...just 3 months ago the 3rd milestone of 20k was reached earlier than expected, last month we also raised our personal year-end forecast from 23k-25k to 25k-28k and now, 1 month later, we are pleased to have to raise it again.

The new target is now 27k-30k and should the upper limit be reached here, the last 10k would be realized in just 6 instead of 10-12 months.

Some people may smile at this numerical example, but this is still a boring dividend portfolio 🤫

...but a quick look at the facts...

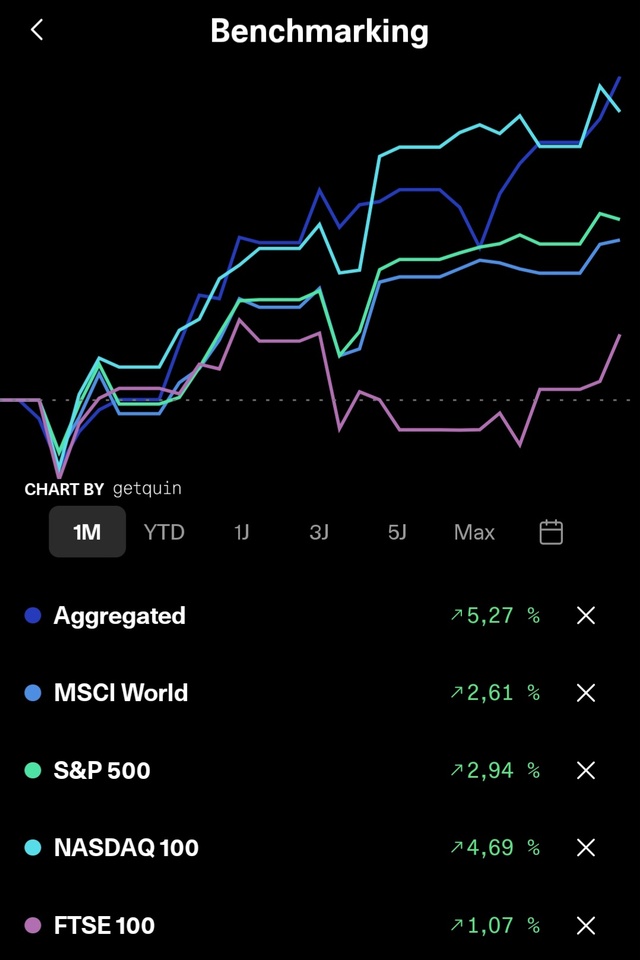

...September, even if it wasn't my strongest month, delivered average results in contrast to the past, but we probably owe that more to the April🍊 correction than to the usual course of events...

