Hey guys.

I found getquin a couple of months ago and initially just used it to monitor my portfolio.

In the last couple of weeks I have been diving into all the community posts and reading some of the interesting stuff posted here every day. So I decided I wanted to be a part of this and will start by introducing myself and what my thoughts and plans are for my portfolio and future investments.

Currently I am 26 and doing my PhD in molecular biology in Germany. In 2020 after school I took my first steps into the world of investing by opening a fund at my bank through a friend of mine who works there. I started with 2 investments; UniGlobalnet and UniNachhaltig Aktien Global with 25€ per month. I mostly forgot about them during my studies because it was not that easy from time to time, so I did not have that much spare time. I was also lucky that my parents paid for almost everything so I didnt have to work after university. But of course I didnt have a lot of money to invest, so I was happy with the way things were going. Since November 2023 I have been working as a research assistant at a university. The salary is 65% of a TV-L E-13, which is about 1,9k netto. Not much, but I really enjoyed spending large amounts of my first real "earned" money. But after a few months I decided that it would be better to invest it in parts. So I opened an account with finanzen.net and started investing in different kinds of ETFs and other assets like $XDWD (-0.37%)

$VWRL (-0.47%)

$NVDA (-1.03%)

$WGLD (-2.4%) and stuff like that without even knowing what I was doing. It was all fun and games and the returns did not look too bad. Over the course of the month I added a few assets through individual purchases and also added some monthly payments for ETFs or stocks that I found interesting.

A couple of months ago I also signed up to Trade Republic (mainly because I wanted the fancy card) and have been using the cashback and round-up facilities there to do some passive farming, but with no real focus on it.

Now I want to add a bit more structure to my portfolio and wanted to get your opinion on my plans. The one Union Investment funds I want to sell over time, but only 1k a year because of the tax exemption order here in Germany. The money will go into one of the core ETFs. I have made some individual purchases such as $NTMC (-3.28%) and things like that just to see how they perform in the future. I know it's not ideal to hold so many positions with so little money, but they're not in my payment schedule, so I'll just hold them. For the next few years I will only be investing in a few ETFs rather than all the ones currently in the portfolio and will also be reducing some individual stocks to focus on a few. Do you have any suggestions on which ones to hold and which ones to sell?

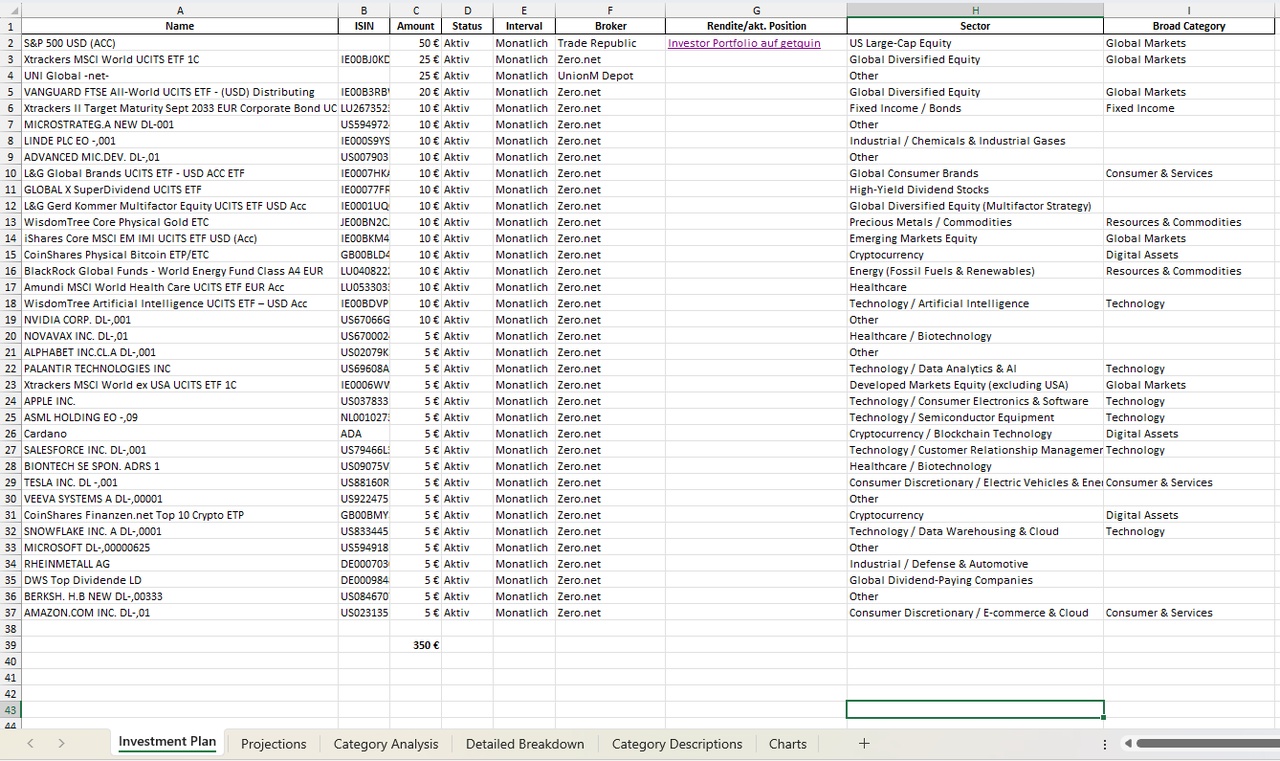

My aim for the next year is a monthly rate of 350€ (see picture) in different assets and for the long run to buy and hold everything. Im not quite sure what I want to do with the money in the future, that just depends too much on things I cant really say at the moment like my position after the PhD, family etc.

These are just some initial thoughts and I would appreciate any comments or advice from you guys, thanks in advance! :)