This was my last savings plan execution for$HMWO (+0,73 %) and $HMEF (+1,76 %) (not in the picture). The two positions together have reached the size of my $VWRL (+0,63 %)-position and are therefore full.

In February, the first savings plan execution of $XDWL (+0,59 %) and $XEMD (+1,64 %). This will then take place once a month instead of twice a month.

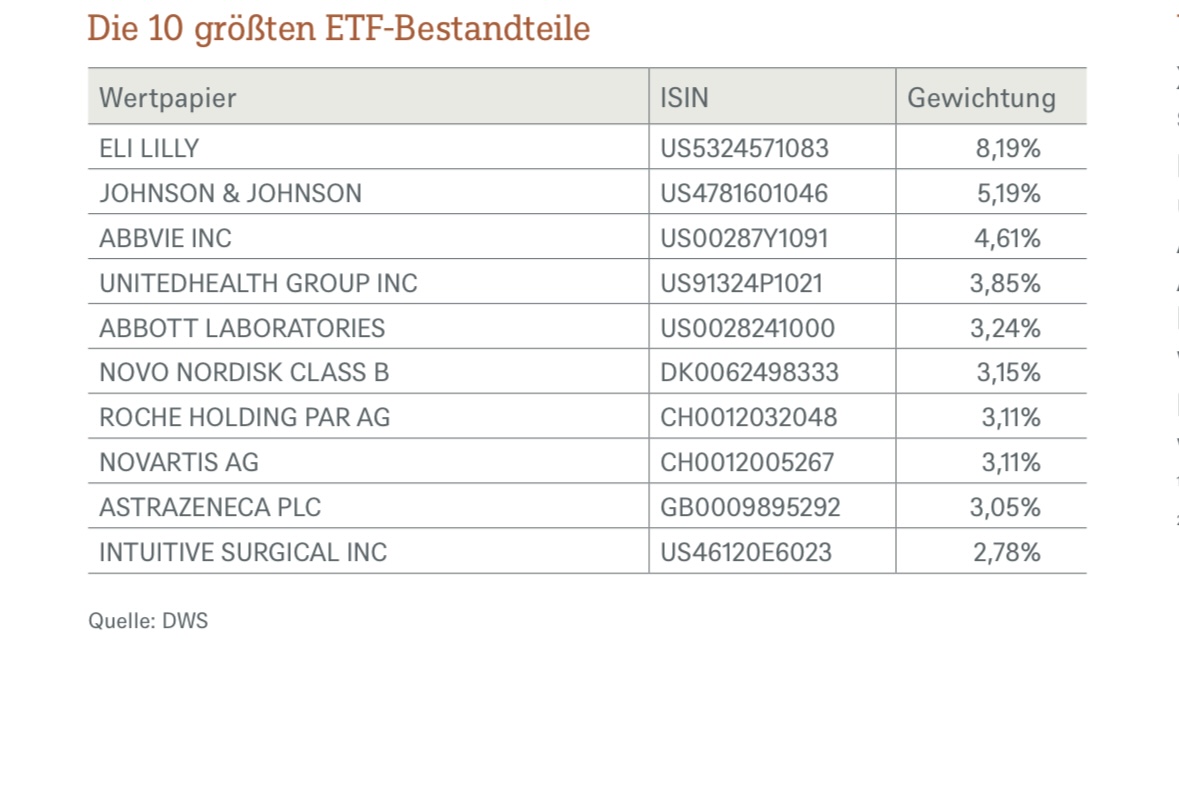

The two smaller savings plans on $WHCS (+0,13 %) and $WITS (+0,45 %) will continue to run, but will also be changed from 2x per month to 1x per month (amount remains identical).

Why I am using several All World ETF / World + EM. Combinations, you can read here: