Bitcoin's recent price action once again shows that markets have decoupled from fundamentals and overshot them - a pattern typical of sharp corrections in digital assets. When sentiment becomes disorderly and price becomes detached from underlying signals, it is often more useful to focus on positioning, capital flows and structural stress indicators to assess whether the downward pressure is nearing its end.

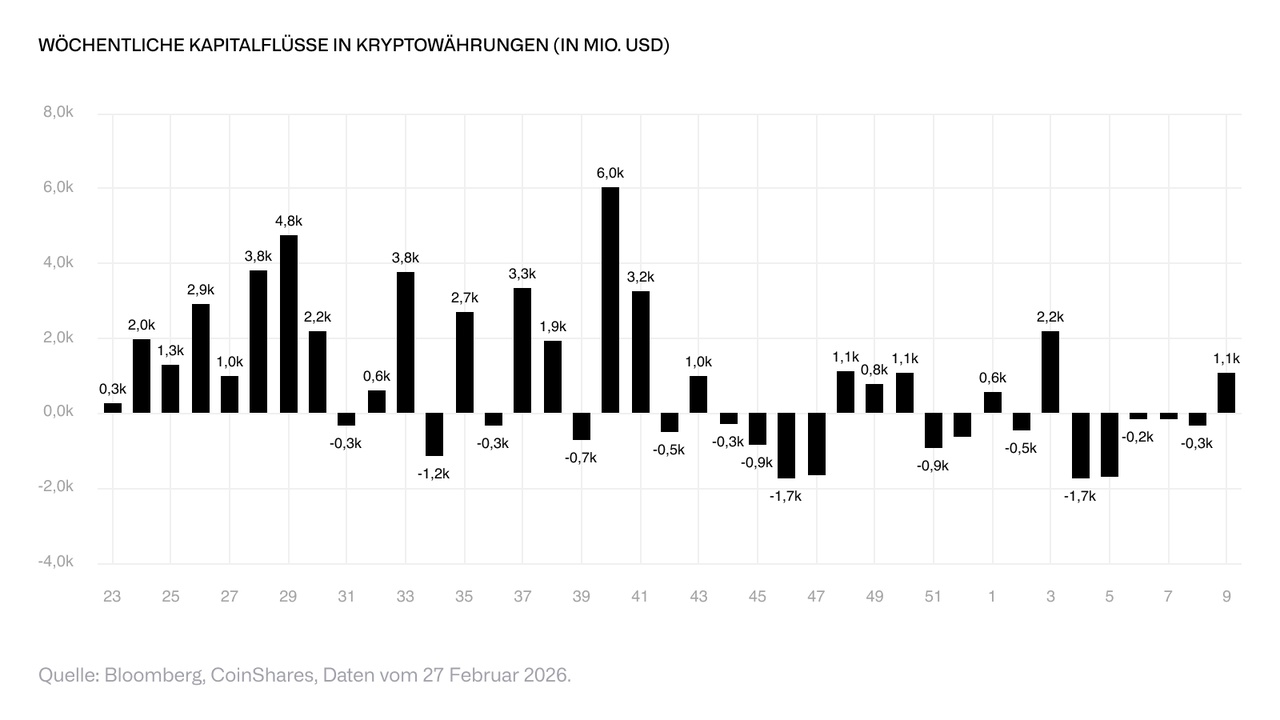

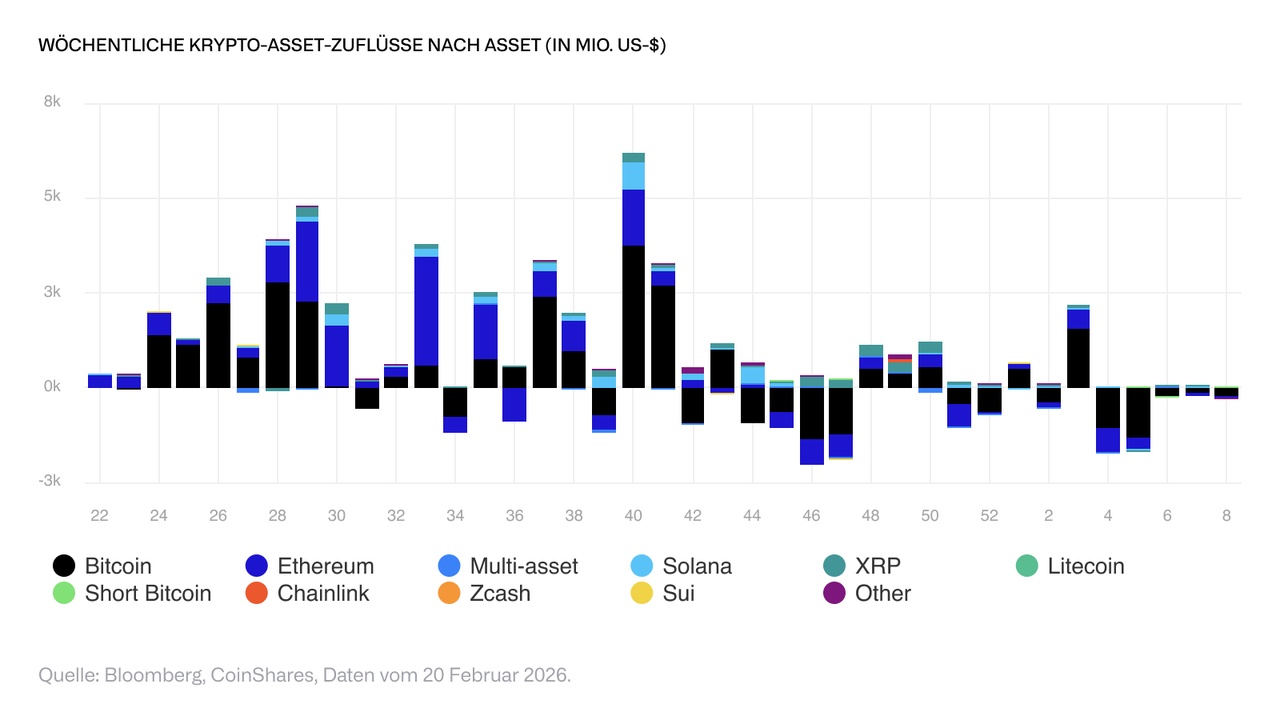

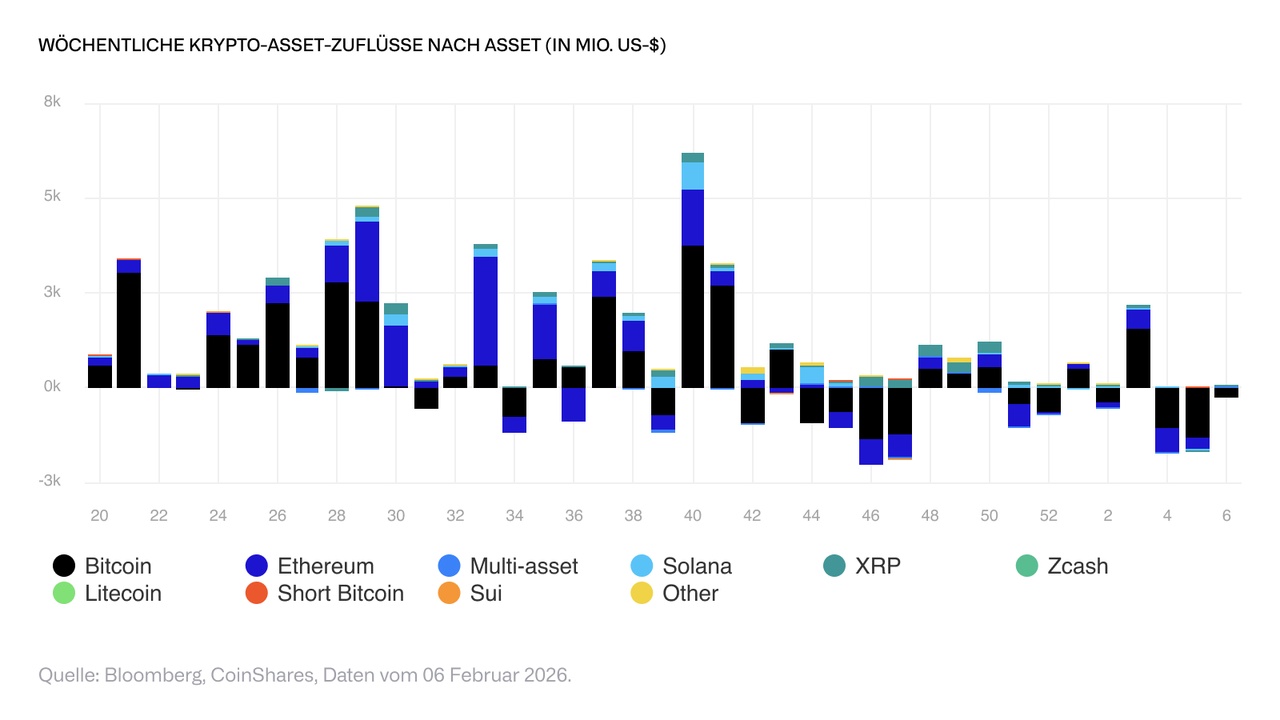

Several of these signals are now beginning to synchronize. Global crypto ETPs recorded their highest ever daily trading volume yesterday at USD 18.5 billion. Such volume spikes during price declines have historically signaled capitulation rather than renewed conviction selling. While net outflows from funds have slowed, in previous cycles it was often the lows in the rate of change of flows, rather than the outflows themselves, that marked local lows.

The on-chain behavior also supports this assessment. Addresses with holdings of more than 10,000 Bitcoin had sold around USD 28 billion worth of Bitcoin since October 2025 during the sell-off, but these sales have recently come to a halt. In the past two weeks, these large holders have bought around USD 4.7 