voestalpine

Price

Debate sobre VOE

Puestos

25voestalpine AG adopts new capital allocation and dividend policy

Voestalpine supplies steel plate for BYD plant in Hungary

US tariffs burden voestalpine

$VOE (-3,36 %)

https://ooe.orf.at/stories/3308198/

Earnings before interest, taxes, depreciation and amortization (EBITDA) fall from 1.7 billion to 1.3 billion

Net profit fell from 207 to 179 million euros.

Turnover decreased by 5.6 percent to 15.7 billion euros

Dividend now reduced to 0.60 (previously: 0.70) euros per share.

The decline in earnings was justified by a gloomy market environment and internal restructuring measures within the Group. Among other things, Voestalpine sold the subsidiary Buderus Edelstahl (sale to $MUX) (-3,11 %) and adjusted its sales structure.

For 2025/26, the Group expects EBITDA of between EUR 1.4 and 1.55 billion. The announced US tariffs on steel products are likely to have a negative impact on earnings in the mid double-digit million euro range.

Trading Part4 - Deepdive indicators 📈📉☕

As always, first the link to the first post, where you will also find the links to all the other parts https://getqu.in/cbIOkg/

Today there are a few more details on the indicators from part 3 https://getqu.in/9XGYtO/

As described in part 3, I start my analysis with the SMA 200 / 50 / 5 daysto get an overview of the trend.

Example $UBER (-1,18 %)

For me, an important setting for the SMA is that I always use the SMA regardless of my chart setting always on a daily basis. daily basis. This means that even if I have set the chart to weekly or 4h, it always shows me the SMA on a daily basis.

Example $UBER (-1,18 %) 1h hour chart - but the SMA are still on a daily basis, not like the default setting, which always refers to the chart - then the SMAs would be calculated on a 200 / 50 / 5 hour basis!

Next, I'll get the VRVP to see the volumes. I have set the chart to the range since Uber has been in an overarching sideways phase.

I can see the price area with the highest volume and the distribution where 68% of the volume has taken place.

My VRVP settings are as follows, I adjust the line size depending on the visible range - the larger the range, the larger the number of lines.

So, I now have a good overview of the trend after a few minutes.

Now it's time to continue with the VWAP. My anchored VWAP I place it in a prominent position for me. In this case the last low before the start of the sideways phase. This is how I see the "DNA" of Uber - How does Uber behave in the statistical areas of the volume-weighted average price.

For my short-term trades, I zoom into the close range, but the anchored VWAP remains. I only switch to the 1 hour chart and the last few months.

The white circles then show potential entries and exits for me. The orange circles at the bottom show the earnings, there's always a lot of movement😁

Of course, I also look in detail at the price action, i.e. the candles per time unit.

In principle, this describes my main procedure for determining the buy/sell point.

That's it 🤷♂️ has been working for me for a long time with the outcome as described in part 2 https://getqu.in/TVNdpR/

Because of the overview, I have hidden the VRVP in the VWAP views, but I always leave it on for my analysis.

Example anchored VWAP with VRVP and SMA5 for the short-term trend

Example anchored VWAP with VRVP and VWAP on a weekly basisI can see where the VWAP of the current week has moved. It's also nice to see how and where the big volumes of the week have positioned themselves 😁

So, that's a bit more detail on my setup. As you can see, with a little practice and routing, you can analyze a stock in a short time. For me, such an analysis usually takes no longer than 10 minutes and I know whether a trade makes sense for me and where to place my buy and sell orders.

PS: I have found a clever script on TradingView for some of my stock screener filters. You can always display some criteria live - in the chart at the bottom right

You can find it under the indicators: Ticker Dashboard For Better Stock Selection

$ADYEN (-1,78 %)

$MMK (-0,81 %)

$MRK (-0,1 %)

$KTN (-2,39 %)

$BRBY (-4,62 %)

$OMV (+3,11 %)

$VER (+4,45 %)

$BG (-3,48 %)

$VOE (-3,36 %)

$ZAL (-2,82 %)

$VRTX (+0,32 %)

$RDC (-2,65 %)

+ 6

It reads very well. 💪🏼

Primetals, Mitsubishi, voestalpine and Rio Tinto build hydrogen-based iron production plant

Primetals Technologies, together with its partner Mitsubishi $8058 (-0,36 %)the steel manufacturer voestalpine $VOE (-3,36 %) and the mining group Rio Tinto $RIO (+1 %) signed a cooperation agreement for the construction of an industrial-scale prototype plant for hydrogen-based iron production in Linz, Austria.

