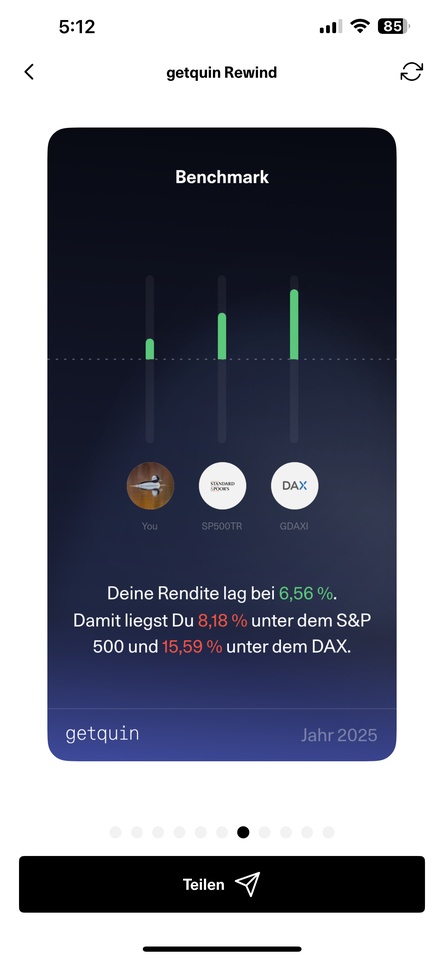

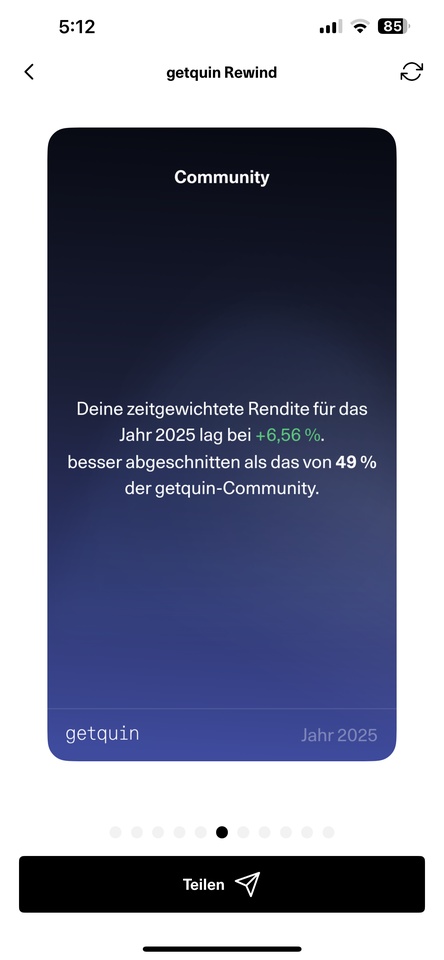

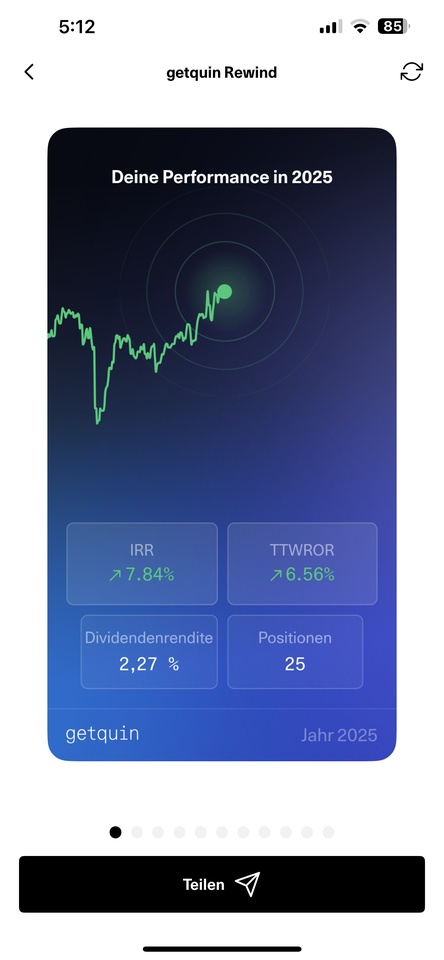

Since it's obviously a trend, I'll join in 😁 Not great in terms of performance, but I don't have to bury myself in shame either. $GOOG (-0,06%) and $SZG (+2,92%) were top performers this year, $WEN (+2,61%) , $AMP (-0,6%) and $CLX (-0,96%) then spoiled my balance sheet again. But all in all, I still achieved what I wanted. If I had to give myself a school grade, it would probably be a 3+, which you forget in 2 weeks 😁.

