Reading time: approx. 6 minutes

Many market movements only seem irrational because they are taken out of context. In retrospect, they usually follow a clear logic. Markets do not develop in a linear fashion, but in phases. These phases do not arise by chance, but from the interplay of expectations, capital flows and psychology. This is precisely where the phase model comes in, which has already been implicit in the previous articles and is now being consciously elaborated.

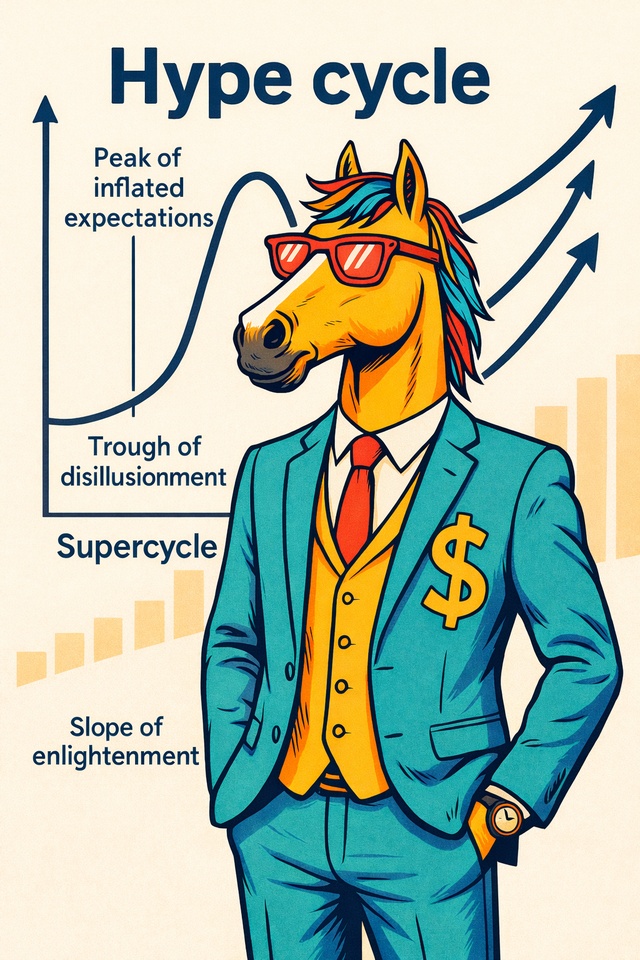

It is worth naming this model explicitly for the sake of classification. Markets typically move through four states:

Build-up phase: Fundamentals improve without prices reacting to this. Expectations are low, skepticism dominates.

Acceleration phase: figures, expectations and capital flows begin to work in the same direction. Price rises become more stable and more broadly based.

Euphoria phase: valuations rise faster than operational progress. Narratives gain weight over hard figures.

Top: Expectations are so high that even good news loses its impact and disappointments have a disproportionate effect.

This sequence is not a rigid pattern, but a robust orientation framework for better categorizing market reactions.

The underlying mechanism is simple. Markets do not react to absolute developments, but to changes relative to what is already expected. As soon as this expectation framework shifts, the price logic also changes, even if the facts remain objectively positive. This is precisely the reason for the patterns that can be observed time and again over the years and across markets.

At the beginning of a cycle, there are often initial fundamental improvements that receive little attention. Cost structures stabilize, excess supply is reduced and cash flows become more predictable. At the same time, sentiment is still strongly influenced by the past. Capital remains cautious, narratives defensive, prices barely react or continue to fall. This phase requires patience and conviction because it provides little confirmation. This is precisely why it is difficult to endure, although this is where the most asymmetrical opportunities arise.

As confirmation increases, the market begins to rethink. Fundamental progress is taken seriously, capital flows back, price rises become more stable. Setbacks lose their terror, trends become established. In this phase, value is created primarily through real improvements. Valuations are often not yet ambitious, although prices have already risen significantly. For many investors, this market phase feels the most rational because fundamentals and price performance are in harmony.

Later, the focus shifts. When a topic is widely accepted, narratives come to the fore. Growth is considered further, risks lose weight, valuation benchmarks are stretched. Price gains are increasingly generated through higher multiples rather than operational progress. This phase feels easy because successes are quickly confirmed. At the same time, the risk increases as expectations leave hardly any buffer.

