Ho ho ho you beautiful Christmas time...

...here again the monthly look in the rear-view mirror🔎

The first thing that surprises me is the fact that the Getquin Rewind is more positive than my monthly benchmark at the end of the month 🤔

According to Rewind, I ended the month with + 1.07%...

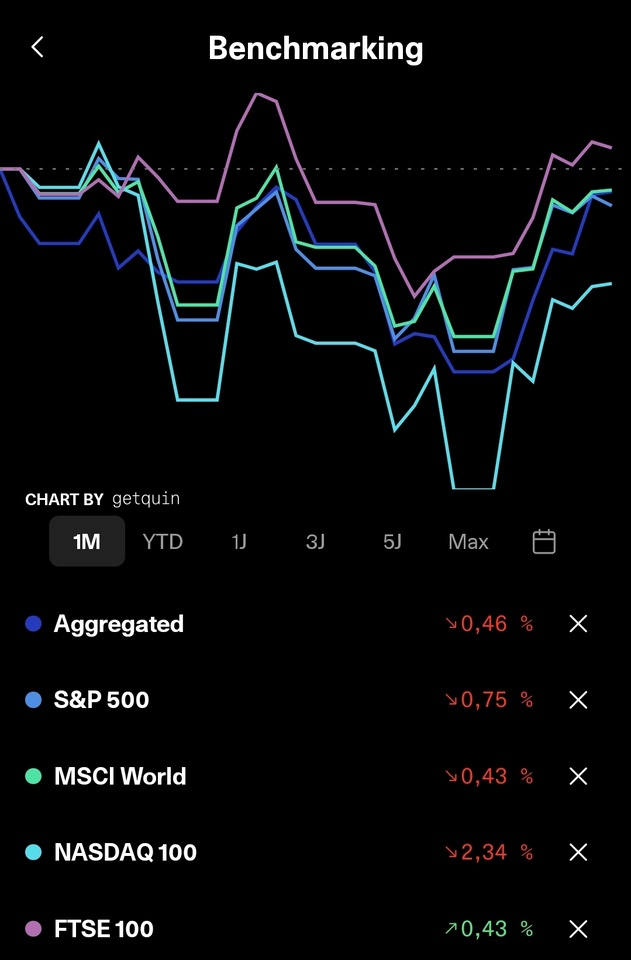

...whereas my benchmark closed the month at -0.46% as at 30.11.2025 🤷🏻♂️

I can't quite put this together yet, but I assume that the cut-off date for the calculation was different from 30.11. or that gross dividends are also used in some cases 🤷🏻♂️

Be that as it may, for me the benchmark is the measure of all things in this context and the month ended with -0.46% 📉

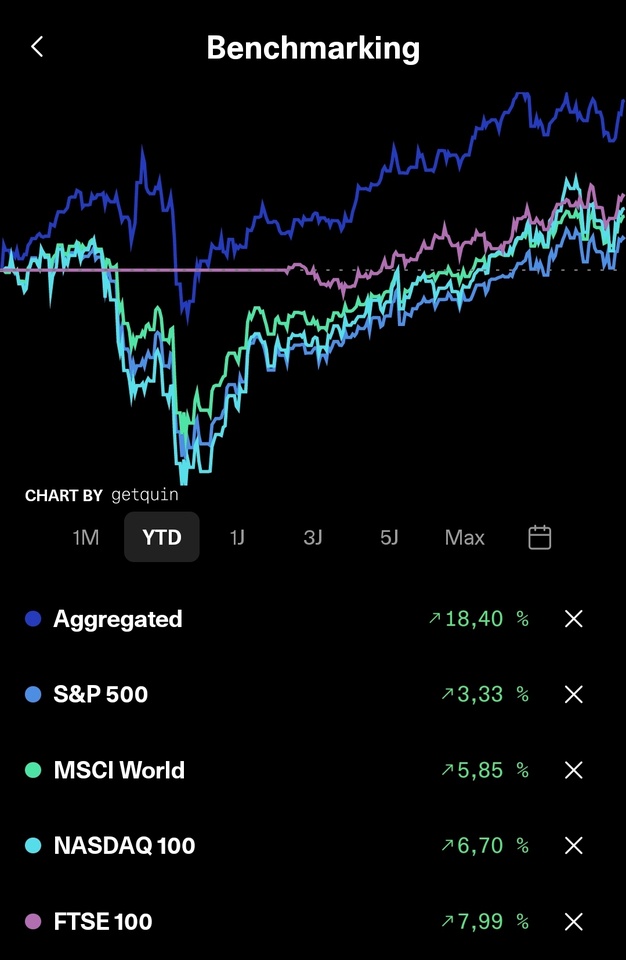

A year-end rally also looks different to me, but all in all I'm quite satisfied with the annual results so far and am close to the lower range of my targets, which have been raised twice so far...

...over the year as a whole, I'm also quite satisfied so far and am on a par with or a nose ahead of the Nasdaq, although my portfolio is anything but tech/growth-heavy 😅

If things continue like this, I see myself well on the way to the first 100k 💪🏻

And if things go really well, this goal could even be reached during the term of office of the Orang(e)-Uta 🍊.

But as we all know, things often turn out differently than you think, so keep spitting in your hands and looking ahead...

In terms of dividends, the month also looked a little better again:

》Gross: € 217.01

》Net: € 176.09

》Yield (TTM): 6.033%

》YOC (TTM): 6.928%

These two values would actually be a little higher, but with every further purchase without a dividend received, they naturally fall again slightly 😉

》Total net dividend: € 1479.94

》CAGR: 495.30%

All in all, after 2 1/2 years, I think it's still easy to bear and should continue to rise steadily in the future, or rather, "the squirrel feeds on hard work" 🙂

》My top 3 this month:

🟢 $BATS (-2,17%) +14,16% (+100,07%)

🟢 $DTE (-1,89%) +1,35% (-1,57%)

🟢 $WINC (-1,89%) +1,30% (+5,31%)

》My flop 3 this month:

🔴 $3750 (+1,7%) -16,35% (+47,92%)

🔴 $YYYY (-0,9%) -7,34% (+3,70%)

🔴 $VAR (+1,23%) -5,49% (+1,01%)

》Disposals:

none

》Additions:

none

》Increased:

Apart from that, there wasn't really much else new, except that my CT scan in November turned out well and my next check-up is due in a week's time.

With this in mind, I wish us all a wonderful pre-Christmas period and a good end to the year...stay tuned 📈👋🏻