- Revenue: $164.1M (Est. $161.4M) ✅; UP +46% YoY

- EPS: -$0.60 (Est. -$0.80) ✅

- In-Force Premium: $840M; UP +22% YoY

Customer & Premium Metrics

- Premium per Customer: $394; UP +11% YoY

- Total Customers: 2.1M; UP +10% YoY

- Policies in Force: 2.13M

- Annual Dollar Retention (ADR): 87%

Other Q2 Metrics:

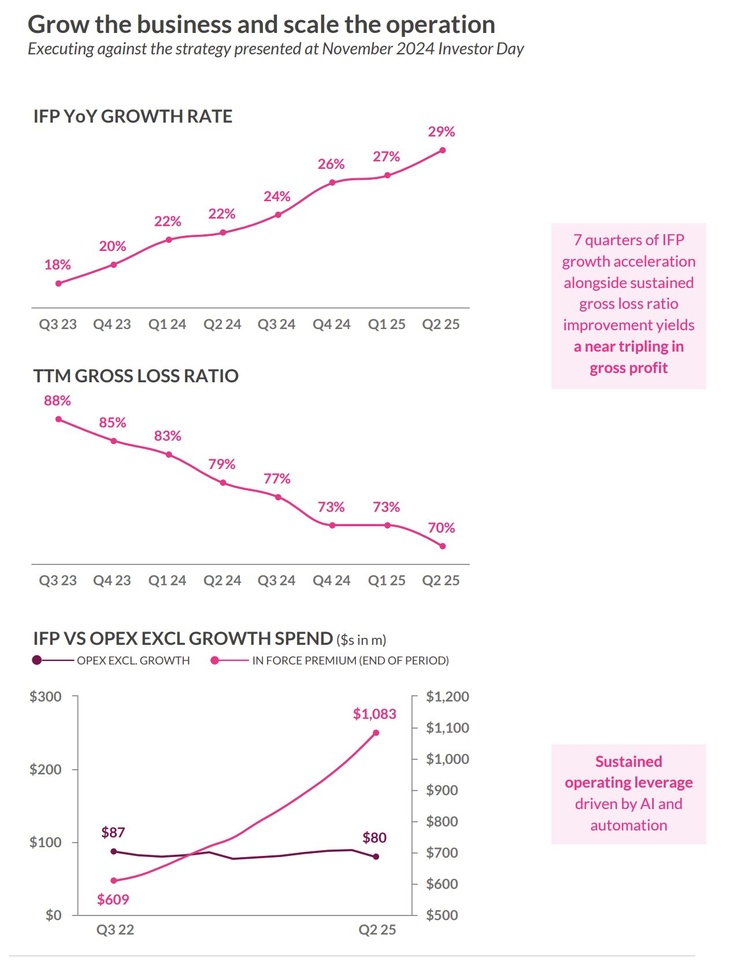

- Gross Profit: $41.3M; UP +91% YoY

- Adj EBITDA: -$30.4M

- Net Loss: $41.6M

- Gross Loss Ratio: 77% (vs. 94% YoY)

- Cash & Investments: $888M

- Net Cash Used in Operating Activities: -$29.8M

CEO comment:

🟡 "We achieved record sales and margin improvements. This is the strongest second quarter in Lemonade's history."

🟡 "We are on track to achieve our target of adjusted EBITDA profitability by mid-2026."

$BRO (-0,24%)

$BRK.B (+0,06%)

$BRK.A (+0,2%)

$PGR (+1,29%)

$ALV (+1,65%)

$MUV2 (+0,8%)

$CS (+1,79%)

$HNR1 (+1,13%)

$UNH (-0,11%)

$ALL (+1,48%)

$601318

$CB (+0,71%)

$ZURN (+0,44%)

$TLX (+1,59%)

$HSX (+1,2%)