So 1.5 weeks have now passed. The first gimmicks are over and my Watchlist Pie has returned a total of 4.5% in one week. This has now been sold and I have built up a pie to save for the next 8-10 years. I'm starting with 50€ a week until I've completed the broker's test phase. After that I'll ramp it up to about 1k per month.

There are still a few stocks missing, but the big ones will be scaled down a bit. Among others $IREN (-7,48 %) ....

What do you think of the selection?

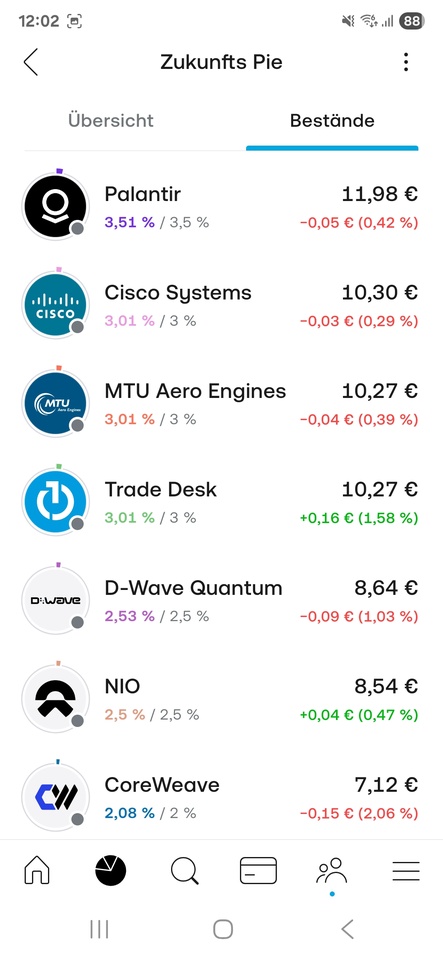

$NVDA (-2,56 %)

$GOOGL (-0,59 %)

$MSFT (-0,48 %)

$AVGO (+0,15 %)

$005930

$AMD (-3,16 %)

$TSLA (-2,04 %)

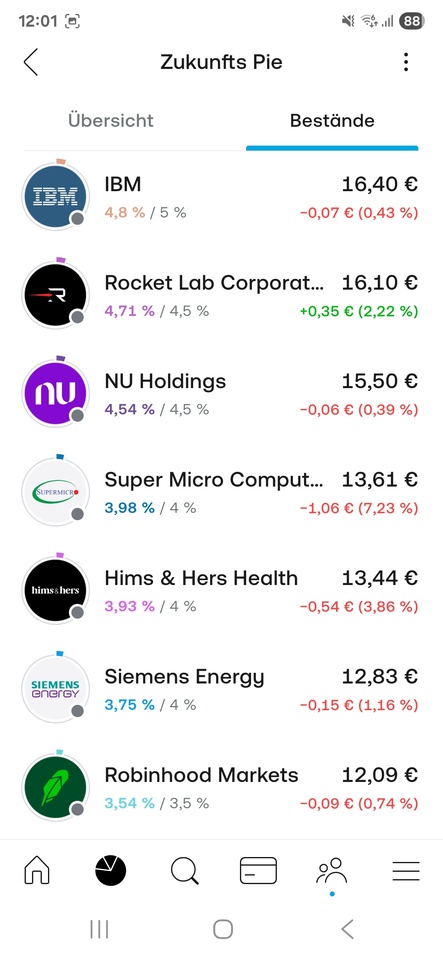

$IBM (+0,64 %)

$RKLB (+0,84 %)

$NU (-0,93 %)

$SMCI (-2,7 %)

$HIMS (-1,1 %)

$ENR (-5,38 %)

$HOOD (-4,81 %)

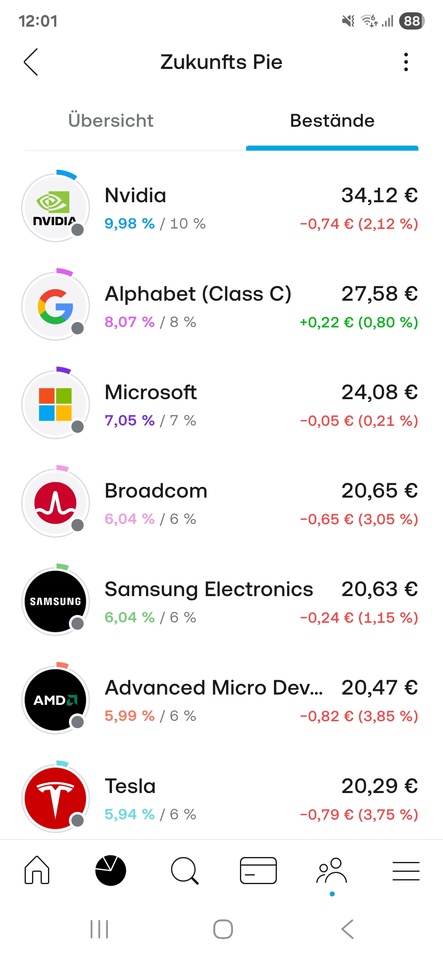

$PLTR (+2,91 %)

$CSCO (-1,86 %)

$MTX (+1,57 %)

$TTD (-2,17 %)

$QBTS (-0,78 %)

$9866 (+1,23 %)

$CRWV (-1,87 %)

And what of course should not be missing is $SIKA (-3,2 %) These are still weighted at 2% 😉 As a craftsman, I really enjoy using the products myself. The technological progress compared to other products such as StoCretec or others is already enormous, but it would go beyond the scope of this article.