The aim of the partners is to drive forward the development of fluidized bed and smelting technologies that could lead to net-zero CO2 emissions in iron production. The plant, which is scheduled to go into operation in mid-2027, will be the first time that a hydrogen-based direct reduction plant for fine ore will be integrated with a smelting plant producing pig iron briquettes, pig iron and pig iron.

The prototype plant will combine two core technologies of Primetals Technologies - hydrogen-based fine ore reduction (HYFOR) and the smelter. HYFOR is the first DR technology for processing iron ore fines without agglomeration and has been in pilot operation at the voestalpine Donawitz site since 2021. The smelter uses renewable energy to melt and further reduce the direct reduced iron (DRI), producing pig iron with potentially zero CO2 emissions.

"This project represents a significant step forward in future-proof ironmaking - for the first time we will implement a continuous production process with hydrogen-based direct reduction," said Alexander Fleischanderl, Chief Technology Officer and Head of Green Steel at Primetals.

"The combination of HYFOR and Smelter is a highly innovative development that has the potential to change the industry, similar to how the LD converter (BOF) has impacted steel production. We are very proud to have voestalpine, Rio Tinto and Mitsubishi as strong partners and together we are able to play a key role in shaping the future of ironmaking with net CO2 emissions."

The new plant will have a capacity of three tons of pig iron per hour.

Mitsubishi, a strategic partner in the development, will support the expansion of the technology through its ferrous raw materials business. "Mining and trading of ferrous raw materials has been one of our core businesses for many decades, and we intend to develop a new range of low-emission metals to support the decarbonization of the steel industry," said Kenichiro Tauchi, COO of the Group's ferrous raw materials business.

"HYFOR and Smelter are promising new technologies to accelerate the decarbonization of the steel industry, and Mitsubishi Corporation is pleased to participate as a strategic partner of Primetals Technologies in the development of these breakthrough technologies together with leading partners in the steel supply chain."

voestalpine sees the project as being in line with its greentec steel strategy. "With greentec steel, voestalpine has a clear step-by-step plan for CO2-neutral steel production," says voestalpine CEO Herbert Eibensteiner.

"As a first step, a green electric arc furnace will be put into operation at both the Linz and Donawitz sites from 2027. By 2029, we will reduce our CO2 emissions by up to 30% compared to 2019. This corresponds to almost 5% of Austria's total annual CO2 emissions and makes greentec steel the largest climate protection program in Austria. Our long-term strategy is to achieve climate-neutral steel production with green hydrogen. Together with Primetals Technologies and Rio Tinto, we are taking a completely new and promising path in research into hydrogen-based pig iron production."

Rio Tinto, one of the world's largest iron ore producers, will supply 70% of the iron ore feedstock for the plant, sourced from its Pilbara operations, the Iron Ore Company of Canada and the future Simandou operations.

"We are pleased to join a consortium that covers the entire iron and steelmaking value chain," said Thomas Apffel, General Manager for Steel Decarbonization at Rio Tinto. "By contributing our ironmaking expertise and iron ore from the Pilbara, Iron Ore Company of Canada and the future Simandou operations, we aim to drive the development and adoption of fluidized bed technology. This fines-based ironmaking solution is a compelling alternative to shaft furnace technology as it eliminates the need for pelletization, which can offer significant benefits to both steelmakers and mining companies. Rio Tinto welcomes the addition of further participants to the consortium and looks forward to supporting the widespread adoption of this innovative technology."

The project has been supported by several EU and Austrian government initiatives. These include the Austrian Federal Government's "Transformation of Industry" program managed by Kommunalkredit Public Consulting (KPC), the "Twin Transition" initiative managed by Austria Wirtschaftsservice (aws), the EU Coal and Steel Research Fund under the Clean Steel Partnership and the EU's Clean Hydrogen Partnership under the Hydrogen Valleys.

Austria News🚨

Today the ATX has made its biggest jump in 3 years.

Shares like

have risen well

Question: What do you think about Austrian shares?

buy the dip

In my opinion, a good entry price. Expect a dividend of EUR 1.40 again in less than 5 years. Planned as a long-term investment (dividend) $VOE (-3,36 %)

$VOE (-3,36 %) In terms of share price, we have once again reached the bottom🥶

It's been a while since you could read anything about the Austrian steel producer here. You only find these lows for VOEST every few years. See also the following daily and weekly charts.

