In Part 1 I described my start as an investor from 2010 to 2016. Despite loss-making investments and bad decisions (buying AT&T instead of Amazon), I was able to achieve a portfolio value of €35,000. These experiences were to lay the first foundation stone for my future successful investment strategy (https://app.getquin.com/de/activity/PElWrODsmV)

In part 2 I talk about further setbacks in 2017 and 2018 and how the purchase of MasterCard shares marked the turning point in my investment career. Despite initial losses and professional dissatisfaction, I realized that my original strategy wasn't working and discovered the "dividend growth" for me. With a new professional position and a solid salary, I was finally able to really hit the ground running in 2019 (https://app.getquin.com/de/activity/LUkWiLtZKX)

In part 3 it will now be about the years 2019 to 2021 will be discussed. In these 3 years, my portfolio has increased fivefold. From €40,000, it went up to €199,000 in the meantime. But not everything was positive here either. During this time, I also made the two worst trades of my investment career. In addition to Wirecard, there were two other equity investments that resulted in losses of over 80%.

The year 2019 & the first share savings plans:

The year 2019 started with a portfolio balance of ~€40,000 and after my MasterCard purchase in December 2018, my major portfolio reorganization was to continue directly at the beginning of 2019. So in the first four months with Tencent $700 (+2,88%)

Intel $INTC (+2,9%)

Salesforce $CRM (+0,18%)

Alphabet $GOOG (+3,79%) and Meta $META (+1,79%) (then still Facebook), five more tech stocks were added to my portfolio. In return I have BHP Billiton $BHP (+1,16%)

Macy's $M (+3,29%)

and Hugo Boss $BOSS (-0,22%) sold.

Later in the year, the shares of Mercedes $MBG (+0,63%)

and AT&T $T (+1,16%) were also removed from the portfolio.

In addition to further acquisitions such as Pepsi $PEP (+0,32%)

Nextera Energy $NEE (+4,7%)

or Xylem $XYL (-0,1%) I also recognized the benefits of share savings plans in 2019 and started to set up a pure "savings plan custody account". At that time, this was still done via comdirect or Consorsbank and each savings plan execution cost a fee of 0.75%.

Another sale in 2019 was the Gamestop-share $GME (+1,25%) . Bought in 2016 to have something to do with gaming in the portfolio, but not taking into account that stationary sales are becoming less and less relevant. In the end, the share price fell by 85% - unfortunately, this was long before the memestock hype emerged.

My portfolio rose to ~€67,000 in 2019 and achieved a return of 23%. However, this was still well below the MSCI World and the S&P 500.

The year 2020 - Corona, Wirecard bankruptcy & 100k before 30 in the portfolio

2020 - a year that few of us will probably forget. While everything was still going reasonably smoothly in January and February 2020, chaos was set to break out from mid-February/March.

The first few weeks of 2020 had given rise to hopes of a very positive development in my portfolio. From the beginning of January to mid-February, my portfolio rose by almost €10,000 to €77,000.

Panic then slowly set in from mid-February. I still remember exactly how trading on the US stock markets was repeatedly suspended for short periods and daily losses of 10% were normal. At 0 o'clock sharp, I looked at the US futures and in seconds the futures went down by -5%. A cap for the futures, the futures loss must not be higher and you knew the next morning it would end badly for the DAX.

But when there is blood in the streets, you can make very good deals! So in March 2020 I bought the Allianz

$ALV (+1,01%) for €118. This gives me a personal dividend yield of almost 12% based on the current dividend of €13.80. Unfortunately, I only bought for €1,000 in total.

Also Starbucks

$SBUX (+1,16%) I was able to buy for less than €50.

The stock market crash continued until the Fed made short work of it and ended the crash single-handedly. The crash was ended with interest rate cuts and massive money printing and once again the saying "Never bet against the FED" proved to be true.

