Hello dear community,

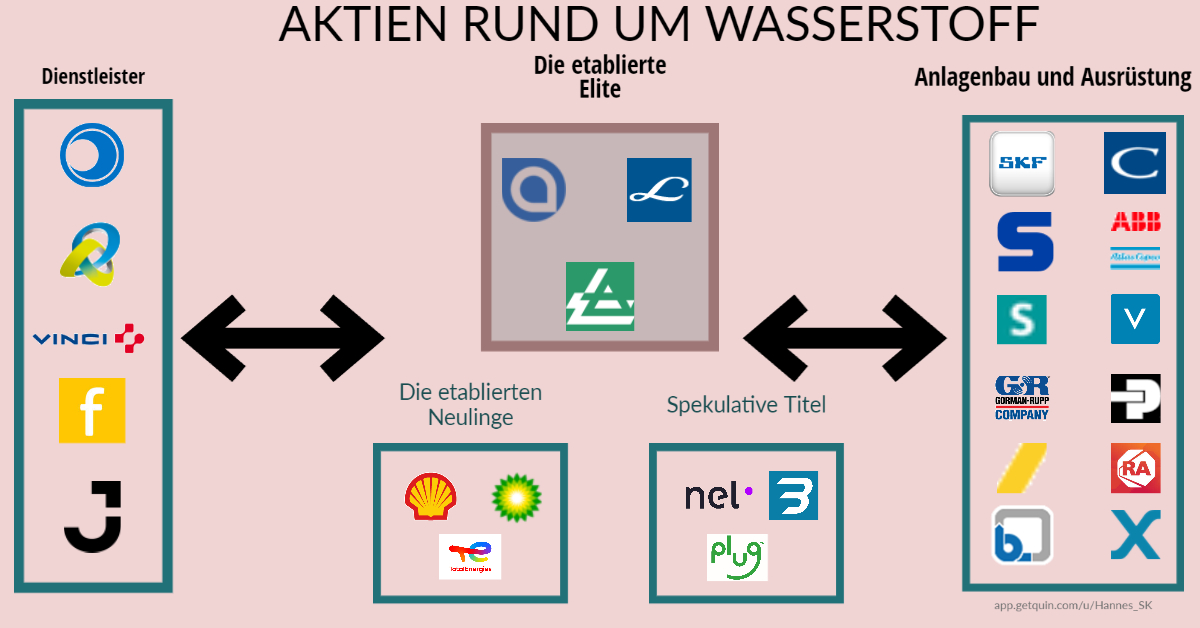

In view of the fact that there are now a lot of newcomers on the platform, I've created a graphic, typical of social media, to give you an overview of stocks that not everyone may have on their radar. It goes without saying that you can't know your way around every sector. But we have come together here in the community for a solid exchange.

But since we're here on Getquin and not on Instagram, here's some input for the inquisitive.

What do the companies do anyway?

Service providers:

On the service provider side, there are some rather atypical companies for the sector.

Here I have Friedrich Vorwerk $VH2 (-1.54%) Vinci $DG (-0.72%) , Ferrovial $FER , Bilfinger $GBF (-3.36%) and Jacobs Solutions $J (-0.42%) are listed here.

Their main focus is the background work on the properties themselves. They support the companies in planning, realization, construction and maintenance. They work decentrally in regional working groups to cover the breadth of the industry. They offer almost every service for an industrial company.

The established elite

If you want to invest in the hydrogen sector, all roads lead to the giants Linde $LIN (-0.32%) Air Products $APD (+0.17%) and Air Liquide $AI (-0.37%) . Their market power in the field of industrial gases and in today's market environment of commercial hydrogen production seems irrefutable. Their know-how in the gaseous material production segment has been tried and tested for decades and the processes are almost perfectly optimized. Each company also has its own engineering divisions, making them perfectly positioned for the future in electrolyzer development.

The established newcomers

With plenty of money in their pockets, the oil companies Shell $SHEL (-0.19%) Total $TTE (+0.85%) and BP $BP. (-0.26%) are also entering the segment. Oil is finite, but the business should not be. These companies are also experienced in dealing with hydrogen. Hydrogen is an essential component in the refinery process. In order to become less dependent on the big 3, new market areas are also being explored here. Will they be able to prove themselves?

Speculative titles

Never anything but expenses. Years of hype and yet a harsh reality hit the small fish in the shark tank surrounding the segment. Nel $NEL (+1.12%) Plug Power $PLUG (+0.26%) and Ballard $BLDP (+0.17%) are long-suffering. They have never been able to deliver even remotely profitable figures. On the contrary, things seem to be getting worse quarter after quarter. Only turnover is increasing. Can that ever be good?

Plant engineering and equipment

Of course, in a globalized world, you no longer take care of the entire value chain from A-Z. Every company specializes in its own segment. The long-term beneficiaries of the industry are therefore the equipment suppliers, because they have to develop the technical foundations for every innovation in order to survive in the vastness of globalization.

The plant manufacturers

They manufacture the physical parts for the process plants.

Examples of this are Voestalpine $VOE (+1.63%) , Atlas Copco $ATCO B or Sulzer $SUNE .

The suppliers

The transportation of substances is also part of this. Material transport in industry, but also at home, for example in water pipes, is ensured by pumps (for liquids) or compressors (for gases). Established brands here are KSB $KSB (+0%) , Xylem $XYL (-0.43%) , Gorrman-Rupp $GRC (+0%) but also as a complete supplier Chart Industries $GTLS (-0.74%) or SKF $SKF B (-0.48%) or for specialized tools Stanley B&D $SWK (+0.21%) .

Process control is also indispensable. Brands such as Siemens $SIE (-0.78%) ABB $ABBN (-1.06%) or Rockwell $ROK (-0.17%) and Parker $PH (-0.63%) have established themselves here. They not only supply the electronic equipment for the process systems. They also offer their software services as safety services so that safety in process control can always be guaranteed.

I hope I have given you a little insight into the industry and would be delighted to receive constructive feedback.