- over 90% in the last 3 months

- just under 50% in the last month

Short quota just under 30% 🫣

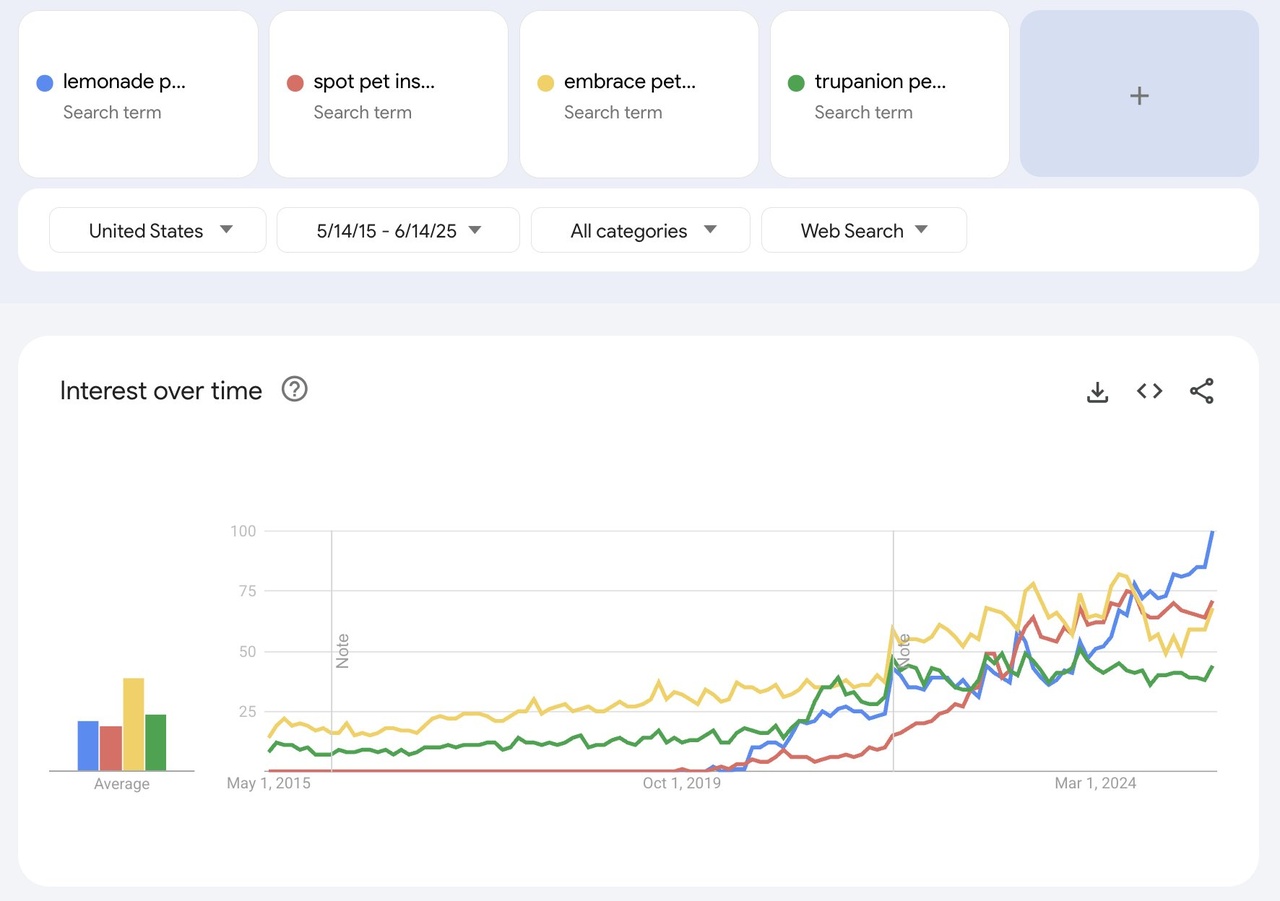

The market is slowly recognizing the potential, momentum continues

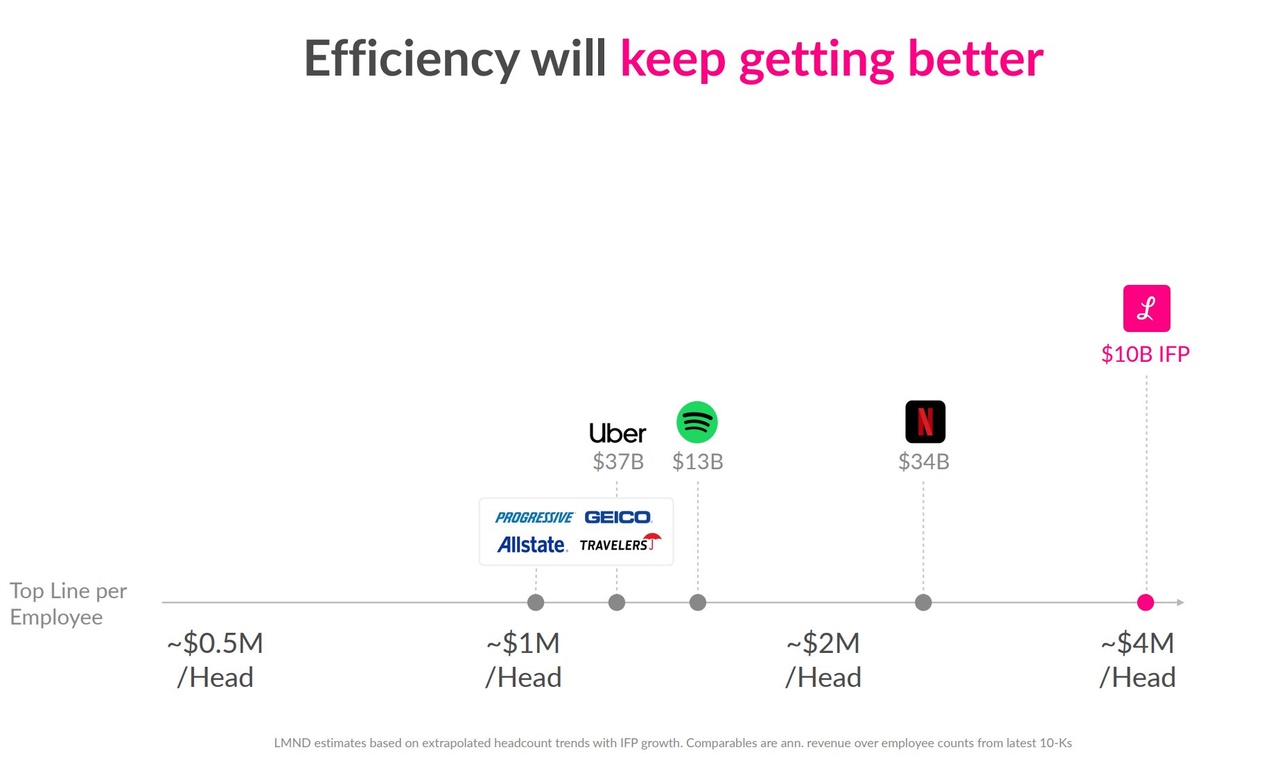