Amplifon

Price

Discussione su AMP

Messaggi

9Amplifon repurchased

The hearing aid retailer Amplifon took a real beating after a quarterly report about four months ago and has more or less gone sideways since then. Nevertheless, I think and hope that business will pick up again soon, and in my opinion things don't look that bleak. Demographics, but also general noise pollution, indicate that demand is increasing and hearing aids are becoming less and less of a taboo. The share price has already come under pressure when Apple announced that the new AirPods would have a hearing aid function, but I don't think that an AirPod will appeal to customers who rely on hearing aids. So I'm expanding my position a little. Let's see.

A quarterly report that hurts...

$AMP (-0,6%) is actually one of my "favorite stocks". However, yesterday's quarterly report was really not good at all. Sales growth of only 1.6%, profit down by more than 3%, more debt and a program to reduce the number of stores after strong expansion. Annual targets have also been withdrawn.

The current share price drop of ~25% compared to the presentation seems a bit too heavy for me, but I can absolutely see that this was really not a good report and that's just the way the stock market is. I think it's also the biggest one-day drop in my portfolio in over 2 years. I would still like to hold on to the investment for the time being, even if additional purchases are out of the question for the time being.

Do you remember any particularly painful quarterly figures for your investments?

📆 Review May 2025

💹 Performance #mai25

- Monthly performance: +5,4 %

- Annual target: +15 %, currently at -3 %

- IPQ (Investment Progress Quota): 116,9

- Robo-Advisor overall performance: +24,9 %

- Exchange rate CHF → EUR: 1 franc = 1.07 euro

🔍 Highlights in May

- Hot factor favorite: Ferrari

- King Midas factor: Xpeng

📈 Investments & changes

🧾 Individual shares, ETFs & savings plans

The savings plan currently only runs on Cheesecake Factoryas already reported last month.

I have fully built up my savings buffer and am now starting to buy into my old portfolio. Many people will say: "That doesn't make any sense" - but it does for me! I started this month with my personal Fallen Angels this month.

First performance:

- $V3V (+2,91%)

Vita 34: -0,25 % - $AMP (-0,6%) : +20,8 %

- $VOW (-1,41%) : +33,9 %

- $AML (-0,15%) : +17,9 %

- $Cerespower: +29.7 %

Before the penny stocks catch their breath: in June it's Waste Management is back in the portfolio.

🪙 Crypto

- Partial sales & portfolio adjustments

🖼 NFTs & music rights

- NFTsNo new developments

- Music rights (Globalrockstars): No new shares

⌚ Timeless

- One new share in Cartier Tank - thanks to discount coupon 🤑

🍷 Winery

- No news

💡 Crowdcube

- Relai-Update: For each share there were 12 new shares. Current status: +95 % ✅

🃏 Pokémon cards

- New set "Eternal Rivals": Immediately sold out mercilessly at RRP

✉️ Job & application

- I might apply for a deputy manager position - but not ready yet.

💰 Interest (Vivid)

- New interest model: Interest is still available from €10,000 - but only at a reduced rate.

🎙 Podcast

- Season 3, episode 1 is online: "Financial goals"

🏠 Real estate

- No new developments

🏎 Travel report: #Formula1inBarcelona

As some have seen here: I was at the F1 race in Barcelona.

Short version: result okay, but unfortunately no Ferrari win.

Lesson for life: In future I will only book grandstand seats. Why?

It was brutally hot and although I was there 7 (!) hours before the race started, I was asked 10 minutes before the start to "please make some room". 20 minutes later the space was free because the guy was too hot. Thanks too.

Then there was the parking lot chaos:

- Saturday: uncoordinated

- Sunday: The marshals finished work at 6 pm - and there were minor crashes, endless traffic jams and sheer chaos. We stood in the parking lot for 3 hours.

🧾 Financial facts about the trip:

- Trip (ID.4)10 hours there & back

- Toll France (there & back): 2× 77,70 €

- Charging costs: 7x charging → 223,90 €

- Total distance: approx. 2,400 km

- Fuel prices: Petrol €1.26, diesel €1.14 → significantly cheaper than in DE

- Parking fees:

- Race track: 80 €

- Hotel: 18 €

- Hotel with breakfast (13 km from the track): 232,35 €/person

- Food on the course: 8-13 €

- Evenings:

- All-you-can-eat sushi: 19 €

- Tapas: 25 €

- Ice cream: 3 €/scoop

- Soccer eveningPSG vs. Inter 5:0

- Cigars + cocktails at the bar2 thick cigars + disgusting 50/50 mix 😅

🔭 Outlook for June 2025

Two weeks vacation to the North Sea. Afterwards, the tax consultant is waiting for our annual financial date.

💬 And what about you?

How did your May go?

📌 If my content or anything else annoys you - use the block function 😉

🎉 If you're celebrating my trip - leave a follow!

Thanks for reading & see you soon! 🙌

Fuel prices make me happy

The children's ice cream consumption is already bringing tears to my eyes 🤣

Sonova publishes annual figures

📊 Key financial figures (FY 2024/25) - $SOON (+0,21%)

- SalesIncrease of 6.6 % to CHF 3.87 billion, exceeding analysts' estimates of CHF 3.84 billion.

