Portfolio feedback

Hey guys,

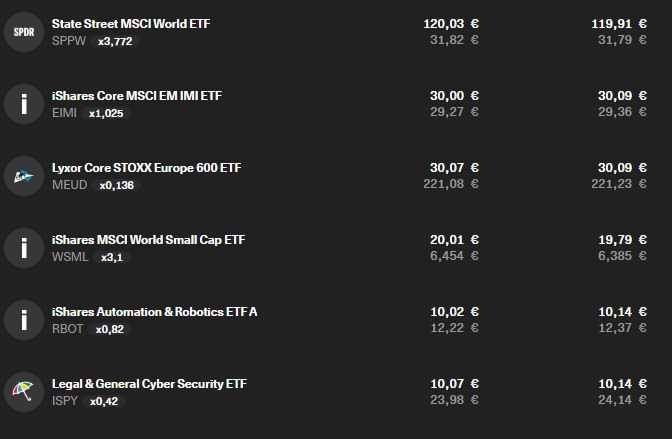

I've been working intensively with ETFs over the last week and wanted to start my first portfolio (I'm 19 in Austria) and would like to get your opinion on it.

My idea was a portfolio with high diversification and a sector bet on AI & Cyber Security, but I'm not sure if I shouldn't keep everything simple and combine some ETFs with an All World ETF $VWCE (+0,76 %) + only one sector bet to keep the TER low.

e.g. like this: $VWCE 75% $ISPY 10% $MEUD 10% $WSML 5% opinion?

I am very convinced of the tech sector, but with the current bull market in $NVDA (+1 %) and Co I feel tempted to wait and see.

I am also undecided whether I should buy all ETFs accumulating or distributing to save taxes.

I would be happy about optimization suggestions to simply create a perfect portfolio according to my idea.