As some of you may have noticed, things have become a little quieter around me and my constant news flow, or rather, for certain reasons, I have stopped writing for the time being.

There are several reasons for this...

...on the one hand, I received a "nice" email from Getquin itself, on the other hand, my training, which was previously interrupted due to an urgent operation, will finally continue in April and the last IHK final exam (accounting specialist) in the field of tax law is coming up after a short time, so you have to sit on all 5s and do something about it.

After that, the certifications from DATEV itself, i.e. "DATEV accounting/DATEV payroll accounting", are still on the agenda and so I'm busy cramming, learning and implementing until the end of the year, in addition to everything else...but nothing comes from nothing.

I also don't really like some developments, grades, dictation and the constant reduction in services, even for premium customers, on the part of the platform operators...

...regardless of the fact that I can't really do anything with the coins I've collected so far anyway, the whole thing about the coins has gone up in smoke and mirrors...

...I don't really need overpriced caps, T-shirts and the like for coins either, I'm not a free or at my own expense free advertising medium and it doesn't help if you get an e-mail with a thank you for the arrangement and a stupid note at the same time...could have sent an appreciation or supporter package for the "arrangement" on their own initiative without a stupid hint...it's more common in the market...but no matter, the community support from Getquin is more and more like falling asleep...at some point the tingling just stops 😅

