Back from my two-week winter break, I’ll start with a brief portfolio recap of last month. December was a much quieter month for me compared to previous ones, fitting with the holiday season. Portfolio activity was limited, with only a handful of buys and a lot more observation than execution. The only real macro event was the widely expected 25bp rate cut at the beginning of the month, followed by a slow but constructive Santa rally. Overall, December was about positioning and re-evaluating conviction, not trading.

Testament to that is the fact that my first trade was only executed on December 10th, when I opened a position in Sea around $125. I won’t go into too much detail here, as I’ve covered the company extensively over the past months. In short, Sea offers one of the cleanest growth setups in global e-commerce right now. The company benefits from rising income levels and improving infrastructure across Southeast Asia — a far more favorable backdrop than mature markets like South Korea. Revenue growth is projected north of 20–30% annually through 2027, cash flow is expanding at a similar pace, the balance sheet holds nearly $8B in cash with no debt, and the stock was down close to 40% from its YTD highs. At a ~5% FCF yield, it’s not dirt cheap, but more than fair given the growth. I’m very comfortable with Sea here, alongside MercadoLibre as my emerging markets exposure.

The next addition was Microsoft. I bought 10 shares at $475, making it a relatively small position below 3% of my portfolio. Microsoft is not a screaming buy, but it’s the kind of company I’d happily hold for a decade without even looking at the stock price. You could call it a typical “Buffett buy”: a wonderful company at a fair price. The forward P/E sits around 30, dropping into the mid-20s on FY27 estimates. Free cash flow is temporarily distorted by heavy and necessary AI CapEx, but the underlying business remains close to perfect: deeply entrenched ecosystems, massive switching costs, recurring revenue streams, and Azure as the rapidly growing #2 player in the cloud market. Still, while Microsoft is an incredible business, it isn’t my favorite Mag7 right now. That crown still belongs to Meta, and second place, in my view, goes to the stock I bought a week later.

That stock was Nvidia, which I added around $170. Nvidia puts me in a dilemma. Long term, I do see risks: extreme customer concentration, hyperscalers with the resources to build their own chips, and early cracks showing as companies like Meta explore alternatives. But in the short to medium term, the setup was simply too compelling to ignore. The stock was down 15–20% from ATHs, AI demand fears were eased after Micron’s blowout earnings, and on FY27 earnings Nvidia trades at a P/E of roughly 25. I’m highly confident Nvidia will rebound from these levels and make new highs in the coming months, even if I’m less convinced about its dominance five to ten years out.

On the same day, I also bought Uber. Similar story: not a forever-hold in my view given advances in autonomy (Waymo in particular), but at ~20% below ATHs and trading at a P/E of ~10, the risk/reward looked asymmetric. Cooler inflation, a stabilizing macro backdrop, and renewed confidence in the broader market created a favorable short-term setup. Adding to that, recent readings from the Atlanta Fed’s GDPNow model pointed to surprisingly strong U.S. growth momentum into Q4, which supports a more constructive outlook beyond just the AI narrative. I can easily see 30–50% upside from these levels, even if Uber isn’t a core long-term conviction.

