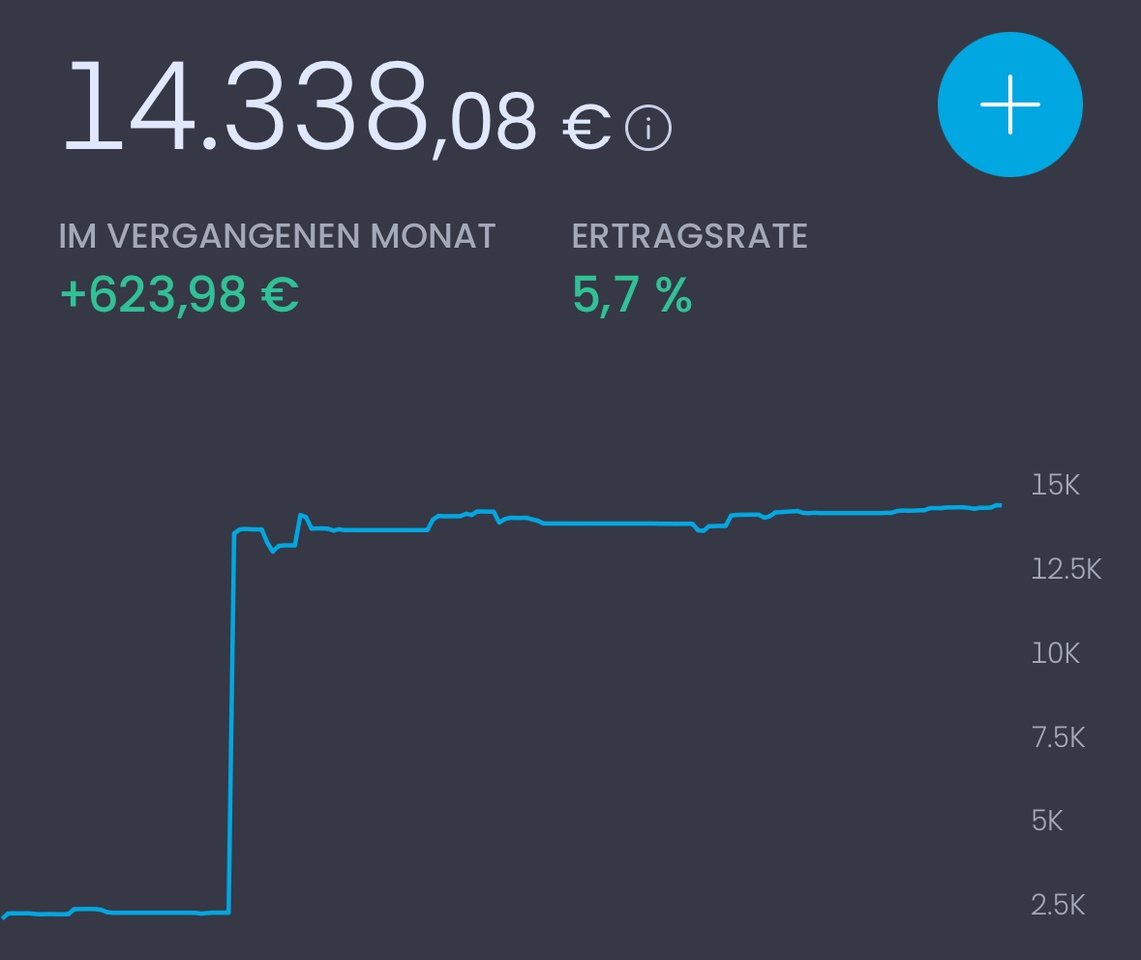

After making my first small investments of a few hundred euros in the stock market in February '25, I added a larger amount in the course of April. It also took some time to develop an investment strategy; where do I want to invest? What risk do I want to take? Accumulating or distributing? ETFs and/or individual shares? If so, which ones and why? Are there specific countries and/or sectors I would like to focus on?

Only at the end of last week were all the answers to these questions clear: a long-term investment horizon of just over 35 years with relatively low risk. A healthy ETF/share mix of 60/40. Distributing portfolio with high-yield and high-growth positions and with a relative focus on the USA and Europe.

I have a good feeling that I am happy with my strategy in the long term and finally no longer have to constantly turn the entire portfolio inside out.

My ETFs and individual stocks are $HMWO (-0,79 %)

$TDIV (+0,07 %)

$DGSD (-0,51 %)

$MAIN (-0,47 %)

$NOVO B (-0,81 %)

$PGR (+3,61 %)

$PSA (+2,09 %)

$UKW (+0,23 %)

$APH (-3,16 %)

$DHL (+0,51 %)

$HSBA (+1,07 %)

$MUX (+1,44 %)

$NEE (-3,59 %)

$ZTS (+0,73 %)

$AFL (+1,45 %)

$O (+0,97 %)

$SHEL (-0,94 %)

$VID (+0,06 %)

$RACE (+0,17 %)

$PLD (+1,97 %)

$OMV (-0,81 %)

$PAL (+0,26 %)

$RIO (-1,82 %) and last but not least $VOW (+0,79 %)

#dividende

#dividends

#etfs

#growth

#personalstrategy

#portfoliofeedback