billion worth of Bitcoin. Sustainable bottoms have rarely occurred without a stabilization and subsequent reversal in the positioning of the so-called whales. This turning point has not yet been definitively confirmed, but is an encouraging signal.

The $BTC (-0.61%)-price is currently below the estimated average production costs. From a production perspective, Bitcoin is trading well below the estimated average production costs of listed miners, which we estimate at around USD 74,600. Historically, phases in which the spot price is noticeably below production costs have usually been short-lived, as the pressure on miners' balance sheets, their capital expenditure and marginal supply increases rapidly.

Behavioral indicators also point to a late stress phase. In the past, reports that private investors were temporarily unable to access trading platforms due to a sharp increase in trading volumes often coincided with phases of maximum selling pressure - and not with the start of longer downtrends.

The macroeconomic environment is becoming more supportive at the margin. Yesterday's JOLTS report was significantly weaker than expected; the number of job vacancies fell to a multi-year low. This led to a noticeable increase in the market's implied probabilities of a rate cut in June - despite the uncertainty surrounding the future leadership of the US Federal Reserve. Although a more hawkish chairman could limit the scope for monetary policy, weaker labor market data reduces the possibility of maintaining restrictive interest rates without political and institutional tensions.

Concerns about quantum computing have also re-emerged in the wake of the decline, but these are significantly overestimated. The risks posed by quantum computing are theoretical, distant and only affect a small proportion of older addresses. The core monetary properties of Bitcoin remain intact, and the protocol has sufficient time and clearly defined pathways to implement post-quantum cryptography if required. This is an engineering issue, not a factor that fundamentally challenges the investment thesis.

As the downward pressure appears to be easing, it is worth returning to the fundamental investment thesis of Bitcoin. Bitcoin remains a scarce, non-governmental monetary asset with a fixed supply and no dependence on institutional credibility. In an environment of increasing fiscal dominance, politicized monetary policy and dwindling confidence in traditional stores of value, this central investment thesis remains unchanged.

(Author: James Butterfill, Head of Research at CoinShares)

$BITC (+6.76%)