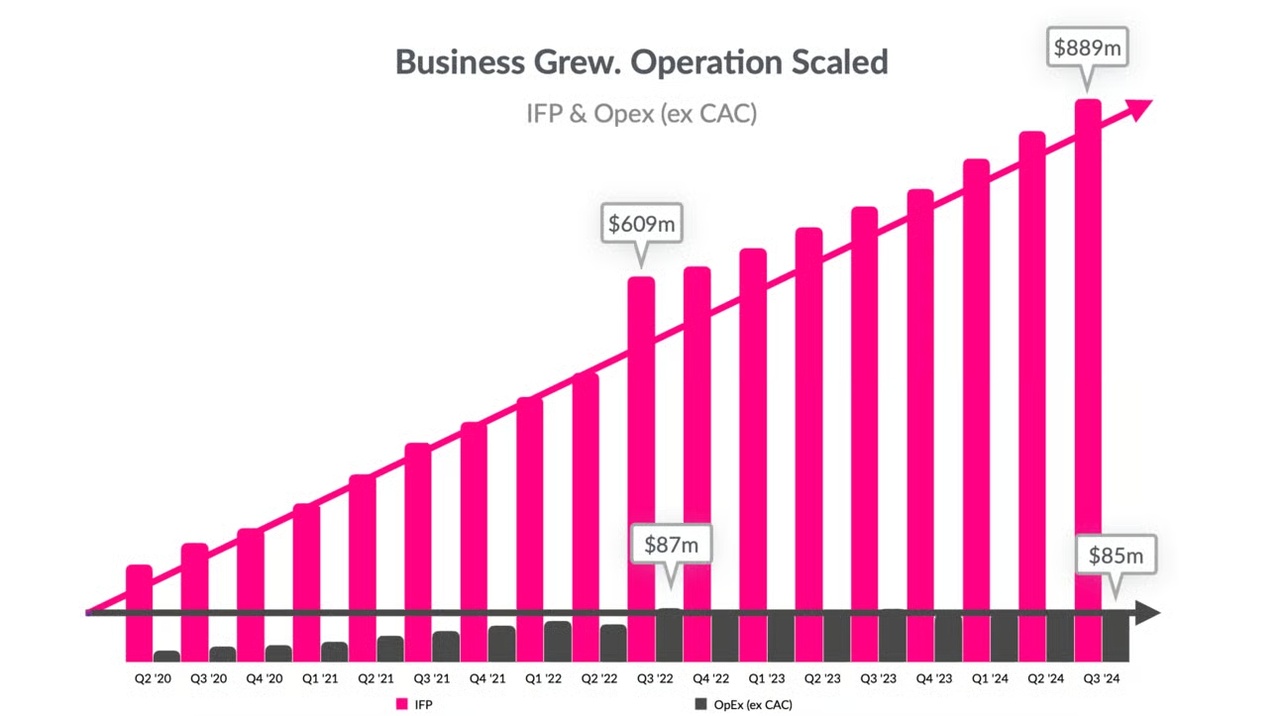

Currently, 98% of all onboarding and 55% of all claims processing is handled by native AI agents without human interaction

This means that scaling is possible without an increase in personnel.

