Hello everyone,

I would like to hear your opinions. Of course there's a lot on the Internet, but I would be more than happy to have an exchange here in the community.

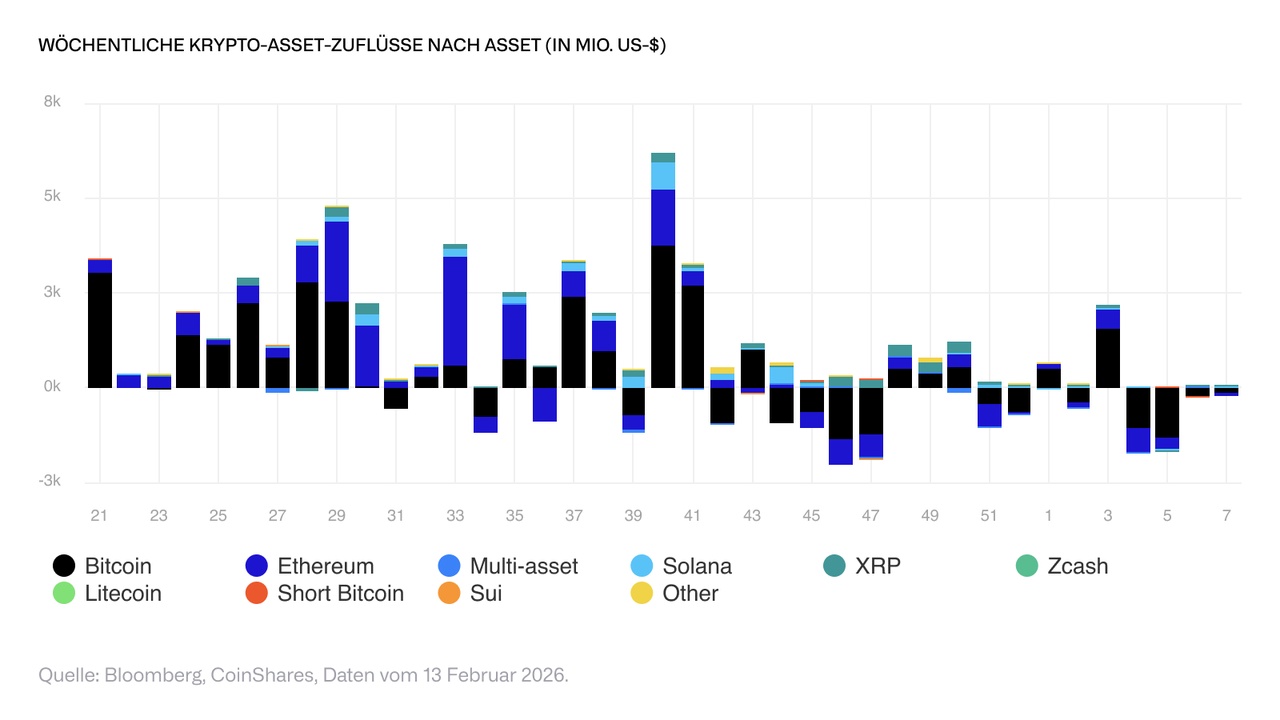

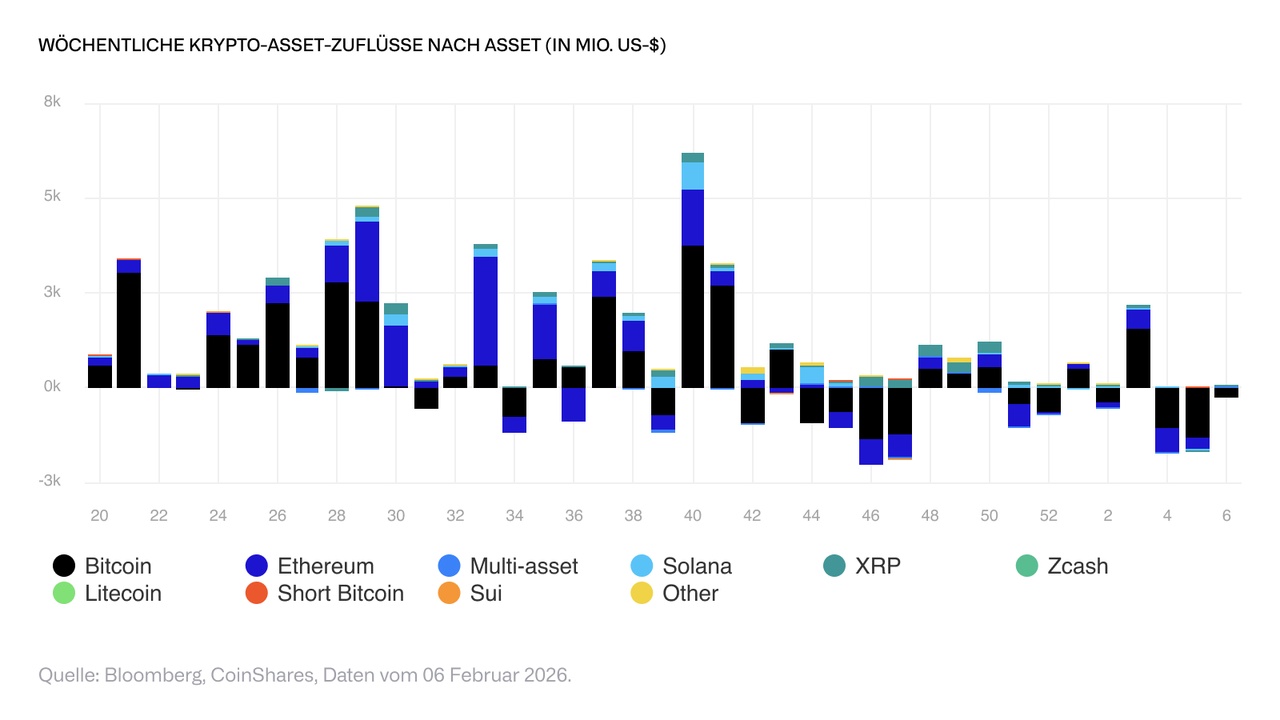

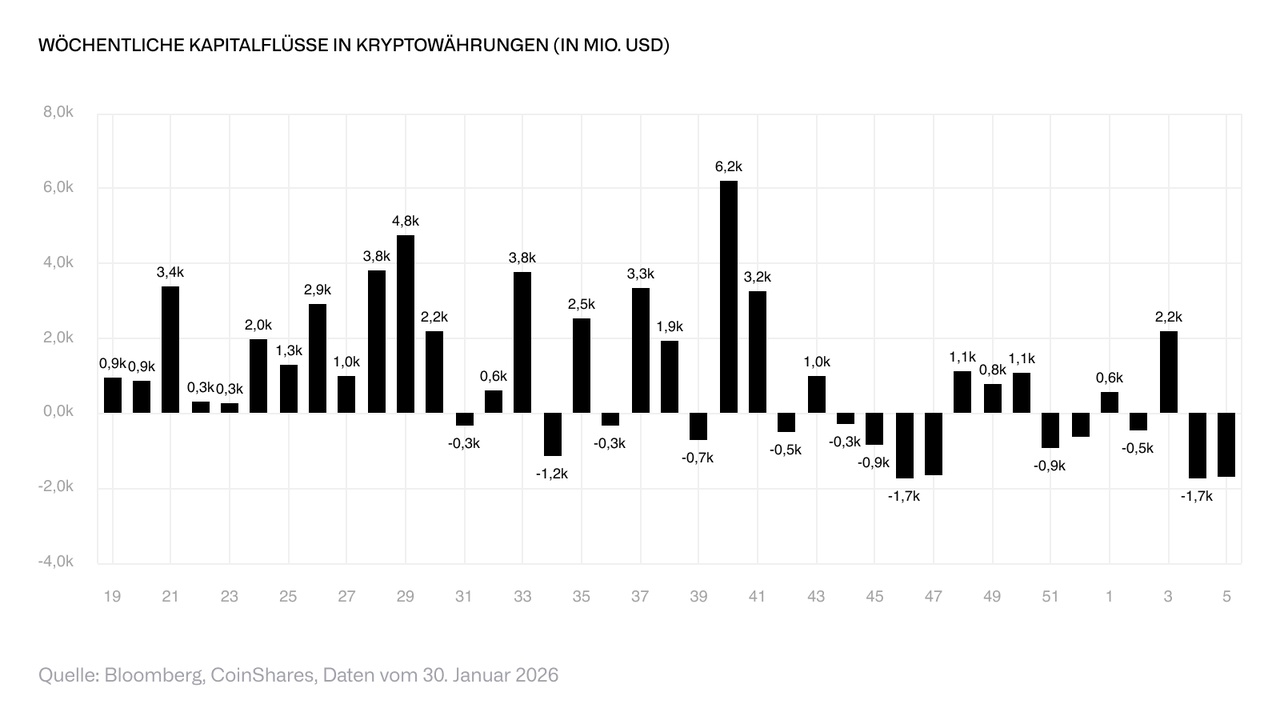

What are your current thoughts on the chewing of $BTC (-0.1%) or perhaps $ETH (-0.03%) .

The price has halved in the last few months.

What do you think about the other coins like $SOL (+1.11%) , $ADA (+1.25%) or also $XRP (+0.49%)

Looking forward to your opinions.