1) Executive Summary

UnitedHealth Group (UNH) is the largest health insurer and healthcare services provider in the United States, serving ~150 million Americans across insurance, pharmacy benefits, and care delivery. While it is mostly known for being a dominant insurance player, many people forget to mention Optum, a multi-segment growth engine, offering services from pharmacy benefit management over physician networks to healthcare IT. UNH is as diversified as a healthcare operator of that size can be, and in the prime position to capitalize on long-term trends, including rising rates of obesity, diabetes, and chronic diseases, especially in the U.S.

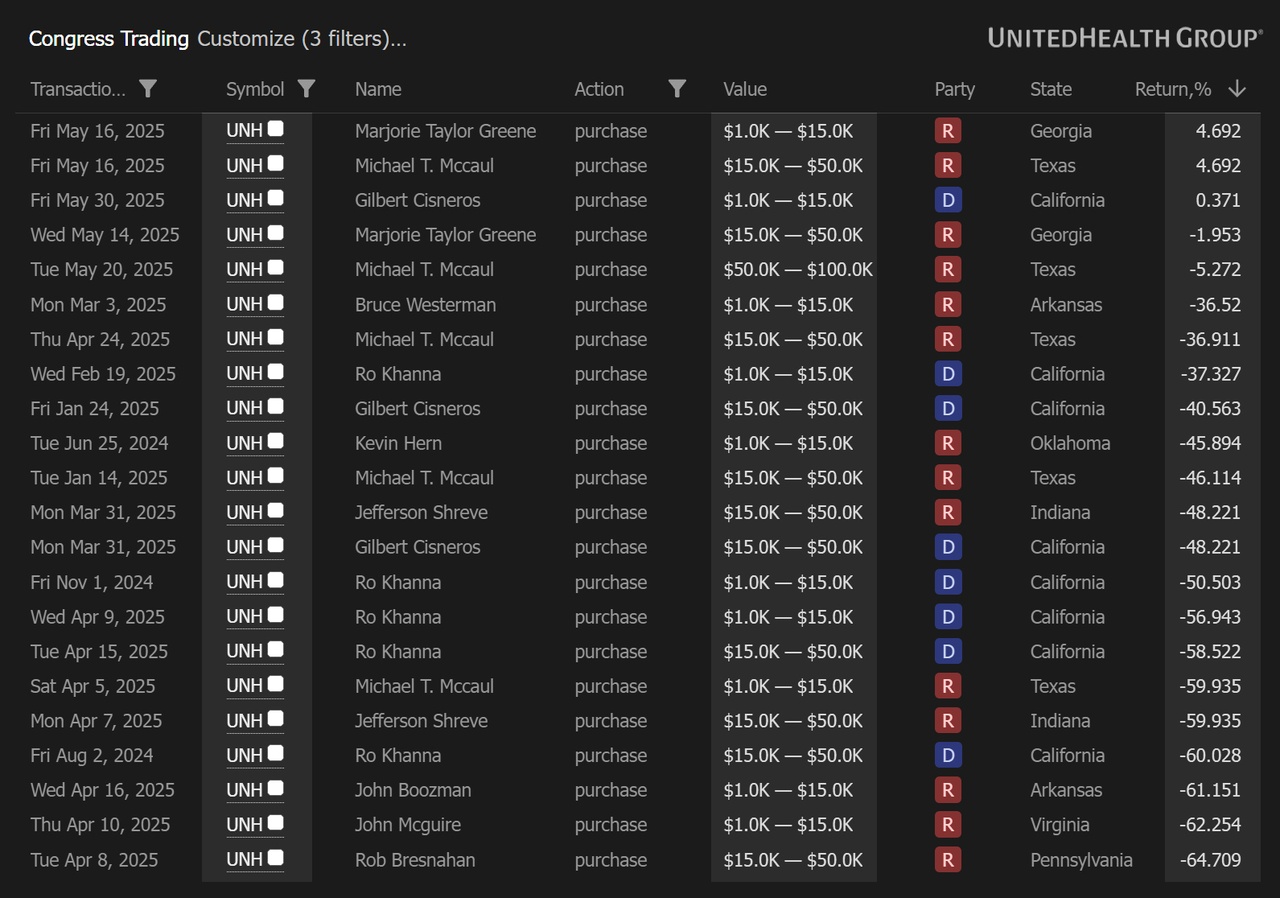

Despite its position, the stock has been under pressure recently, due to a variety of headwinds: unexpected hikes in medical costs, investigation of malpractice by the DOJ, leadership turmoil and the tragic murder of UnitedHealthcare’s CEO Brian Thompson last December. Share prices have declined sharply to under $250, erasing years of premium valuation and gains.

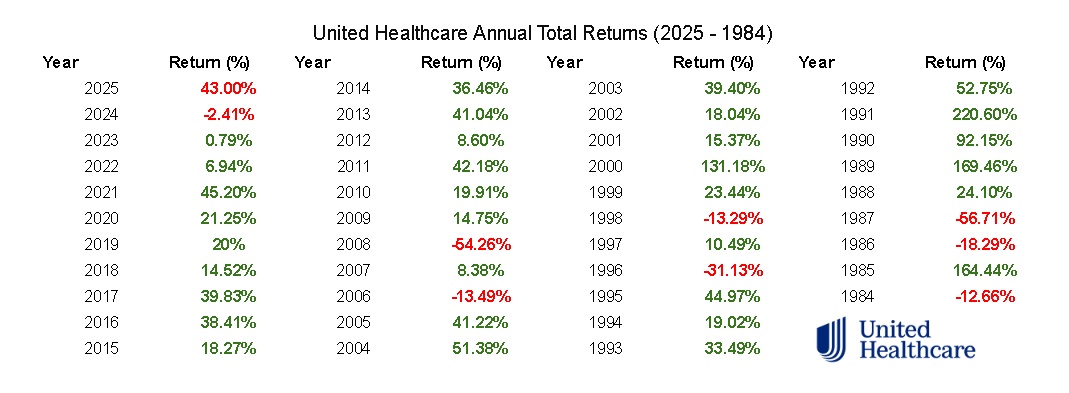

Nevertheless, notable investor Warren Buffett and his Berkshire Hathaway disclosed a $1.6 billion stake in UNH, which he started building up during Q2 of 2025. This is a reminder of the company’s stability, strategic positioning, and persistent undervaluation, which many retail investors fail to recognize. Warren Buffett likely identified these structural tailwinds, and UnitedHealth is, in fact, exactly the kind of company Berkshire Hathaway screens for.

2) Investment Thesis

UnitedHealth is more than just an insurer. It is a healthcare infrastructure conglomerate. Its unique combination of insurance (UnitedHealthcare) and services (Optum) makes it one of the most diversified companies in the entire healthcare sector. There is very little within this industry that UNH does not cover – and they are highly successful with it. Insurance provides data and forms the core of UNH’s business, while Optum drives cost management, care integration, and creates recurring revenue outside of the typical insurance segment.

The company is the largest player in the health insurance industry, dominating the field and combining its experience across all offerings to create a healthcare behemoth. The breadth gives resilience. UnitedHealth is the 9th largest employer in the U.S. and the biggest insurance company worldwide. It is a member of the Dow Jones Index and, until recently, had a market capitalization of $500 billion. Almost half of the U.S. population uses one of UNH’s services, and investors continue to treat it like a dying business.