This means an increase in efficiency and operational leverage.

AI-centric design also reduces costs.

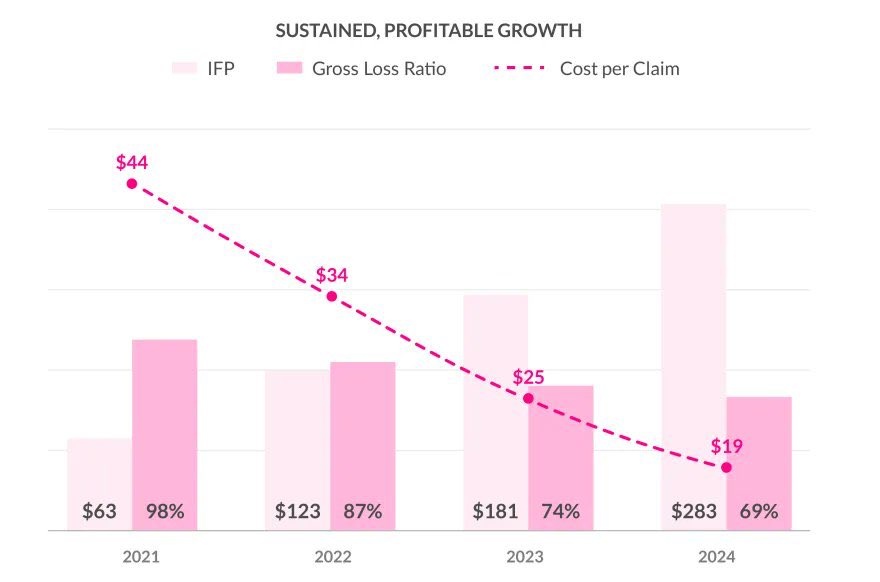

The majority of costs in the insurance industry arise from claims settlement.

