Hello my dears, @Klein-Anleger1

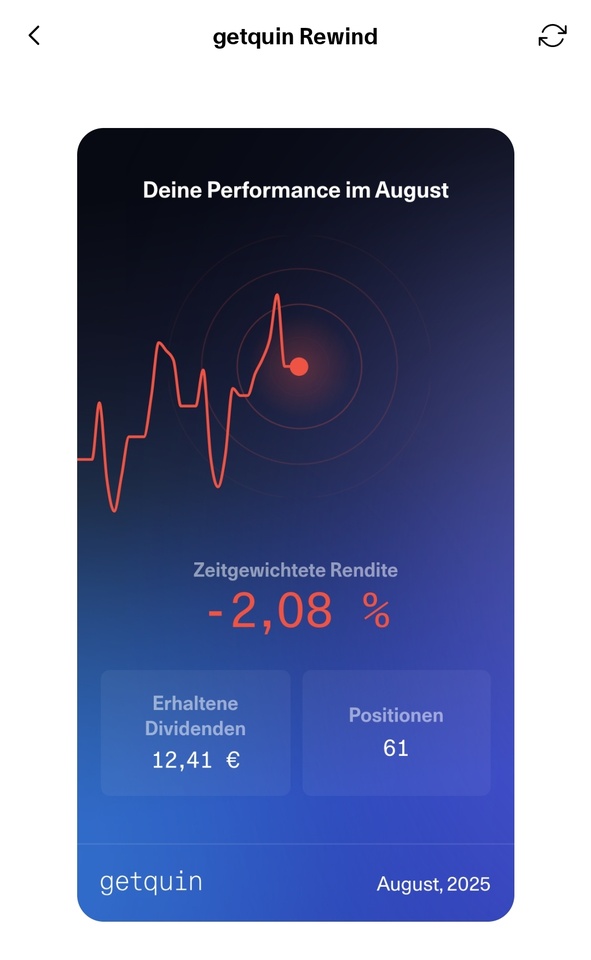

after the great performance in the previous months

August was unfortunately not so successful.

But September is going well again so far. And so I am YTD with + 5.04 % better than the

NASDAQ 100 + 0.16% World+ 1.14 %.

Reasons for the underperformance in August are earnings at my large position GFT and negative news at Defi Technologie.

The tariffs weighed on Embraer, and the correction in defense weighed on Kitron and AeroVironment.

Vertex's earnings were also the fly in the ointment.

Negative position: (month of August)

Defi Technology - 25.61%. $DEFI (+1,72%)

Innodata - 23.64%. $INOD (+2,41%)

Tokyo Electron - 20.95%. $8035 (+0,97%)

Vertex. - 16,38% $VRTX (+7,9%)

Aixtron. -15,53%. $AIXA (+2,52%)

Transdigm. -15,13%. $TDG (-1,44%)

Vertiv. -14,72%. $VRT (+8,96%)

Coinbase. -13,01%. $COIN (+1,32%)

AeroVironment. -11,91%. $AVAV (-2,23%)

Kitron. -7,79%. $KIT (-2,18%)

Microsoft. -7,64%. $MSFT (-0,07%)

Embraer. -4,75%. $ERJ (+4,14%)

Nvidia. -4,33%. $NVDA (+2,01%)

GFT Technology -3.67%. $GFT (+3,66%)

With so many negative positions, I am glad that I got off lightly due to my positive positions.

Plus positions: (month of August)

Gilat Satellite. +22,14%. $GILT (+7,91%)

Applovin. +18,69%. $APP (+3,2%)

NU Holdings +17.88%. $NU (-0,55%)

SoFi. +12,24%. $SOFI (-1,29%)

Alphabet. +8,95%. $GOOGL (+2,31%)

Fortescue. +8,90%. $FSUGY (+0,85%)