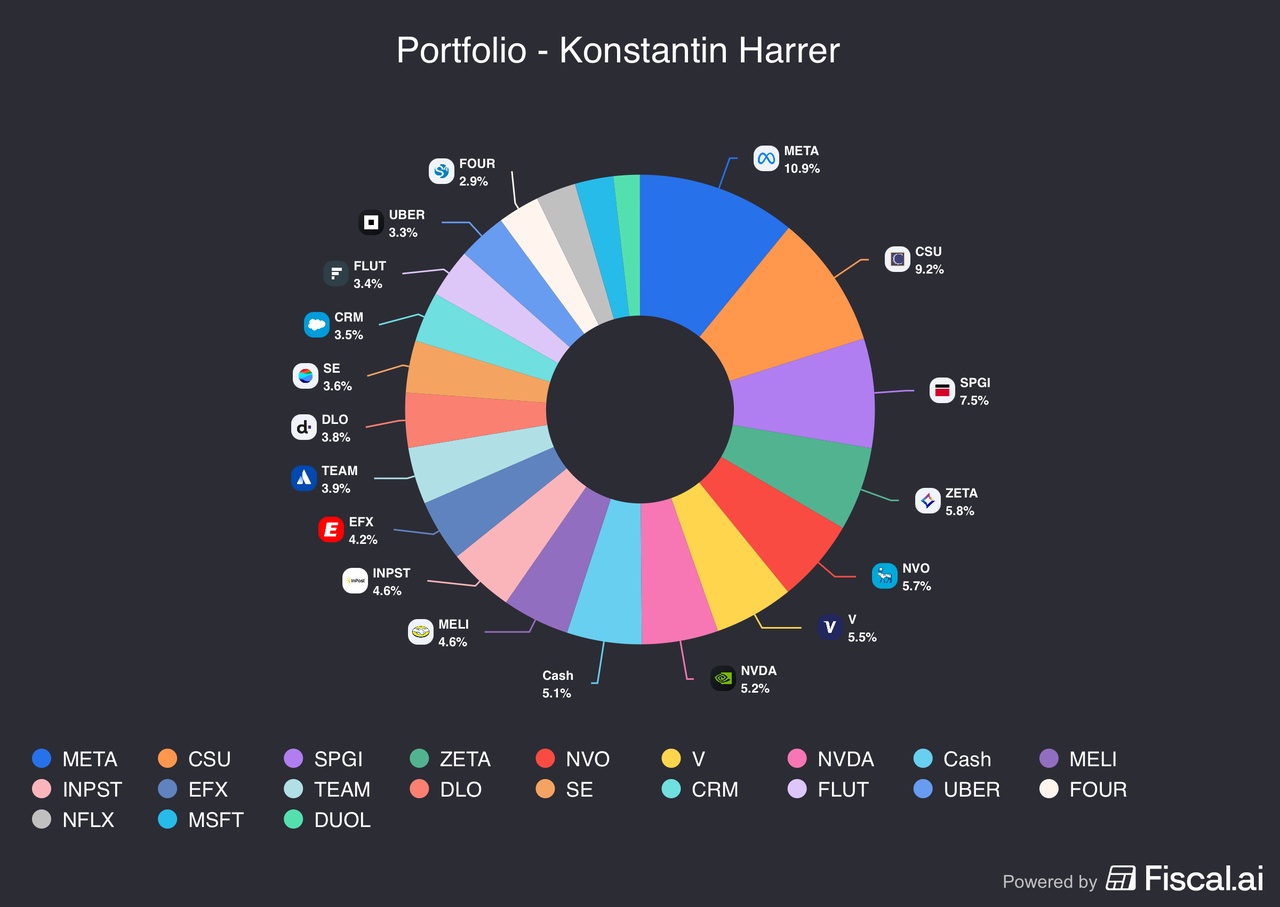

December was also strong relative to my benchmark. The MSCI World was essentially flat for the month, while my portfolio gained around 5.6%. I started this portfolio in July 2025, and performance has been broadly in line with the MSCI World so far. For 2026, however, my goal is clear: visible outperformance through deliberate stock picking, generally focusing on quality-growth compounders. Alongside my core holdings (e.g. Meta, Visa, S&P Global), I’ll mix in selective high-risk, high-reward satellite positions where I see significant upside potential over the next few years (e.g. Zeta, Duolingo, Shift4).

Return since inception: +13%

$SE (+0.82%)

$MSFT (-0.43%)

$NVDA (-0.02%)

$UBER (-1.15%)

$META (-0.63%)

$CSU (+0.84%)

$SPGI (+0.6%)

$ZETA (-1.08%)

$NVO (-13.4%)

$NOVO B (-13.44%)

$V (-0.48%)

$MELI (-0.22%)

$INPST (+0.03%)

$EFX (+0.3%)

$TEAM (+3.88%)

$DLO

$CRM (-0.89%)

$FLTR (-0.53%)

$FOUR (-0.03%)

$NFLX (-0.63%)

$DUOL