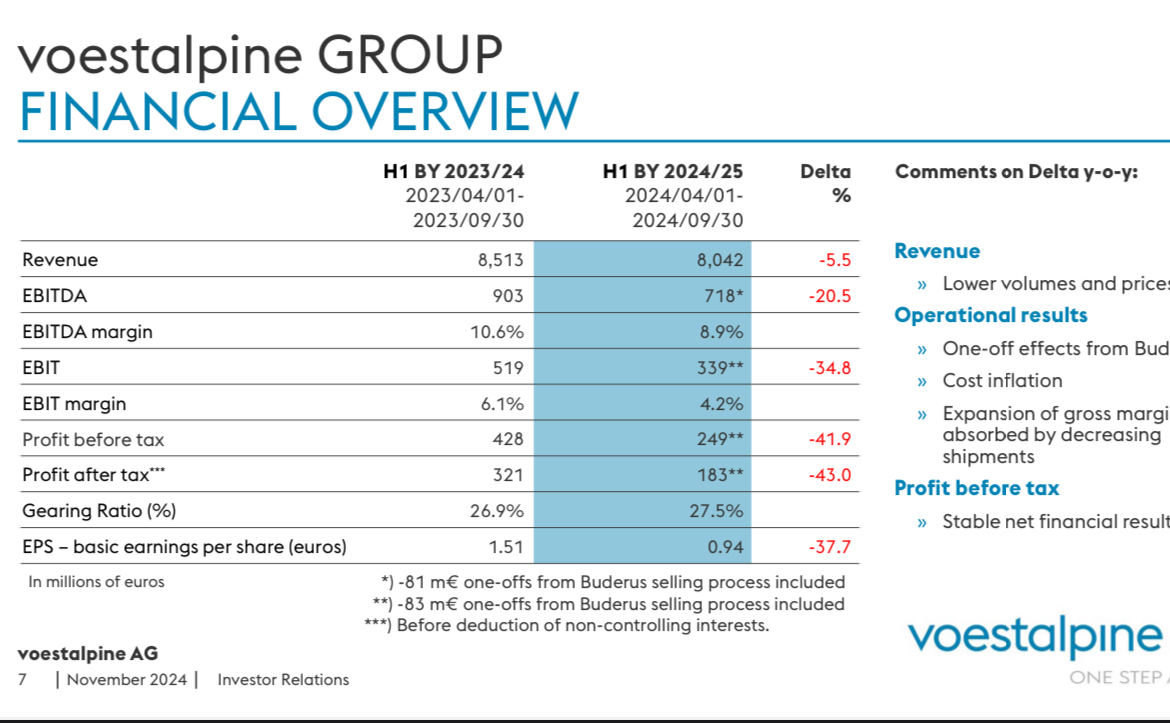

Yesterday there were the 1st half-year figures 2024/2025.

- Focus on high-tech products and broad positioning by sector and region supports Group result

- Sales of EUR 8 billion slightly down on the previous year (EUR 8.5 billion)

- EBITDA of EUR 718 million influenced by negative one-off effects (previous year: EUR 903 million)

- Equity of EUR 7.4 billion stable compared to the balance sheet date (March 31, 2024) Leverage ratio at 27.5 % (March 31, 2024: 22.0%) at a solid level

- Numerous international growth growth projects being implemented

- Successful placement of a green bond - the first European steel company to do so

