$ONDS (+7,55 %) INNNN. Let's go

Got some doubts:

Which stocks would buy in this deep phase between these ones?

Postes

38$ONDS (+7,55 %) INNNN. Let's go

Got some doubts:

Which stocks would buy in this deep phase between these ones?

Due to some partial profit-taking in the (US) tech/AI sector ($NBIS (+0 %) / $AVGO (+0,56 %) / $MPWR (+1 %) / $AMD (+0,45 %)) and OS selling ($RKLB (+4,29 %) / $AMD (+0,45 %)), the portfolio will be rebalanced and restructured. $RKLB (+4,29 %) , $LMND (+3,79 %) , $GOOG (-0,19 %) and $9988 (-0,32 %) but I'm not touching them (yet) 😀

Unfortunately, the entry prices for GQ have been completely messed up due to the recent transfer from TR to SC.

I am still undecided about the potential increase in $UBER (+1,74 %) , $NU (+2,84 %) , $ZTS (-0,99 %) and $TTD (+3,03 %) - and would be happy to hear a few opinions! I feel Nu and Uber are the most likely at the moment - although Waymo is accelerating well.

$GRAB (-0,36 %) - lower value 👀 expected

I only see wave A so far.

I expect a final breakout of wave C towards the confluence of 0.618 Fibonacci and 200-WMA.

After that, an enormous uptrend is possible.

I'll take a closer look at 3.88 dollars.

Alert is created ⏰

First pick for this year $GRAB (-0,36 %)

after I had to liquidate almost all my shares last year for personal reasons🥲 I am starting 2026 from scratch, so to speak.

In addition to building up cash, I have now also made my "first purchase" for this year.

$GRAB (-0,36 %) was part of the previous portfolio for a long time and now has $GRAB (-0,36 %) made its way back into my portfolio and is slowly being rebuilt piece by piece 😬

Doubts? Not at all!

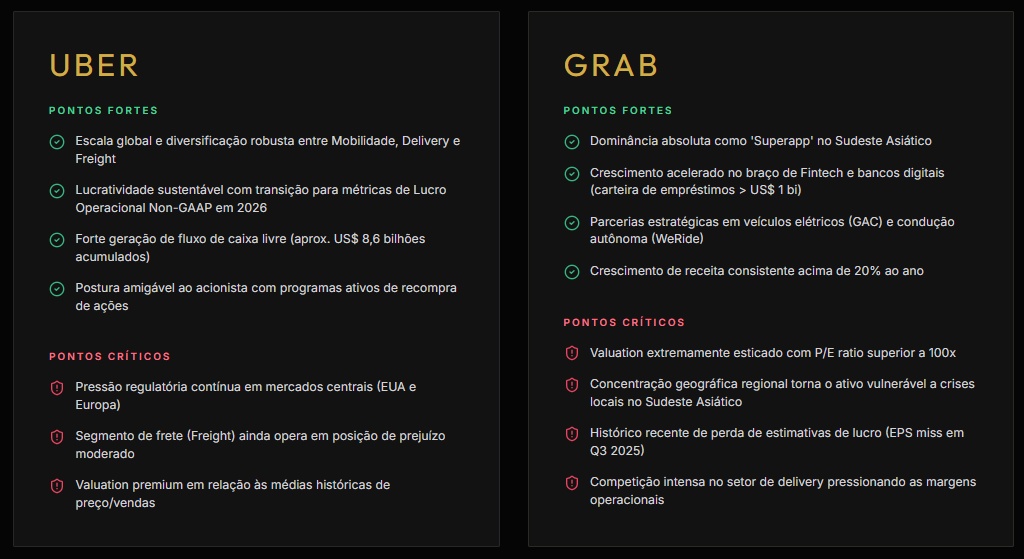

Uber ($UBER (+1,74 %) ) wins the duel by presenting a more balanced risk-return profile. While Grab trades at very high valuation multiples (P/S > 5x) and still struggles with net profit consistency, Uber has consolidated its GAAP profitability, has greater global scale and offers greater financial resilience. Uber is seen as a 'Blue Chip' of the mobility sector, while Grab remains a high-growth, high-volatility bet in emerging markets.

The case for GRAB!

A look at Grab Holdings ($GRAB (-0,36 %)

) in January 2026 is to observe one of the most interesting transformations in the post-pandemic technology sector: the transition from a "cash-burning" company to a profitable financial and logistics ecosystem.

Grab is the rare example of a local company defeating a global giant. Operating in Singapore, Malaysia, Indonesia, the Philippines, Thailand and Vietnam, Grab holds more than 50% of the delivery market and an almost monopolistic position in ride-hailing in several cities.

Grab's true value in 2026 is not just in the cars, but in the GrabFinancial.

#GRAB

Hello lovelies,

first of all: thank you very much for sharing your TR-Ref.links under my post.

I would of course like to share with you how:

How the share gift turned out for me as the referrer and the referrer.

What I will now use the TR Depot for and how it will continue (I had already briefly spoiled that it will be rather exotic there, take it literally😂).

So let's get started:

I received a whopping €30 as a gift in $DIS (-0,61 %) which I think is very reasonable for the little effort involved and the manageable minimum deposit. The referrer drawn from the comments @ZPark91 unfortunately "only" landed €10 in $MC (-3,08 %) but a gift is a gift, after all.