The actual top is rarely a single moment. It is a state in which expectations are so high that even good news loses its impact. Price reactions become more erratic, volatility increases and small disappointments are punished harshly. Fundamentally, a lot can still be right, but the market demands more than can realistically be delivered. Anyone relying solely on the story here is confusing tailwinds with substance.

This phase model is not an instrument for precise timing. Its value lies in its classification. It helps you to adjust your own expectations to the current market logic and avoid typical mistakes, such as becoming euphoric too late or avoiding early phases out of impatience.

Just how tangible this model is can be seen particularly clearly in the uranium market.

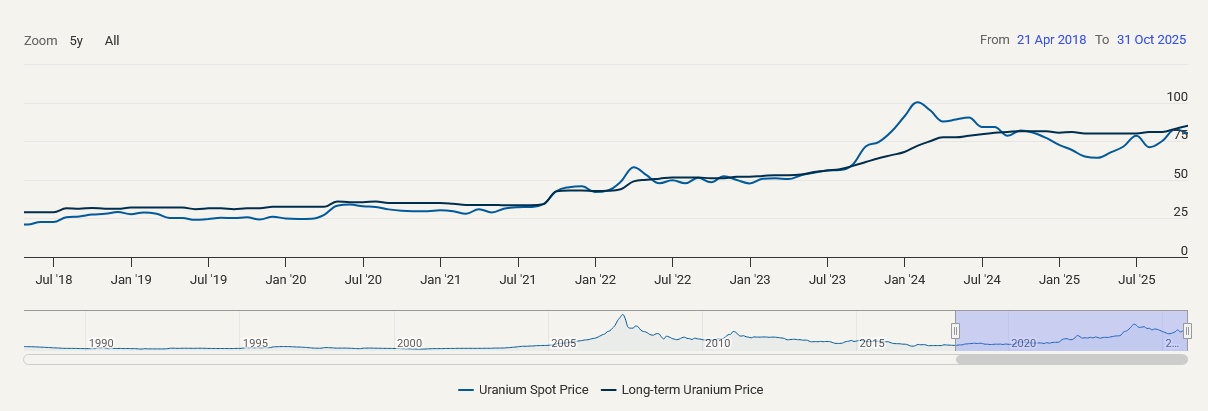

After the Fukushima accident, uranium was a market without an audience for years. Prices were below production costs, mines were shut down and investments were frozen. At the same time, the supply side gradually began to tighten. Projects were postponed or abandoned, capacities disappeared permanently. Fundamental improvements were available, but were ignored. The market was still mentally trapped in the old picture.

During this phase, producers and developers improved their structures. Companies such as $CCO (+0,52 %) (Cameco) reduced costs and secured long-term purchase agreements. Developers such as $NXE (-0,3 %) (NexGen Energy) positioned projects for a future supply deficit. Nevertheless, prices hardly reacted. Setbacks dominated, positive news fizzled out. This is typical of early market phases in which facts run ahead of perception.

