$CAMX (+2,99%)

Hello folks,

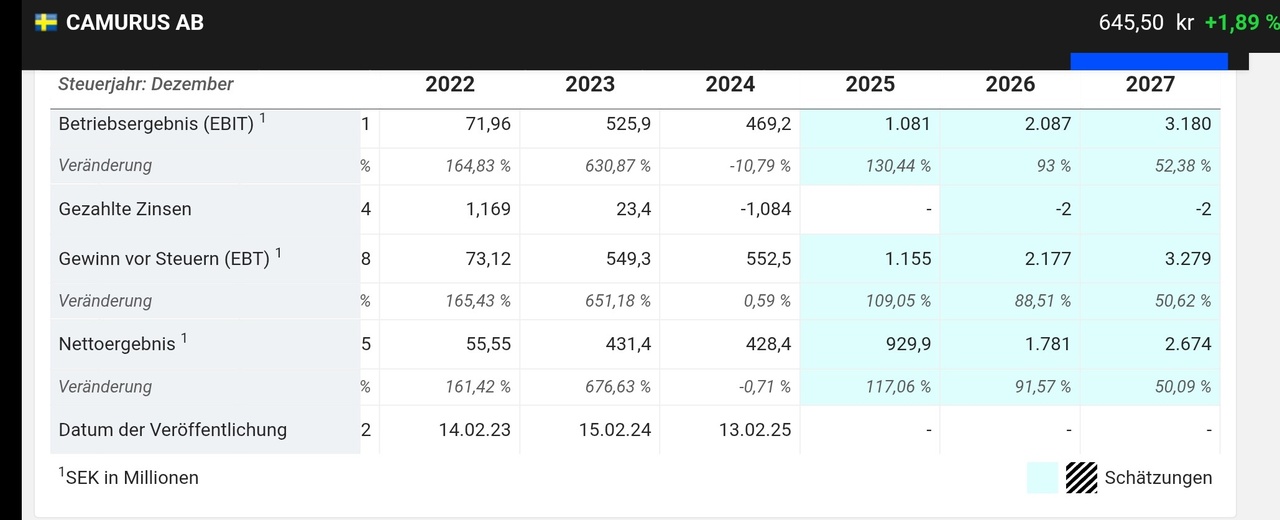

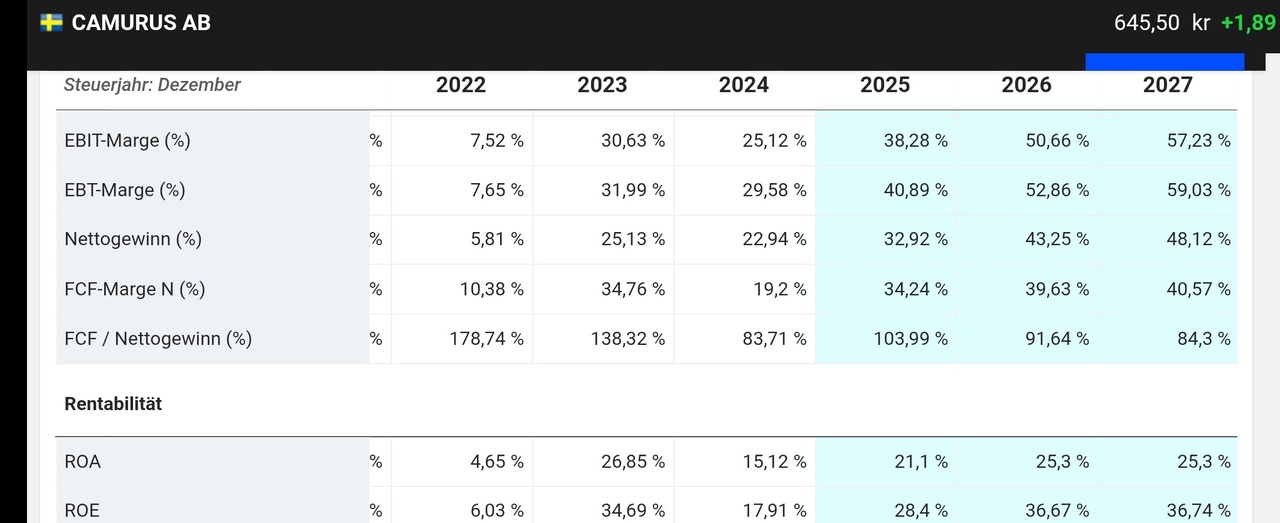

I've already introduced you to Camurus several times, so I won't write too much more about it today.