This is because humans used to be heavily involved in this.

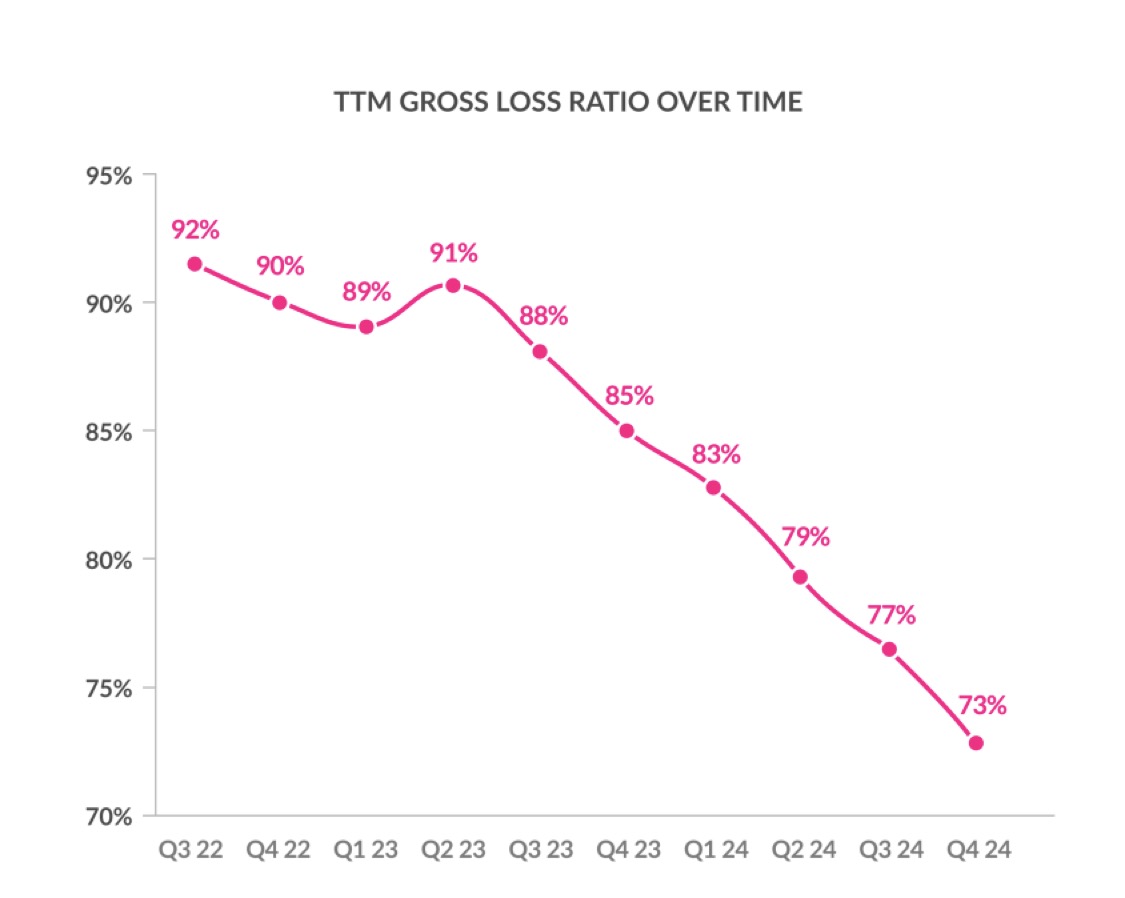

As $LMND (-11,35%) now handling this with the help of AI, their loss ratio is also falling.

