Hello friends,

My personal assessment:

Many still see Siemens as a boring industrial stock. For me, Siemens has long since ceased to be that. Whether it's in the Mobility division or in other divisions.

Implementing AI in industry and thus making production processes even more efficient has huge potential in my opinion. With its digital twin, Siemens will speed up planning processes enormously and minimize costs enormously. Follow-up costs that were previously caused by planning errors can also be avoided. For me, digital twins have huge potential. Whether in aircraft construction, shipbuilding, bridge construction or other large projects.

For me, Siemens is one of the major industrial AI players.

That's why I'm staying invested.

The WEF has honored the fifth Siemens factory with the title "Global Lighthouse".

Digitalization, this feeling could arise, only Siemens seems to have mastered it perfectly in Germany. At least that's the impression you get when you read the aktuellen Global-Lighthouse-Network-Report of the World Economic Forum (WEF). In the prestigious ranking, the company is now listed with five production sites.

After the plants in Amberg, Erlangen - which Computerwoche berichtete darüberErlangen - where Siemens uses AI in production - and Fürth, as well as Chengdu in China, the Nanjing site has now also been included in the elite Lighthouse KPI. Digital Native Factory been included in the elite Lighthouse circle. The WEF has been recognizing the world's most advanced production sites since 2018. It recognizes achievements in the areas of productivity, supply chain resilience, customer focus, sustainability and talent development.

Virtual planning, real efficiency

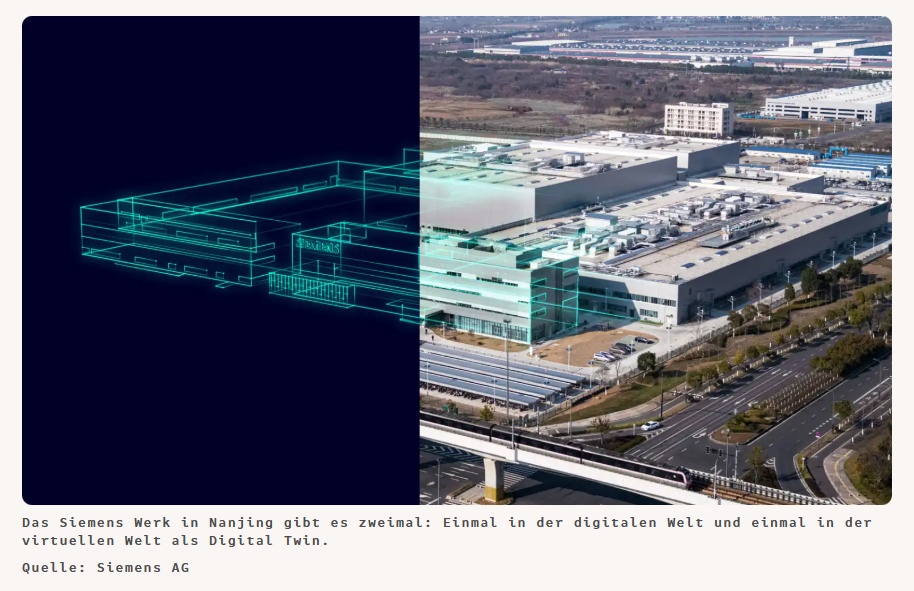

Such as the Siemens plant in the Chinese metropolis of Nanjing. Here, the WEF jury was impressed by the continuous digital transformation of the production site and the use of state-of-the-art AI applications. There is a factory in Nanjing that actually exists twice. Once made of steel and glass, and once it exists as an exact digital replica - i.e. a digital twin - in the virtual world.

What makes the factory in Nanjing so extraordinary began long before the ground-breaking ceremony. Before even a single brick was laid, engineers had already virtually designed, tested and optimized the entire factory and all its processes. According to Cedrik Neike, member of the Managing Board of Siemens AG, this digital-first approach made it possible to build the plant quickly and cost-effectively, even under the difficult conditions of a pandemic.

Countering market pressure with digitalization

Today, Nanjing is Siemens' largest research and production center for CNC systems, drives and electric motors outside of Germany. The site is setting new standards in terms of digitalization and the digitalization of production is so important for Siemens because, according to the company, customer requirements have changed massively. Individual products in small batches with short delivery times are now increasingly in demand. Whereas these used to be 45 days, they have now shrunk to ten days. As a result, the production lines in Nanjing have to be completely reconfigured every four weeks or so.

Over 50 AI applications

Siemens has responded to this pressure with a digital excellence strategy. More than 50 different AI applications are used in the factory. In addition, end-to-end digital twins are used, along with modular automation and manufacturing operations management systems.

The bare figures prove that the massive use of technology is not an end in itself. Compared to 2022, the plant was able to

- reduce throughput times by 78 percent,

- accelerate the market launch of products by 33%,

- increase productivity by 14% by 2024,

- increase quality so that failures in the field fell by 46 percent, and

- reduce CO2 emissions by 28 percent.

For Siemens, Nanjing is therefore much more than just a production site. It is a showcase project that demonstrates how connecting the real world with the digital world can accelerate industrial transformation. In a world where market demand is constantly fluctuating, this digital native factory proves that flexibility and efficiency need not be a contradiction in terms.

Siemens – Deutschlands einziger KI- und Digitalisierungsleuchtturm? | CIO DE