Why am I introducing the company to you again anyway?

Because the share fits well into my new category

"Points kings" category.

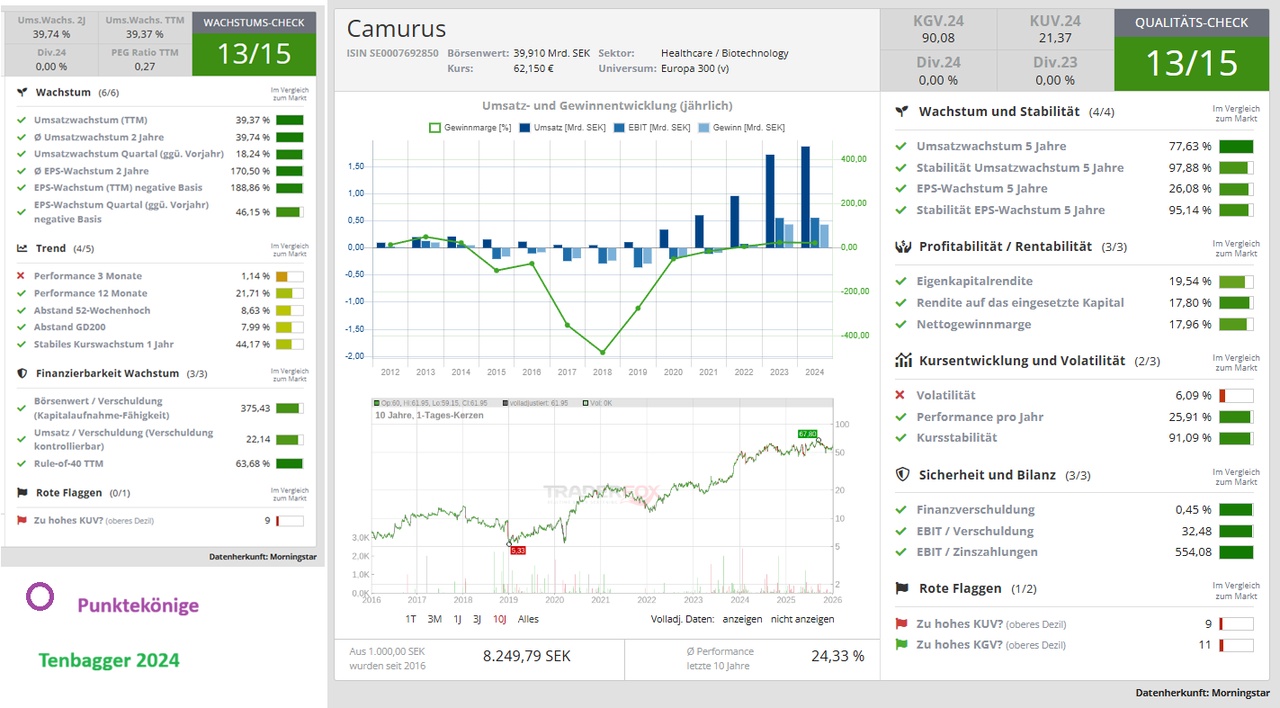

This can be seen in the Traderfox quality and growth check below.

Which most of my readers will already be familiar with.

Why am I reminding you of this share again today?