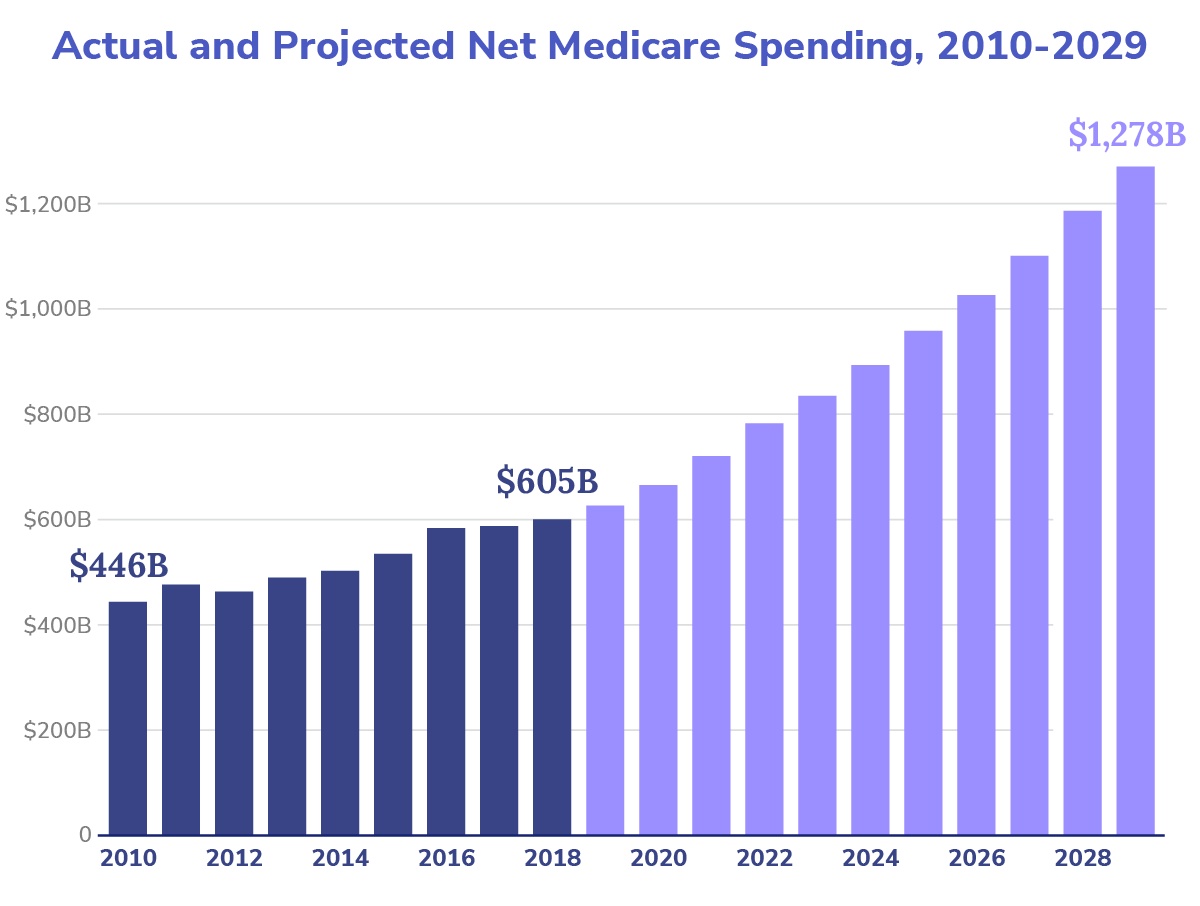

The U.S. healthcare system – by far the largest in the world – spends nearly $4.8 trillion annually (~17% of GDP), which is projected to grow faster than inflation in the coming years, mainly driven by aging demographics, increasingly unhealthy lifestyles, and the rising prevalence of obesity, diabetes, and chronic diseases within society. UnitedHealth sits at the epicenter of this spend and therefore operates in an unmatched position to scale and integrate organically.

The market is overly focused on near-term headwinds, overlooking the long-term potential. It is crucial to remember that UNH’s moat is growing, not shrinking. The stock is trading at a Forward P/E of 18, not only below historical averages, but also significantly lower than the shares of inferior competitors. The company is practically indestructible and still showing robust growth year over year.

3) Growth Drivers

UnitedHealth’s growth is driven by a few solid long-term trends, which not only secure the company’s future but could even help reaccelerate expansion over the coming years. If the execution is right, the stock price could soon reach new highs, fueled by the following catalysts:

Medicare Advantage (MA):

- The fastest-growing segment of U.S. insurance, covering over half of Medicare beneficiaries.

- Currently downplayed, due to a short-term increase in utilization, which should disappear over the next quarters.

Optum Health – Physician Integration:

- Optum Health is building the largest U.S. physician organization, with over 90,000 people already employed – and expanding further.

- As for MA, recent senior utilization hurt earnings, but structurally, physician ownership is a defensive and unwavering asset.

Optum Rx – Pharmacy & GLP-1 Growth:

- Pharmacy spend is accelerating, particularly for GLP-1 weight-loss drugs. By 2030, projections estimate that almost half of the U.S. population could suffer from obesity, and more than 86% of people could be classified as overweight. Similar to my Novo Nordisk ($NVO) theory a few days ago, this will be one of the most persistent trends in the next few years. There is no sign of slowing down, rather the opposite.

- Optum Rx processes billions of scripts annually, benefiting from volume growth in these segments.

Optum Insight – Healthcare IT:

- Since the major cyberattack in 2024, margins are continuing to normalize.

- UNH has incurred $1–2 billion in direct breach costs; apart from that, damage should be manageable, and security has been improved since then.

Macro Outlook:

- U.S. healthcare spending is projected to exceed $7 trillion by 2031, with consistent outperformance of GDP growth.

Demographic and chronic disease prevalence ensures demand growth, regardless of economic tensions, ensuring UNH’s revenue safety in the future.