- Adjusted EBITA: Increase of 4.7 % to CHF 807.8 million, slightly above the consensus of CHF 804.9 million.

- Gross marginImproved to 71.9 %, an increase of 50 basis points compared to the previous year.

- Organic growth: 4,5 %

- Contribution from acquisitions: 1,4 %

These results reflect a solid performance, particularly in hearing aids, supported by the launch of a new product platform in August.

🔮 Outlook for the 2025/26 financial year

- Sales growthExpected between 5% and 9% at constant exchange rates.

- EBITA growthForecast between 14% and 18%, also at constant exchange rates and adjusted for special effects, but including restructuring costs.

These forecasts are based on the assumption that no additional significant customs duties will be introduced.

👥 Management change

CEO Arnd Kaldowski will step down in September 2025 for personal reasons. Eric Bernard, former CEO of WS Audiology, will take over the position from October 2025.

📈 Market reaction

Sonova's share price performed positively following the publication of the results, indicating investor confidence in the company's strategic direction and future growth prospects.

Overall, Sonova presented solid annual results with a promising outlook for the coming financial year, supported by innovative products and a strategic realignment in management.

Competitors:

$DEMANT (-3,66%) /$AMP (-0,6%) / $GN (-2,37%)

Own investment:

Total: CHF 1,045.72 (x4 shares)

Invested: CHF 936.80

Price gain: CHF 108.92 (11.63 %)

Realized gain: -

Total return: 113.07 CHF

Buy In: 234.20 CHF

Invest is currently not being increased. But I am a big fan, $SOON (+0,21%) to hold. Hearing aids are not only relevant for the ageing population, but also increasingly the protection of hearing and "perfect enjoyment of sound" as a luxury movement.

🔙 A look back: April 2025

April was another exciting month - time for a little tour of my depot and everything around it:

📊 Performance & figures:

- Monthly performance: +1,12 %

- Annual target: +15 %

- Current IPQ: 118,7

- Hot factor favorite: Ferrari 🏎️

- King Midas Factor: Nexus ✨

- My Robo-Advisor continues to perform strongly with an overall performance of +21,61 %

- And the franc? It currently stands at 1,06 €

💻 Crypto & digital assets:

- In my crypto area there were a few adjustments and partial sales.

- At Timeless I have added the Pattex Philippe Calatrava with a discount coupon.

- NFTs: Currently no new developments.

- Music rights via Globalrockstars: No new shares here either.

- Winery news? No news - all quiet in the cellar 🍷

📈 Individual shares, ETFs & savings plans:

- Some ETF savings plans have been paused, but a new savings plan on Cheesecake Factory

$CAKE (+2,67%) has been launched. - Anyone who has been with me for a long time knows my story: I hadn't bought any individual shares for a long time due to additional costs when buying real estate. The buffer has been back since June 2021 - and I'm starting again!

- I'm starting with the "small" stocks from before - not at the same price, but in the same quantity:

- Coloplast$COLO B (-1,14%)

- Amplifon$AMP (-0,6%)

- Aston Martin$A5S

- Ceres Power$CWR (-4,75%)

- Vow$VOW (-1,41%)

- Vita 34 $V3VJ

These positions also help me to reduce my loss pot to fill up a little again.

📊 Crowdcube investments:

- A few shares in manga.io secured - the nerd in me needed it. 🎌📚

🎴 Pokémon cards:

- I put together small sets from cards I won - and donated them to a school. Giving back a little piece of joy.

✉️ Application & work:

- April was quiet - one week of vacation, 9 days of overtime reduction, so hardly any time in the clinic.

- Unfortunately, it didn't work out with the 50 % position did not work out.

🏦 Interest & podcast:

- Vivid has adjusted the interest rates - from 10k there is now even a gradation of the interest rate, let's see how long I'll be there.

Podcast Season 3 Episode 1: Financial goals 🎧

🏠 Real estate:

- The 5% special repayment for 2025 have been saved up - transfer will go out next week. One step closer to being debt-free!

🔮 Outlook for May:

- Portfolio focus: I'm continuing to build my ETF and moving more into individual shares.

- Vacation: At the end of May I'm going to Barcelona for the Formula 1 race. I'll make a detour to the burger chain I bought shares in two years ago - let's see how things go there. 🍔🏁

And you? How was your April?

📌 If you don't like my investments - use the block function. 👍 If you celebrate my ideas - please feel free to follow! Thanks for reading - see you in May! 🙌

Amplifon

Amplifon is making my start to the stock market year. Despite a moderate performance last year, this is one of my favorite stocks on the stock market. After the last quarterly reports, the share fell, although the course of business was actually absolutely fine in my view. For example, a record year was announced for sales, and the company has more stores than ever before. The "threat" of the hearing aid function of the new AirPods added to the negative sentiment. However, I consider both to be an overreaction and hearing aids to be a good investment. We will soon have quite a few old people in many Western countries who may need one or two hearing aids 😬.

Titoli di tendenza

I migliori creatori della settimana