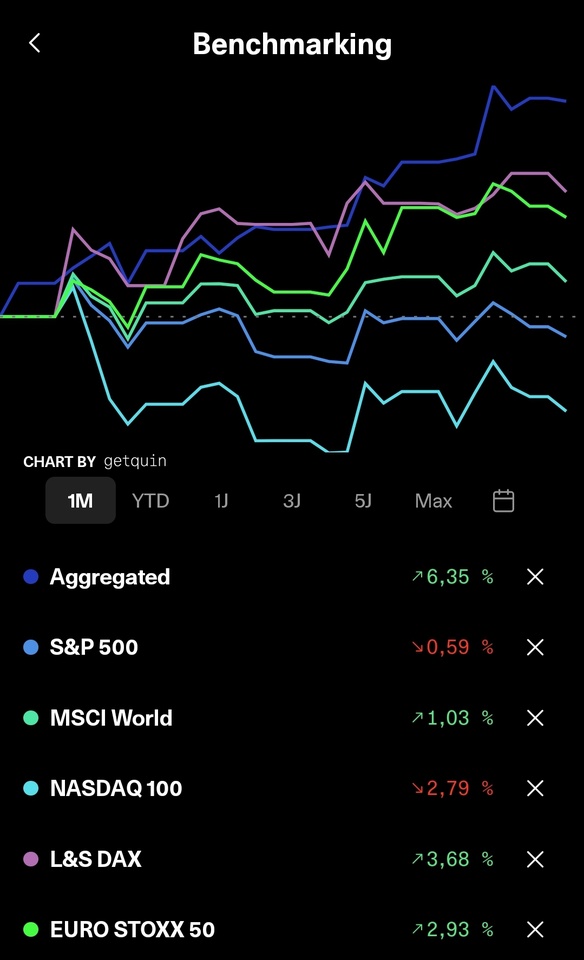

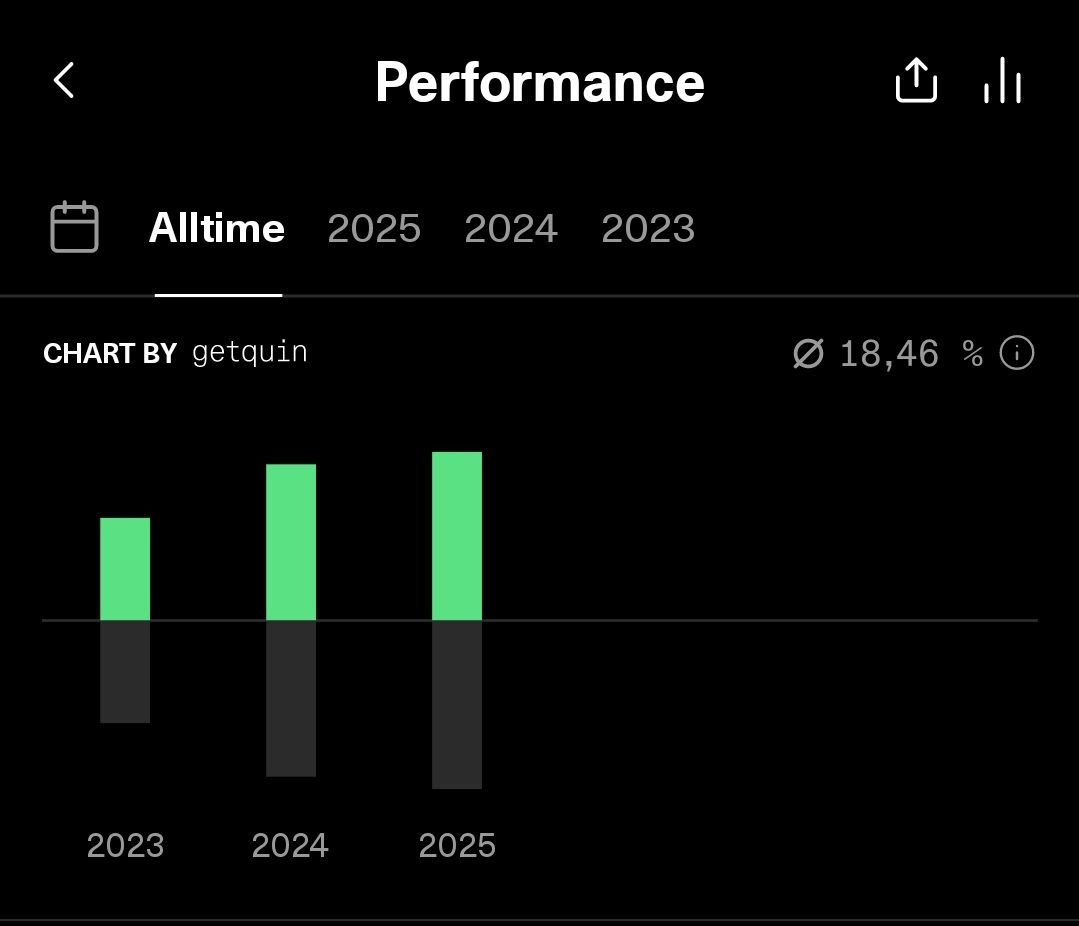

Be that as it may, February was a relatively good month this year despite all the capers...

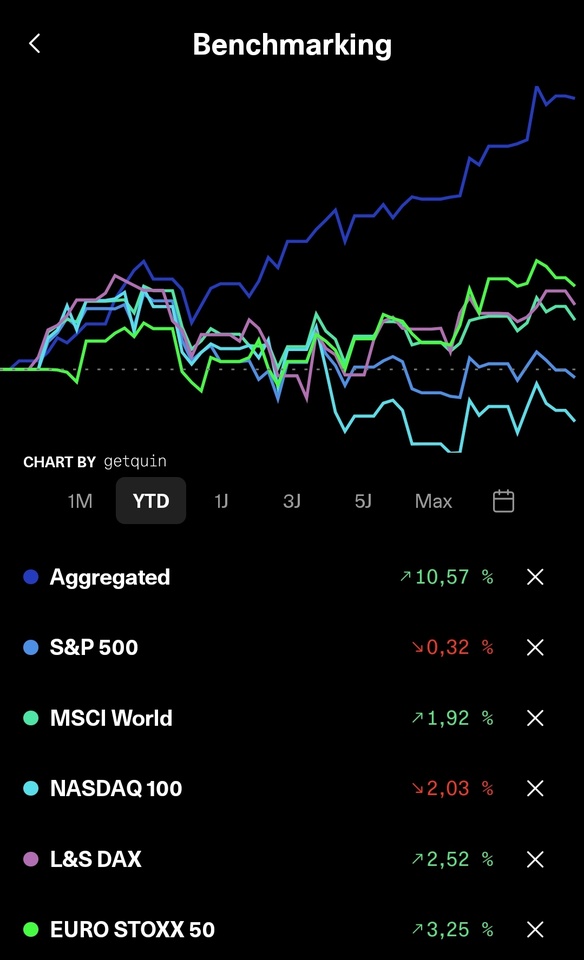

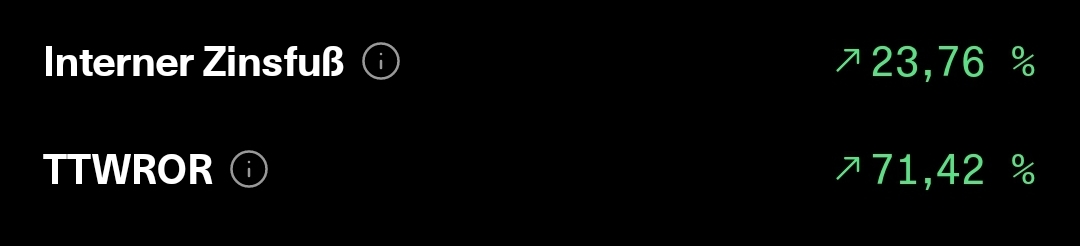

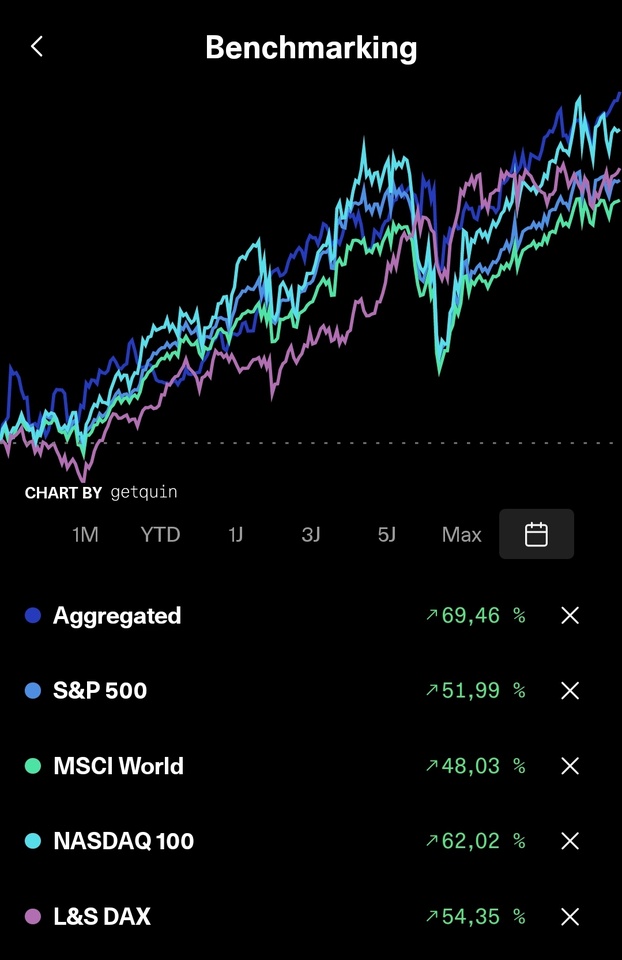

...even after tearing several small ATH's, it has positioned itself today, just below the last one 😊 ...but also in the overall view of the year...

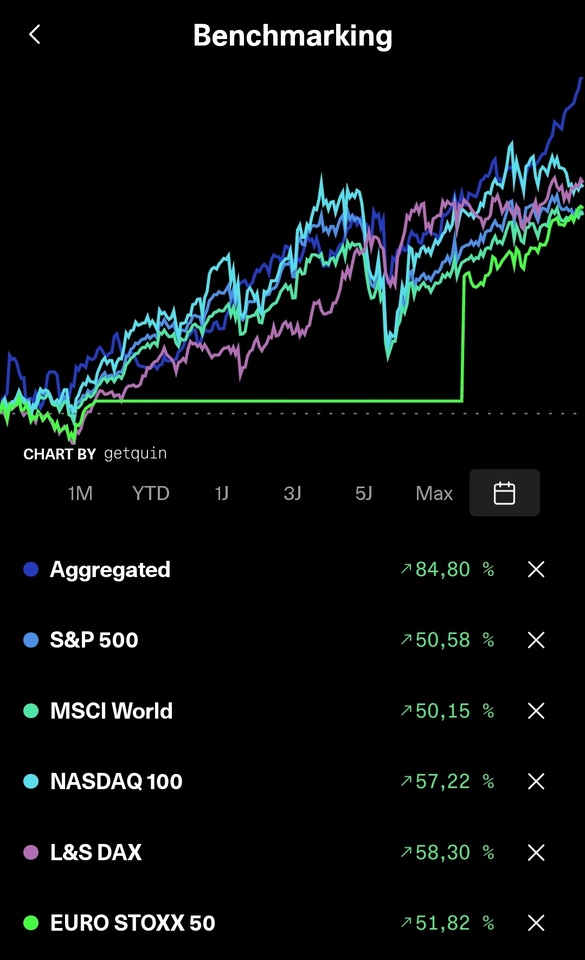

...it still looks quite good so far and even in the long term, everything is in the green 👍🏻

So now it's time to keep the ball rolling and stay true to our own strategy, which should pave the way for further growth with Orange.

