$LMND (+0 %)

History:

$LMND (+0 %) is an insurance company that was founded as a public benefit corporation and has its headquarters in New York and its European branch in Amsterdam. Lemonade has been traded as a public company on the New York Stock Exchange since July 2020.

$LMND (+0 %) Insurance was founded in 2015 by Daniel Schreiber and Shai Wininger with the goal of revolutionizing the insurance industry through technology. The company started by providing home insurance and relies heavily on artificial intelligence and chatbots for claims processing and customer service.

$LMND (+0 %) has experienced rapid expansion, including an IPO in 2020 and expansion into Germany

business model:

Lemonade, Inc. offers renters, homeowners, auto, pet and life insurance.

Current market capitalization 3 billion

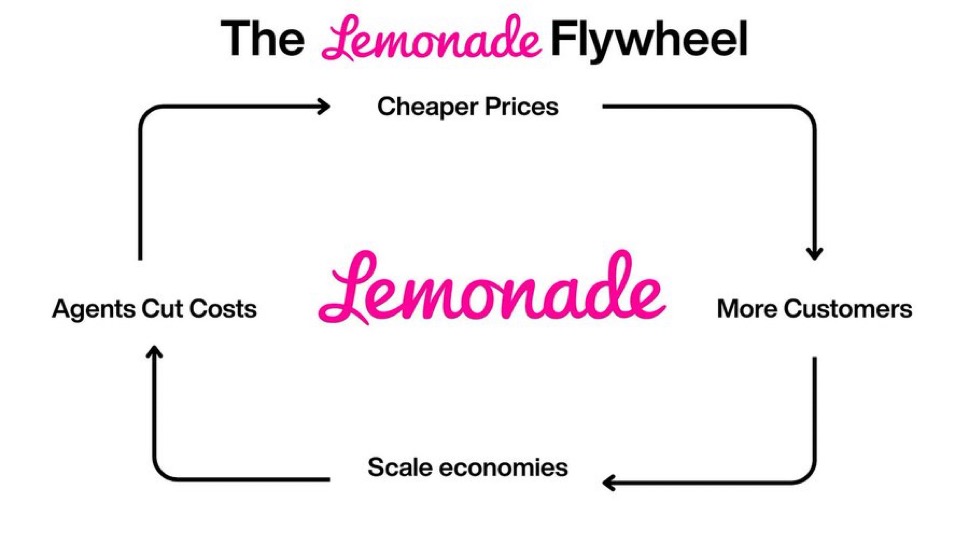

The company's full-stack, artificial intelligence-powered insurance carriers in the United States and European Union replace brokers and bureaucracy with bots and machine learning. The company's digital substrate enables it to integrate marketing and onboarding with underwriting and claims processing, and to collect and utilize data.

Its technology includes Data Advantage,

AI Maya, AI Jim, CX.AI, Forensic Graph, Blender and Cooper.

AI Maya, the onboarding and customer experience bot, uses natural language to assist customers in the onboarding process.

AI Jim, the claims reporting bot, receives the customer's first claim and pays the claimant or rejects the claim without human intervention.

The company offers pet insurance policies that cover diagnoses, procedures, medication, accidents or illnesses. Even the basic pet insurance covers blood tests, urinalysis, laboratory tests and CT scans.

What is the Lemonade $LMND (+0 %)

Giveback?

Giveback is at the heart of Lemonade. This core element of the business model enables customers to use their Lemonade insurance policies to support causes that are close to their hearts.

Since 2017, Lemonade has $LMND (+0 %) donated over 10 million US dollars to help build new homes, provide clean water, improve education, promote animal rights and much more.

Here's how it works:

When a customer purchases a $LMND (+0 %) renters, homeowners, auto or pet insurance, charges a flat fee to cover $LMND (+0 %) a flat fee to support and grow the business. A portion of the premiums goes towards claims settlement and the balance goes directly to one of their Giveback Partners - non-profit organizations selected by our customers.

$LMND (+0 %) is a non-profit corporation:

$LMND (+0 %) is a Public Benefit Corporation and a certified B Corp, which means they are legally committed to making a positive social impact. B Corp certification is awarded to companies that demonstrate that they balance profit and purpose while putting people and the planet at the center.

Every three years, they undergo a comprehensive assessment of their entire organization.