The stock markets then went through the roof and within a very short space of time were already back to a positive level compared to the end of 2019. Every share that somehow falls under the term "stay at home" was suddenly the hot tip on the stock market. Whether the Peloton $PTON (-0,45%)

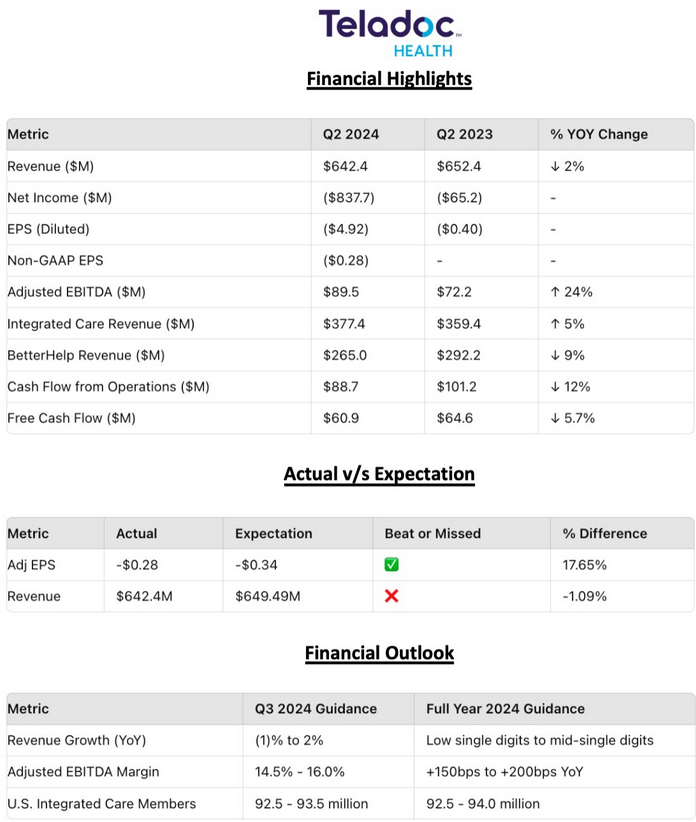

or Teladoc $TDOC (-5,06%) everything went through the roof.

I let myself get carried away and did about 10 "Stay at Home" hype stocks into a growth savings plan portfolio. Of these, at the end of 2024 with Sea $SE (+3,95%) and MercadoLibre $MELI (+5,8%) only two shares remained. It goes without saying that most of them left the portfolio at a loss.

But 2020 was also the Wirecard year $WDI BaFin's ban on short selling, a year-long audit by EY, political backing and massive investments by German fund managers from DWS, UnionInvest and Deka vs. a journalist from the Financial Times.

Wirecard's claims that the journalist was in cahoots with short sellers and the backing from various institutions were unfortunately too credible for me.

When Wirecard faced the press and announced that EUR 2 billion could no longer be found, things went downhill and it became clear to everyone that the company was heading for insolvency. Before trading was suspended, I was able to sell my shares at a 50% loss and got off lightly.

Later in the year, I was able to conclude an extremely favorable leasing offer and sell my private car. The proceeds went straight into my securities account and I broke the €100,000 barrier in November 2020.

My portfolio then ended the year with a value of ~€120,000. At +5%, my performance was pretty much in line with the MSCI World.

The year 2021 - HYPE! Wall Street bets, crypto and almost 200k in the portfolio

The year 2021 was characterized above all by hypes. Cryptocurrencies, memestocks and memecoins were in the headlines everywhere. Gamestop, Dogecoin, SPACs and NFTs everyone had to have.

Traditional shares became almost boring.

One of the reasons was certainly the checks that the US government issued to its citizens. It was still Corona, many were locked down and suddenly people started gambling on the stock market.

The hype can be illustrated very well using the example of NFTs. In 2021, NFTs worth $17 billion were traded, in 2023 it was only 80 million - a decline of 97%. According to one study, ~95% of all NFTs are now completely worthless.

The madness in one example: Procter & Gamble launched a Charmin toilet paper NFT. This was sold for over $4,000. All proceeds were donated, but a symbol of the madness of 2021.

From a portfolio perspective, 2021 was great! In the end, there was a +32% return and a portfolio value of over €190,000, which at times in November 2021 was €199,000.

My top performers were NVIDIA

$NVDA (+2,2%) with over 100% price gains and Pfizer $PFE (-0,28%)

, which was driven by the vaccine hype and at €50 was twice as high as in 2024.

My worst performer was another 80% loss with TAL Education $TAL (-0,46%) . An education company from China. Unfortunately, this was the first time I was able to experience the political arbitrariness in countries like China. Overnight, it was decided that education/tutoring could only be run as a non-profit. Of course, this was almost a death sentence for the company and the share price plummeted by 80%.

