The bear is dancing! 🐻 - 5 Bearish Scenarios for Western Oil Stocks.

The oil industry has been battling massive media headwinds in the public eye since as early as the 1980s. Nevertheless, the saying proves true: "Those who are believed dead live longer!" proves true again and again.

In the following, I have listed some points that could indeed trigger bearish scenarios in the Western oil and gas sector. The probabilities for it are quite given, although these are now realistic, I am not able to judge with the contribution.

1. decoupling of the world markets

Many of you must have heard about it in the news. China is currently mediating in the dispute between the oil powers Saudi Arabia and Iran. It is said to amount to reconciliation and a new alliance is to be forged.

Oil trade, explicitly between Saudi Arabia and China, is then to be traded via the yuan (the Chinese currency).

What does this mean? Currencies have no material value. They are printed numbers with a sometimes fancy design intended to facilitate trade in a country or currency union. Behind this piece of paper, however, is always the respective person's imagination of the economic power of the respective nation. Almost all international trade is in U.S. dollars.

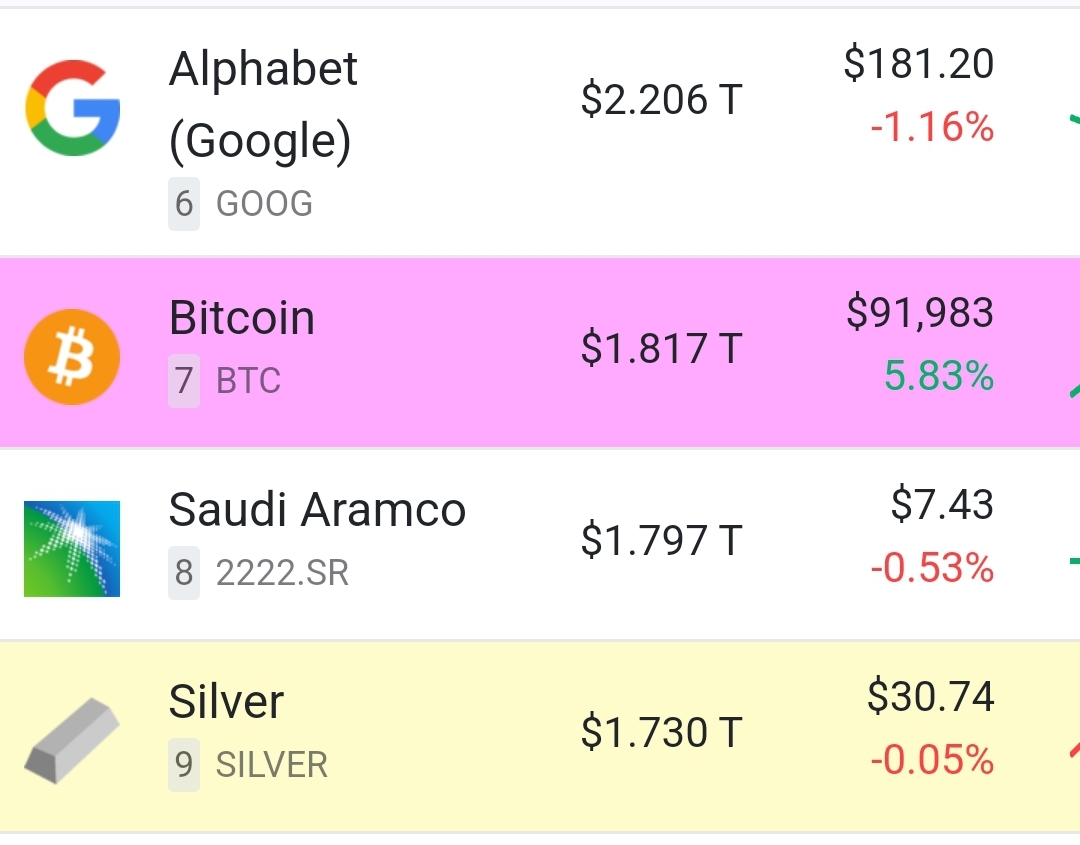

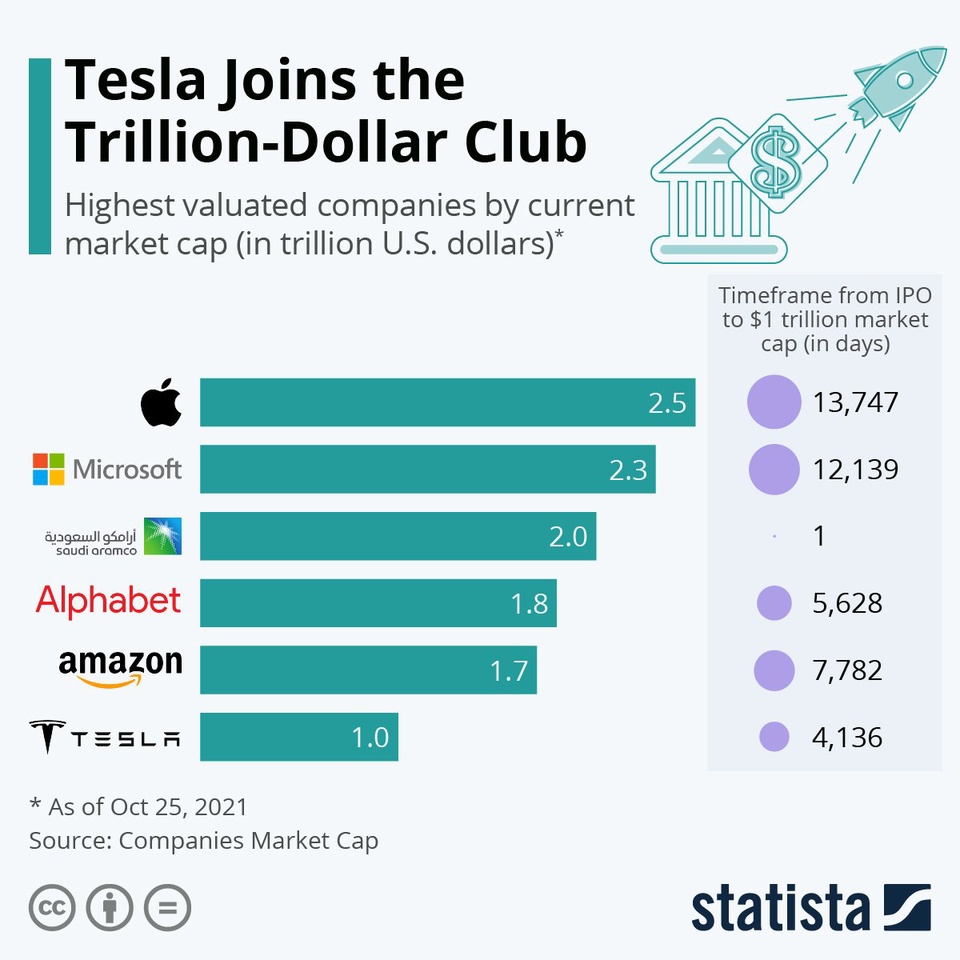

Saudi Arabia owns about 13% of the world's oil reserves (according to OPEC statistics). Not for nothing is Saudi Aramco $2222 has at times been the most valuable company in the world. China, on the other hand, is one of the largest buyers of oil. If one now transacts this trade in yuan, one suffers a relatively high loss of value in the dollar. The prices of WTI or Brent, which are tradable for us, would inevitably lose value as well, as demand collapses accordingly. (Long-term view)

In addition, we should continue to monitor China's activities with regard to Iran. After all, Iran also has huge oil reserves that cannot participate in the market at the moment due to the nuclear dispute and the resulting embargo.

2. persistently high prices

Persistently high prices could also spell doom for our oil industry. At present, it is true that money is being made strongly and shareholders can enjoy dizzying records. Nevertheless, the search for alternatives is becoming more attractive. The high demand from the industry may topple as soon as the high prices cannot be passed on to the end consumer, as this would again lead to demand deficits and increased supply. This leads to production cuts and ultimately to demand problems for oil.

The search for alternatives becomes more attractive, as high oil prices make one attractive to the overall market. This does not necessarily spur renewable energy sources. Relatively low coal and gas prices also lead to a reorientation on the energy markets. This can be read particularly clearly from the prices of the respective commodities from 2022. With the difference that the scenario was true for gas.

