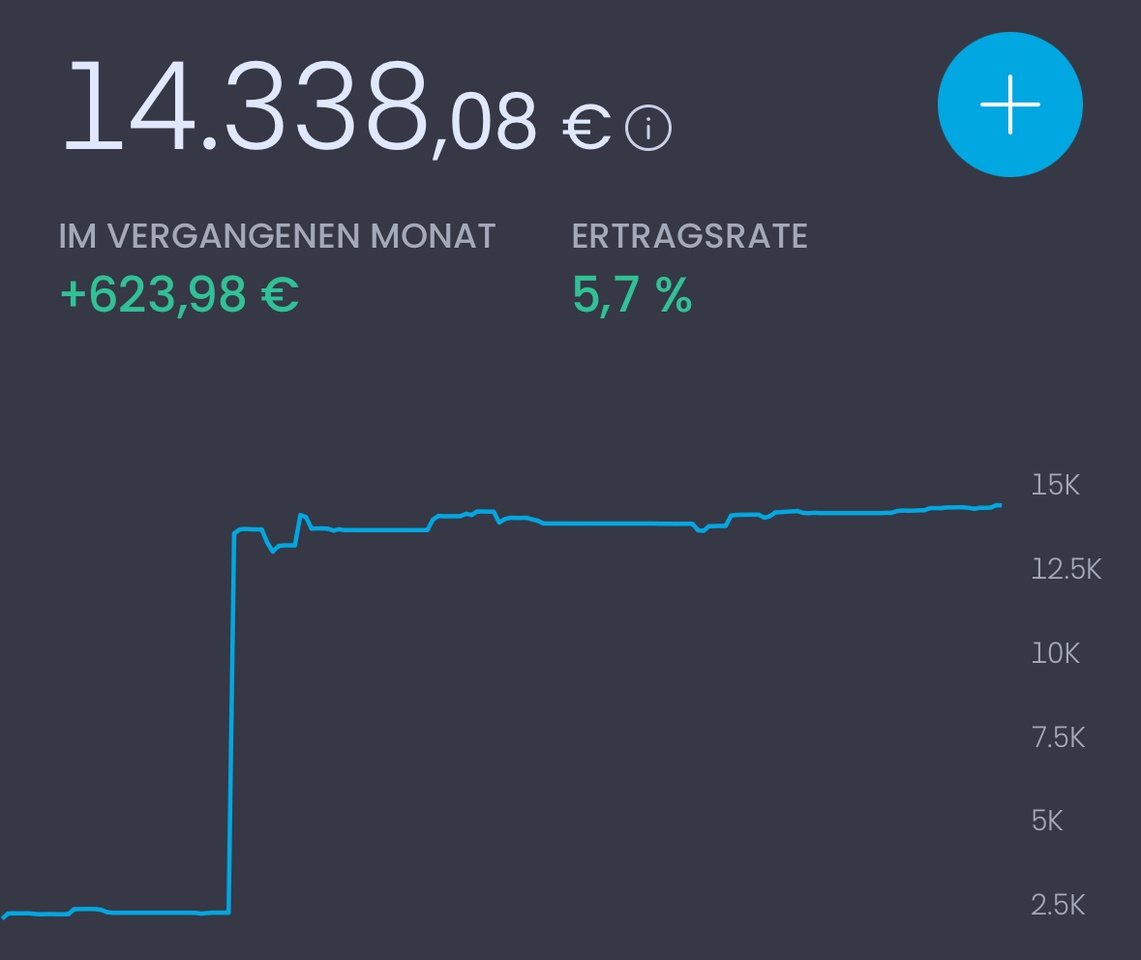

I’m running a small investing experiment to see which approach can generate steadier monthly cash flow: dividend investing or selling covered calls.

My portfolio is relatively small, so I don’t mind taking a bit more risk if it means I might learn something new.

Disclosure: I used ChatGPT to clean up my phrasing and typos, but I asked it to keep things simple and stay true to my own words.

Why I’m Doing This

I currently invest through my company, which gives me a great tax advantage.

- I don’t pay tax on realized capital gains because my company is under Hungary’s KIVA system. Under KIVA you don’t pay corporate tax on profits or investment income; instead, you pay a flat 10 % on the total gross salaries you pay out each year. So if you have many employees—or pay yourself a generous salary—you effectively pay tax through that payroll base rather than on the gains themselves.

- I don’t pay the usual 15 % Hungarian dividend tax because I invest through my company under the KIVA system, where the same 10 % salary-based rule applies. Some countries still withhold tax at the source—for example, U.S. dividends now get a 30 % haircut since the Hungary-U.S. tax treaty was dropped, while the U.K. doesn’t withhold anything extra.

- Option premiums are also untaxed, so I keep 100 % of those.

Running a company teaches you that strong cash flow is everything. So I thought: why not try to create reliable cash flow from investments too? Monthly-paying dividends are one way. Another is selling covered calls, which can provide instant income.

Quick Covered-Call Primer

A covered call means you own at least 100 shares of a stock and sell a call option giving someone else the right to buy those shares at a set price by a set date.

Because you already own the shares, the call is “covered.” The buyer pays you a premium up front.

Your obligation: if the option is exercised, you must deliver those shares or buy back the contract (often at a higher price).

If you’re curious, watch a few good YouTube explainers—it’s easier to grasp from a video than from my summary.