4) Competitive Position

UnitedHealth’s moat rests on scale, integration, and data. It is the largest insurer worldwide with more than 400,000 employees. This provides the company with immense pricing power throughout its different business segments. However, UNH also integrates its segments successfully. The company owns care delivery, PBM, and IT, which enables better cost control and stickier contracts with employers and governments.

Something that is often overlooked when assessing the company’s moat is its power to collect data. UnitedHealth processes billions of claims, which gives it a unique and unmatched edge over competitors in predicting demographic and healthcare-related trends.

UNH’s moat is further solidified by enormous barriers to entry. Insurance requires capital intensity, PBMs require scale, and physician ownership requires consolidation. Competitors entering UnitedHealth’s field would be years behind, which is why very few attempt to take market share from UNH.

The business is extremely sticky: large corporations, states, and Medicare rely on stability. Switching providers is often not worth the effort and is operationally disruptive. UNH has long-standing relationships with the government and employers, further bolstering its competitive position.

In conclusion, UnitedHealth has the widest moat in the entire industry, and combines the key strengths of its competitors (CVS in PBM, Humana in senior care, etc.) into one massive conglomerate. UNH is the perfect all-in-one investment if you are seeking to bet on the U.S. healthcare sector.

5) Fundamentals

- Revenue: $423 billion (12% CAGR since 2020)

- Net Income: $22 billion (8% CAGR)

- Free Cash Flow: $25 billion (5% CAGR)

- Operating Margin: 7.3% (slightly declining due to higher costs)

- Return on Invested Capital: 8.8% (also slightly declining)

- Dividend & Capital Returns: Consistent dividend growth and opportunistic repurchases, though buybacks paused during cyber fallout

UnitedHealth’s fundamentals underpin its strong position in the market and efficient investment, though they also highlight recent issues, such as an increase in medical costs and Medicaid utilization. Nevertheless, the numbers remain strong and as soon as short-term headwinds fade, margins are likely to recover along with profitability.

