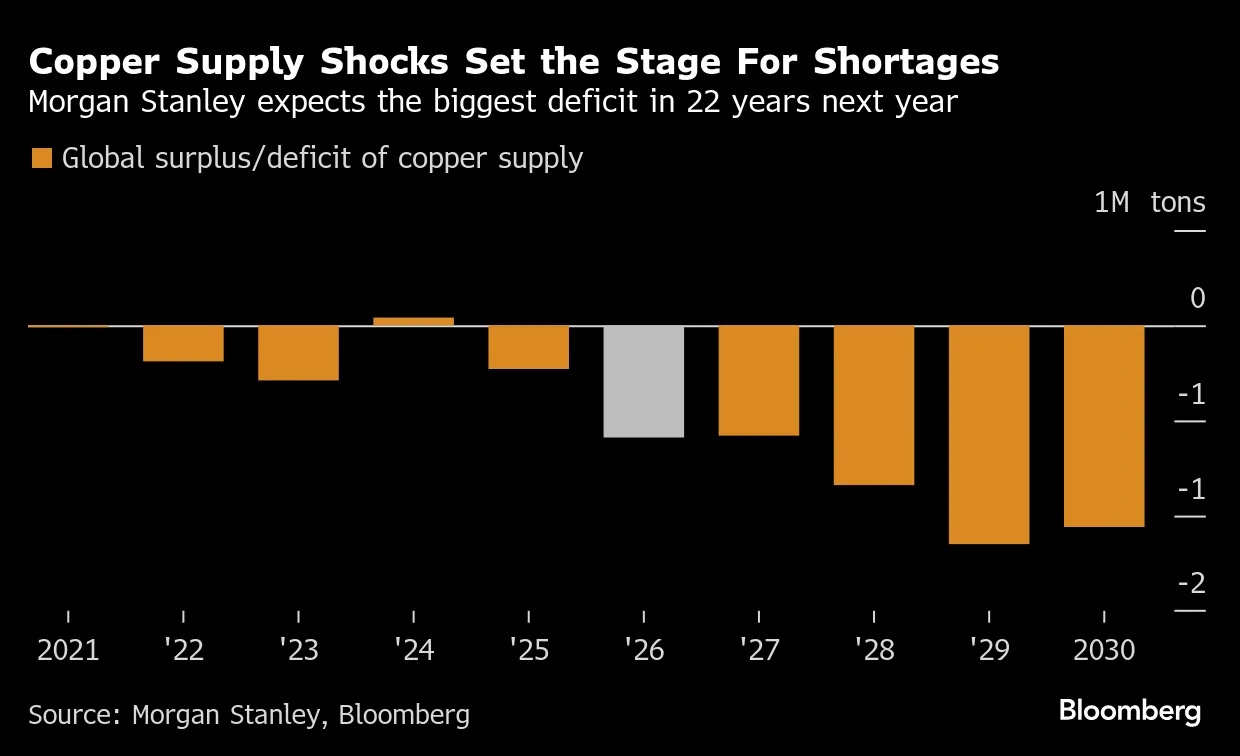

Copper prices in London have reached a new record high. The rally is being driven primarily by supply disruptions at fairly large mines in Chile and Indonesia as well as lowered production guidance from the likes of $GLEN (+0.25%) & $AAL (-0.86%) . In parallel, demand drivers such as transportation, EV, AI and renewables continue to drive consumption. The International Copper Study Group has drastically adjusted its forecast for the coming year and now expects a deficit of 150k tons. Prices are receiving additional support from hopes of a rate cut by the FED and positive signals from the trade talks between the USA and China.

- Markets

- Stocks

- Anglo American PLC

- Forum Discussion

Anglo American PLC

Price

Discussion about AAL

Posts

13Review of the year 2024

The year 2024 is over in stock market terms and I would also like to review the year.

I started with a portfolio value of just over €53,000.

I knew that a reallocation of around €20,000 was still pending and had therefore set my sights on the target of €100,000.

This was very ambitious, as I naturally didn't know what the year would bring. After all, there were already enough economic and political uncertainties at the start of 2024.

As I only really started investing in 2021 and 2022 was therefore my first full year on the stock market, I made a lot of mistakes at the beginning, had fluctuations in my strategy (once one was in place) and of course also made a few losses.

