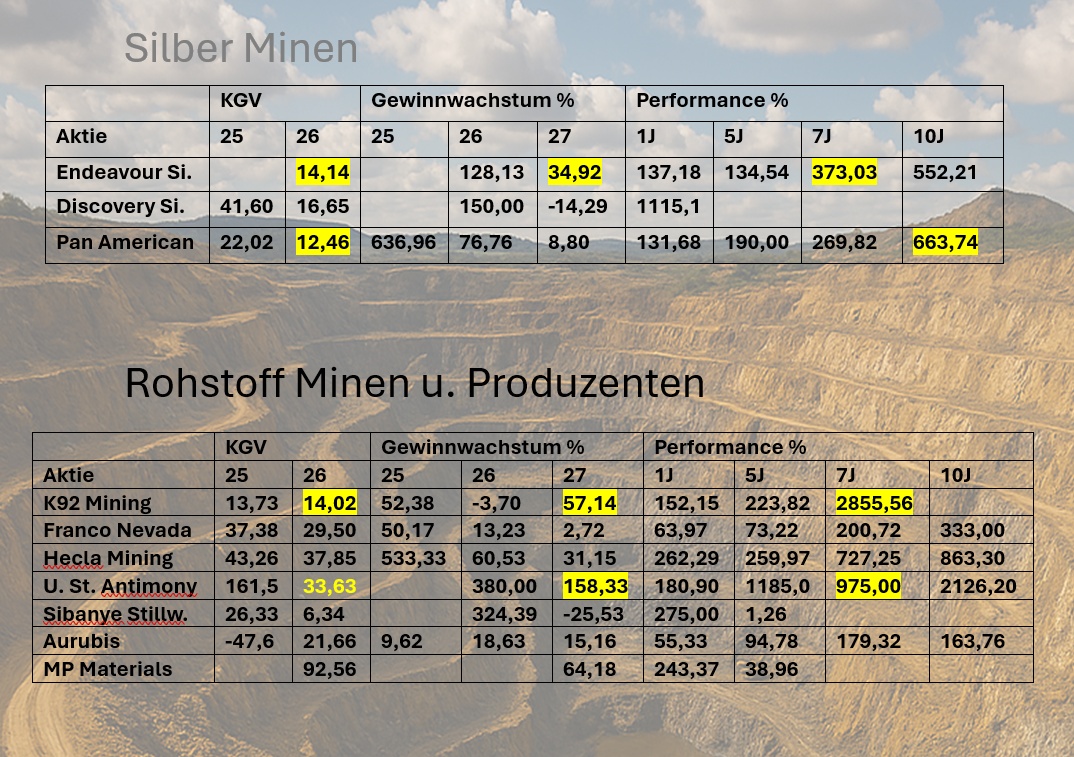

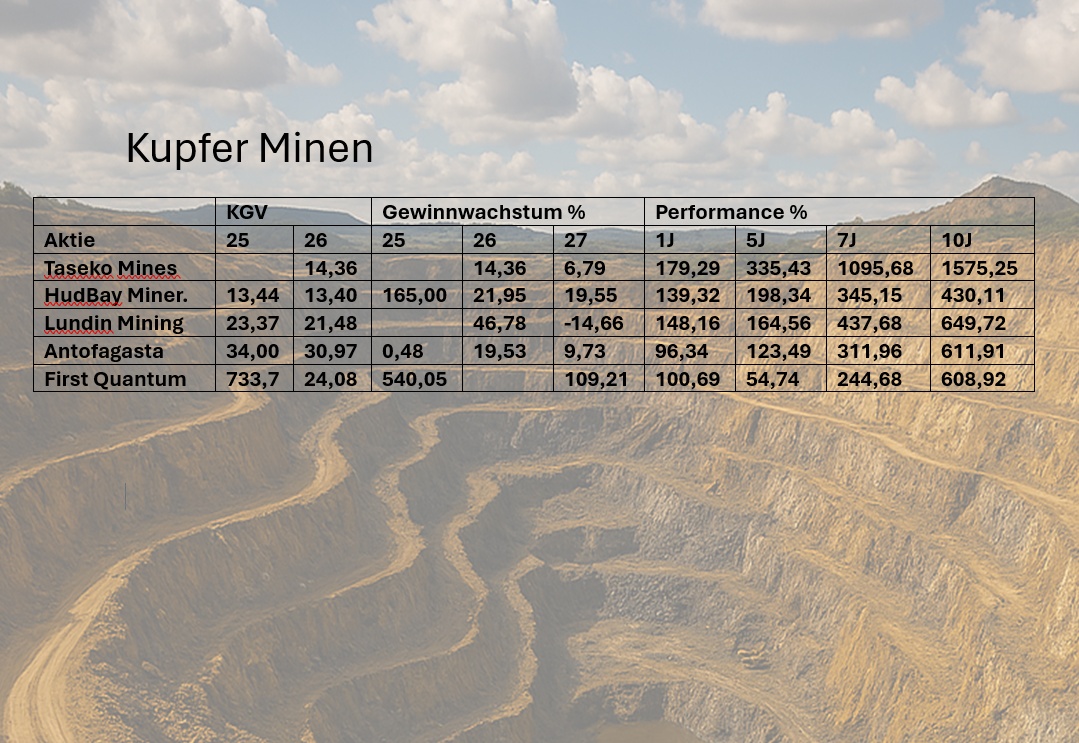

That's why I looked at the shares according to three different criteria

- Long-term historical performance

- Forward P/E ratio

- Earnings growth 2027 (I think investors will be interested in this next year)

I have marked these points YELLOW to find favorites.