Asset development & return:

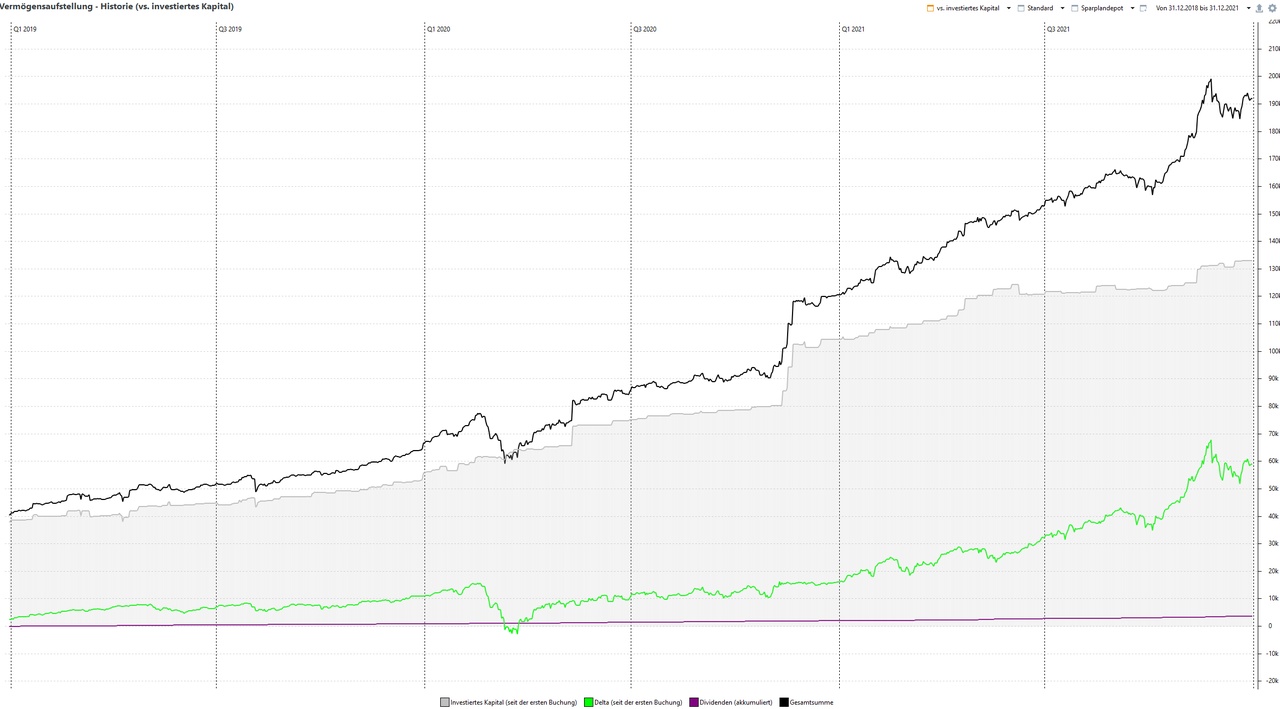

After the years 2013 to 2018 were forgettable in terms of returns, the years 2019 to 2021 finally delivered:

Year

Deposit value

Yield

2019 67.000€ +19%

2020 121.000€ +5%

2021 193.000€ +34%

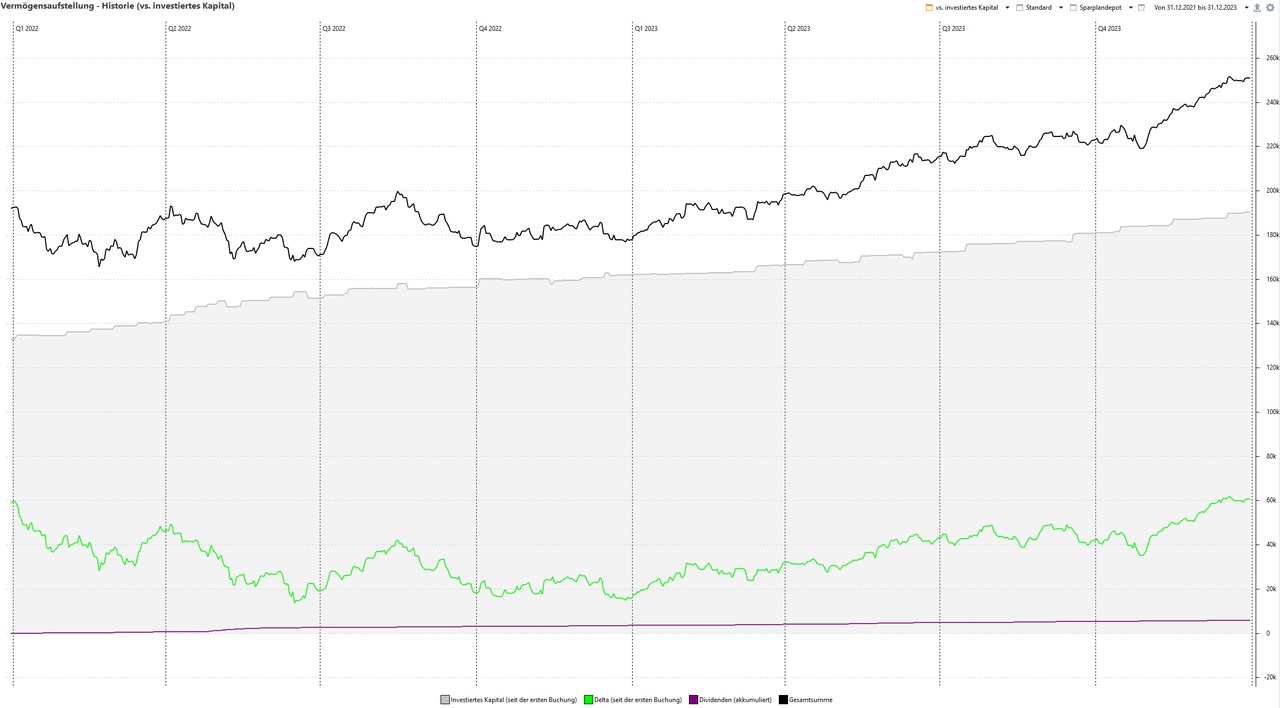

Vermögensentwicklung 2019-2021:

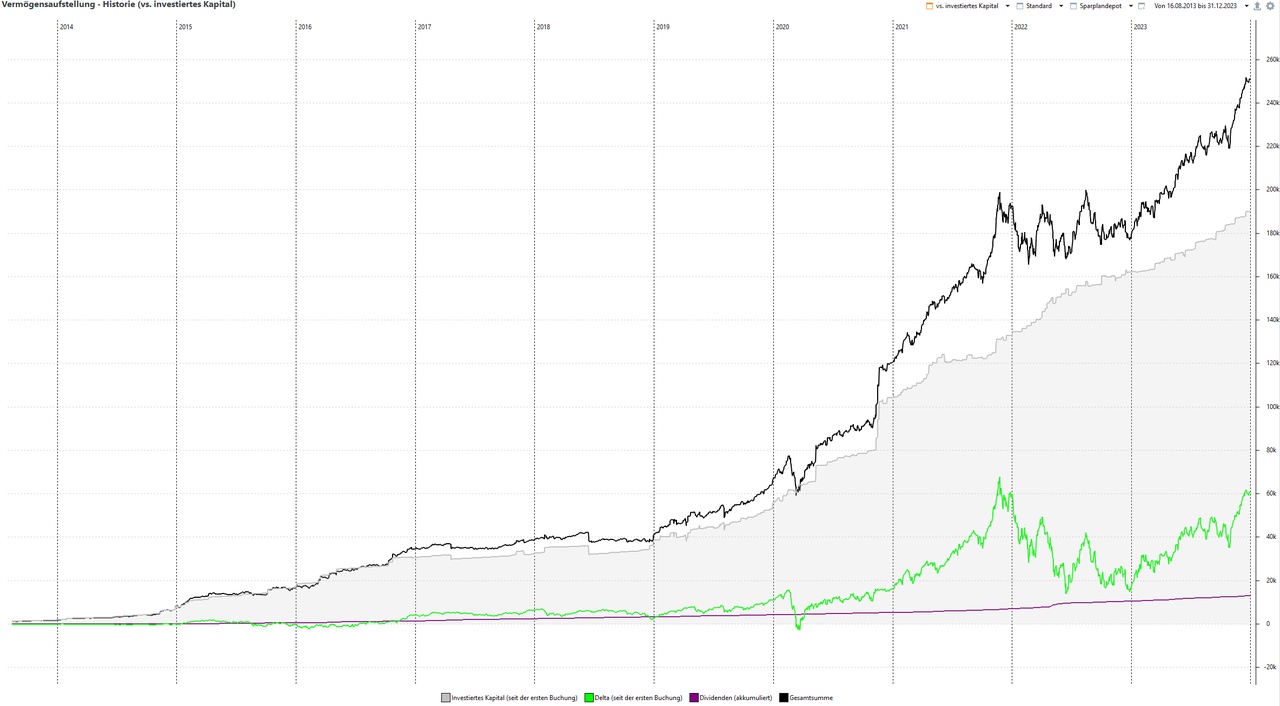

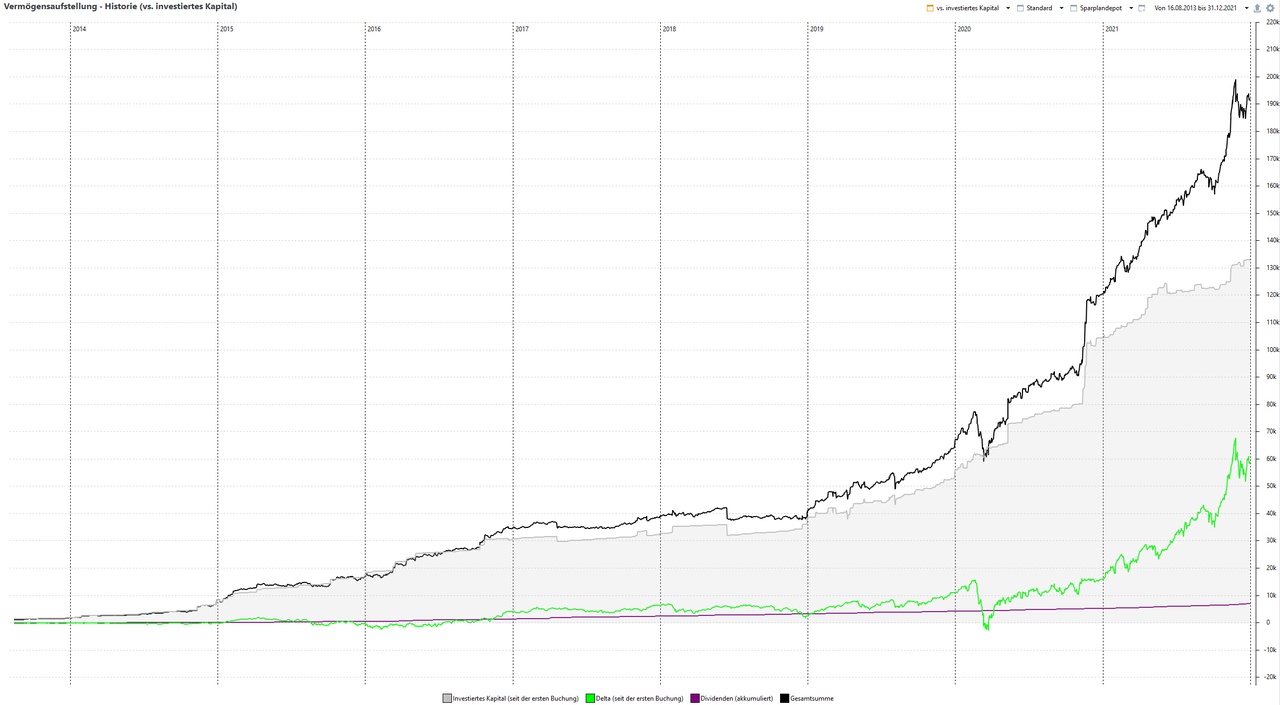

Vermögensentwicklung 2013-2021:

Outlook:

Looking back on the hype year 2021, it is almost obvious that 2022 had to be clearly negative.

After the party, however, came the hangover in the form of inflation and the war in Ukraine. Sharply rising interest rates and global economic concerns did the rest.

In the next part, I would therefore like to look at the years 2022 & 2023. I will then combine 2024 with my review of the year in the last part.

#strategy

#personalstrategy

#etfs

#dividends