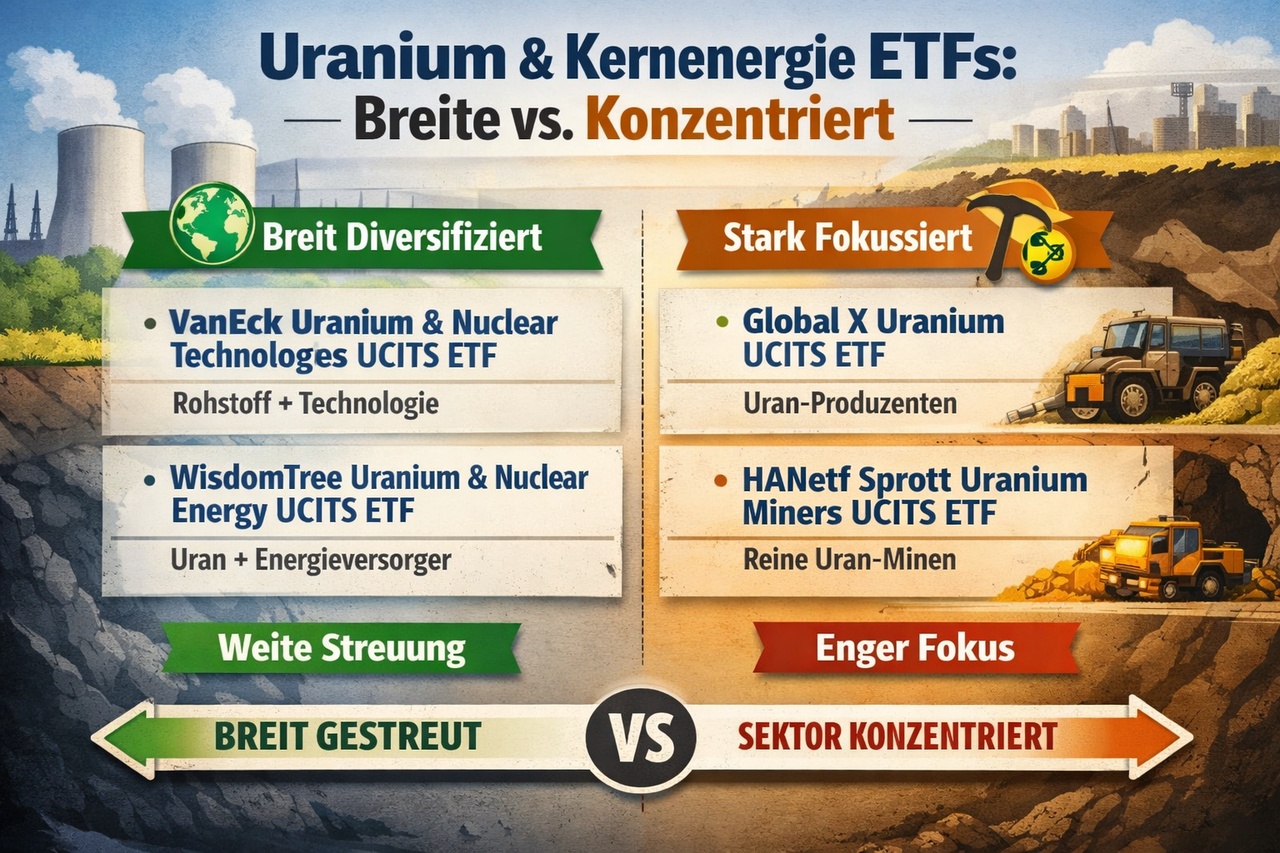

The picture changed with the reassessment of energy policy. Rising demand for electricity, geopolitical risks and the return of nuclear energy as a base load led the market to reconsider its assumptions. Uranium prices rose, projects became financeable again and capital returned. Price rises during this phase were mainly driven by fundamentals. Stocks such as $DML (-0,64 %) (Denison Mines) or $PDN (-4,85 %) (Paladin Energy) did not benefit from euphoria, but from a real shift in supply and demand.

In my opinion, the uranium market is currently still in the acceleration phase, albeit at an advanced stage. The central structural drivers are real and continue to be effective, and many price movements can still be explained fundamentally. At the same time, the key arguments are well known and increasingly priced in. Setbacks are still being bought, but more selectively, and the spread between qualitatively strong producers and purely narrative stocks is widening. This pattern argues against pronounced euphoria, but clearly shows that the risk/reward ratio has shifted compared to the early phases.

The uranium example illustrates why market phases are practically relevant. The same asset can be fundamentally convincing and yet represent a completely different investment depending on the phase. Those who ignore market phases often misinterpret price reactions. Those who classify them act more calmly and with more realistic expectations.

The next step is no longer about individual market phases within a stable framework, but about the moment when this framework itself tips. After all, not only markets but also strategies move in cycles. Phases in which growth dominates alternate with periods in which value or substance is in demand. Small and large caps, risk-on and risk-off also rotate. These changes rarely occur by chance, but usually follow changes in interest rates, liquidity and political intervention. Those who recognize them understand why previously successful approaches suddenly no longer work - and why the biggest misjudgments arise at precisely these points.