3. political environment

The following scenario is itself very unlikely, since the lobby in the EU can enjoy quite a lot of influence. Nevertheless, one is quite capable of surprises.

Suppose political environment in a large economic area changes rapidly. This can mean various legalities.

As an example, I take the decoupling of alternatives from oil and gas products. Biofuels could be fully more competitive, or a tax break, as in the 2000s could be a consequence. As a result, demand for oil fell just as sharply, and the federal government consequently rescinded the tax break and passed the Fuel Quota Act to compensate.

4. speculative bubbles in emissions trading

Many may not be familiar with it. In the EU, emitters are obliged to compensate for their emissions. In this case, the responsible companies have to buy certificates for this purpose. However, every emitter participates in this market. Accordingly, it can lead to speculation bubbles forming here as well. The corporations pass these costs on to the consumer. Accordingly, the respective economic good naturally becomes more expensive.

However, this emissions trading system is not limited to the EU. China and other countries also have such trading systems, although the prices there are rather symbolic in comparison.

In addition, there are of course national emissions trading systems, such as the one we have in Germany with the so-called CO2 pricing.

5. overthrow in own rebuilding

The petroleum companies on the European continent in particular are almost outdoing each other with their sustainability goals.

While Total $TTE (+0,47 %) has nevertheless been able to solidly claim the gas market in the LNG sector for itself, Shell hardly plays a significant role in it. $SHEL (+1,05 %) hardly plays a significant role in it. Overall, in the liquefied natural gas market, US brands such as. $LNG (-0,17 %) , $CVX (+0,28 %) and $COP (+0,19 %) have established themselves.

Please note that this is the fossil market. In the renewables sector, Shell, in turn, already plays a quite considerable role.

BP $BP. (-0,04 %) on the other hand, is rather cautious and timid in this respect. Rightly so?

Of course, this cannot be said across the board, since no one can reliably predict the future, especially the general conditions for the future. Nevertheless, the restructuring of the petroleum companies costs an enormous amount of capital and destroys their original business model. It is therefore necessary to venture into new and uncertain sectors, into markets that are already dominated by other well-known companies. The risk of losing market share both in the oil industry and in the so-called "future industries" is therefore very high.