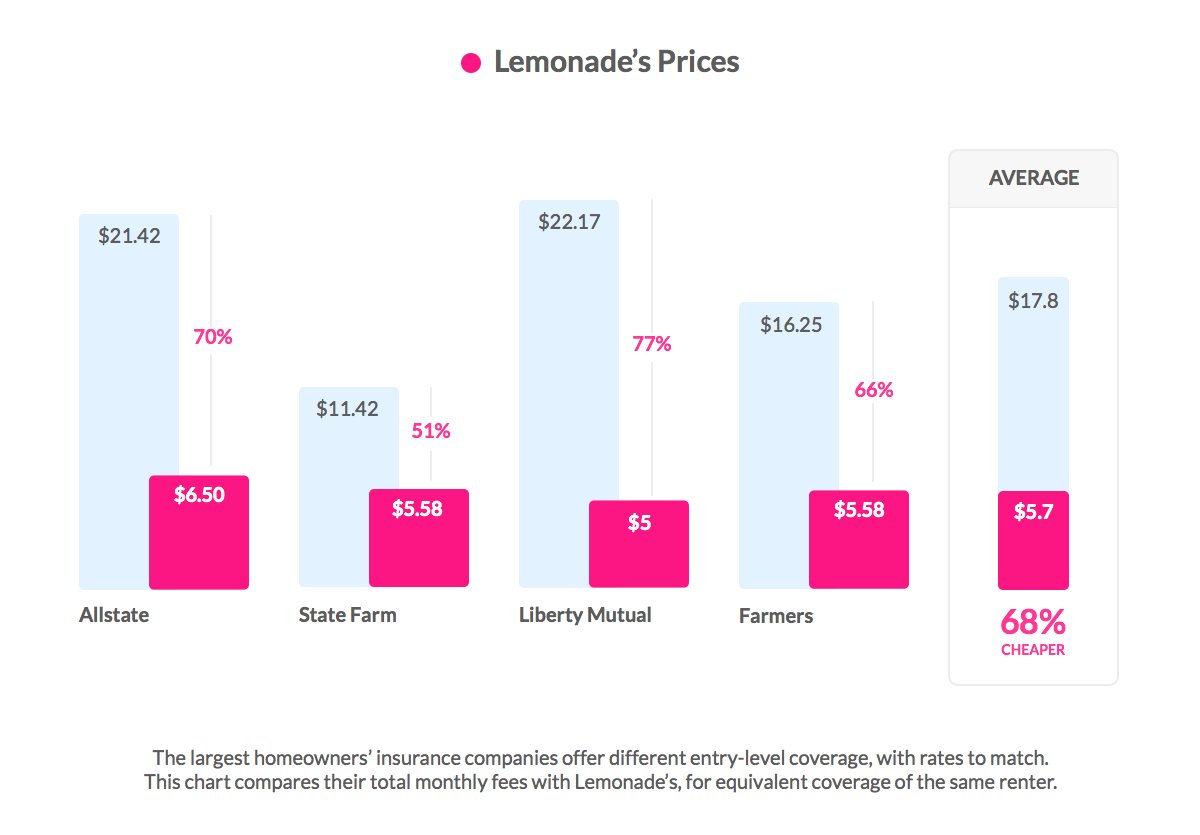

Lower costs lead to lower prices.

Some of these cost savings are passed on to customers in the form of lower prices.

Currently, prices are on average 68% lower than those of the competition.