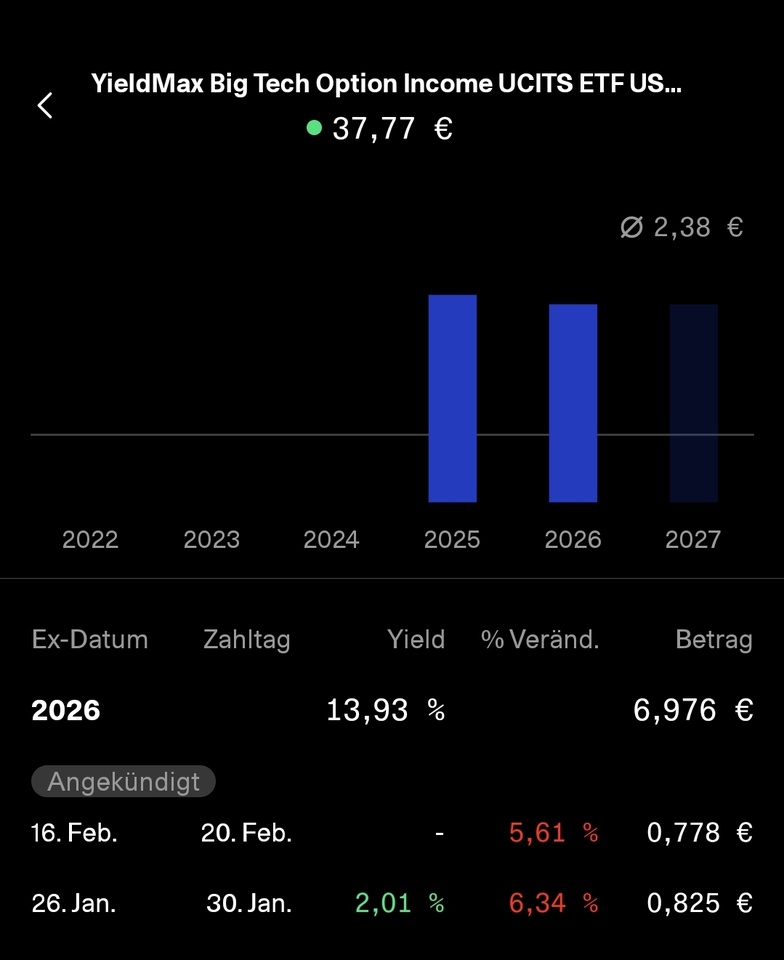

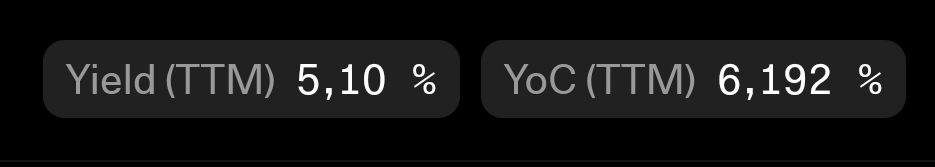

In addition to value, the focus was of course once again on my beloved dividends and so last month there were €133.34 in net dividends, which represents an increase of 38.85% in the YOY and will be further expanded over time. The good months are still to come....😊

》Top 3《

$HAUTO (+2,42%) +26,34% (+64,76%)

$DTE (-0,73%) +23,34% (+20,19%)

$VICI (-0,1%) +8,89% (+25,35%)

》Flop 3《

$ASWM (-2,95%) -8,54% (-4,05%)

$YYYY (-0,68%) -6,43% (-9,68%)

$1211 (-0,15%) -3,95% (-13,58€)

》Purchases《

$1211 (-0,15%) 10x

$PID 35x

Apart from that, there wasn't really much else worth mentioning this month...

...so in this, wishing everyone another good hand...see you soon 👋🏻