Friends,

If you're wondering how to invest in SpaceX, this post is for you. You can also learn from a mistake I made myself 🙂

Starting point

My thought was sparked by the rumor that SpaceX is planning an IPO in 2026 - with a possible valuation of around 800 billion USD (IPO-Kracher aus dem Silicon Valley: SpaceX peilt 2026 an - DER AKTIONÄR).

Option 1: Secondary markets

In principle, shares in unlisted companies are traded on so-called secondary markets are traded on secondary markets. For example, employees can sell their ESOPs (employee shares) there before the IPO.

As a rule, the larger the company, the more liquid these markets are.

The largest platforms for such deals are

- Forge Global

- EquityZen

- Hiive

Hook:

To invest there, you have to be an accredited investor and have a corresponding minimum investment (often five-digit amounts).

As I didn't want to make this effort, the secondary market was not an option for me.

Option 2: Indirect investments

That leaves two alternatives:

Sector ETFs (e.g. Space ETFs)

Proxy investments in companies that hold shares in SpaceX.

Examples:

- Scottish Mortgage Investment Trust (SMT)

- EchoStar (ticker: STATS)

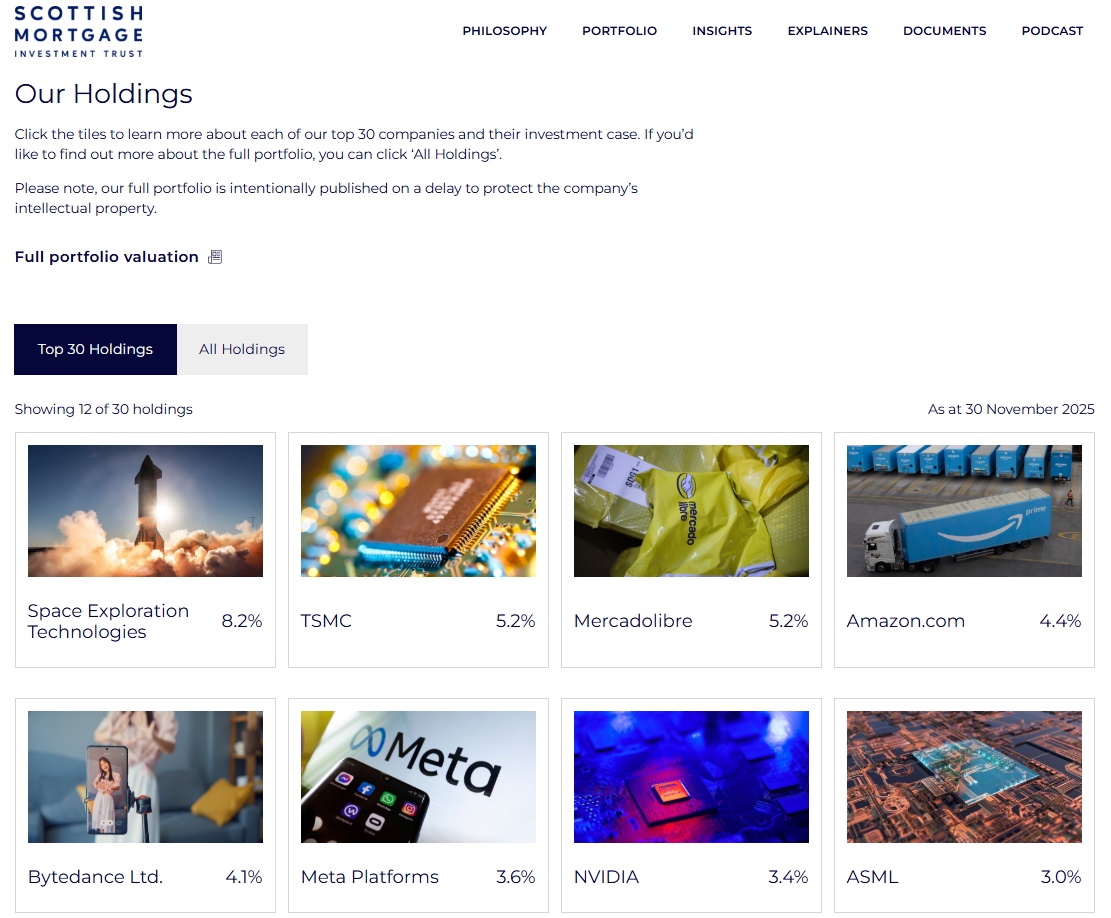

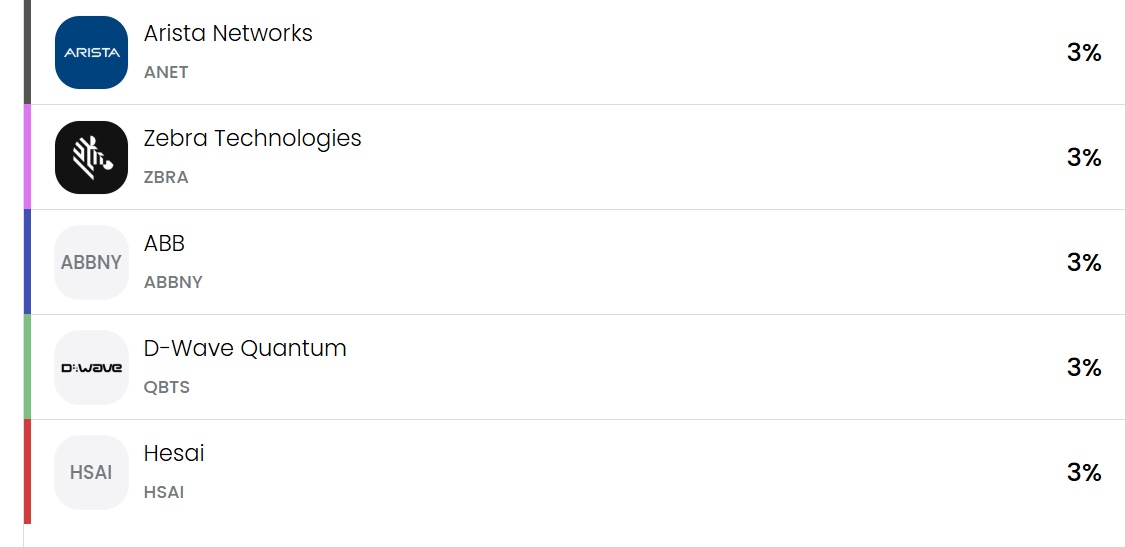

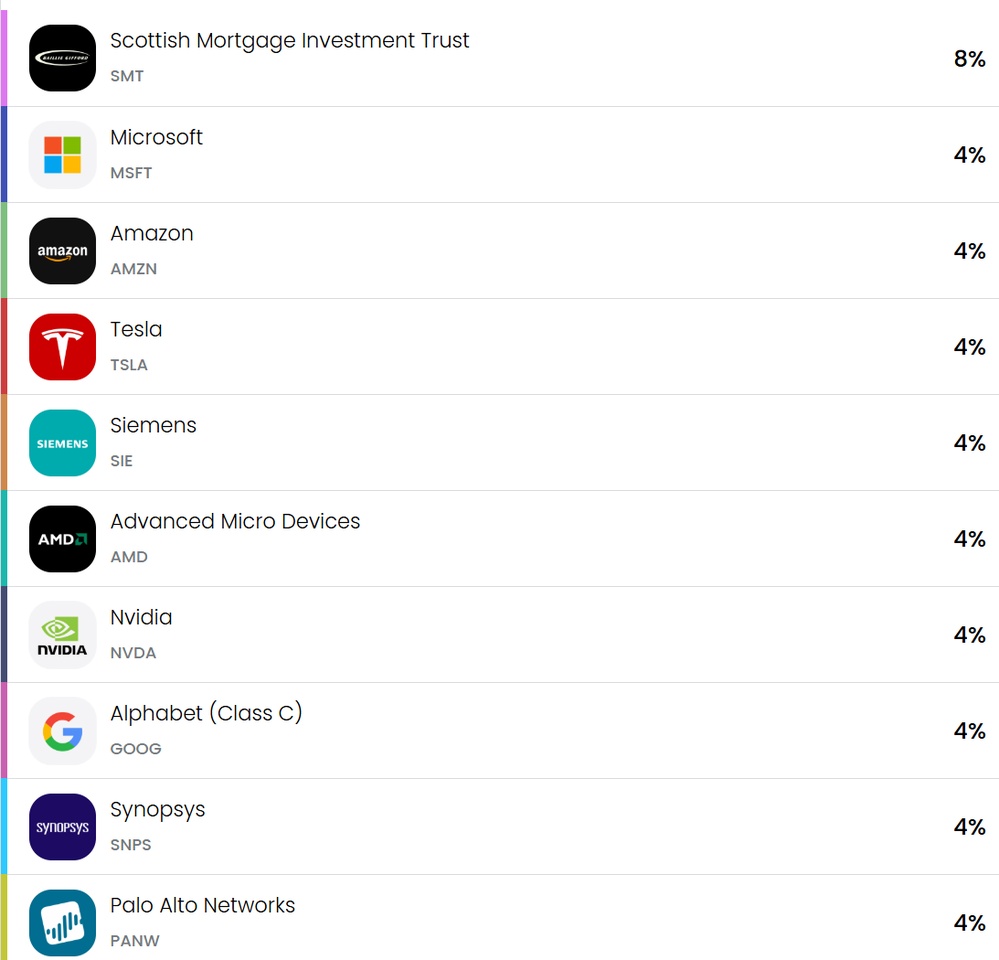

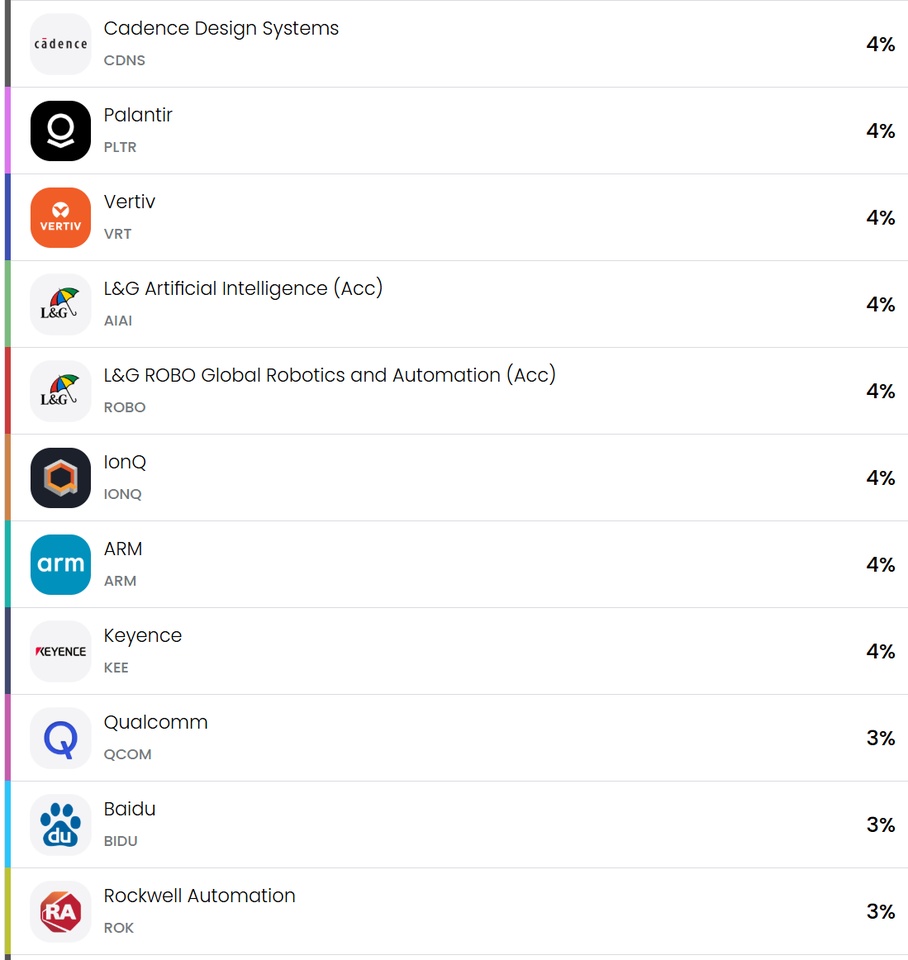

