Hello my dears,

September is over.

That's why I'd like to give you a little overview of the month.

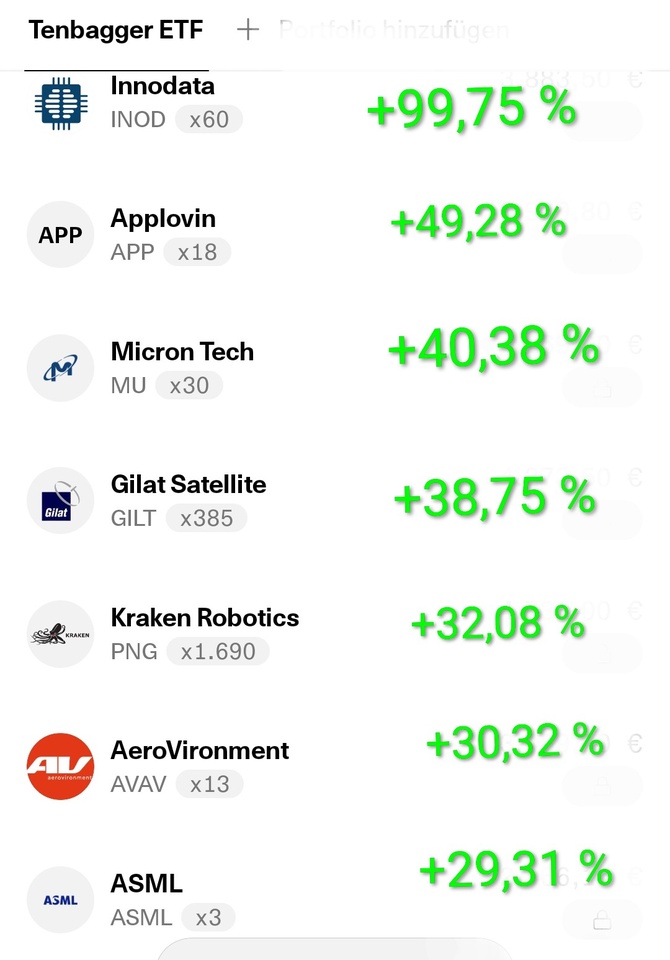

Tops: 📉

$INOD (-0,68%)

$APP (-1,53%)

$MU (-5,88%)

$GILT (-3,47%)

$PNG (-4,95%)

$AVAV (+5,64%)

$ASML (-5,28%)

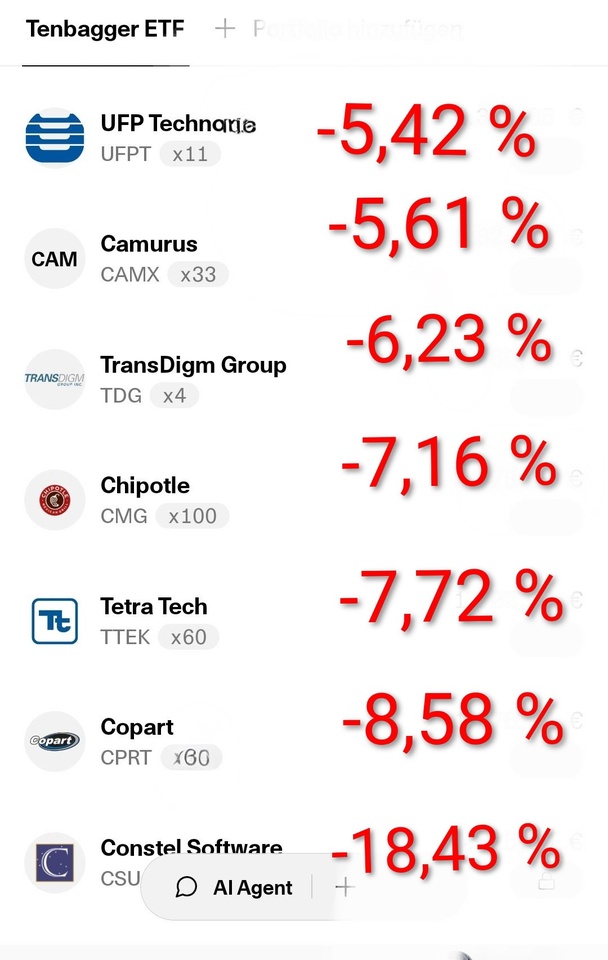

Flops: 📈

$UFPT (-0,06%)

$CAMX (+0,24%)

$TDG (-0,13%)

$CMG (-4,73%)

$TTEK (-3,22%)

$CPRT (-1,53%)

$CSU (+6,34%)

It was noticeable in September that there were a lot of long runners and compounders among the flops. For this reason, I am relaxed for the time being and will stick to the values.

📉

My overall portfolio closed the month up 8.64 %.

$EQQQ (-1,56%) NASDAQ 100. +4.81 %

$IWDA (-1,16%) MSCI World. +2,62 %