As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/QvY4eZ7BttA?si=jKeG5vZruYFgmdWh

Monday:

Germany continues to invest too little. In real terms (after deducting inflation), private AND public investment (despite 'special funds') was at the same level as in 2016. It is clear that without growth, the state will also be able to invest less money. Without investment, however, growth potential will be further restricted.

Tuesday:

It may not be a free trade agreement, but at least there is a trade deal between the EU and India. Among other things, car tariffs of more than 100% in some cases are to be gradually and significantly reduced. Among other things, this will reduce the EU's dependence on China.

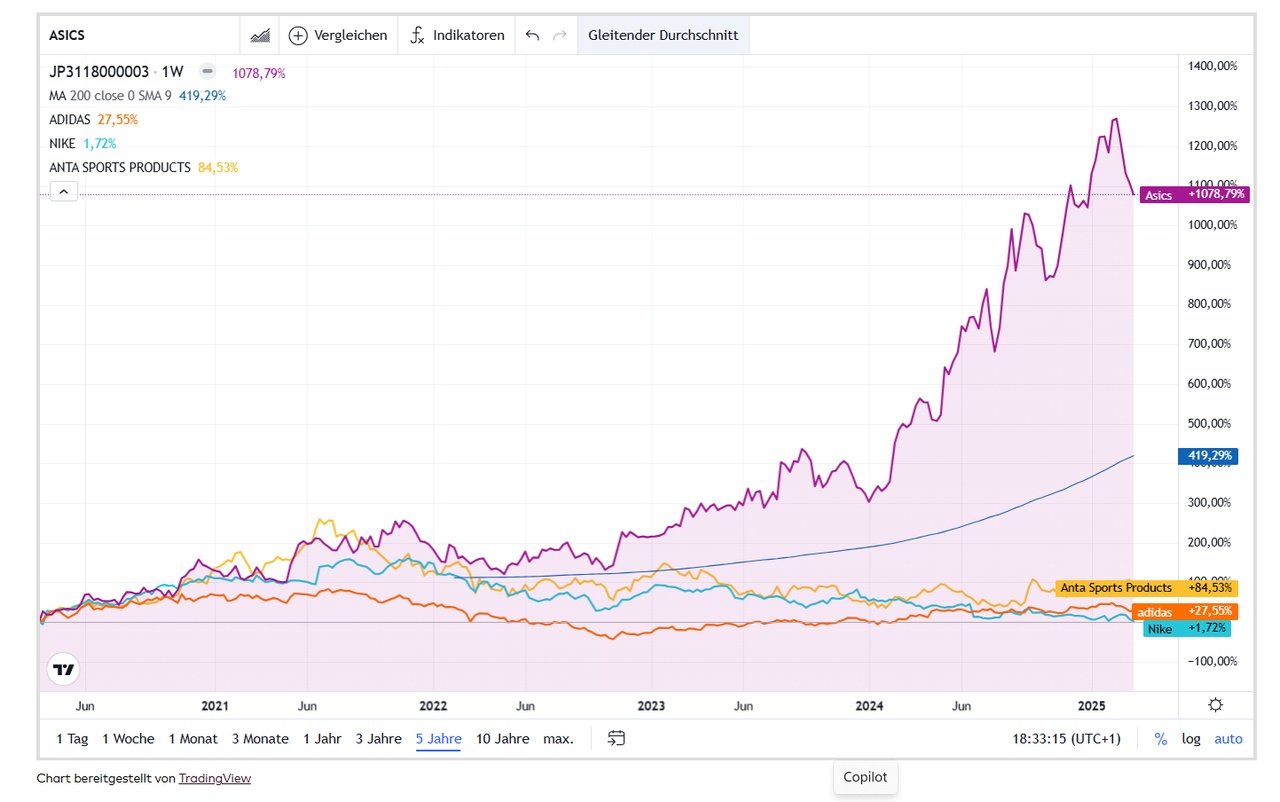

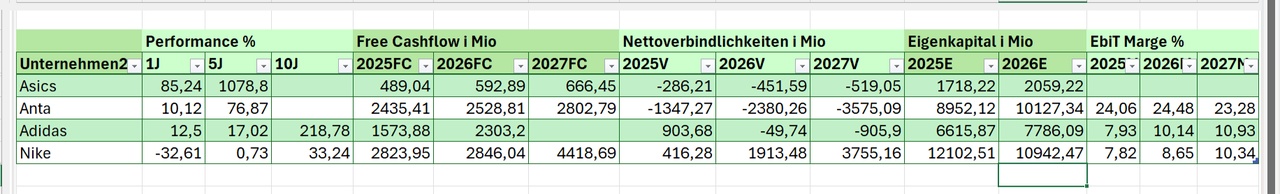

The Chinese group $2020 (-1,62%) Anta Sports acquires a 29% stake in Puma. Anta from Jinjiang has also acquired Jack Wolfskin & Fila, among others. Via Amer, it also has stakes in Arcteryx, Salomon, Peak Performance and Wilson.

Wednesday:

The continued strength of the euro against other currencies increases the likelihood of an interest rate cut by the ECB. A strong currency makes imports cheaper and thus ensures a lower inflation rate.

Despite great pressure from the White House, the Fed pauses its interest rate cuts. The key interest rate thus remains at 3.5 - 3.75 %.

https://www.bbc.com/news/articles/c9wxedz9v22o

Friday:

Donald Trump nominates Kevin Warsh as the new chairman of the Fed. In doing so, Donald Trump is also listening to the voices on Wall Street, who also favor Warsh. Among other things, Warsh wants to reduce the Fed's balance sheet and print less money in order to curb inflation. This is another reason why gold fell significantly today.

These are the most important dates for the coming week:

Monday: 08:00 Retail trade (DE)

Tuesday: 11:00 Inflation data (EUR)

Wednesday: 14:15 Interest rate decision (ECB)