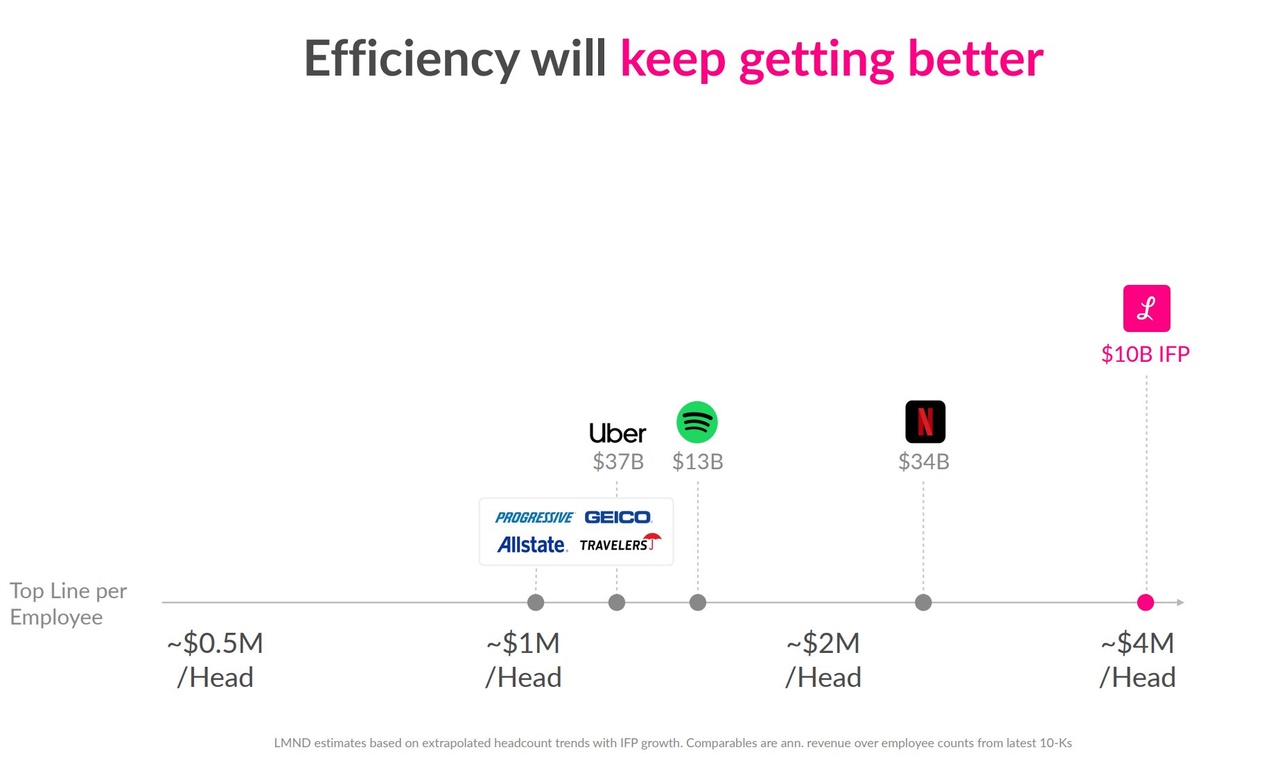

Number of employees: 1 258 (end of 2024)

Profitability:

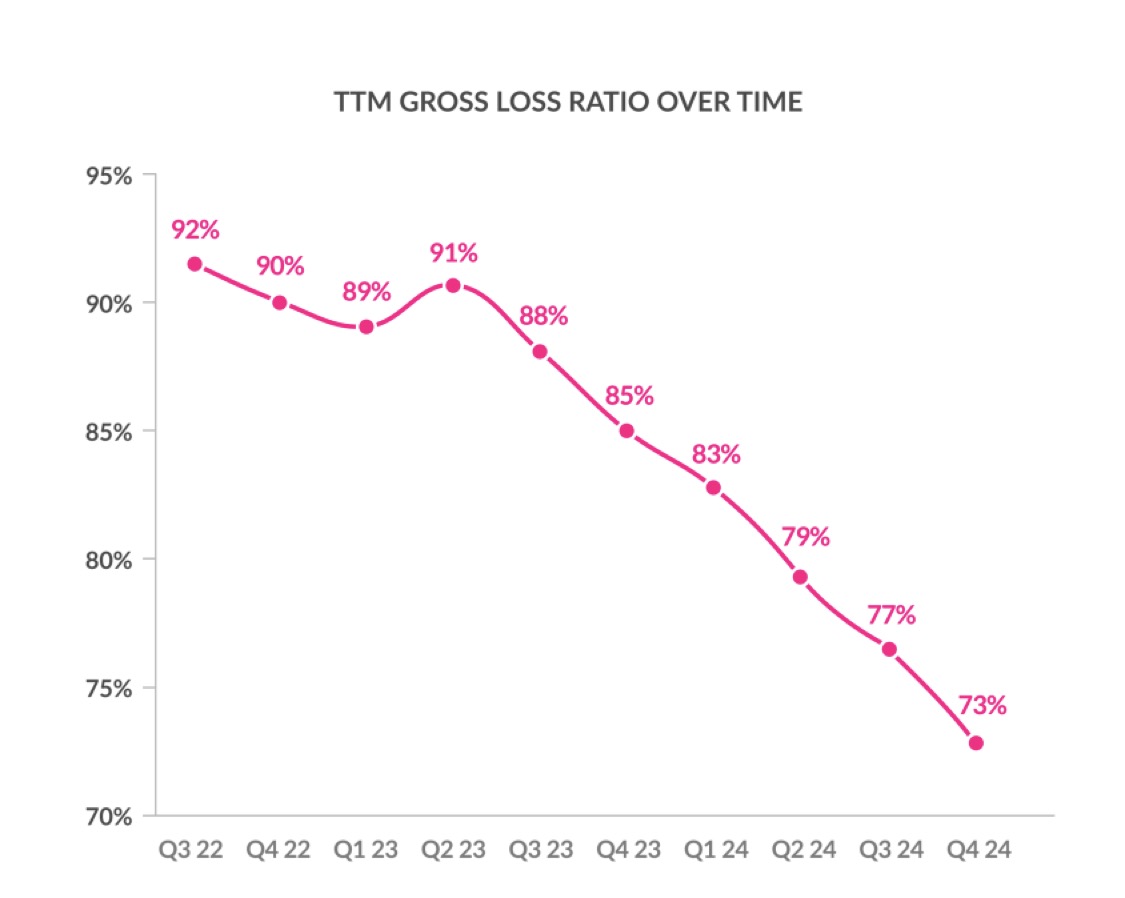

$LMND (+0 %) Approaching a turning point, possibly offering a promising investment opportunity.

Profitability increases with size, as costs do not rise due to additional premiums, as is normally the case with conventional insurance companies.

Management expects EBITDA profitability in 2026 and net profit profitability in 2027.

They see an extremely clear path to profitability:

They also have a clear path to profitability :

- Loss ratio from 92% to 73

- Net profit margin -123% to -20.2%

- Continued increase in sales growth rates

Growth:

Growth is currently still controlled, but the real growth is yet to come, with sales growth rates continuing to rise in the last two quarters.

They have been able to achieve these growth rates without an expansive expansion (both in existing and additional potential states) of automobile insurance, which represents a huge opportunity for $LMND (+0 %) represents a huge opportunity.

Car insurance

$LMND (+0 %) currently has around 2.3 million customers who use renters, pet and other insurance products. These customers use $LMND (+0 %) for one reason: favorable price and convenience.

The share of car insurance is currently still very small and has a lot of room for expansion, so if we were to assume that only 30% of them become car insurance customers with an average annual turnover of USD 1,800, that would be an additional USD 1.24 billion in turnover per year ... just by cross-selling 30% (without any other new customers)

Pet insurance:

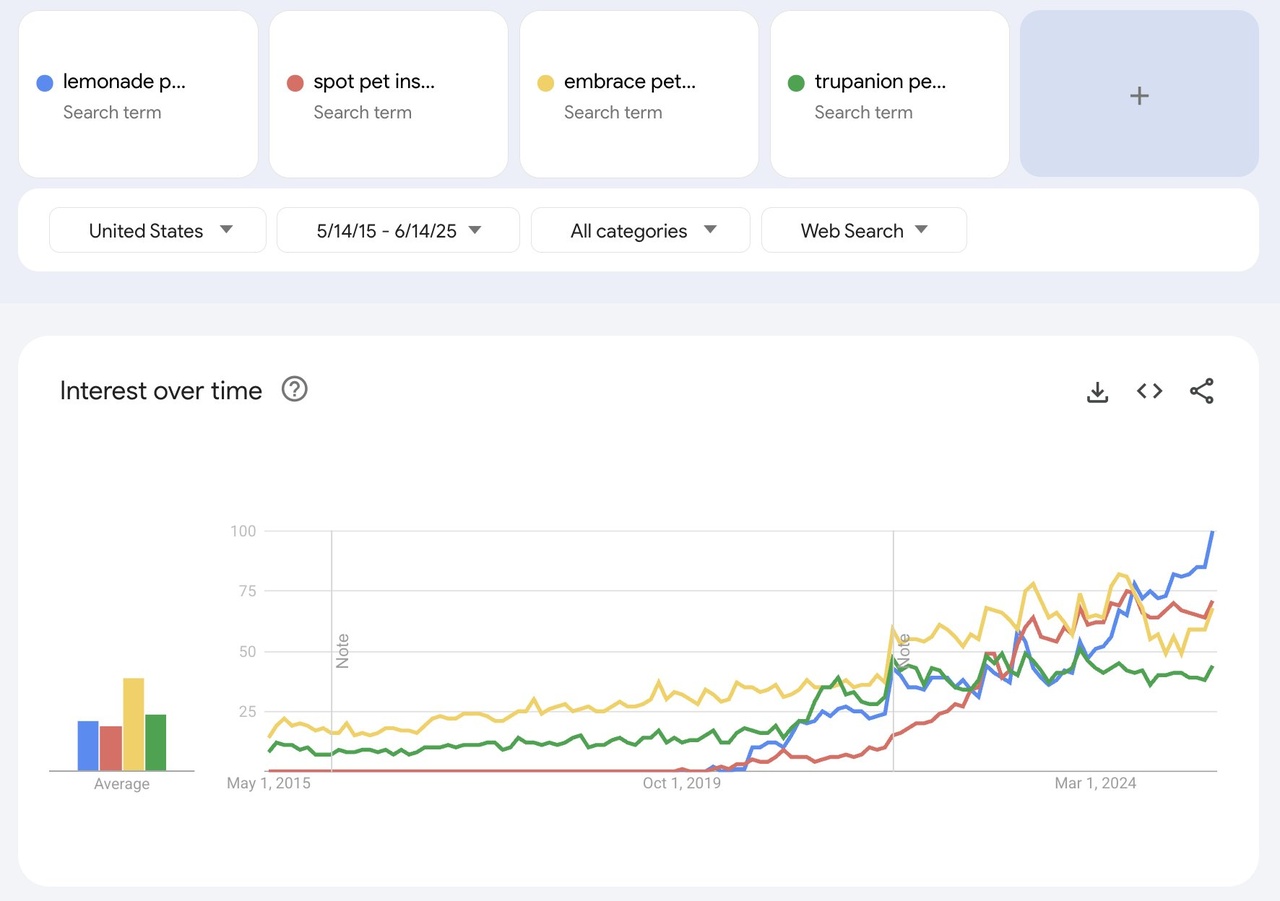

The pet insurance market was a $5 billion market in the US last year. It is expected to reach 6 billion dollars in 2025 and 15.7 billion dollars by 2030, growing by 22% annually.

$LMND (+0 %) - Total annual premiums recently surpassed the $1 billion mark. So if you were to capture 50% of the pet insurance market, premiums would increase eightfold in just five years (800% assuming the projected growth above)

Trupanion (green line) has a 25% market share today. $LMND (blue line) is around 5%.

However, the search trend will continue to have a positive effect for $LMND (+0 %) especially as it is only just beginning to expand further into all states. (This also applies to the other insurance segments)

Opportunities/long-term potential:

I think the future possibilities and opportunities for $LMND (+0 %) a supposedly boring industry are enormous.

The insurance market has one of the largest TAMs of all.

The global insurance market was worth around USD 8 trillion in 2024. The USA and China are the largest insurance markets worldwide, with the USA leading the way with a market share of around 45% and China with around 10%.

- Slight international expansion (online)

- Product expansion (additional lines)

- Enormous cross-selling potential

- Decreasing dependence on reinsurance

- Simple and fast premium calculation, conclusion and claims settlement (through AI)

- Already tested/calculated in-house: https://www.lemonade.com

- 10-fold sales opportunity

$ALV (+0,3 %)

$MUV2 (+0,82 %) , $HNR1 (-0,4 %) , $PGR (-1,6 %) , $GEC , $ALL (-2,35 %) , $AIG (-1,55 %) , $UNH (-1,35 %) , $CVS (+0,21 %) , $UQA (-1,33 %) , $G (+0,17 %) , $VIG (-1,26 %)