My Two Test Portfolios

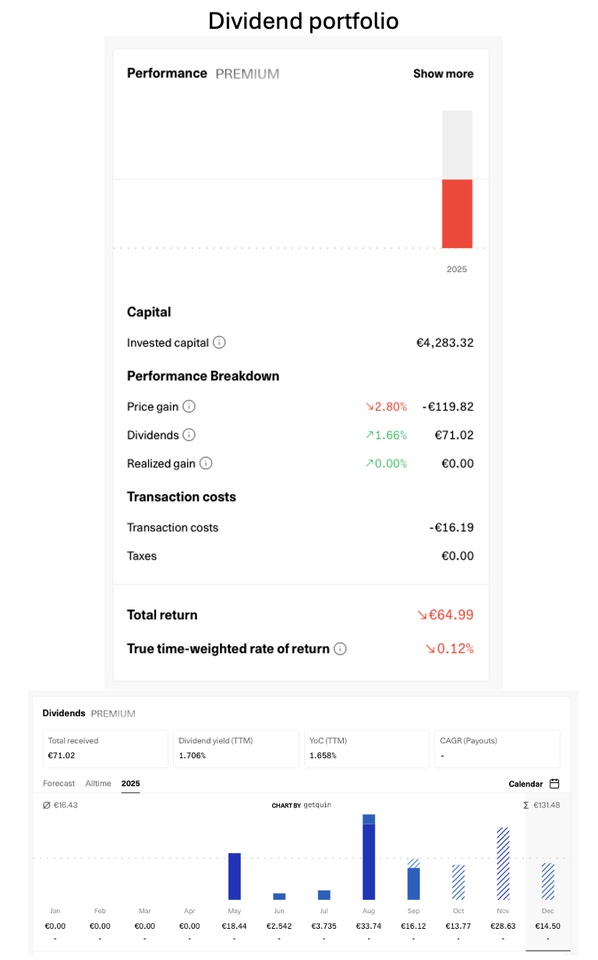

Dividend Portfolio

Contains $JEGP (+0,46 %) , $UKW (+0,23 %) , $MCSTP (+0 %) —each paying around 8–10 % annually.

- JEGP and UKW dividends are tax-free for me.

- MCSTP is taxed at 30 %, but I’m testing how this new product of $MSTR (-2,02 %) works long term.

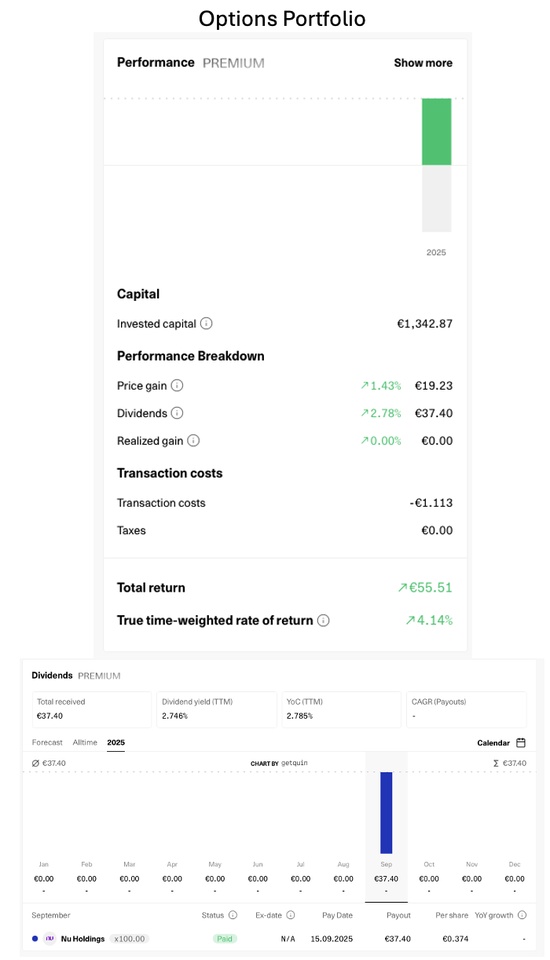

Options Portfolio

Currently just $NU (-7,96 %) . I like the stock, it’s easy to buy 100-share lots, and it’s great for covered calls.

Yes, if NU “goes to the moon” my call might get exercised and I’d have to sell—but I’d still keep the premium. You can roll options to capture extra upside, but that usually means choosing a later expiration date (moving from monthly to perhaps yearly).

Bought 100 shares for $1,580, sold an Oct 24 call at $16.50, and pocketed a $44 premium.

Early Results & Thoughts

- Dividend side: Launched in April. Prices have dipped, so even with dividends I’m slightly negative—mainly due to $UKW (+0,23 %) . I’m okay with small paper losses since I’m here for cash flow.

- Options side: Less than a month old. $NU (-7,96 %) ’s price moves more, which suits me. If I get called away, I’ll just rebuy 100 shares next month and sell another covered call.

In October I need to decide whether to add another 100 NU shares or introduce a second stock. On my watchlist: $WT (+0 %) and $INFY (+3,32 %) . My screening process still needs fine-tuning.

I also figured out how to track option income in Getquin: just add a manual “dividend” to NU so the dividend features capture the premiums. Works nicely for performance tracking.

See the attached picture for results. Feel free to follow if you’re curious how this experiment unfolds.

I don’t post often, so you won’t get spammed—just occasional updates on new moves and my thinking.

I’m far from a pro, so don’t expect sophisticated analysis!

Cheers!

Dividend Portfolio

Options Portfolio