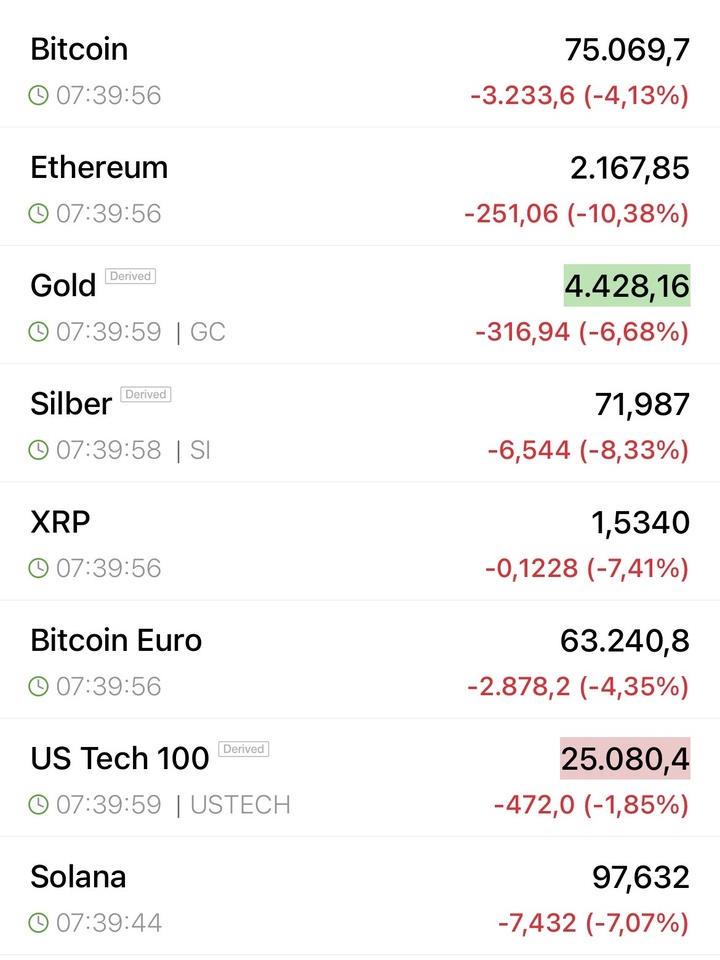

A short confession from me: I'm 19 and this year I've burned around €500, which was actually intended for my MacBook (within 1 1/2 weeks), mainly through long and short positions ($ASML (+4.35%) short, $PHAG (+3.87%) short , and $MSFT (-0.07%) ) with aggressive leverage.

It was instructive, but also painful.

Conclusion for me: That's it for leveraged products for now. Too much emotion, too little experience and you end up paying the price. I realized that the quick in-and-out is not for me - at least not at my age and with my capital and little experience.

I've also learned something:

If you just buy what's on the forum, you have to expect exactly that.

Nobody here is responsible for my decisions, everyone is responsible for their own investments.

I'll file this away as an experience, learn from it and focus on calmer strategies in future (or nothing at all for the time being).

Perhaps this post will help one or two people who think that leverage is the fast track to success.