$UUUU (+0,7 %) reported for Q3 25 EPS of -$0.07 (Est. -$0.05) ❌

Revenue on the other hand increased by +337.3% YoY ($17.71M) and beat expectations by $7.92M ✅

Guidance 2026:

$UUUU (+0,7 %) Expects to sell approximately 620,000 to 880,000 pounds of Uranium Oxide U3O8 under its long-term contracts in 2026. It also reserves the right to sell additional uranium on the spot market if deemed appropriate.

Energy Fuels expects the uranium price to level off in Q4-25 and FY-26 and not increase further.

Highlights:

- Robust Balance Sheet with Nearly $300 million of Liquidity

- Completion of Upsized $700 Million Convertible Senior Notes Offering Post-Quarter

- Over $15 Million of Additional Liquidity from Market Value of Finished Inventory

- Reduced Net Loss of $16.7 Million Compared to Q2 2025

- Well-Stocked to Capture Market Opportunities and to Meet Long-term Contract Obligations

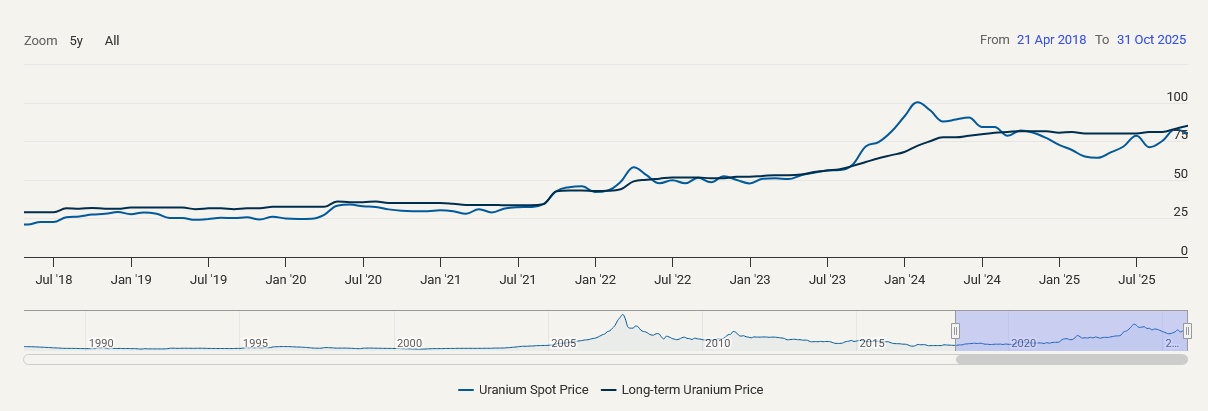

The long-term uranium price continues to creep slowly upwards, was also briefly reached by the spot price, but this has bounced off and is heading downwards for the time being.

At the moment it looks as if companies in the commodity/uranium sector are suffering somewhat due to weaker prospects and the selling off of strong profits.

$BWXT (+0,68 %) Despite strong figures and a good outlook, the US dollar has also lost ground.

Tomorrow is $CCO (-0,21 %) to present its earnings tomorrow, I am very excited 👀

If we also see a stronger decline in the share price here for the time being, buying opportunities could emerge again in the entire sector.

$NXE (-0,23 %) just under -7% (at close)

$UEC (+0,34 %) just under -8% (at close)

etc...

What is your current view on the uranium sector? @Multibagger Do you see any potential to add here, as you are deeply involved in the commodities market and the company mentioned?