That's why it was important for me to stay true to my strategy in 2024 and not throw everything overboard again. Because, as I always say, going back and forth empties your pockets.

Some of you may also remember my early days, when I had a lot of savings plans in place, but they weren't particularly high and were constantly being changed. At the beginning of 2024, my portfolio contained a total of 47 individual share positions and 3 ETFs.

My goals for 2024 were therefore

- Stay true to the strategy

- No new stocks in the portfolio, rather clear out

- 100,000€ portfolio value

- 2000€ net dividend

- Investment of €17,000 (without reallocation)

2024 went as follows for me:

January: +4.0%

February: +1.3%

March: +3.0%

April: -0.4%

May: +0.5%

June: +1.7%

July: +1.7%

August: +0.9%

September: +1.0%

October: -0.4%

November: +3.4%

December: -1.7%

TTWROR 2024: +15.8%

Dividend (already in the performance): € 1956.56

Invested: €24,900

Reallocation: €21,700

Thanks to a special payment from my old employer, to which I was still entitled, I was surprisingly able to invest around €5,000 more than I had originally thought.

Did I achieve my goals?

Not all of them.

With the dividends, I'm ~€43 below my target. That's a shame, but it motivates me to step on the gas even more and crack the €2400 net dividend in 2025. That would be €200 net per month, which corresponds to an increase of 22.66%. Again, very ambitious, but you should set yourself ambitious goals.

However, I was already able to break the €100,000 barrier in September. This was of course due to the strong market. I ended the year with just over €111,500. I have remained true to my strategy, but a few new stocks have slipped into the portfolio (and a few out).

The cheering contribution to the €100,000 was here:

https://app.getquin.com/de/activity/XGtdQzCdYF

New in the depot:

$NESN (+0.11%) Nestle

$CTAS (-0.98%) Cintas (savings plan)

$RACE (+0.19%) Ferrari

$D05 (+0.32%) DBS

$UNH (+0.05%) United Health

$V (+0.57%) visas

$CSNDX (+0.45%) Nasdaq 100 (savings plan)

$XEON (+0.01%) As an overnight money substitute for fixed planned money for loan repayment in 6 years or special repayment if the interest rate on the balance falls below the loan interest rate of 0.75%. Is topped up with special payments from the employer during this period.

Left my securities account:

$AAL (-0.86%) Anglo American PLC (+37%)

$IBM (+0.03%) (+26%)

$BAC (-0.03%) Bank of America (+45%)

$UKW (+0%) Greencoat UK Wind (0 to 0 due to dividends)

$SBUX (+0.02%) Starbucks (+10%)

$BIGG (+1.18%) Bigg Digital Group (-95%)

Unfortunately, I sold IBM and Bank of America too early, but I am still satisfied.

What else has happened?

- I bought Bitcoin from TR to estimate the costs. Conclusion: savings plan is always around 3-4% higher. Not worth it, if at all then individual purchases

- Weingut Dürnberg: First dividend received and prospects look reasonable. Depending on how the grape harvest turns out next year, a dividend will be paid again and investments can still be made.

- The conservatory and paving the courtyard are done. The house construction is more or less finished, everything else will take time and are small things, but now I have to start saving again as I only have a small nest egg and my deposit. All other funds have been used up as the costs were twice as high as originally planned.

- Podcast with @Koenigmidas is running rather slowly this year due to personal time constraints. You can find the latest episode here: Link zur Folge (also available on Amazon)

Outlook for 2025

So what are my plans for 2025 in terms of finances?

- Investment of €15,000

- Net dividend of €2,400

- One slightly greater focus on high dividend stocks (e.g. to increase $HTGC (-0.32%) to increase the cash flow a little faster)

What are your targets for 2025? Did you reach your 2024 targets and to what extent did you change your targets after reaching (or not reaching) your 2024 targets?

Feel free to let me know in the comments, as I always find it very exciting to see how ambitiously others set/change their goals.

I wish you a good start to 2025 and every success with all your plans and goals.

