Short stock opinion/stock analysis on KDDI $9433 (+1.14%)

Reading time ca.5min

(No investment advice)

Table of Contents:

1.What is KDDI

2 . news about KDDI

2.1 Co-operation with SpaceX

2.2 Expansion of 5G

3.future view from KDDI management

4.how attractive the dividend seems

5.is the KDDI share favourably valued?

6.conclusion

1.What is KDDI: KDDI is a Japanese company engaged in telecommunications and information and communications technology (ICT). Headquartered in Tokyo, the company employs nearly 50,000 people and serves primarily residential customers, with about 85 percent of sales in the "Personal" business segment, but also includes business customers with about 15 percent in the "Business" segment.

KDDI strives to offer innovative technologies and services to meet the needs and requirements of its customers. The company also invests in research and development to drive new technologies such as 5G communications, IoT (Internet of Things) and AI (artificial intelligence), and to continuously improve its services.

2.Latest on KDDI: Recently, there are several events that have contributed to short-term successes. There is also the question of which events will be decisive for the success of the next quarters.

2.1Cooperation with SpaceX: In order to prevent "blind spots" in telecommunications, the Japanese telecommunications company has teamed up with SpaceX. With its help, network coverage is to be ensured even in remote mountainous or island regions and in the event of natural disasters. SpaceX's Starlink satellites began operating in December 2022. Outside of that, KDDI has partnerships with the following streaming service providers: Netflix, Apple Music, Youtube Premium, DAZN, Amazon Prime and others.

2.2Development of 5G: One of the largest telecom outages in the company's history last July only briefly affected KDDI's share price to the tune of about 4 percent. The company subsequently insured deep controls to increase the resilience of its telecom network.

In its medium-term strategy, KDDI has called out growth in so-called "focus areas" around its traditional telecommunications business thanks to the 5G rollout . These include the following areas:

- Digital Transformation (DX)

- Finance

- Energy

- Life Transformation (LX)

- Regional Co-Creation

3. future view from KDDI management: In the medium term, KDDI aims to achieve double-digit annual growth in the Focus Areas DX (digital transformation), Finance and Energy. Among other things, growth is to be driven by home equity lending. The loan volume is expected to grow to more than 3 trillion yen by 2025, representing a further increase of around 25 percent from the current level.

Monetary revenue contributions per user(ARPU) are expected to rise above the 2022 level (4,200yen) again in 2025. Of the operating cash flow, slightly less than half is to be invested in growth with a focus on 5G, "focus areas" and strategic acquisitions. At least 40 percent will be distributed in the form of dividends. Any remaining surplus capital will be used flexibly for share buybacks, depending on new growth opportunities.

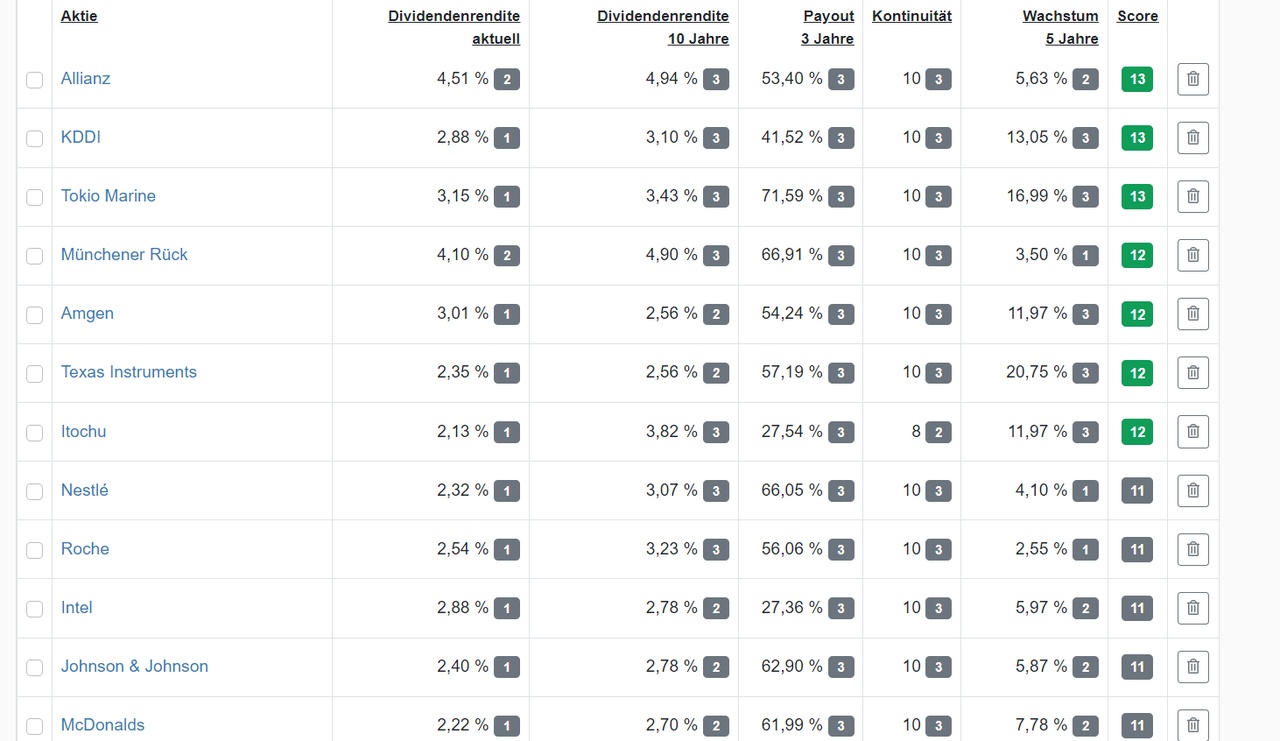

4.How attractive does the dividend appear: The dividend 5-year average value of the share is 3.4%. This is comparable to the current dividend yield of about 3.3%, indicating a fair valuation. Measured against the 10-year corridor, however, the current dividend yield is just at the upper end, which could indicate an attractive entry opportunity for dividend investors.

5.Is the KDDI share favorably valued: The average adjusted P/E ratio over the past 10 years is around 12.5.Initially, KDDI stock seems to be fairly valued with a current P/E ratio of 13.1%. After a short look at the share price, it becomes clear that this is also true and that the KDDI share is currently even slightly undervalued. At the current cheap purchase price, one can expect an annual return of 9.6% p.a. in the medium term.

6.conclusion: Balance sheet, profit development, shareholder return, market share - The figures for KDDI embody stability, as does the price performance compared to the overall market. Based on the dividends and the share price performance, one can certainly assume a fair value for the stock. KDDI sees its 5G network at the center of numerous future topics. Thanks to "focus areas" around "5G and beyond", the group wants to be involved in these, from Internet of Things (IoT) to artificial intelligence for business customers. Another area to watch is the fast-growing financial services business, within which KDDI also acts as a bank. I expect further upswing in the telecom sector and see high share price and dividend potential in the future.

PS: I somehow couldn't add any pictures, but I hope it helped you and was somewhat readable.

Sources:

https://aktienfinder.net/blog/kddi-investor-update-5g-ausbau-mit-spacex-neues-allzeithoch-im-visier/

https://www.finanzen.net/aktien/kddi-aktie

https://www.onvista.de/aktien/KDDI-CORP-Aktie-JP3496400007

https://ch.marketscreener.com/kurs/aktie/KDDI-CORPORATION-6492137/