6) Valuation

- Price (Aug 2025): ~$300

- Market Cap: ~$280 billion

- Forward P/E: ~18x

- EV/EBITDA: ~13x

- Dividend Yield: ~2.9%

- Buybacks: Historically aggressive

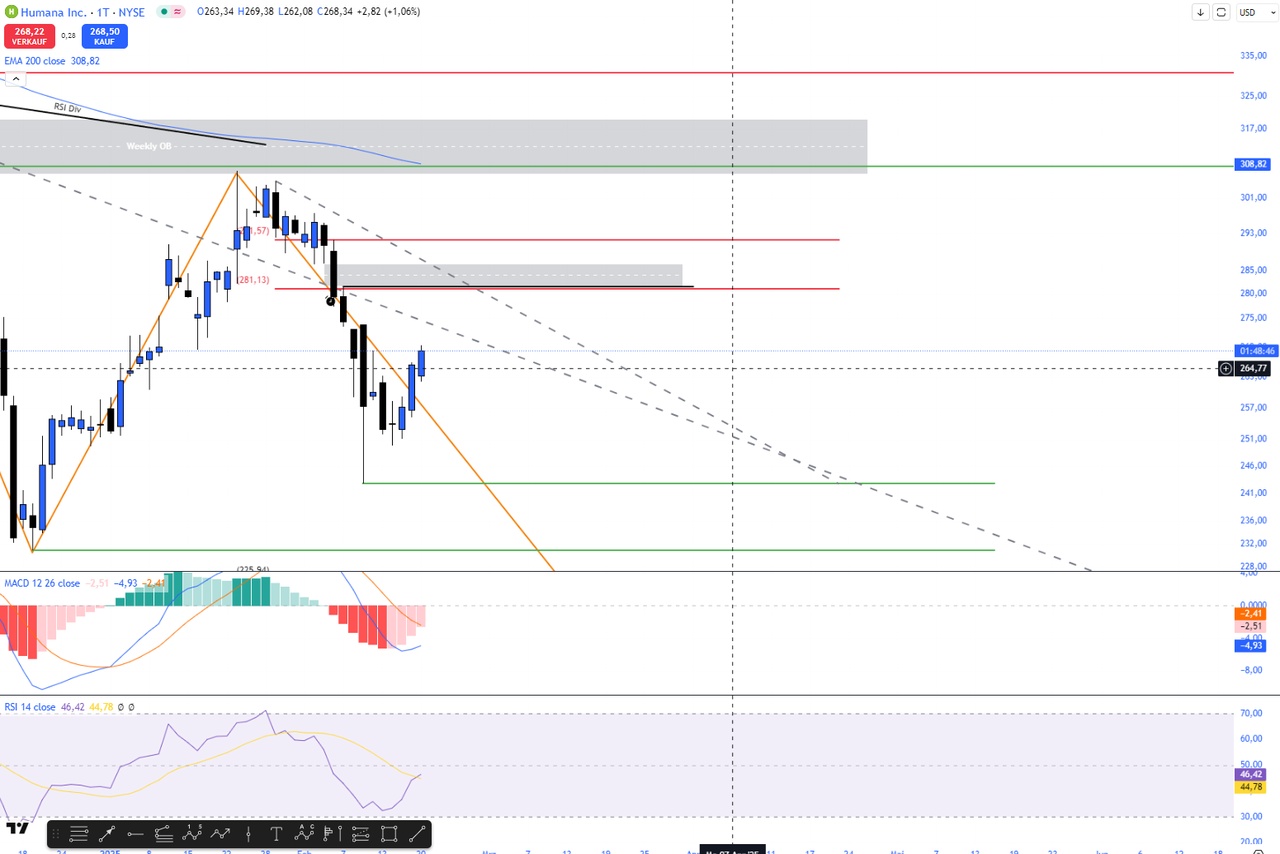

Compared with peers (CVS ~19x, Humana ~22x), UNH typically trades at a premium. Not anymore, since UNH has become prevalent in negative news articles, the stock has dropped significantly and erased its premium. However, the premium position over competitors has not changed, which creates a compelling opportunity based on historically low valuation metrics. Furthermore, management agrees with that premise and continues heavily buying back shares. If investors refuse to recognize the potential in the company, UNH may eventually own itself entirely.

7) Recent Troubles

It is important to highlight why UNH has lost its premium valuation, but equally discuss the mitigation of these problems:

- The first and key issue for the company is unexpectedly high costs; seniors are going to doctors and outpatient centers more often, utilizing Medicare consistently. This development pushes the medical care ratio (MCR) higher, explaining retreating margins.

- An investigation by the DOJ is running criminal and civil probes into UnitedHealth’s Medicare billing practices, which increased pressure on the stock. However, these investigations usually last for years and often end up nowhere. Therefore the risk can be deemed negligible for the near future.

A leadership crisis at UnitedHealthcare as well as the parent company UnitedHealth Group followed the vicious brutal murder of UnitedHealthcare’s CEO in December 2024. The insurance arm had to look for new leadership, while increasing security spending to prevent such tragedies in the future. In a less dramatic case, the group CEO Andrew Witty stepped down for personal reasons, clearing the way for the returning CEO Stephen J. Hemsley. The 73-year-old was reappointed amid this company crisis to lead the healthcare giant back to stability.

8) Catalysts & Timeline

Medicaid costs are expected to normalize again, which would mean margin recovery across all metrics and aid the insurance segment of UNH’s business. While margin recovery for Optum Insight could come from post-hack stabilization, which should restore profitability in the next years.

The DOJ concerns are also likely to be priced out of the stock. Many of the largest companies in the US are regularly investigated by the DOJ and these processes tend to stretch over years – with typically limited outcomes. Leadership change could prove positive, since Stephen J. Hemsley has a strong record and knows how to manage this healthcare giant. Additionally, macro trends remain in place, increasing the need for UnitedHealth’s services year over year organically.

9) Conclusion

UnitedHealth sits in the middle of U.S. healthcare spending, with an unmatched ecosystem of services across insurance, pharmacy benefits, care delivery, and healthcare IT. The company is expanding steadily year over year and integrating its business segments further, using data aggregation and pricing power.

2025 has been a stand-out year for the company, where short-term pressure put UNH’s stock price under stress. On the bright side, this provides long-term investors with the perfect opportunity to own one platform covering the entire healthcare sector. Maybe Warren Buffett’s endorsement was the spark needed for people to understand the resilience and unmatched position of UnitedHealth.

The macro math does not lie: healthcare spending will continue to rise. Demographic trends are undeniable. UNH is perfectly positioned to capitalize on trends such as chronic diseases, obesity, diabetes, and longevity, especially considering its sticky business model, which makes it extremely disruptive to switch away from the company.

In short: UnitedHealth is the healthcare monopoly hiding in plain sight – and right now, it is trading at a discount, not seen regularly for a company of that size.

$UNH (-1,16 %)

$IYY (-0,45 %)

$CVS (-0,55 %)

$HUM (-0,66 %)

$OSCR (-1,47 %)

$NOVO B (-1,95 %)

$NVO (-2,09 %)

$LLY (-0,82 %)