As with everything, of course, if you're not interested, feel free to keep scrolling and/or use the block function. 😊

Earnings summary this morning 👇🏼

$ULVR (-0.91%) | Unilever Q3 2024 Earnings

Rev €15.25B (est €15.398B)

DIV/SHR €O.4396

Underlying Volume 3.6% (est 3.1%)

Underlying Sales 4.5%, (est 4.25%)

Still Sees FY Underlying Sales To 5% (est 4.2%)

Still Sees FY Underlying Oper. Margin At Least 18%

2024 FY Outlook Unchanged

$BARC (-0.3%) | Barclays Q3 2024 Earnings

Pretax Profit £2.23B (est £1.96B)

Net Interest Income £3.31B (est £3.11B)

Investment Banking £594M (est £552.3M)

FICC Rev. £1.18B (est £1.13B)

Sees FY Cost To Income Ratio About

Sees FY UK Net Interest Income About £6.5B

$AAL (-0.86%) | Anglo American Q3 2024 Earnings

Diamond Prod 5.6M Carats (est 5.6M)

Copper Output 181,000 tons (est 181,334)

American Sees Fy Diamond Prod 23M to 26M Carats

De Beers To Continue To Assess Options To Lower Output

PGMS Demerger Is On Track To Complete By Mid 2025

$RMS (-0.62%) | Hermes International Q3 2024 Earnings

Rev €3.70B (est €3.68B)

Sales At Constant FX 11.3% (est 10.5%)

Leather Goods Sales At Constant FX 14% (est 12.8%)

CFO: Sees No Change In Global Trends Early Q4

CFO: China Higher Basket Spend Made Up For Lower Traffic

$005380 | Hyundai reports a 6.5% drop in profits in the third quarter despite an increase in sales, leading to a fall in the Seoul share price of almost 5%. Operating profit falls to 3.6 trillion won, while the operating margin drops to 8.3%.

$BN (-0.97%) | Danone increases its turnover in the third quarter by 4.2% to 6.9 billion euros, exceeding analysts' expectations. Demand is particularly high in North America and Asia.

$RNO (-1.69%) | Renault increases sales by 1.8% to 10.7 billion euros in the third quarter, but falls short of analysts' expectations. Exchange rate effects have a dampening effect on the result, without which a 5% increase in sales would have been possible.

$SY1 (+1.95%) | Symrise raises its forecast for organic growth in 2024 to around 7 % after strong sales growth in the first nine months. Sales rose by 6 % to 3.8 billion euros, driven by petcare and fragrance products.

$WAF (+0.69%) | Siltronic raises 2024 EBITDA margin guidance to 24-26% as acceptance of new Singapore factory is delayed. Third-quarter sales rise 2.3% to EUR 357m, exceeding expectations, while profit falls to EUR 19m.

$BEI (-0.88%) | Beiersdorf records organic sales growth of 6.5% to 7.5 billion euros, but falls short of analysts' expectations. Sales of the luxury brand La Prairie fall by over 7% in China, while the annual targets for 2024 are confirmed.

No news about $GLEN (+0.25%)

While it is exciting at $ABHPG and $AAL (-0.86%) who is taking over what here now.

So I'm quietly on my way to filling my position.

Different courses at $AAUKF and $AAL (-0.86%)

I decided to invest in Anglo American at the time and simply bought the "normal" $AAUKF bought. Now I see here that the PLC version has a different price trend and was also extremely fueled by the takeover fantasies of BHP, while my normal $AAUKF shares are even in the red today😅

Can someone shed some light on what this is all about?

Heading south again. So I took the profit for the time being. Nobody has become poor yet!

Light at the end of the tunnel! After $AAL (-0.86%) has already performed well since the beginning of the year, today there was a further substantial boost following the confirmation of takeover interest by $BHP (-2.08%) the takeover interest.

Light at the end of the tunnel! After $AAL (-0.86%) has already performed well since the beginning of the year, today there was a further substantial boost following the confirmation of takeover interest by $BHP (-2.08%) the takeover interest.

The picture below was taken during my last vacation in South Africa. You can see me there at the Venetia mine.

I've been flirting with a financial entry for a while now, after I managed the physical entry quite well on my vacation.

So why wait for a good annual resolution when I can just get in now?

Expansion of the existing position after yesterday's price decline.

Share of mining companies ($GLEN (+0.25%)

$AAL (-0.86%)

$WPM (+1.26%) ) in the overall portfolio is now just under 6%.

Trending Securities

Top creators this week