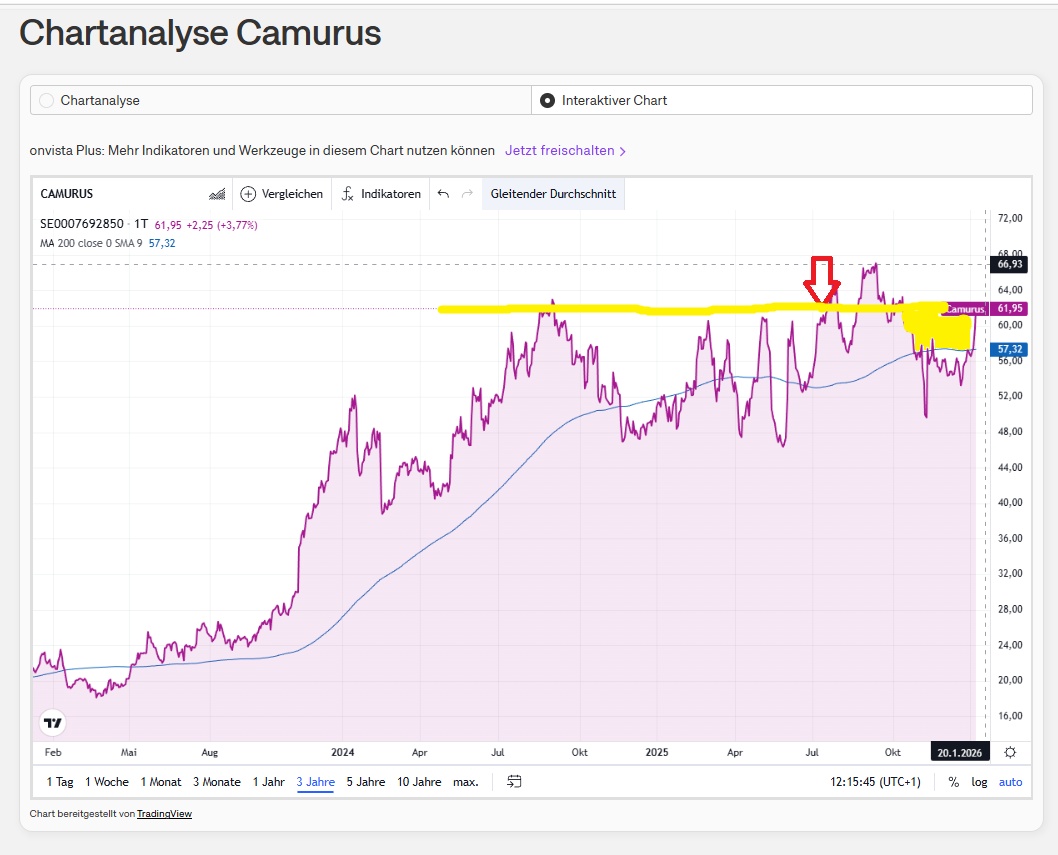

When I bought the share 5 months ago (see red arrow), I assumed that it would break out of the longer sideways movement. I like the fundamentals of the company (see post below from 5 months ago).

But the time for the biotech sector had not yet come. As a result, I first went into negative territory with the share and thus had a good opportunity to buy more.

However, we have seen a sector rotation over the last few days. With good momentum for biotech stocks. Which we can also observe with Camurus (yellow area).

Ladies and gentlemen, could the share be of interest to you now?

@Multibagger

@Dividendenopi

@TomTurboInvest

@All-in-or-nothing

@TradingHase

@Klein-Anleger and everyone else.

📈 1. trend analysis (short / medium / long)

(purely based on price, daily range, 52-week range and price level)

🔹 Short-term trend (days to a few weeks)

- Strong daily increase: +3,77 %

- Closing price near daily high: 61.95 vs. 62.25

- Intraday range shows clear buyer dominance.

→ Short-term trend: clearly upward (bullish).

🔹 Medium-term trend (weeks to months)

- Price is well above the middle of the 52-week range (41.10 - 67.90)

- Current share price: 61,95i.e. in the upper third.

- No indications of a trend break in the visible data range.

→ Medium-term trend: stable upward trend.

🔹 Long-term trend (months to 1 year)

- 52-week low: 41,10

- 52-week high: 67,90

- Current price close to high.

→ Long-term trend: clearly positive, structurally bullish.