I am still in the discovery phase for copper.

My dears,

What do you think of my selection process and my favorites? And what are your favorites in this sector?

(P.S. since it is very difficult to present the figures here at getquin in a reasonable way, I have done this for you today in a Word Doc. Hope you can read it well)

FAVORITES:

- Gold

Eldorado Gold $ELD (-0,11 %) Low P/E ratio with high earnings growth

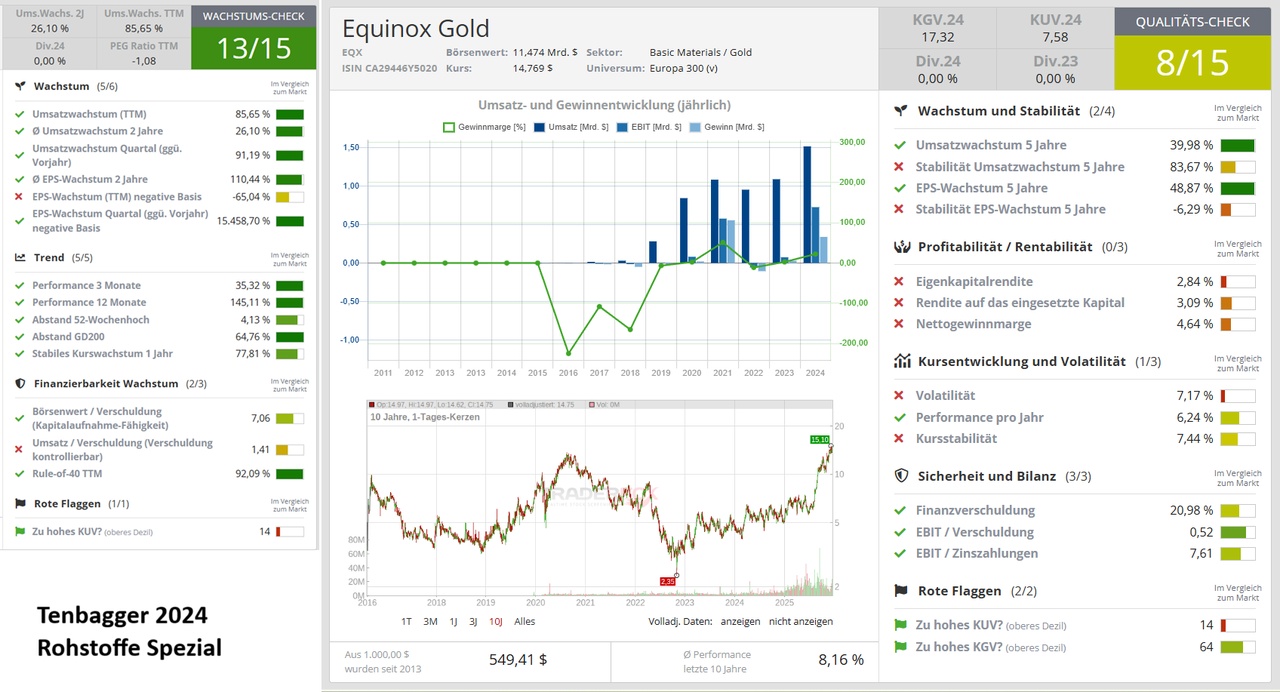

- Equinox Gold $EQX (+0,19 %)