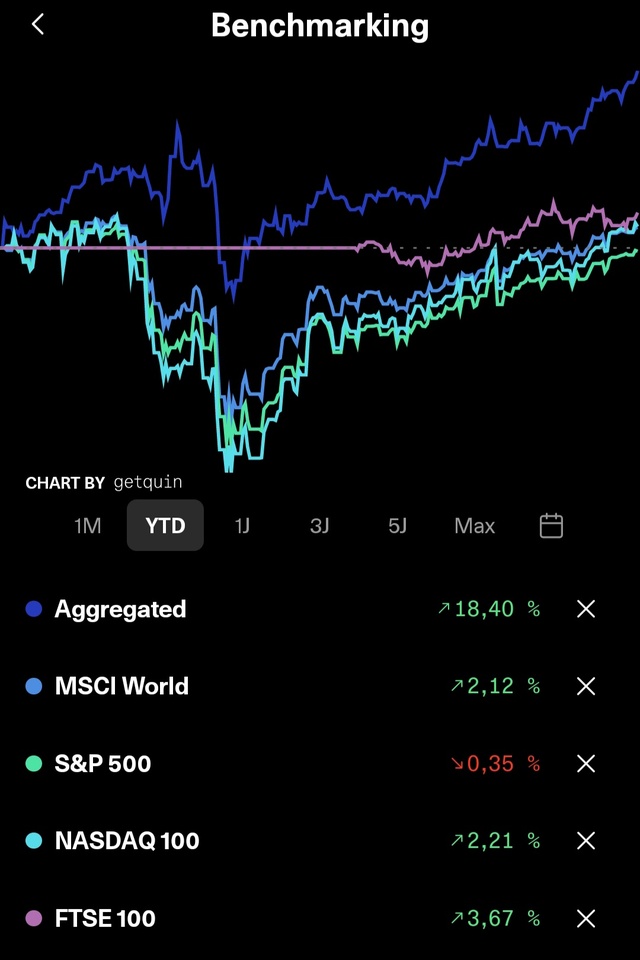

...for the year as a whole, as I mentioned at the beginning, things are still looking pretty good...

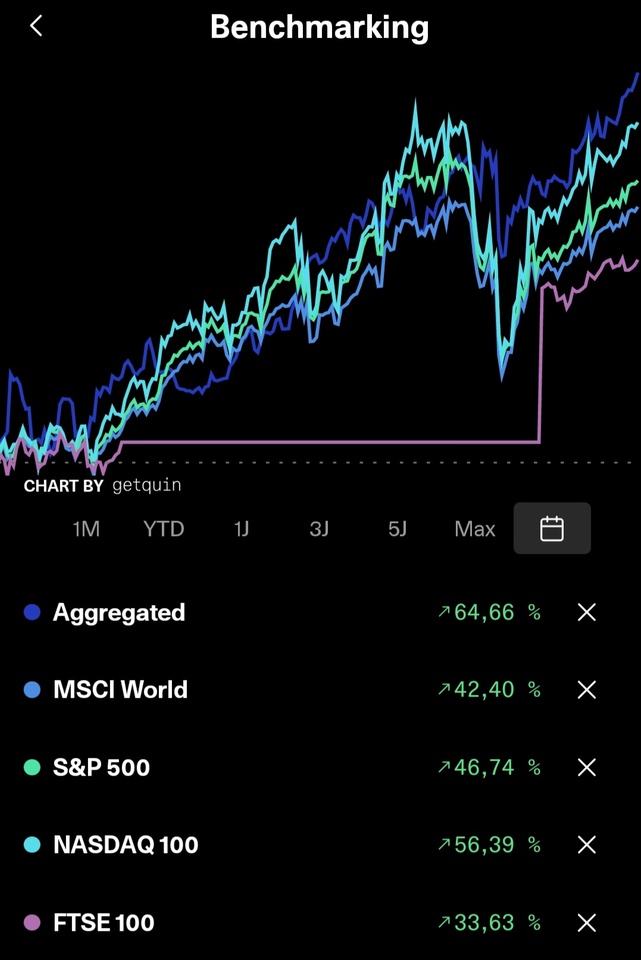

...and more than satisfactory over the entire term so far 🫠

Above all, however, because the currently forecast dividend value for 2026 is mathematically a good ~27% of the average annual investment amount or, to put it another way, this increases by a good ~27% on its own (without taking into account any increases/caps) 💪🏻

Which brings us to the topic of dividends...

...September was a good month and, despite the still modest portfolio value, brought us a monthly dividend of €275.42 net (gross €298.99) for a good reinvest 🤑

There was also a small change to the portfolio itself this month:

》🟢 Top 3

$3750 (-0,87 %) +35,19% (+74,45%)

$HSBA (+1,43 %) +9,41% (+23,42%)

$RIO (+0,67 %) +4,91% (+5,95%)

》🔴 Flop 3

$HAUTO (+0,56 %) -8,32% (+44,10%)

$BATS (+2,33 %) -6,64% (+80,26%)

$1211 (-0,75 %) +1,28% (-16,36%)

》Disposals

》Additions

》Increased

All in all, a good look back at the future 📈

Wishing everyone a nice rest of Sunday and a good UPtober together ✌🏻