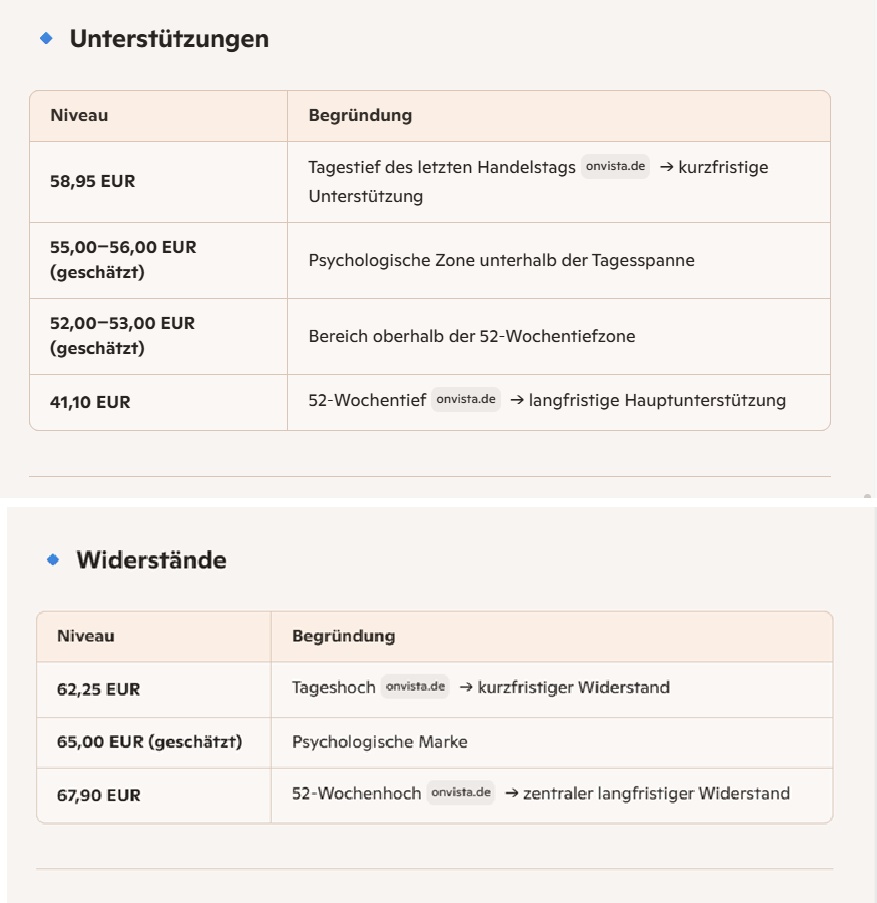

🧱 2. supports & resistances

(derived from daily range, 52-week range and price levels)

🔮 3. scenario model (bullish / neutral / bearish)

(derived purely from chart data and trend situation)

🟢 Bullish scenario

Trigger: Break above EUR 62.25 Targets:

- EUR 65.00

- 67.90 EUR (52-week high)

- A new high would be possible above this (trend continuation)

Probability: High, as all trends are bullish.

⚪ Neutral scenario

Trigger: Setback to the EUR 58.95 - 56.00 zone Behavior:

- Sideways phase

- Consolidation after strong rise

- Buyers only appear again at EUR 56-59

Probability: Medium.

🔴 Bearish scenario

Trigger: Break below EUR 55 Consequences:

- Acceleration towards EUR 52-53

- Further pressure: Test of the 52-week low (EUR 41.10)

Probability: Low, as trend structure is clearly positive.

🎯 Conclusion

Camurus shows in the Onvista chart a clean bullish overall picture:

- Short-, medium- and long-term uptrend

- Buyer dominance in the course of the day

- Price in the upper part of the annual range

- Clear upward resistance, but no structural weaknesses visible

🔮 5. what does this mean for you as an investor?

🟢 Bullish

- The price is moving in the upper channel area in all time frames

- This speaks for trend strength and further potential

⚪ Neutral

- A setback to the zone 58-59 EUR would be completely normal

- This is where the lower short-term edge of the channel

🔴 Bearish

- Only below 55 EUR the long-term channel would be violated

- That would be a structural warning signal

Chart analysis created via Copilot, the rest was created without AI.