- Equinox Silver

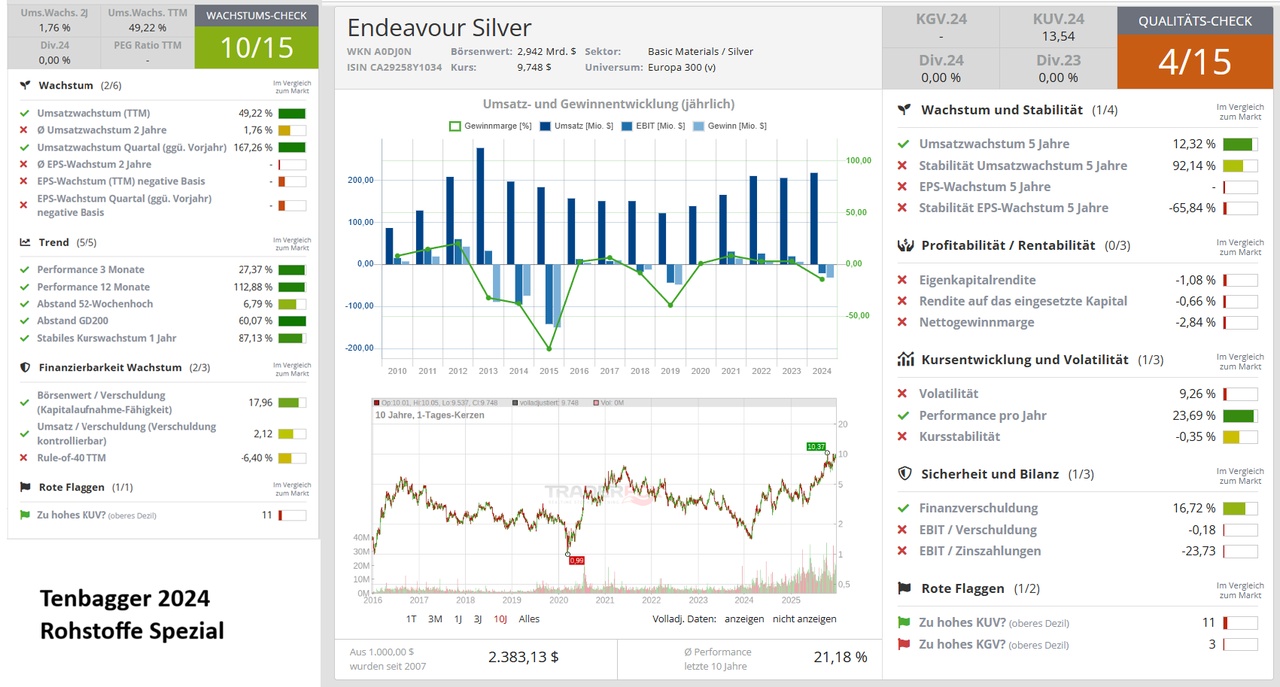

Endeavour Silver $EDR (+1,09 %) Low P/E ratio and high earnings growth

- Various commodities

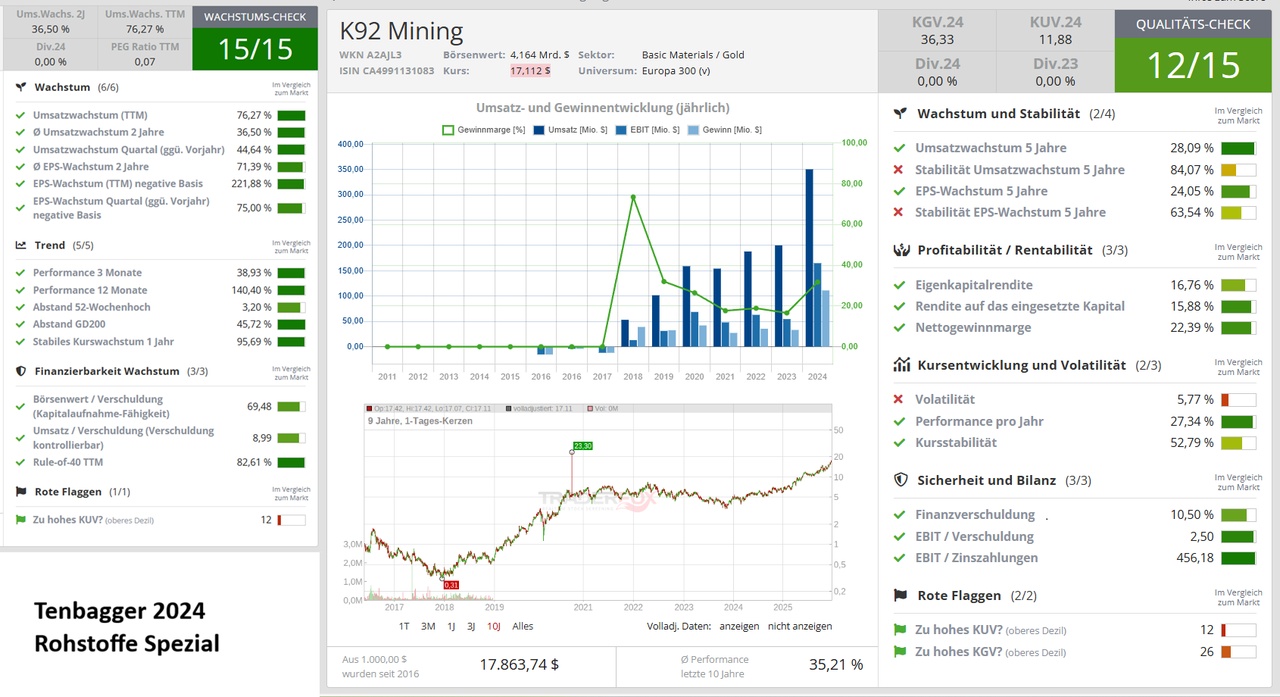

K92 Mining $KNT (-0,33 %) Low P/E ratio, growth, good in quality and growth check