Scottish Mortgage Investment Trust ($SMT (-1.1%)

)

According to the last report of 30.11 $SMT (-1.1%) about 8 % in SpaceX. This is a higher exposure than Alphabet, which is also invested.

In addition $SMT (-1.1%) exciting positions in the AI segment such as TSMC, ASML and NVIDIA.

Note: Anyone buying $SMT (-1.1%) should check whether they are already heavily invested in AI to avoid duplication (SCMORT - November 2025).

My mistake

I did not question the stated 8% position.

The NAV report showed 8%, but the daily updated NAV on the website was changed on December 15 from 1,221p to 1,297p (+6 %).

Reason: The rumor about the SpaceX IPO.

The SpaceX share now stands at 15,3 %no longer at 8 %.

The share price has of course already partly priced this in.

Learnings

Between the NAV releases trigger events can significantly change the portfolio structure.

Private market investments are often only adjusted after such events (e.g. IPO rumors or financing rounds).

Excursus: NAV-GAP

$SMT (-1.1%) trades like other closed-end investment companies with a discount to NAV.

At $SMT (-1.1%) this amounts to approx. 10 %at Pershing Square $PSH (-0.49%) by Bill Ackman even more.

This discount hardly disappears historically and is mainly due to manager and governance risks risks.

EchoStar $SATS (+1.8%)

In 2025, EchoStar acquired shares in SpaceX via a radio frequency deal worth USD 11 billion (valuation at the time: USD 400 billion).

If the IPO takes place at USD 800 billion, this stake will double.

The share price has already partially priced this in:

- 04.12: 74 USD (market cap: USD 21 billion)

- 12.12: 108 USD (market cap: USD 31 billion)

The SpaceX share (at 800 bn valuation) currently corresponds to >65 % of the market capitalization of EchoStar.

Rumors about SpaceX

There is speculation that the valuation could be as high as 1.5 trillion USD could be as high (Weltraum trifft Wall Street: SpaceX und der riskanteste Börsengang der Geschichtehinkt).

If that happens, EchoStar $SATS (+1.8%) would be the clear winner (+60 % price increase), while $SMT (-1.1%) would "only" gain around 15 %.

Conclusion

If the market believed the 1.5 trillion valuation, the prices of the proxies would probably already have risen more sharply.

An investment in $SMT (-1.1%) or $SATS (+1.8%) remains an exciting bet:

- $SATS (+1.8%) = higher potential return, but significantly riskier

- $SMT (-1.1%) = more conservative, more broadly diversified, with "downside protection"

I have opted for SMT.

I find it exciting how quickly the stock market recognizes such "detour investments" and closes the arbitrage margin.

Question for you:

Does anyone have experience with secondary markets? I find the topic exciting and would like to delve deeper into it.