I probably won't use the TR Depot very actively, but since I had to make 3 purchases anyway, I simply picked out the most spaced-out stocks that my watchlists had to offer and where you can also add a savings plan with TR. Since I was almost fully invested, the amounts at the start were manageable, but savings plans also came in directly from 02.01.26.

I ended up buying €50 each for

Since $GRAB (-0,36 %) has been on my watchlist for some time anyway, I have opened a small position here and am now expanding it via a savings plan.

The $MNTN (-0,61 %) has been added solely due to the investment in Space X. Let's see what happens if there is an IPO.🤷🏼♂️

On $AAF (+2,49 %) I became aware of it through dear @Epi (what, how does that work? 🤔😂). Under a post by @HenningtonGlobal on the subject of dollar devaluation, he raised the topic of EM and the $AFK (-1,11 %) and $ILF (+0,7 %) linked. I then did a search for myself $AFK (-1,11 %) I filtered for exciting companies that suited me and to be honest $AAF (+2,49 %) was almost the only one where I found the chart appealing.🤷🏼♂️

What happens next?

The 3 positions are now running monthly in the savings plan until further notice. I'll take a closer look at TR, as long as the fee structure there remains the same, the 3 stocks, plus my donated $DIS (-0,61 %) fragments may remain there. For the time being, I will probably not make any major purchases of the stocks that are now there, as the spreads are already very wide in some cases, despite the fact that the domestic stock exchanges are open.

However, I will probably use the share gift campaign to give my wife a portfolio there, so we'll see what other gifts are added.

Today there will be a short post about my last BOTH "real" purchases this year, so stay tuned.😉

Growth, cash, and a booming market

I’ve been looking closely at two of Southeast Asia’s fastest-growing tech champions: Sea and Grab. Both dominate their respective ecosystems, both are profitable or on the verge of it, and both hold strong cash positions. But as much as I like the growth stories, the valuations tell a slightly different story. These are fair businesses right now, not necessarily cheap, also not expensive, just balanced on the edge between quality and risk.

Starting with Sea, the e-commerce and digital powerhouse behind Shopee, Garena, and SeaMoney. Estimates suggest top-line growth between 20–30% for the next three years, driven by Shopee’s expansion, rising monetization, and a rapid fintech ramp-up through SeaMoney. Garena, once the group’s profit engine, is stabilizing and still provides useful cash flow. Sea holds over $8 billion in cash, which gives it breathing room and flexibility. Free cash flow is growing in the mid-double digits, and the FCF yield of roughly 3–4% looks set to expand quickly if growth stays consistent. The business is scaling beautifully, but I can’t call it cheap. At these levels, execution needs to remain flawless to justify the current multiple. In the past, growth has been suppressed and pretty much flat; now it’s reaccelerating, but everything has to go well. That’s why I believe the stock isn’t a bargain right now. However, the story might change at 10–20% cheaper.

Then there’s Grab, Southeast Asia’s well-known “superapp.” Mobility, deliveries, and financial services are all doing pretty well. The company is what you get when you put Uber and Amazon together, then place it somewhere in Asia. Revenue is growing about 20% year over year, the company has close to $5 billion in cash, and free cash flow has turned positive with improving margins. On paper, it’s a very similar story to Sea: high growth, expanding profitability, and an FCF yield around 3%. The difference is that Grab feels very similar, but less compelling based on financials, even though the story is exciting.

Sea offers more upside thanks to its successful multi-segment business model and faster scaling, outperforming Grab mainly on valuation and financials. Both are fairly valued, not screaming buys, but still worth watching for those occasional deep pullbacks that are common in EM growth names. Just consider that Grab already traded around $3.60, and it can move very fast in those regions.

I’m keeping both on my radar. The fundamentals are very interesting, with strong balance sheets, clear growth, and rapidly improving cash flows, but I’d rather wait for the market to give me a better entry. Growth is fantastic, yes, but fair is not cheap, and patience could be key here.

To all $GRAB (-0,36 %) holders out there, how have you been reacting to recent volatility?

The stock recently saw tremendous upside, are you selling right now or expecting it to go even higher?

I’m also curious to see what you think of an investment in $GRAB (-0,36 %) for the long term, like 10+ years

Subscribe to the podcast so that Jusos fail.

00:00:00 Beware of private equity at Trade Republic

00:12:00 Private equity shares

Blackstone A2PM4W

Apollo Global Management A3DB5F

EQT A2PQ7G

CVC Capital Partners A40B55

KKR A2LQV6 (+315% in 5 years)

BXPE - Fund

00:47:30 Duolingo A3CWBB

01:20:00 Grab, Uber & Tesla

01:39:29 AMD, Intel & Nvidia

01:53:00 Podcast ban by Jusos

Spotify

https://open.spotify.com/episode/1NOvAmyAvSABmECZ0ZLQ5i?si=9AvXWSulRg2Tv4yNnLVBug

YouTube

Apple Podcast

$BX (+3,1 %)

$NVDA (+3,71 %)

$INTC (+1,07 %)

$AMD (+0,45 %)

$GRAB (-0,36 %)

$UBER (+1,74 %)

$APO (+2,78 %)

#traderepublic

#privateequity

#fonds

#etfs

#podcast

Meilleurs créateurs cette semaine