- Number of employees (FTE) increased by 1% year-on-year to 51,700

- EBITDA outlook at around EUR 1.4 billion

Not available for TL:TR -- the whole thing in more detail📃

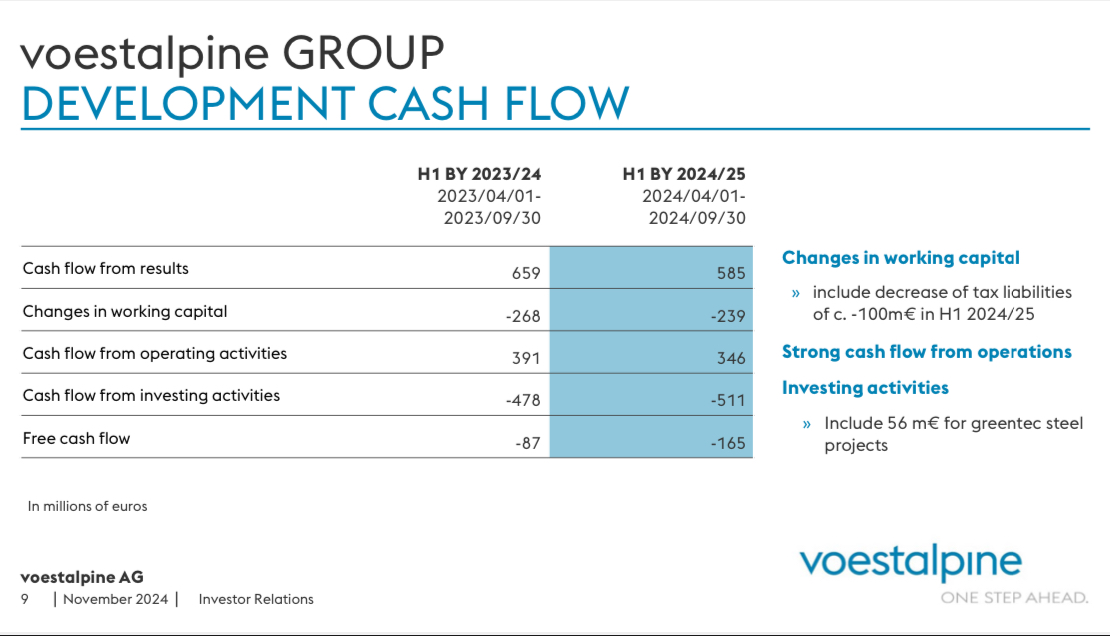

The voestalpine Group was confronted with low economic momentum in the current reporting period. This weakened the revenue fell by 5.5% in the first half of 2024/25, from EUR 8,512.8 million in the previous year to EUR 8,042.3 million. The year-on-year decline in sales, which affected all four divisions equally, is the result of lower sales volumes and a drop in prices against the backdrop of falling raw material costs.

The operating result (EBITDA) of the voestalpine Group vdecreased by 20.5% year-on-year in the first half of 2024/25, from EUR 903.4 million (margin of 10.6%) to EUR 718.1 million (margin of 8.9%). The operating result (EBIT) of the voestalpine Group fell by around a third year-on-year, from EUR 519.3 million (margin 6.1%) in the first half of 2023/24 to EUR 338.5 million (margin 4.2%) in the first half of 2024/25.

Outlook.

Outlook:

At the start of the 2024/25 financial year, the weak performance of the construction, mechanical engineering and consumer goods industries was offset by very good demand from the railroad infrastructure, aviation, warehouse technology and conventional energy sectors. The automotive industry also performed largely stable at a solid level.

The conventional energy sector weakened noticeably over the course of the first quarter and the automotive industry also lost considerable momentum at the end of the second quarter following a series of profit warnings from well-known European OEMs. The economic mood in Europe changed over the course of the first half of 2024/25 after large corporations announced extensive plans to reduce their workforce.

On the basis of the result for the 1st half of 2024/25, the significantly gloomier market developments in Europe and the non-recurring burdens on earnings totaling more than EUR 100 million from the sale of Buderus Edelstahl and the reorganization of the reorganization of the Automotive Components business in Germany the Management Board of voestalpine AG expects for the business year 2024/25 from today's perspective an EBITDA in a range of around EUR 1.4 billion.

This earnings outlook is based on the on the expectation of continued good global development in the railroad infrastructure, aviation and warehouse technology business areas. The assessment of the performance of the voestalpine sites outside Europe in the other business segments also remains positive for the second half of 2024/25.

The challenges in Europe, and especially in Germany the Management Board of voestalpine AG is meeting the challenges in Europe, and especially in Germany, with active management and, where not otherwise possible, by reducing the Group's presence in this region.

My conclusion: I will continue to hold my position for the time being, but will not expand any further. Depending on the economic environment, Trump's influence, etc., a sale may also be an option

Who else has VOEST in their portfolio? What's your view? Hold, increase or sell?

Source of the data: voestalpine Investor Relations & Geschäftsbericht - voestalpine

+ 1

$VOE (-3,36 %) Voestalpine (steel) will be my first Austrian share! After a long period of observation, I will open my first position in the coming weeks!

So what makes them special, where do you see a good rating etc.? :)

Valores en tendencia

Principales creadores de la semana