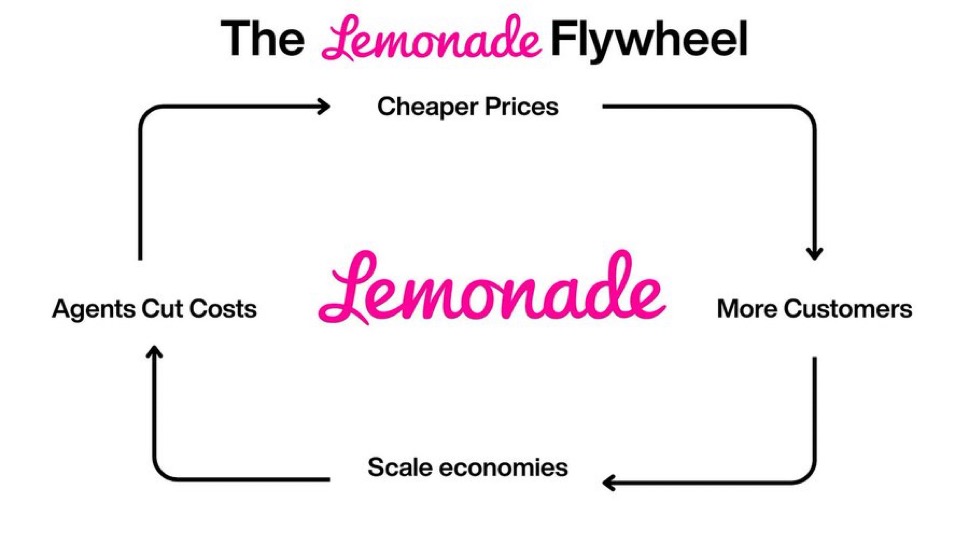

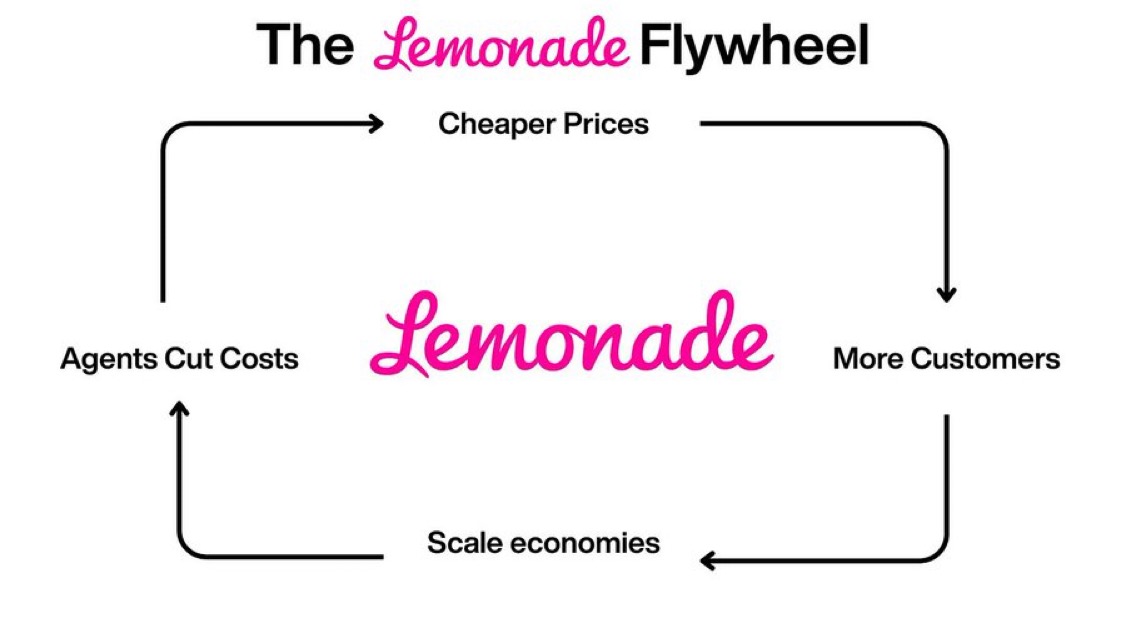

This creates a positive feedback cycle:

- Operating leverage reduces costs.

- Reduced costs increase efficiency.

- This allows $LMND (-11,35%) charge lower prices.

- Lower prices attract more customers.

- Larger scale increases operating leverage again.

A cycle of growth 🚀

$ALV (-0,07%)

$MUV2 (+0,48%)

$ALL (-0,2%)

$PGR (+0,16%)

$BRO (-0,42%)

$ZURN (+1,78%)

$CS (+0,47%)

$BRK.B (-0,92%)